Economics > AQA A/As Level Question Paper > AQA AS MACRO ECONOMICS. 259 terms with accurate definitions. Rated A+ (All)

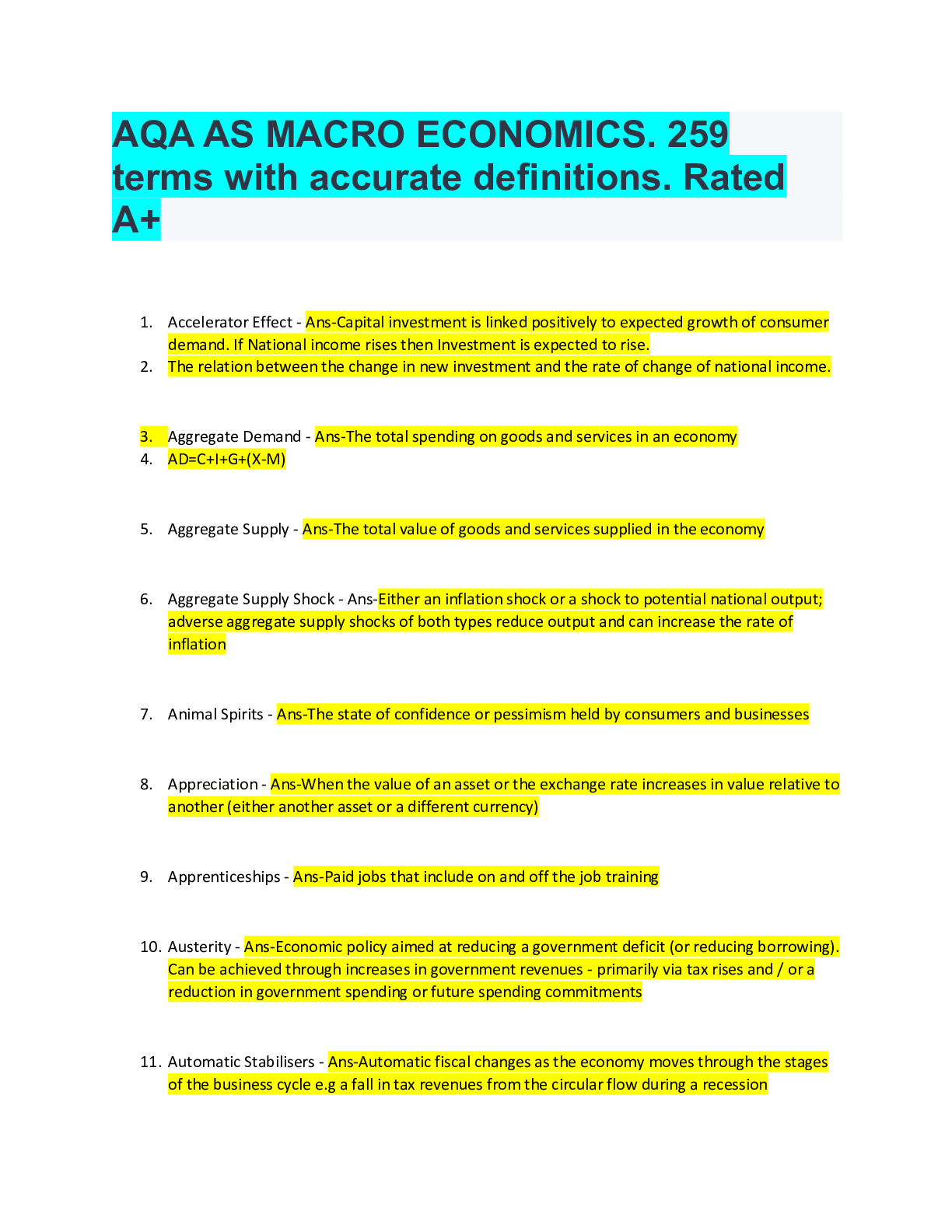

AQA AS MACRO ECONOMICS. 259 terms with accurate definitions. Rated A+

Document Content and Description Below

1. Accelerator Effect - Ans-Capital investment is linked positively to expected growth of consumer demand. If National income rises then Investment is expected to rise. 2. The relation between the ch ... ange in new investment and the rate of change of national income. 3. Aggregate Demand - Ans-The total spending on goods and services in an economy 4. AD=C+I+G+(X-M) 5. Aggregate Supply - Ans-The total value of goods and services supplied in the economy 6. Aggregate Supply Shock - Ans-Either an inflation shock or a shock to potential national output; adverse aggregate supply shocks of both types reduce output and can increase the rate of inflation 7. Animal Spirits - Ans-The state of confidence or pessimism held by consumers and businesses 8. Appreciation - Ans-When the value of an asset or the exchange rate increases in value relative to another (either another asset or a different currency) 9. Apprenticeships - Ans-Paid jobs that include on and off the job training 10. Austerity - Ans-Economic policy aimed at reducing a government deficit (or reducing borrowing). Can be achieved through increases in government revenues - primarily via tax rises and / or a reduction in government spending or future spending commitments 11. Automatic Stabilisers - Ans-Automatic fiscal changes as the economy moves through the stages of the business cycle e.g a fall in tax revenues from the circular flow during a recession 12. Balanced Budget - Ans-Where government receipts equal government spending in a financial year 13. Balance of Payments - Ans-The total value of all the money coming into a country from abroad minus the total value of the money going out of the country during the same period 14. Balance of trade - Ans-Differences between exports and imports of just goods or just services only or of goods and services combined 15. Bank Run - Ans-When a large number of people suspect that a bank may go bankrupt and withdraw their deposits 16. Bond - Ans-Both Companies and governments can issue them when they need more money. 17. Bond Yield - Ans-The rate of interest market investors demand when purchasing government bonds 18. Boom / Bust Policy - Ans-The Government using macroeconomic tools to stimulate and then contract the economy 19. Brain Drain - Ans-Movement of highly skilled people moving from their own country to another country 20. BRIC economies - Ans-Brazil, Russia, India and China as the emerging markets, The BRIC economies have a larger share of the world trade then the USA 21. Broad Money - Ans-Money that is held in banks and building societies but that is not immediately accessible 22. Bubble - Ans-When the prices of securities or other assets rise so sharply and at such a high rate that they exceed the valuations justified by fundamentals making a sudden collapse likely (i.e. it bursts) 23. Budget Deficit - Ans-When government spending is greater than tax revenue which leads to a rise in the level of national debt 24. (G>T) 25. Budget Surplus - Ans-Where government receipts exceed government spending in a financial year 26. Business Confidence - Ans-Expectations about the future of the economy, vital in influencing business decisions about how much to spend on new capital goods 27. Business Cycle - Ans-Fluctuations of economic growth around trend 28. Business Taxation - Ans-Taxation aimed at firms such as VAT, corporation tax and a carbon tax 29. Capacity Utilisation - Ans-Measures how much of the productive potential of the economy is being used, it falls during a recession leading to a rise in spare capacity 30. Capital - Ans-Factors of production that are used to make other goods and services e.g machinery, a plant, equipment or technology 31. Capital Market - Ans-A stock or a bond market where firms can raise money for investment purposes 32. Capital Stock - Ans-The value of the total stock of capital inputs in the economy 33. Capital Spending - Ans-Government spending to improve the productive capacity of the nation, including infrastructure, schools and hospitals 34. Capital - Labour substitution - Ans-Replacing workers with machines in a bid to increase productivity and reduce the unit cost of production. This can lead to structural unemployment 35. Catch Up Effect - Ans-When countries that start off poor but grow more rapidly than countries that start off rich causing convergence in the standard of living measured by per capita GDP 36. Central Bank - Ans-The financial institution in a country or group of countries typically responsible for issuing notes and coins and setting short term interest rates 37. Claimant Count - Ans-The number of people claiming jobseekers allowance (JSA) benefits 38. Classical LRAS - Ans-A vertical curve as classical economists argue that a country's productive capacity is determined by factors other than price and demand such as investment and innovation 39. Classical View - Ans-Economists who believed that recessions and slumps would cure themselvess 40. Closed Economy - Ans-An economy operating without imports and exports i.e closed to global trade 41. Comparative Advantage - Ans-Refers to the relative advantage that one country has over another. Countries can benefit from specialising in and exporting the product(s) for which it has the lowest opportunity cost of supply 42. Competitiveness - Ans-Cost and non-price factors that make a business successful in the international market 43. Components of AD - Ans-House hold consumption is the largest element accounting for about 60% of the total in 2011. Government spending about 23% Investment 15%. Net exports about 2% 44. Constant Prices - Ans-Tell us that the data has been inflation adjusted 45. Contractionary Fiscal Policy - Ans-Increasing levels of tax revenue relative to government spending, appropriate during a boom in economic activity 46. Consumer Confidence - Ans-Confidence surveys with information generally released ahead of official statistical data, can indicate changes to the economic outlook as well as turning points in the economic cycle 47. Consumer Durables - Ans-Products such as washing machines that are not used up immediately when consumed and which provide a flow of services over time 48. Consumer Price Index (CPI) - Ans-The governments preferred measure of inflation 49. Corporation Tax - Ans-A tax on the profits made by companies 50. Cost Push Inflation - Ans-An increase in the price level (or average price of goods and services) caused by a sustained increase in firms cost of production 51. Credit Crunch - Ans-Situation where banks across the economy reduce lending to each other due to falling confidence that loans will be repaid 52. Credit Rating - Ans-The assessment given to debtors and borrowers by a ratings agency according to their safety from an investment standpoint - based on their creditworthiness or the ability of the company or government that it borrowing to repay 53. Creeping Inflation - Ans-Small rises in the general level of prices over a long period of time 54. Creeping Protectionism - Ans-Where import tariff rates rise gradually and where countries introduce quotas and barriers to the mobility of labour and capital 55. Current Account - Ans-The balance of imports and exports of goods and services , income and transfers combined 56. Current Account Deficit - Ans-The amount by which money relating to trade, investment etc. going out of an economy is greater than the amount coming in. It implies a net reduction of demand in a country's circular flow 57. Current Account Equilibrium - Ans-Where the current account exercises no effect on the domestic macroeconomy 58. Current Spending - Ans-Government spending on the day-to-day running of the public sector, including raw materials and wages of public sector workers 59. Currency War - Ans-A term used to describe competitive devaluation of currencies, a scenario where various nations try to devalue their currencies in an attempt to gain an advantage over each other 60. Cyclical Trade Deficit - Ans-A trade deficit that arises purely due to the changes in the economic cycle, for example many countries run a deficit when their economy is growing strongly 61. Cyclical Unemployment - Ans-Involuntary unemployment due to a lack of demand in the economy. Also known as Keynesian unemployment 62. Deflation - Ans-A persistent fall in the general price level of goods and services 63. De-industrialization - Ans-A decline in the share of national income from manufacturing industries 64. Demand Shock - Ans-An unexpected shock to one or more components of aggregate demand e.g. from a recession in the economy of a major trading partner 65. Demand Pull Inflation - Ans-Where aggregate demand exceeds aggregate supply leading to an increase in the level of prices 66. Demand Side Fiscal Policy - Ans-Changes in the level or structure of government spending and taxation aimed at influencing one or more of the components of aggregate demand 67. Depreciation - Ans-A fall in the market value of one exchange rate (or asset) against another exchange rate (or asset) 68. Depression - Ans-Used to describe a severe recession which may become a prolonged downturn in the economy and where GDP falls by at least 10% 69. Deregulation - Ans-Reducing barriers to entry in order to make a market more competitive 70. Developing Country - Ans-Countries generally lacking a high degree of industrialization and/or other measures of devlopment 71. Discouraged Workers - Ans-People often out of work for a long time who give up on job search 72. Discretionary Fiscal Policy - Ans-Deliberate attempts to affect AD using changes in government spending, direct and indirect taxation and borrowing 73. Discretionary Income - Ans-Disposable income adjusted for spending on essential bills such as fuel 74. Disinflation - Ans-A fall in the rate of inflation. This means a slower increase in prices but they are still rising 75. Disposable Income - Ans-Income after the effects of direct taxes and welfare benefits have been calculated 76. Double Dip Recession - Ans-When an economy goes into recession twice without a full recovery in between. 77. Dumping - Ans-When a producer in one country exports a product to another and sells it at a price below the price it chargers in its for engquiries mail me at wamaesymonatgmail [Show More]

Last updated: 3 years ago

Preview 1 out of 25 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 22, 2022

Number of pages

25

Written in

All

Seller

Reviews Received

Additional information

This document has been written for:

Uploaded

Jun 22, 2022

Downloads

0

Views

159