Financial Accounting > TEST BANKS > TAXATION Q&A. 130 Commonly tested questions and scenario/statement Solutions. (All)

TAXATION Q&A. 130 Commonly tested questions and scenario/statement Solutions.

Document Content and Description Below

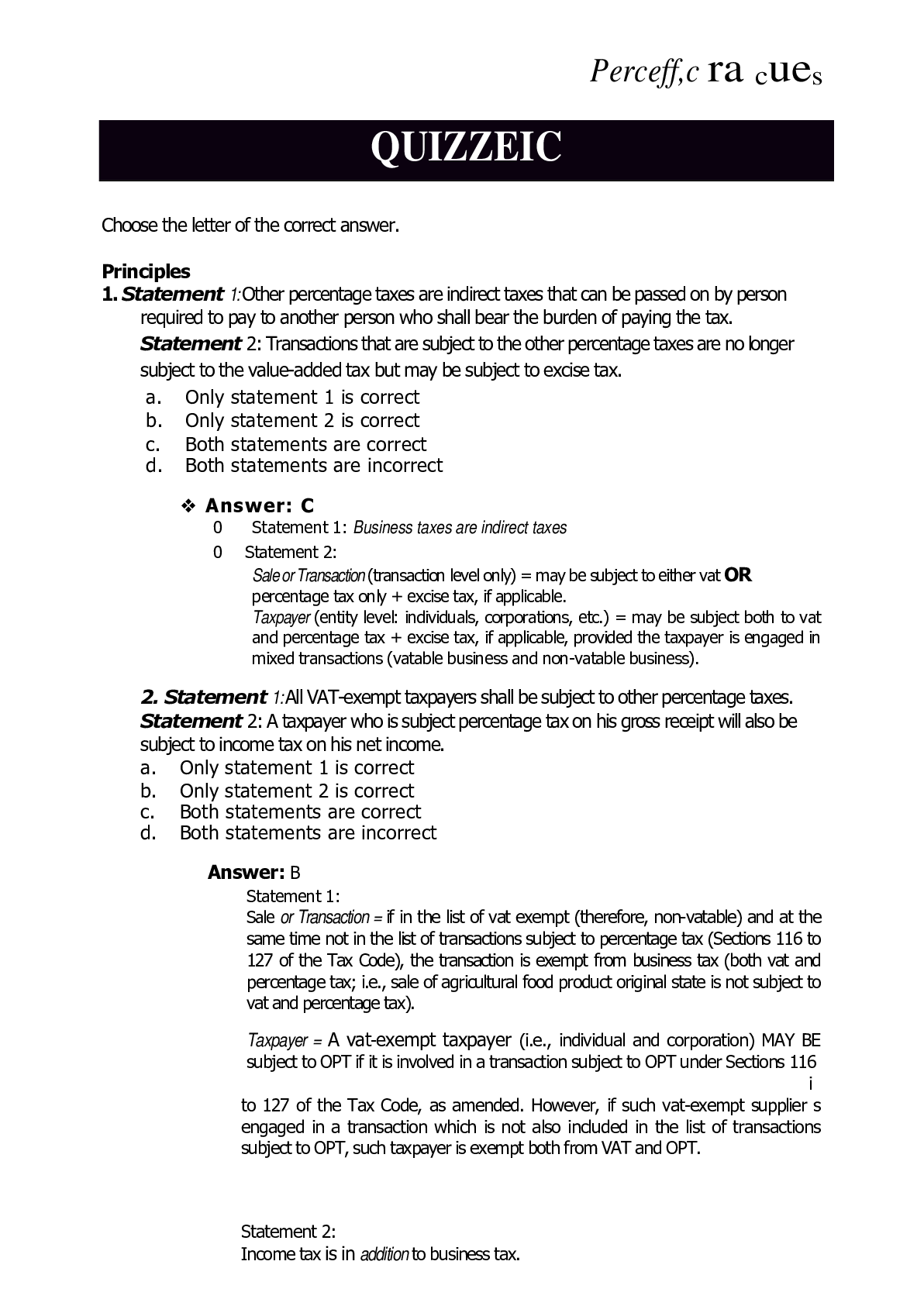

Perceff,c ra cues QUIZZEIC Choose the letter of the correct answer. Principles 1.Statement 1:Other percentage taxes are indirect taxes that can be passed on by person required to pay to another p... erson who shall bear the burden of paying the tax. Statement 2: Transactions that are subject to the other percentage taxes are no longer subject to the value-added tax but may be subject to excise tax. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statements are correct d. Both statements are incorrect ❖ 0 Statement 1: Business taxes are indirect taxes 0 Statement 2: Sale or Transaction(transaction level only) = may be subject to either vat OR percentage tax only + excise tax, if applicable. Taxpayer (entity level: individuals, corporations, etc.) = may be subject both to vat and percentage tax + excise tax, if applicable, provided the taxpayer is engaged in mixed transactions (vatable business and non-vatable business). 2. Statement 1:All VAT-exempt taxpayers shall be subject to other percentage taxes. Statement 2: A taxpayer who is subject percentage tax on his gross receipt will also be subject to income tax on his net income. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statements are correct d. Both statements are incorrect Statement 1: Sale or Transaction = if in the list of vat exempt (therefore, non-vatable) and at the same time not in the list of transactions subject to percentage tax (Sections 116 to 127 of the Tax Code), the transaction is exempt from business tax (both vat and percentage tax; i.e., sale of agricultural food product original state is not subject to vat and percentage tax). Taxpayer = A vat-exempt taxpayer (i.e., individual and corporation) MAY BE subject to OPT if it is involved in a transaction subject to OPT under Sections 116 i to 127 of the Tax Code, as amended. However, if such vat-exempt supplier s engaged in a transaction which is not also included in the list of transactions subject to OPT, such taxpayer is exempt both from VAT and OPT. Statement 2: Income tax is in additionto business tax. 3. Which of the following is not correct? The percentage tax: a. Is a tax on sale of services. b. May be imposed on sale of goods c. May be imposed together with the value-added tax. d. May be imposed together with the excise tax. The applicable business tax to a particular "transaction" may be: o VAT (in general); or o Percentage tax (if in the list of OPT); or o Exempt from business tax = if in the list of vat exempt and not included in the list of transactions subject to OPT o However, VAT and OPT is not allowed to be imposed at the same time to a particular "transaction". 4. Which of the following statements is not correct about percentage tax? a. It is a business tax. b. It is a transfer tax. c. It is an ad valorem tax. d. It is not a progressive tax ❖ 0 Transfer tax is applicable to gratuitous transfers (donation or inheritance) while percentage tax and vat are applicable to onerous taxes. 5. Which statement is wrong? a. Percentage taxes are basically on sales of services. b. Percentage taxes are not allowed by law to be shifted to the customers or clients. c. An isolated transaction not in the course of business will not result in a liability for a percentage tax d. None of the above • "C" is correct because it is not pertaining to a "business" transaction. It may only be subjected to income tax. Section 116—OPT on vat exempt sales and transactions 6' A seller of agricultural food products is vat-exempt. His annual gross sales in 2018 amounted to P3,000,000. To what business tax is he liable? b. 3% tax on vat-exempt persons b. 12% value-added tax C. 3% common carrier's tax d. none of the above ; Refer to the explanation in Quizzer #2, Statement 1. Perce (tecs. 7. Which of the following is subject to 3% percentage tax under Section 116 of the Tax Code? a. Fruit dealer whose gross receipts for the year amounted to P2,800,000 only. b. An individual taxpayer whose gross sales for the year amounted to P100,000. c. School bus operator whose gross receipts for the year amounted to P2,500,000 d. None of the above ❖ Section 116 shall apply if: 1. The transaction is vat exempt and the reason for vat-exemption is simply because the taxpayer's gross sales or receipts did not exceed the vat threshold of P3M (previously P1,919,500) ; and 2. The taxpayer is not vat registered. 0 If the reason for vat exemption is not because of #s 1 and 2 above, the transaction is not subject to Section 116. The taxpayer in item "B" is known as Marginal Income Earner (MIE), an individual whose gross sales or receipts during the year is not more than P100,000. MIE is not subject to business tax (Vat and OPT). 8. The taxpayer is a trader of poultry feeds. Determine his applicable business tax. a. Subject to 12% vat b. Vat exempt but subject to 3% OPT under Section 116 c. 12% vat or 3% OPT, at his option d. Exempt from 12% vat and OPT ❖ 0 Refer to Quizzer #2, Statement 1. 0 Sale of Poultry Feeds is vat exempt, but the reason for vat exemption is not simply because the seller's gross sales did not exceed the vat threshold of P3,000,000 (previously P1,919,500) but because poultry feeds are intended for poultry animals. 9. One of the following is subject to three percent (3%) percentage tax a. Establishments whose annual gross sales or receipts exceed P3,000,000 and who are VAT registered. b. Businesses whose annual gross sales or receipts exceed P3,000,000 and who are not VAT registered. c. VAT registered establishments whose annual gross sales or receipts do not exceed P3,000,000 d. Establishments whose annual gross sales or receipts do not exceed P3,000,000 and who are not VAT registered. ❖ Percoul 10..Ana hasthe following data for 2020 the taxable year: Gross sales Collections P2,850,000 1,420,000 If Ms. Ana is a seller of goods, her business tax for the year should be a. P42,600 OPT b.P85,500 OPT c. P170,400 vat d. P342,000 vat + 0, () OPT = P2,850,000 x 3% = P85,500 The basis of business tax for sale of goods is gross sales. 11. If Ms. Ana is a seller of service, her business tax for the year should be a. P42,600 OPT c. P170,400 vat b. P85,500 OPT d. P342,000 vat ❖ () O. OPT = P1,420,000 x 3% = P42,600 The basis of business tax for sale of service is gross receipts or collection. 12. If Ana is vat registered a. She is subject to 12% vat b. She is subject to OPT under Section 116 c. She is subject to 12% vat or 3% OPT, at her option d. She is exempt from OPT under Section 116 if she opted to be taxed at 8% ❖ A n s w e r : A 0, The 8% optional tax is not applicable to vat registered taxpayers. 13. If Ana is a taxi operator a. She is subject to 12% vat b. She is subject to common carrier's tax under Section 117 c. She is subject to 12% vat or 3% common carrier's tax, at her option d. She is exempt from OPT if is she opted to be taxed at 8% ❖ 0, The 8% optional tax is not applicable to taxpayers who are subject to OPT other than Section 116 of the Tax Code, as amended. 14. Floyd (self-employed) is a non-vat registered taxpayer who operates a convenience store. The following were provided for 2020: Sales of processed food items Sales of non-food items P280,000 220,000 Purchases of processed food items 100,000 Purchases of non-food items 80,000 Salaries of helpers 48,000 How much is the correct percentage tax due? a. P15,000 c. P50,000 b. P32,000 d. P27,200 ❖ The taxpayer is non-vat registered + his gross sales did not exceed the vat threshold. + the transactions are not exempt from vat. Consequently, he is subject to 3% OPT under Section 116 of the Tax Code, as amended. OPT = (P280,000 + 220,000) x 3% = P15,000 15. Assume Floyd opted to be taxed at 8% on his gross sales and receipts, his applicable business tax is: a. Subject to 12% vat b. Vat exempt but subject to 3% OPT under Section 116 c. 12% vat or 3% OPT, at his option d. None of the above ❖ 0 The 8%optional tax under TRAIN Law is in LIEU of Graduated income tax and Section 116 of the Tax Code. Obviously, if the taxpayer is subject to Section 116, he is no longer subject to vat. pcSi • Nem 4Amended Return7 Eves C No se Form tic)- pg of • 4 g 1 2019 (ENCS1 Par1 FO r " 2 year f...nded Oterrin Tax s Name Last mane RDO Code 0 M YA 9 ST B R GY A P 14 Tail TaxDue4reoni 3caeduie 1 gem7) L e s s : T a i t Mach 20 Strchange tniefest 11 I I I I 1 1 1 1 I I I I I I I I I I I 1 I otor Mance Ropoblle orVie DaparinnPhillP911"4 name or Minna' Riven* Quarterly Percentage Tax Return Erre-at WOW irotonsecoirt CARTAL LETTERstoiatAcKslaw bares wa an 'X'. Tiwo =plea 1411STbe /Bed lilt ere Marx:one ha/byre Tamer 12 1111111M1111 25510 1:11; ifiENCs P1 5 Wrierof Sheet!! Aitathed 6 Tstpayer Identification NuMber (TN) A G P A N G AP - '0917 71817t5t3t4181 Ai,vousracrxi al tax relterunder 12 Lair orintemanonai TaxT 0 Yes Ell No 12A IF yes, specify 13 onty for individualtaxPaYers *hose sagegresespts are subject t Percenlage Tax under Seefion 116 of the TM'Code as amended: What or Ine mat* year) taxable inoraneL j 8 % 22 Compro mise income tax rates are you avadince ?noose Give) (To be fledour any onme trams E l Graduated irtoome tax rate on net El qtarier iworne tax rate on gross saiesereoeotsinthers Part II – Total Tax Payable, I1 1 15101010 10 0 15 Creatable Pe Tax Withheld per RR Farm No. 2307 16 Tax Paid in Return Previousty Red, tthis is an Amended Rearm 47 Other Tax Credit/Payment (sivcsyy lt Total Tax Camay ants f:5-ato of Items 15 to 17) 19 Tax ail Payablet(Overixtyment) (tiern 14 Le:4 /ONO 18) — Add PenaPties 5 0 To be latallia Tat Credit Cerro* 0 0 kW, nide 0 , 24 TOTALAMOUNT PAYABLEilaverparsont)ismsart/ern /0 NE) 24caerpayrnent, inara crne txer To be rbee 1----b% deanunderix poviimd pejo/tut to Woo, led ohoalbsiwreds, hew been rnade draft*, vailical *roe* mitt* bestriradair kraut* ard dal awed De Milan gib 'Wand biota Room in twisidet, Iaeriadlions watillated 64*e? .1Irtefra 4weri "he Irxra" ihimara Na 141 Oar A d a f t bet' lieformal anoktritar V* Forbion-widniduat dish wffiargokaa Pil awraw the ISR DataMacy Pclic, Inlaid to 4""ir.1.1"141 Far Incimatat: Tat Agent AccreatatonNo) R O I 1 4 ) Date or lathe amagerirm FLOYD MAGE3ANUA oser Rated Name dr TaimeePaitudaed RePlemdahleirahlYt AmatoOtioarsiamain016 Natie Of Pitaideritt Arsloaltaal Olicer or Reimertatheeffa Ment asooesiolagorlot nit Dilree• Sara) ASIAfray Part 119 – Deans cd Payment /dumber Bate tadraoneYYM Details failed ainallittotedArtEaftgl Siampofmutton OfOcad4ABararDate orReceipt tROS sronartresintTeiers swap 23 Total Penartiesparr orMenu 2010 22) BIR Form No. 2551Q January 2018 (ENCS) Page 2 TIN Quarterly Percentage Tax Return a er s Last Name Of individual) iR - festered d i Illitillt 2551001118ENCS Narne(tt Non-Individual) 1 - ......... p2 4121 3 1 9 1 4 1 2 1 3 1 6 1 5 1 0 1 0 1 0 A 4 A G B A N U A F L O Y D Schedule I - Computation of Tax fAttach additional sheet's, if DecessaryL. . . , , . . . . . . . . . . ...i. ........ Alphanumeric Tax Taxable Amount Tax Tax Due E I P T 0 1 0 5 0 0 0 0 0 0 0 03% 1 5 0 0 0 oa I 1 % I 1 • 13 % II I I I I I I I I I - ____I______ _ 1 is 6 1 1 1 1 I l l 1 1 1 1 1 i • 1 1 1 1 1 E 1 1 1 . 1 - 7 Total Tax Due (Sum Of tents 1 to 6)(To Part 111terri14) I I 1 1 1 1 11 15 1010 10 ,. 010 Table I — Alphanumeric Tax Code (ATC) ATC . P e r c e n t a g e T a x O n — Tax Rate PT 010 Persons exempt from VAT under Sec. 109(BB) (Sec. 116) 3% PT 040 Domestic carriers and keepers of garages (Sec. 117) 3' PT 041 International Carriers (Sec_ 118) 3% PT 060 Franchises on gas and water utilities (Sec. 119 2% PT 070 Franchises on radio/TV broadcasting com fames whose annual •ross recei its do not exceed P10 M Sec. 119 3% PT 090 Overseas dispatch. message or conversation originating from the Philippines (Sec. 120) 10% PT 140 Cockpits (Sec. 125) 18% PT 150 Tax on amusement places, such as cabarets. night and day dubs. videoke bars, karaoke bars, karaoke television, karaoke boxes, music lounges and other similar establishments (Sec. 1251 18 % PT 160 Boxing Exhibition (Sec. 125) 10 % PT 170 Professional Basketball Games (Sec. 125) 15 % 1 PT 180 Jai-alai and Race Tracks (Sec. 125) 30 % Tax on Banks and Non-Bank Financial Intermediaries Performing Quasi-Banking Functions (Sec. 121) 1) On interest, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining matunties of instruments from which such receipts are derived PT 105 - Maturity penod is five (5) years or less 5% PT 101 - Maturity period is more than five (5) years 1% PT 102 2) On dividends and equity shares and net income of subsidianes 0% PT 103 3) On royalties, rentals of property, real or personal profits from exchange and all other gross income 7% PT 104 4) On net trading gains within the taxable year on foreign currency, debt securities, derivatives and other financial instruments 7% Tax on Other Non-Bank Financial Intermediaries not Performing Quasi-Banking Functions (Sec. 122) , 1)On interest, commissions and discounts from lending activities as well as income from financial leasing, on the basis of remaining maturities of instruments from which such receipts are derived PT 113 -Maturity period is five (5) years or less 5% PT 114 -Maturity period is more than five (5) years 1% PT 115 2) From all other items treated as gross income under the code 5% PT 120 Life Insurance Premiums (Sec. 123) 2% Agents of Foreign Insurance Companies (Sec. 124) -' PT 130 1) Insurance Agents 4% PT 132 2) Owners of property obtaining insurance directly with foreign insurance companies 5% Section 117 — Common Carriers Tax on Domestic Common Carriers 16. This refers to persons, corporations, firms or associations engaged in the business of carrying of transporting passengers or goods or both, by land, water, and air, for compensation, offering their services to the public and shall include transportation contractors. a. Common carriers; b. Dealers in securities; c. Lending investors; d. Franchise grantees. ❖ 17 . A person whose business is to keep automobiles for hire or keep them stored for use or a. Keepers of garage b. Common carrier c. Taxicab operator d. Tourist bus operator ❖ 18. A keeper of garage whose gross receipts for 2020 exceed P3,000,000 is subject to: a. Value-added tax b. Garage sales tax c. Common carriers tax d. Franchise tax. ❖ A keeper of garage is subject to common carrier's tax regardless of the amount of its gross receipts. 19. Which of the following is subject to the 3% common carrier's tax? a. Transportation contractors on their transport of goods or cargoes. b. Common carriers by air and sea relative to their transport of passengers c. Owners of animal-drawn two-wheeled vehicle. d. Domestic carriers by land for the transport of passengers. •• • "A":transport of goods — subject to vat. "B":transport of passengers or goods "via air or sea"— subject to vat. "C" - exempt 20. Statement 1: The gross receipts of common carriers derived from their incoming and outgoing freight shall not be subject to the local taxes imposed under RA 7160,q)therwise known as the Local Government Code of 1991. Statement 2: The 3% common carrier's tax is based on the actual quarterly gross receipts or minimum quarterly receipt whichever is lower. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statements are correct d. Both statements are incorrect + ; Statement 2 -shall be whichever is higher 21. A non-vat- registered transportation contractor is engaged in the transport of passengers, goods and cargoes. What business taxes is he liable? a. 12% value-added tax; b. 3% common carrier's tax; er cod c rtres c. 3% tax on VAT-exempt persons on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipts from transport of passengers; d. 12% VAT on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipts from transport of passengers. ❖ ; (subject to Section 116 and Section 117) 22. Using the same information in the preceding number, except that he is a vat-registered. What business taxes is he liable to? a. 12% value-added tax; b. 3% common carrier's tax; c. 3% tax on VAT-exempt persons on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipts from transport of passengers. d. 12% VAT on gross receipts from transport of goods and cargoes and 3% common carrier's tax on gross receipt from transport of passengers. ❖ A n s w e r : D 23. One of the following statements is wrong: Operators of transport facilities are a. Subject to the value-added tax on gross receipts from transporting passengers. b. Subject to the value-added tax on gross receipts from transporting goods and cargoes. c. Subject to percentage tax on gross receipts from transporting passengers. d. Subject to the value-added tax on gross receipts from renting out its transportation facilities. ❖ ; (subject to Section 117) 24. A domestic carrier by land is engaged in the transport of goods. It is not VAT-registered and its annual gross receipts do not exceed P3,000,000 during 2020. To what business taxes is it liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. ❖ 25. Assume the annual gross receipts in the preceding number exceeded the revised vat threshold of P3,000,000 during 2020. To what business taxes is it liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. • An sw e r: A Ji ercert!7 7 - 26. A domestic carrier by sea is engaged in the transport of passengers, goods and cargoes. It is not VAT-registered and its annual gross receipts do not exceed P3,000,000 during 2020. To what business taxes is it liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. ❖ 27. Assume the annual gross receipts in the preceding number exceeded the revised vat threshold of P3,000,000 during 2020. To what business taxes is it liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. 28. A domestic carrier by land is engaged in the transport of passengers. It is not VATregistered and its annual gross receipts do not exceed P3,000,000 during 2020. To what business taxes is it liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. ❖ 0 If it involves transport of passengers by land by domestic carriers, it is subject to Common Carrier's Tax under Section 117 of the Tax Code, regardless of the amount of annual gross receipts. 29. Assume the annual gross receipts in the preceding number exceeded the revised vat threshold of P3,000,000 during 2020. To what business taxes is it-liable? a. 12% value-added tax b. 3% OPT under Section 116 c. 3% common carrier's tax under Section 117 d. Not subject to business tax. 30. Maharlika Airlines, a domestic corporation plying domestic routes, had the following gross receipts. for the month ended April 2020: carriage of passenger, P4,500,000; carriage of cargo, P7,000,000. The correct amount of business tax for the month ended April 2017 is: a. PO c. 8345,000 b. P135,000 d. 81,380,000 ❖ 0 Business Tax (vat) = (P4.5M + P7M) x 12% = P1,380,000 0 Domestic airline companies are not subject to Section 117. Use the following data for the next (2) two questions: Rianne is an operator of ten (10) buses with routes from Manila to Subic and is likewise a transportation contractor with three (3) freight trucks. For the taxable year 2020, he reported gross receipts from his bus operations of P36,000,000. His gross receipts, however, from his freight of goods or cargoes amounted only to P800,000 for the year. 31. Assuming Rianne is non-vat registered, how much is his total business tax due? a. P1,080,000 c. P1,176,000 b. P1,104,000 d. P4,416,000 ❖ A n s w e r : B Common carrier's tax = P36M x 3% P1,080,000 Section 116 = P800,000 x 3% 24,000 Total business taxes 1,104,000 32. Assuming Rianne is vat registered, how much is his total business tax due? a. P1,080,000 c. P1,176,000 b. P1,104,000 d. P4,416,000 ❖ Common carrier's tax = P36M x 3% P1,080,000 VAT = P800,000 x 12% 96,000 Total business taxes 1,176,000 33. Pedro is a jeepney operator. He is also engaged in the business of leasing residential units. His gross receipts from his jeepney operation amounted to P5,000,000 for the year. The monthly rental of the residential units is P14,000 with a total annual gross receipts of P3,500,000 for 2018. Which of the following is correct? a. Pedro is required to register under the vat system b. Pedro may apply for optional vat registration c. Pedro is exempt from business and income tax d. None of the above ❖ He is not required to register under the vat system nor apply for optional vat registration because his business activities are not subject to vat. 0 He is not exempt from business tax. He is subject to common carrier's tax under Section 117 of the Tax Code. 34. All of the following, except one, are not subject to common carrier's tax a. owner of a parking lot/building b. rent-a-car companies c. common carriers engaged in carriage of goods or cargo d. domestic airline companies •• ; Choices "a, c and d" are subject to vat. 35 . Isarog is a vat registered common carrier with passenger buses and cargo trucks. For the month of June 2020, it had the following data on revenues, and receipts, taxes not included: o For transporting passengers, gross revenues and receipts of P330,000. o For transporting cargoes, gross revenues of P220,000, of which P200,000 was received. o For renting out to the MMDA its towing trucks, gross receipts of P50,000, representing P10,000 from gross revenue of the quarter ending March 31 and P40,000 for the month of June. The percentage tax is: a. P1,500 c. P15,900 b. P9,900 d. P17,400 ❖ 0 Common Carrier's Tax under Section 117 = P330,000 x 3% = P9,900 The basis of business tax if from sale or service is collections or receipts, regardless of when the it was earned. 36. The value added tax is: a. P24,000 c. P28,800 b. P30,000 d. P25,000 ❖ A n s w e r : B 12% Vat = (P200,000 + 50,000) x 12% = P30,000 37. Milagros Lines, a VAT-registered person, has the following gross receipts in February: Bus 1 (carriage of goods, P18,000) 100,000 Bus 2 (carriage of goods, P13,500) 165,000 Taxi 90,000 Jeepney 35,500 Cargo truck 45,000 Sea vessel Additional Information: 250,000 1Salaries of drivers and conductor 125,000 ✓ Cost of oil and gasoline 175,000 During the month, Bus 1 was bumped by another bus owned by Mandaon Lines and paid Milagros Lines P120,000 for the damage. The Percentage tax due on Milagros Line in February is: a. P10,770 c. P11,715 b. P14,370 d. nil Perceittf rween Solution: • Bus 1. = P100,000 18,000 Bus 2 = P165,000 — 13,500 Taxi Jeepney Total x OPT; CCT P82,000 151,500 90,000 35,500 P359,000 3% P10,770 Ignore income and expenses for business taxation purposes. 38. The total business taxes in the preceding number should be: a. P10,770 c. P49,950 b. P39,180 d. nil ❖ •• Solution: OPT (refer to the preceding number) VAT: Carriage of goods (P18;000 + 13,500) P10,770 31,500 Cargo truck 45,000 Sea vessel Total 250,000 P326,500 X 12% 39,180 Total Business Taxes P49,950 39. ______________ is a pool of land transportation vehicles whose accessibility to the riding public is facilitated through the use of common point of contact which may be in the form of text, telephone and/or cellular calls, email, mobile applications or by other means. a. Domestic common carriers b. International 'carriers c. Transportation network vehicle services (TNVS) d. P a r t n e r s 40. The owner(s) of the vehicles, other than the TNVS, used in transporting passengers and/or goods in TNVS, shalt be referred herein as a. Domestic common carriers b. International carriers c. Transportation network vehicle services (TNVS} d. P a r t n e r s Percezi ciacres* ) 41 Statement 1: Under RMC 70-2015, transport network vehicle services, such as but not limited to the likes of USER, GRAB TAXI, their Partners/suppliers and similar arrangements, which are holders of a valid and current Certificate of Public Convenience for the transport of passengers by land, shall be subject to 3% common .carriers tax under Sec. 117. Statement 2: Transport network vehicle services, such as but not limited to the likes of UBER, GRAB TAXI, their Partners/suppliers and similar arrangements, which are not holders of a valid and current Certificate of Public Convenience for the transport of passengers by land, shall also be subject to 3% common carriers tax under Sec. 117. a. Only statement 1 is correct b. Only statement 2 is correct c. Both statements are correct d. Both statements are incorrect ❖ Statement 2 — shall be subject to 12% vat. Section118—Common Carrier's Tax on International Carriers 42. The 3% percentage tax on international carrier is imposed upon: International air carrier doing business in the Philippines International shipping doing business in the Philippines a . Y e s Yes b . No No c . Y e s No d . N o Yes 43. Statement 1: Domestic common carriers are subject to 0% on its flight originating from abroad to the Philippines. Statement 2: Resident international carriers are subject to the 0% VAT on its gross Philippine billings on flight originating from the Philippines to a foreign destination. Statement 1 Statement 2 a . T r u e True b . T r u e False c . False False d . F a l s e True •:• GUIDE: Domestic Common Carriers 0 On their transport of passengers by land = Sec. 117 0 On their transport of goods or cargoes including mails, by land = 12% vat 0 On their domestic transport from and to the Philippines of passengers, goods/cargoes, and mails by air or by sea = 12% vat. 0 On their international flights and shipments originating from the Philippines to a foreign country = 0% vat A. B. Perreilia WiC.reS On their international flights and shipments originating from abroad to the Philippines = exempt from business tax. International Carriers 0 On their transport of passengers on their international flights and shipments originating from the Philippines to a foreign country = exempt from business tax 0 On their transport of goods/cargoes and mails on their international flights and shipments originating from the Philippines to a foreign country = Section 118; Common Carriers tax on International Carriers. 0 On their international flights and shipments originating from abroad to the Philippines = exempt from business tax. 44. Determine the carrier that is subject to the Percentage Tax: a. Resident foreign corporation operating as an international shipping carrier b. Non-resident foreign corporation operating as an international air carrier c. Domestic corporation with international flights d. Domestic corporation with international voyages ❖ 0 Nonresident foreign corporations operating as international carriers are not subject to CCT under Section 118 of the Tax Code because they are not operating in the Philippines. Domestic carriers on their international flights and shipments originating in in the Philippines are subject to 0% vat, not CCT. 45. Statement 1: International air carriers and international shipping carriers shall not be subject to 12% value added tax but to 3% common carrier's tax based on gross receipts derived from their transport of passengers and goods from Philippines to other countries. Statement 2: In cases when the Gross Philippines Billings Tax of 2.5% for international carriers is not applicable (i.e., tax exempt based on reciprocity or treaty), the common carrier's tax under Section 118 of the NIRC, as amended, shall still apply. C. D. Statement 1 True True False False Statement 2 True False True False ❖ ; (S1: Gross receipts from transport operations shall be excluded) 46. Statement 1: Banks are subject to the VAT on its interest income. Statement2: Resident international carriers are subject to the 0% VAT on its gross Philippine billings on flight originating from the Philippines to a foreign destination. Statement 1 Statement 2 a . T r u e True b . T r u e False c . F a l s e False d . F a l s e True ❖ •••• 47. The Republic . of Korea, as an act of goodwill, does not impose business taxes to Philippine carriers. Korean Air is operating in the Philippines having two flights a week. If you were engaged by Korean air as its tax consultant and asked you whether it is liable to percentage tax, which of the following will be your advice? a. KoreanAir is liable to percentage tax based ongross receipts from passengers, goods, cargoes and mails. b. Korean Air is liable to percentage tax based on gross receipts from passengers only. c. Korean Air is liable to percentage tax based on gross receipts fromgoods, cargoes and mails only. d. Korean air is not liable to percentage based on the principle of reciprocity. ❖ 0 Unlike in income taxation for International carriers, reciprocity is not applicable to Section 118 (common carrier's tax on international carriers) of the Tax Code. Section 119—Franchise Tax 48. A right or privilege granted by the State to a person, individual or corporation, to operate a public utility such as radio broadcasting, television station, electric light system, telephone company, gas, and water utilities. a. Franchise c. Dealers in securities b. Common carriers d. Lending investors • 49. Statement 1: A franchise is a privilege to serve the public acquired by special grants from private organizations. Statement 2: There are franchise holders whose gross receipts are subject to 12% vat even if not vat registered. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second statement is correct. 50. Whichof the following franchise grantees is subject to the franchise tax? a,Franchise on radio and/or television broadcasting companies the annual gross receipts in the preceding year exceed P10,000,000. b. Franchise on gas and water utilities. c. Franchise on toll road operations. d. PAGCOR and its licensees and franchisees. Q Radio and/or television broadcasting whose gross receipts in the preceding year exceed P10,000,000 shall be subject to value added tax. P4,000,000 600,000 P1,200,000 160,000 M P3,800,000 P1,040,000 P4,840,000 12% P580,800 business tax is: 53. if the franchisee is a gasand waterutilities, the correct amount of C . P 5 8 0 , 8 0 0 Percezt Although there are other franchises granted by the government such as but not limited to electric companies, cable companies and telecom companies, the term "Franchise Tax" shall pertain only to franchise tax levied under Section 119 of the Tax Code, as amended. 51.Statement1: Radio and/or television broadcasting whose gross receipts in the preceding year did not exceed P10,000,000 shall have an option to be registered as value-added taxpayer. Statement2: Once a radio and/or television broadcasting franchise grantees registered as value-added tax0yer, the registration shall not be revoked. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second statement is correct. ❖ Answe r: A 52. A franchisee, had the following dataon revenues and receivables in 2020: .Quarter ended, March 31, 2020 Covered by the franchise Not covered by the franchise Revenues P4,000,000 1,200,000 AR, beg. AR, end P600,000 P800,000 160,000 If the franchisee is generating and selling electricity, the correct amount of business tax is: a. P200,800 c. P580,800 b. P456,000 d. P238,800 ❖ Covered by the franchise: Revenues Add: AR, beg. Less: AR, end = Collections Not Covered by the franchise: Revenues Add: AR, beg.Less: AR, end = Collections Total collections x Vat Rate ValueAdded Tax 0 Sale of electricity is subject to vat instead of franchise a. b. P200,800 P456,000 d. P238,800 • Year 2018 2019 2020 Perceit!dp Wicuas Covered by the franchise: Revenues Add: AR, beg. Less: AR, end = Collections x Franchise Tax Rate Not Covered by the franchise: Revenues Add: AR, beg. Less: AR, end = Collections x Vat Rate Total Business Tax P4,000,000 600,000 E±Lio,pm_ P3,800,000 2% P76,000 P1,200,000 (160,000) P1,040,000 12% 124,800 P200,800 0 The gross receipts from those covered by the franchise is subject to the applicable franchise tax rate, regardless of the amount of the gross receipts. The gross receipts not covered by the franchise is subject to vat because the gross receipts for the taxable year will obviously exceed the vat threshold. 54. if the franchisee is a radio television broadcasting company, the correct amount of business tax is: a. P200,800 c. P580,800 b. P456,000 d. P238,800 ❖ An s w e r : D Covered by the franchise: Revenues Add: AR, beg. Less: AR, end = Collections x Franchise Tax Rate Not Covered by the franchise: Revenues Add: AR, beg. Less: AR, end = Collections x Vat Rate Total Business Tax P4,000,000 600,000 (800,000) P3,800,000 3% P114,000 P1,200,000 A160,9AL P1,040,000 12% 124,800 P238,800 55. Bulwagan ng Katotohan Broadcasting Company, a non-vat holder of a franchise to Operate a radio and/or television network provided the following data (net of any tax): Gross Recei is P9,000,000 12,000,000 10,000,000 Percettt The business tax liability should be: 2018 2019 a . P 2 7 0 , 0 0 0 P360,000 b . 1,080,000 1,440,000 c . 2 7 0 , 0 0 0 360,000 d . 1,080,000 360,000 2020 P1,200,000 1,440,000 300,000 360,000 0 2018 = P9,000,000 x 3% =P270,000 0 2019 = P12M x 3% = P360,000; • Gross receipts preceding year 5 P10M; apply 3% Franchise Tax 0 2020 = P10,000,000 x12% =P1,200,000 ■ Gross receipts preceding year > P10M; subject to vat 56. Gallaxy Transport Corporation is a holder of franchise from the government to offer passenger and cargo transport operations by land. Its gross receipts from passenger operations amounted to P10,000,000 while its gross receipts from cargo operations amounted to P2,000,000. How much is the franchise tax due for the month? a. P300,000 c. P1,440,000 b. P540,000 d. PO ❖ Answer:D 0 The gross receipts from passenger operations by land is subject to CCT under Section 117, not Franchise Tax under Section 119 of the TaxCode. 0, The gross receipts from cargo transit operations is subject to vat, instead of Franchise Tax under Section 119 of the Tax Code. 57. Using the same data in the preceding paragraph, how much is the total business taxes due for the month? a. P300,000 c. P1,440,000 b. P540,000 d. PO + Passenger operations (CCT) =P1 OMx 3% Cargo operations (Vat) = P2M x 12% Total BusinessTaxes P300,000 240,000 P540,000 58. Which of thefollowing is subject to percentage tax under Section 119 of the Tax Code: a. PAGCOR b. Tollway operators c. Telecomumication companies d. None of the above 0. Q PAR subject to franchise tax of fivepercent (5%) of its gross revenues sr earnings from its casino operations, dollar pit operations, regular bingo operattsionon, and income from mobile bingo operations operated by it, with agents Percelli commission basis (RMC 33-2013, April 17, 2013). This franchise tax, howe different from the franchise tax imposed under Sec. 119of the Tax Code. ver, is Tollway operators and Telecommunication companies are subject to vat. Section 120 — Overseas Communications Tax 59, A telephone company, VAT-registered, provides services for domestic and overseas calls. What business taxes are due from the services offered? I. Value-added tax for domestic calls. IL Overseas communications tax for overseas calls. a. I only c. Both I and II b. II only - d. Neither I nor II ❖ GUIDE: Local communications = 12% vat Overseas originating in the Philippines = 10% OCT under Section 120 Overseas originating abroad = not subject to business tax 60. One of the following is subject to overseas communications tax: a. Long distance call by a son from Manila to his father in Iloilo City. b. Monthly telephone bill from PLOT. c. Telephone bill on a call by a mother in the Philippines to her son in London. d. Telephone call by Magda in Hongkong to her friend in Manila. ❖ 0 "a" and "b", subjectto vat "d" not subject to business tax 61.Smart-Globe Telecommunications has the following data for a particular month: Gross receipts, domestic calls Gross receipts, overseas calls (originating in the Philippines) Purchase of supplies used in connection with domestic calls net P5,000,000 3,000,000 300,000 of VAT Purchase of equip. used in connection with both domestic calls and overseas calls, net of VAT 800,000 Business expense 1,000,000 How much is the overseas communications tax collected from persons who used the communications facilities? a. P300,000 c. P800,000 b. P500,000 d. nil ❖ OCT = P3,000,000 x 10% = P300,000 Pere r 62.Using the same data in the preceding number, how much is the vat payable? c a. P420,000 C. P504,000 b. P470,000 d. nil • Solution: Output vat (P5M x 12%) Input vat: Directly attributable = P300,000 x 12% Allocated = P800,000 x 12% x 5/8 Vat Payable P600,000 (36,000) (60,000) P504,000 63. Which of the following statements is false? a. BBC, an international news agency, is required to pay 10% percentage tax from messages originating from the Philippines by telephone or telegraph. b. Amounts paid for messages transmitted by an embassy and consular offices of a foreign government is not subject to 10% overseas communications tax. c. Overseas communications initiated by a resident citizen not engaged in trade or business is subject to overseas communication tax. d. None of the above ❖ EXEMPT from OCT: ◼ Diplomatic Services ◼ International Organizations/ as provided under international agreements/treaties ◼ News Agencies or Services ◼ Government 64. One of the following statements is incorrect. a. Overseascommunications tax is imposed on overseas communications originating from the Philippines. b. The person liable to overseas communications tax may or may not be engaged in any trade or business. c. The overseas communications tax is imposed whether the overseas communications are made in the course.of trade or business or not. d. The overseas communications tax is imposed on the owner of the communication facilities used to make overseas communications. • "D"is wrong. Itis imposed on the user of.the facility 65. Moon TelecomInc. has the followingcollections for the month of April 2020: Overseascall Originating abroad Overseas call originating in thePhilippines P1,120,000 880000 , Local calls 2,240,000 7-) ercott How much is the overseas communications tax to be remitted by Moon for the month? a. P220,000 c. P200,000 b. P88,000 d. P80,000 •:• Collections x Revenues exclusive of OCT x OCT % OCT P880,000 100/110 P800,000 10% P80,000 Journal Entry: Dr. P880,000 Cr. Cash OCT Expenses 80,000 Revenues P880,000 OCT Payable 80,000 NOTE: Percentage Taxes, except Stock Transaction Taxes under Sections 127(A) and (B) of the Tax Code are classified as operating expenses for income taxation purposes. The overseas calls originating abroad is not subject to business tax in the Philippines. 66.Based on the preceding number, howmuch is the output tax? a. P240,000 c. P360,000 b. P454,286 d. P268,800 ❖ Solution: Collections P2,240,000 x 100/112 Revenues exclusive of vat x OCT % OCT P2,000,000 12% P240,000 Journal Entry: Dr. P2,240,000 Cr. Cash Revenues Output vat P2,000,000 240,000 Unlike percentage taxes, vat on sale (outputvat) is not classified as operating expenses. It is a tax credit against output vat. Perceitia r Section 121 and 122 — Gross Receipts Tax 67. Which of the following is subject to Other Percentage Taxes? I . I I . I I I . I V . B a n k s Financing/ credit Companies P a w n s h o p s Duly registered Credit Cooperatives a. I and II only c. I, II, Ill and IV b. 1, II and III only d. None of the above ❖ 68. Banko Natin sold a repossessed car to JJ at P1,000,000. Banko Natin is I. Subject to value added tax II. III. Subject to gross receipts tax of 7% Subject to regular corporate income tax a. III only c. II and III only b. 1 and III only d. None of the above ❖ 69. Maharlika Bank purchased machineries from a VAT supplier. What is the treatment for VAT purposes of the sale transaction considering that banks are subject to percentage taxes under Sec. 121 of the Tax Code? a. 0% vat c. exempt from vat b. 12% vat d. percentage tax ❖ 0 Although banks and other financial institutions are not subject to value added tax but to gross receipts tax under Section 121 of the Tax Code, it does not follow that sale of vatable goods to them is no longer subject to vat. Sale of machineries are subject to vat. Consequently, sale of such items to a banking institution is subject to vat. 70. Which of the following is subject to Gross Receipts Tax? I. Pawnshops/money changers Credit cooperatives III. Lending activities ofmulti-purpose cooperatives. A. B. C. D. Yes Yes Yes No 11 Yes No No No III Yes No Yes No ❖ Other non-bank financial intermediaries, such as money changers and pawnshops, are subject to percentage tax under Sections 121 and 122, respectively, of the Tax Code. [Sec. 4.109-1 (B)(w), RR 4-2007) P1,000 3,500 700 P5,200 P O - r e / d i / f e z r d e e z r 71 A pawnshop. for business tax purposes a. Is treated as a lending investor liable to 12% vat on its gross receipts from interest income and from gross selling price from sale of unclaimed properties. b. Is not treated as a lending investor but liable to 5% gross receipts tax under Section 122 of the Tax Code on its gross receipts from interest income and from gross selling price from sale of unclaimed properties. Is exempt from 12% vat and OPT c. d. Is subject to 12% vat and OPT • ; [Sec. 4.109-1 (13)(w), RR 4-2007] 72. piggy Bank has the following data for the month of January 2020: Interest income, the remaining maturity of the instrument is 5 years Rentals (gross of 5% expanded withholding tax) P100,000 50,000 0, (10,000) Net trading loss How much is the gross receipts tax on the collections of Piggy for January 2020? c a. P5,000 C. P7,800 db. P3,500 d. P8,500 Interest income—from short term loan = P100,000 x 5% Rental income—P50,000 x 7% Gross receipts tax P5,000 3,500 P8,500 73. In addition to the information in the preceding number, Piggy Bank has the following information for the month of February 2020: Interest income, the remaining maturity of the instrument is 6 years Rentals (gross of 5% expanded withholding tax) 100,000 50,000 Net trading gain 20,000 How much is the gross receipts tax on the collections of Piggy for February 2018? a. P5,200 c. P9,200 b. P5,900 d. P9,900 ❖ A n sw e r: A Interest income - from long term loan = P100,000 x 1% Rental income - P50,000 x 7% Net trading gain = (P20,000-10,000) x 7% Gross receipts tax Apply cumulative rule as to net trading gain 74. Pedro executed on January 1, 2016, a long term loan from PRTC Bank in the amount of P6,000,000 payable within ten (10) years, with an annual interest of 2%. However, on tJanu.ary 31, 2020, the loan was pre-terminated. Assuming PRIG Bank declared correctly the from 2016 to 2019 and the applicable gross receipts taxes were paid, how m u gross receipts tax should be paid for the year 2020? a.pioo c. b , P19,700 p 2 4 , 5 0 0 d. P500 7erceit GRT payment from Jan. 1. 2016 to Dec. 31. 2019 (P6,000,000 x 2% x 4 years) x 1% Adjusted GRT (P6M x 2% x 4 x 5%) Adjustment (deficiency) Add: GRT for January 2020 (P6M x 2% /12months) x 5% Total Gross Receipts Tax, Jan. 31, 2020 (P4.800) 24,000 P19,200 500 P19,700 75. December 1, 2015, Rianne borrowed P1,000,000 from BDO payable within 10 years. The loan pays an annual interest of P100,000 payable every December 1 beginning December 1, 2016. On December 1, 2020, Riannne pre-terminated the loan by repaying the principal in full. The gross receipts tax still due from BDO due to the pre-termination in 2020 is: a. P5,000 c. P21,000 b. P16,000 d. P25,000 ❖ GRT payment from Dec. 1, 2016 to Dec. 1, 2019 (P100,000 x 4 years) x 1% Adjusted GRT (P400,000 x 5%) Adjustment (deficiency) Add: GRT for 2020 = P100,000 x 5% Gross Receipts Tax Due, Dec. 1, 2020 (P4,000) 20,000 P16,000 5,000 P21,000 76. China Bank extended loans to its debtors during the year, with real properties of the debtors being used as collateral to secure the loans. When the debtors failed to to pay the unpaid principal and interest after several demand letters, the bank foreclosed the same and entered into contracts of lease with tenants. The bank is subject to business tax as follows: I. II. 12% vat 7% gross receipts tax a. I only c. Both I and II b. II only d. Neither I nor II ❖ Section 123—Premiums Tax on LifeInsurance Section 124—Premiums Tax on Agents of Foreign Insurance companies 77. Statement 1: The tax on insurance premiums applies to every person, company or corporation doing life insurance business of any sort in the Philippines, except purely cooperative companies and associations. Statement2:A person engaged in non-life insurance business is subjectto value-added tax. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d . Only the second statement is correct. 78. Statement1: The tax on life insurance premiums is 2% based upon the total premiums collected whether such premiums are paid in money, notes, credits, or any substitute for money. Statement2: The tax on agents of foreign insurance companies is 4% based upon the totalpremiums collected. a. Both statements are correct. b. Both statements are incorrect. c, Only the first statement is correct. d.Only the second statement is correct. 79. Statement 1:Allinsurance premiumcollected by life insurance company is subject to 2% gross receipt tax. Statement2: A life insurance premium refunded within six (6) months is not subject to a 2% percentage tax. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second statement is correct. 80. Section 124 of the Tax Code, as amended, provides that every fire, marine or miscellaneous insurance agent authorized under the Insurance Code to procure policies of insurance as he may have previously been legally authorized to transact on risks located in the Philippines for companies not authorized to transact business in the Philippines shall pay a tax equal to: a.2% b.4% c. 5%, d. 10% The tax rate, as provided in the Tax Code, is twice of Section 123. 81. A domestic insurance company gave the following information for the month: Gross receipts from its insurancepolicies Premium on life insurance Premium on non-life insurance Grossreceipts as agent of a non-resident foreign insurance co. Premium on non-life insurance Premium on property insurance P2,100,000 1,500,000 P4,000,000 1,000,000 The percentage tax due for the month is: a. P355,000 c. P242,000 b. P430,000 d. P605,000 ❖ Gross receipts from its insurance policies Premium on life insurance (P2,100,000 x 2%) Gross receipts as agent of a non-resident foreign insurance company Premium on non-life insurance (P4,000,000 x 4%) Premium on property insurance (P1,000,000 x 4%) Percentage Tax for the month P42,000 160,000 40,000 P242,000 82. Pro-Life Insurance is engaged in business. It also serves as an agent of a marine nonresident foreign insurance company. It has the following data for the current month: Total premium collected as an agent of a foreign insurance company P2,000,0 0,00000 Total premiums collected from non-life insurance in the Philippines 50 Purchase of supplies for use in non-life business in the Philippines 300,000 How much is the tax for total premiums collected as an agent of a foreign insurance company? a. P80,000 c. P40,000 b. P100,000 d. P20,000 • :* Q Tax on Agents of Foreign Insurance Co. = P2,000,000 x 4% = P80,000 83. Using the same data in the preceding problem, how much is vat payable? a. P24,000 c. P40,000 b. P52,800 d. P20,000 • :• Output vat (P500,000 x 12%) Less: Input vat (P300,000 x 12%) Vat payable P60,000 (36,000) 24,000 84. Mabuhay Insurance Corporation furnished us its data shown below: ◼ Insurance Premiums collectible is P3,750,000 ◼ The breakdown of the above premiums is as follows: Life Insurance Premiums 75% Non-life insurance premiums 25% ◼ Duringthe month, 70% of collectible life insurance premiums and 50% of collectible non-life insurance premiums were collected. The Premiums Tax payable is: a. P39,375 c. P94,437.50 b. P78,750 d. P196,875 ❖ Solution: Insurance premiums collectible x x Total premiums collected on life insurance x Premiums Tax Payable P3,750,000 75% 70% P1,968,750 2% P39,375 85.Using the same data in the preceding number, the total business taxes should be: a. P39,375 c. P95,625 b. P56,250 + d. P120,000 Premiums Tax Payable (preceding number) Output Vat (P3,750,000 x 25% x 50% x 12% Total business taxes for the month P39,375 56,250 P95,625 86. Pedro wants to procure fire insurance for his Mansion in Forbes Park, Makati from Gallaxy Insurance Company, a non-resident foreign corporation, through its agent in the Philippines, G.I. Joe. He paid premiums in 2018 amounting to P500,000. How much is the premiums tax payable on the transaction? a. P10,000 c. P25,000 b. P20,000 d. P50,000 ❖ Premiums Tax on Agents of Foreign Insurance Co. = P500,000 x 4% = P20,000 87. Using the same information above, but assuming Pedro directly obtained the insurance policy from Gallaxy Insurance Company, how much is the premiums tax payable on the transaction? a. P10,000 c. P25,000 b. P20,000 d. P50,000 ❖ Premiums Tax = P500,000 x5% = P25,000 Section 125—Amusement Taxes 88.A tax on the right or privilege to enter places of amusement a. value added tax c. amusement tax b. franchise tax d. income tax • 89. The operator of one of the following places is not subject to amusement tax. a. Cockpits b. Racetracks Percad c. Bowling alleys d. KTV Karaoke joints 0 Bowling alleys are subject to vat, not amusement tax. 90. One of the following is a correct amusement tax rate: a. 30% on jai-alai and racetracks b. 15% on cockpits, cabarets, night and day clubs c. 18% on boxing exhibitions d. 10% on professional basketball games ❖ A n s w e r : A 0 cockpits, cabarets, night and day clubs shall be 18% boxing exhibitions shall be 10% professional basketball games shall be 15% 91. One of the following is an incorrect amusement tax rate: a. Jai-alai and racetracks — 30% b. Cockpits, cabarets, night and day clubs — 18% c. Professional basketball games — 15% d. Boxing exhibitions 12% 92. One of the following is subject to amusement tax on gross receipts a. Owners of winning racehorses. b. Proprietors of karaoke KTV houses. c. Owners of winning cocks in the cockpits d. Lessees of bowling alleys ❖ Owners of winning racehorses are subject to percentage tax on winnings under Section 126 of the Tax Code, not amusement tax. Owners of winning cocks in the cockpits are subject to income tax only "D" is subject to vat 93. Gross receipts for amusement tax shall include all the following except one. Which one is it? a. Income from television, radio and motion picture rights. b. Income from sale of tickets. c. Income from sale of food and refreshments within the amusementplace. d. Income from sale of food and refreshments outside the amusement place. Percerth Vf ratt, es 94.Statement 1:All boxing exhibitions held in the Philippines shall be subject to amusementtax. Statement2: Admission charges to amusement places are required for the imposition of amusement tax. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second statement is correct. ❖ A n s w e r : B 95. Apol B., a Filipino citizen, promoted a world boxing championship bout in the Philippine Arena in Bocaue, Bulacan featuring Manny Pacquiao, a Filipino champion, and Lucas Matthysse, dubbed as "Fight of Champions". Gate receipts amounted to P30,000,000 and additional receipts from television coverage was P20,000,000. The amusement tax due is: a. P2,000,000 c. P5,000,000 b. P3,000,000 d. nil ❖ A n sw er : D 96. Assuming the bout above will be held in Malaysia, how much is the amusement tax? a. P2,000,000 c. P5,000,000 b. P3,000,000 d. nil ❖ 97. Assuming the bout is in the Philippines but the promoter, ApolB.,is a foreign national, how much is the amusement tax? a. P2,000,000 c. P5,000,000 b. P3,000,000 d. nil •:* 0 Amusement Tax = (P3OM + P20M) x 10% = P5M 98. Zirkoh, a comedy bar, had the following data during the month of March 2020: Net income during the month Collections during the month: From services rendered in January P160,000 200,000 From services rendered in February 1,200,000 From services to be performed in March 40,000 How much is the amusement tax for the month? a. P216,000 c. P259,200 b. P252,000 d. P288,000 Percatfit 7,trenj Solution: Collections during the month: From services rendered in January From services rendered in February From services to be performed in March Total collections x Amusement Tax 200,000 1,200,000 40,000 1,440,000 18% P259,200 0 For business tax purposes, ignore income and expenses. 0 If it pertains to sale of services, the basis of business tax is gross receipts or collections, regardless of when the service was rendered. A comedy bar, for business taxation purposes, is subject to amusement tax: Q "Night and Day Clubs" as provided in RMC 18-2010 are drinking, dancing and entertainment venues which oftentimes serve food and provide entertainment. "Cabarets", on the other hand, are restaurants or clubs where liquor and food are served, with a stage provided for performances by musicians, dancers or comedians, including a venue for dancing by patrons/customers, similar to that of nightclubs. With the advent of modern interactive entertainment, along with recorded music (and/or music video) using a microphone and public address system, the proprietors/lessees or operators of these amusement places have pursued a new form of lounge and club entertainment. Most of these establishments provide facilities to allow patrons to sing with the expectation that sufficient revenue will be made selling food and drinks to customers. The "terms" nigh and day clubs and cabarets have become passe'. Amusement places which offer the same pleasurable diversion entertainment and function now include videoke bars, karaoke bars, karaoke televisions, karaoke boxes and music lounges. As such, the proprietors, lessees, or operators of the aforementioned establishments are deemed also subject to 18% amusement tax under Section 125 of the Tax Code, and not to the 12% value added tax. 99. Based on the preceding number, if it is a racetrack, how much is the amusement tax payable for the month? How much is the amusement tax for the month? a. P60,000 c. P432,000 b. P360,000 d. P480,000 Solution: Collections during the month: From services rendered in January From services rendered in February From services to be performed in March Total collections x Amusement Tax 200,000 1,200,000 40,000 1,440,000 30% P432,000 3 Hotel rooms 82,000,000 Dining Hall: 1,000,000 Sale of food and refreshments Sale of wine, beer and liquor Disco: Sale of food and refreshments 700,000 600,000 Sale of wine, beer and liquor 500,000 Collections P1,500,000 850,000 650,000 550,000 450,000 Intjlya# P1,000,000 18% P180,000 P1,500,000 1,500,000 P3,000,000 12% P360,000 103. Philippine Basketball Association (PBA), a professional basketball league in the Philippines, opened its own coliseum during April of 2018 and held all its games for the month in the newly built,state of the art facility in Bulacan. PBA provided the following data duringthe month: Receipts from Entrance Fee Gross Receipts from Restaurant operations: Sale of food and beverages P9,800,000 2,200,000 Use the followin • data for the next three • uestions: Casa Palawan,vatregistered,offers different services to its guests. The following data taken from the books of the taxpayer are for the first quarter of 2020: Revenues 100. How much is the amusement tax for the quarter? a. P180,000 c. P540,000 b. P360,000 d. P438,000 ❖ Gross receipts from disco operations x amusement tax rate Output vat 101. How much is output vat for the quarter? a. P180,000 c. P540,000 b. P360,000 d. P438,000 ❖ A n sw e r : B Gross receipts from: Hotel rooms Dining hall (P850k + 650k) Total gross receipts subject to vat x Vat rate Output vat 102. How much is the total business taxes for the quarter? a. P180,000 c. P540,000 b. P360,000 d. P400,000 ❖ An sw e r: C Amusement tax Output vat Total business taxes P180,000 360,00 0 P540,000 Percod Sale of wines & liquor Expenses How much is the amusement tax for the month? a. P1,210,000 c. P1,762,000 b. P1,320,000 d. P1,912,500 4:* Gross receipts from entrance fee Sale of food and beverages Sale of wines and liquors Total gross receipts x Amusement Tax 750,000 3,800,000 P9,800,000 2,200,000 750,000 12,750,000 15% P1,912,500 104. Based on the preceding number but suppose the restaurant is owned and operated by Bryan, a vat-registered person, the amusement taxes of Bryan and the PBA is Bryan PBA a . b . c . d . P 3 5 4 , 0 0 0 P 1 , 3 2 0 , 0 0 0 P 3 5 4 , 0 0 0 P- P1,320,000 P354,000 P354,000 P1,470,000 ❖ PBA: Gross receipts. PBA = P9.8M x 15% OPT Bryan: Gross receipts, restaurant = P2,950,000 x 12% vat P1,470,000 354,000 0 Bryan is subject to vat, not to amusement tax. 105. Boxingexhibitions shall be exempt from amusement tax when the following conditions are present: a. Involves World or Oriental championships in any division. b. One of the contenders is a citizen of the Philippines. c. Promoted by citizens of the Philippines or by a,corporation or association at least 60% of the capital is owned by Filipino citizens. d. All of the conditions above must be satisfied ❖ Section 126 — Tax on Winnings 106. The Percentage Tax on Winnings is imposed on the winnings of bettors in: a. Cockfighting b. Horse race c. J a i - a l a i d. b o x i n g la m /cetth 107. The following shall always besubject to10% percentage tax, except? y X a. Overseas call made b Mr.X,resident of Manila, to his mother in Libya b. c. Winnings from horse races by a bettor Oriental Championship match in the Philippines, betweena Filipino and Mexican d. Winnings from horse races by a horse owner. 0 A bettor of horse races may be subject to 10% winnings. Basis: Net winnings = Gross winnings or di winning ticket(s) % of Tax: or 4% tax based on net dividends less cost of the • Ordinary winnings: 10% ◼ Special winnings (forecast, double, trifecta,quinela): 4% Horse owner(s) are subject to 10% tax based on gross winnings. 108. Statement 1: The 10% tax on winnings is based on actual amount paid to the winner. Statement 2: The rate of tax on winnings in case of double, forecast/quinella and trifecta shall be four percent (4%). a. Both statements are correct. b. Both statements areincorrect. c. Only the first statement is correct. d. Only the second statement is correct. ❖ 109.MangJose, a horse-owner, received gross winnings of P120,000 during the current month. His tax on winnings shouldbe: a. P6,000 b.P12,000 c. P18,000 d. P24,000 + ; (Tax on winnings = P120,000 x 10% = P12,000) 110. Leo purchased horse racing tickets amounting to P6,000. Fifty percent (50%) of the tickets purchased won double, entitling him a prize of P60,000. How much cash will be given to Leo by the operator? a. P57,720 c. P54,300 b. P54,720 d. P51,300 • Gross winnings Less: Tax on winnings Gross winnings P60,000 P60,000 (3,000) P57,000 Cost of winning tickets (P6,000 x 50%) Net winnings x 4% (2,280 Amount to be paid to Pedro P57,720 Percetth 7 ; e The cost of the winning tickets shall not be deducted from the amount to be paid to Pedro because the purchase of ticket and receipt of dividends or winnings are separate transactions. 111. Pedro, a horse bettor, had the following records of his horse races for the month of May of 2020: Type of Gross Cost of Horse Winnings Winnings winning tickets Ana Khan Lor Naden Fe Licidad Trifecta P100,000 P40,000 Ordinary 250,000 50,000 Double 325,000 75,000 How much is the business tax on winnings? a . P 3 2 , 4 0 0 c. P49,000 b . P 3 5 , 7 5 0 d. P68,000 ❖ Horse Type of Winnin•s Net winnin •s Tax Ana Khan Trifecta P60,000 4% P2,400 Lor Naden Ordinary 200,000 10% 20,000 Fe Licidad Double 250,000 4% 10,000 TOTAL P32,400 112. Mike Ong received P100,000 winnings from cockfighting. Determine his tax liability. I. Subject to 10% OPT (tax on winnings) under Section 126 of the Tax Code II. Subject to income tax Ill. Subject to 10% OPT (tax on winnings) under Section 126 of the Tax Code and 20% final tax on passive income a. I only c. Ill only b. II only d. I and Ill ❖ 113. MannuGal received P100,000 winnings from horseracing. Determine his tax liability. 1. Subject to 10% OPT (tax on winnings) under Section 126 of the Tax Code II. Subject to basic income tax Ill. Subject to 10% OPT (tax on winnings) under Section 126 of the Tax Code and 20% final tax on passive income a. I only C. III only b. II only d. I and III •:• 114. A race track bettor won the following bets: ◼ On double, a bet of P200 and dividend of P200 per P20 ticket. ◼ On winner take all, a bet of P500 and a dividend of P1,000 per P50 ticket a_ C/ etc' m On forecast, a bet of P1,000 and dividend of P100 per P20 ticket Thetotal percentage tax due from the winnings is: a. P682 c. P1,280 b. P1,182 d. P1,530 •• ON DOUBLE = P200 bet/P20 per bet = 10 tickets = Net winnings per ticket = P200-20 = P180 OPT = P180 x 10 tickets x 4% = P72 0 ON Winner Take AU (Ordinary winnings) = P500 bet/P50 per bet = 10 tickets = Net winnings per ticket = P1,000 — 50 = P950 OPT = P950 x 10 tickets x 10% = P950 ON FORECAST = P1,000 bet/P20 per bet = 50 tickets = Net winnings per ticket = P100-20 = P80 OPT = P80 x 50 tickets x 4% = P160 TOTAL Tax on Winnings = P72 + P950 + 160 = P1,182 Section 127—Stock Transaction Tax The next four (4) questions are based on the following data: Galaxy Corporation, a closely-held corporation, has an authorized capital stock of 20,000,000 shares with par value of P5.00/share. Of the 20,000,000 authorized shares, 5,000,000 thereof were subscribed and fully paid up by the following shareholders: Pedro 1,000,000 Ana 1,000,000 Lorna 1,000,000 Fe 1,000,000 Juan 1,000,000 Total Shares Outstanding 5,000,000 On February 2020,Gallaxydecided to conduct an initial public offering (IPO) and initially _Offers 5,000,000 of itsunissued shares to the investing public forP7.50/share. entire the PO period, one of its existing shareholders, Lorna, has likewise decided to sell her ntre 1,000,000 shares to the public for P7.50/share. 115.How much is the percentage tax due on theprimary offering? a. b. P375,000 81,500,000 d. nil c. P750,000 7erce/ti Solution: 0. Tax on "primary offering' refers to percentage tax due of the issuing corporation during its initial public offering (IPO). 0 RATIO = shares issued @ IPO over outstanding shares after IPO =5/10=50% IPO Rate =1% 0 OPT on IPO = Proceeds x Tax % = 5M shares x P7.5 x 1% = P375,000 116. How much is the percentage tax due on the secondary offering (by Lorna)? a. P75,000 c. P150,000 b. P300,000 d. nil ❖ 0 Tax on "secondary offering" refers to percentage tax due of the shareholder who sold his/her share at the time the corporation is undergoing initial public offering (lP0). 0 RATIO = shares issued @ !PO over outstanding shares after IPO =1/10=10% IPO Rate =4% 0 OPT on IPO = Proceeds x Tax % = 1M shares x P7.5,x 4% = P300,000 117. If in May 2020, Gallaxy again decides to increase capitalization by offering another 6,000,000 of unissued shares to the public at P10.00/share, how much is the percentage tax due? a b. P600,000 P1,200,000 c. P2,400,000 d. nil ❖ 0 Issuance of shares by the issuing corporation after IPO is known as "follow-onfollow-through issuance". The issuing corporation is subject only to one (1) type of Percentage Tax, the Percentage Tax on IPO under Section 127(8) of the Tax Code, as amended. 0 The issuing corporation is not subject to Percentage Tax before and after IPO. However, it is liable to documentary stamp tax (DST) on the issuance of stock certificate to shareholders. 118. If in August 2020, Juan decides to sell his entire stock ownership to the public at P10.00/share, how much is the percentage tax due? a . b . P 5 0 , 0 0 0 P 6 0 , 0 0 0 c. P400,000 d. nil ❖ SALE of shares by a shareholder after IPO is known as "follow-on-follow-through sale" under Section 127(A) of the Tax Code, as amended, subject to Percentage Tax as follows: ◼ Sale prior to 2018: % of Ph of Gross Selling Price ◼ Sale on or after Jan. 1, 2018:,6/10 of 1% of Gross Selling Price 0 OPT = 1,000,000 shares x P10 x .006 ISSUING CORPORATION Primary Offering Follow on follow through Issuance of shares during IPO Issuance of shares after IPO SHAREHOLDER Sale of shares before 1PO; Sale of shares of unlisted DC OR Capital gains tax; TRAIN Law = 15% STT of 6/10 of 1% of GSP Primary Offering STT: 4%, 2%, 1% Follow onfollow TRAIN Law: through ADDITIONAL GUIDE: Issuance of shares before IPO APPLICABLE TAX Not subject to VAT, OPT & income tax but subject to DST SUMMARYOF APPLICABLE TAXES IN THE ISSUANCE OR SALE OF SHARES OF STOCK TERM USED STT: 4%, 2%, 1% Not subject to VAT, OPT and income tax but subject to DST Sale of shares during IPO Sale of shares after IPO; or Sale of shares ofListed DC C. d. 119. Issuance of shares by a closely held issuing corporation shall besubject to: a. Percentage tax—6/10 of 1% based on gross selling price or gross value in money. b. Capital gains tax of 15% on capital gain c. Percentage on IPO—4%, 2%, 1% based on gross selling price or gross value in money. d. No business tax but subject to documentary stamp tax (DST) ❖ 120. Primary offering of shares by the issuing corporation (issuance during initial public offering)shall be subject to: a. Percentage tax—6/10 of 1% based on gross selling price or gross value in money. b. Capital gains tax of 15% on capital gain. c. Percentage on IPO—4%, 2%, 1% based on gross selling price or gross value in money. d. No business tax but subject to documentary stamp tax(DST) + 121. Followon follow through issuance of shares by the issuing corporation (issuance after IPO) shall be subject to: b.Percentage tax — 6/10 of 1% based on gross selling price or gross value in money. b. Capital gains tax of 15% on capital gains. Percentage on IPO — 4%, 2%, 1% based on gross selling price or gross value in money. No business tax but subjectto documentary stamp tax(DST) 122. Shares of stock held as investment when sold directly to a buyer on or after January 1, 2018 shall be subject to: a. Percentage tax — 6/10 of 1% based on gross selling price or gross value in money. b. Value-added tax — 10% based on gross income. c. Capital gains tax — 15% of capital gain d. Percentage on IPO — 4%, 2%,; 1% based on gross selling price or gross value in money. ❖ 123. Secondary offering of stock held as investment when sold during IPO period shall be subject to: a. Percentage tax — 6/10 of 1% based on gross selling price or gross value in money. b. Value-added tax — 10% based on gross income. c. Capital gains tax of 15% on capital gain. d. Percentage on IPO — 4%, 2%, 1% based on gross selling price or gross value in money. ❖ 124. Shares of stock held as investment when sold through the local stock exchange on or after January 1, 2018 shall be subject to: a. Percentage tax — 6/10 of 1% based on gross selling price or gross value in money. b. Value-added tax — 10% based on gross income. c. Capital gains tax of 15% on capital gain. d. Percentage on IPO — 4%, 2%, 1% based on gross selling price or gross value in money. ❖ 125. In 2019, Trillanes invested P5,500,000 in the shares of stock of Du30 Corporation. The corporation's shares are listed and are traded in the local stock exchange. Trillanes subsequently sold the shares in 2020 for P5,000,000 through the local stock exchange. The percentage tax on the sale is: a. P15,000 c. P30,000 b. P25,000 d. P50,000 ❖ 0 Stock Transaction Tax = P5M x .006 = P30,000 126. Assuming the shares were not listed in the local stock exchange and that Trillanes sold the shares to Cayatano, the percentage tax on the sale is: a. P15,000 c. P30,000 b. P25,000 d. P0. ❖ A n s w e r : D 0 Subject to CGT, not percentage tax 73ercet& racres 127. Oneof the following statements is incorrect. 'aThe6/10of.1% tax shall be collected by the broker who made the sale and shall be remitted within 5 banking days from the date of collection b. The tax paid on sale of shares through local stock exchange and initial public purposes offering (1P0) and secondary offering shall not be allowable deduction or income tax c. The 6/10 of 1% stock transaction tax is a final withholding tax on income. d. The 6/10 of '1% stock transactio in n tax is collected whether there is an income or a loss and is a percentage tax. ❖ 128. 1stStatement: Sale by a stock dealer of shares of stocks through the local stock exchange is subject to the stock transactions tax. 2ndStatement: Sale by a stock dealer of shares of stocks directly to a buyer is subject to the capital gains tax a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second state statement is correct • Answer:B Sale of shares by a stock dealer is subject to basic income tax and vat. 129. All of the following except one are liable to 6/10 of 1% stock transaction tax. Which one is not? a. Individual taxpayers, whether citizens or alien b. Corporate taxpayers, whether domestic or foreign c. Estates and Trust d. Dealers insecurities ❖ Dealers in securities are subject to value added tax. 130. Gallaxy Corporation issued 10,000shares, with par value of P100 per share, to Mr. per share. Thetransaction did not pass through the Apolinario Bobadila for 12150 p Philippine Stock Exchange. How much is the capitalgains tax on the sale? a. P45,000 c. P50,000 b. P25,000 d. zero • . • CGT is applicable only if the seller is a shareholderor investor, not issuer 0 The transaction is not subject to any business tax except DST Percelliff 131. Using the data in the preceding number, how much is the percentage tax assuming Mr. Mr. Bobadilla subsequently sold his shares for P200 per share? a. P45,000 c. P10,000 b. P25,000 d. zero The sale will be subjected to capital grains tax (an income tax) but not subject to percentage tax • 132. Statement1: The buyer of shares under primary offering shall .be the one liable for the payment of stock transaction tax to be withheld and remitted by the stock broker. Statement 2: The seller shall be the one liable for the stock transaction tax of shares sold under secondary offering offering. •71Bri alit ..• u•a A. B. C. D. Statement 1 True True False False Statement 2 True False True False AwsnmaINIMMI1001001••■■■••• ❖ An sw e r: C 133. Which of the following percentage taxes is paid on a quarterly basis upon effectivity of the TRAIN Law? I. Tax on overseas dispatch, message, or conversation originating from the Philippines Amusement taxes Stock transactions tax Percentage tax on international carriers II. III. IV. a. I and II only c. I, II and IV only b. III and IV only d. I, II, III and IV ❖ 0 Item "Ill" is filed and paid as follows: o Section 127(A): within 5 banking days o Section 127(B): within 30 days from listing o Refer also to the next problem 134. Statement 1: Upon the effectivity of the TRAIN Law, payment of stock transaction tax of 6/10 of 1% is within five (5) banking days from the date withheld by the broker. Statement 2: Payment of stock transaction tax of 4%, 2% and 1% on primary offering should be within thirty (30) days from the date of listing in the local stock exchange. a. Both statements are correct. b. Both statements are incorrect. c. Only the first statement is correct. d. Only the second state statement is correct. [Show More]

Last updated: 2 years ago

Preview 1 out of 43 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 01, 2022

Number of pages

43

Written in

Additional information

This document has been written for:

Uploaded

Jul 01, 2022

Downloads

0

Views

135