A Level Geography_H481/02 Mark Scheme Oct 2021 | Human Interactions

$ 7

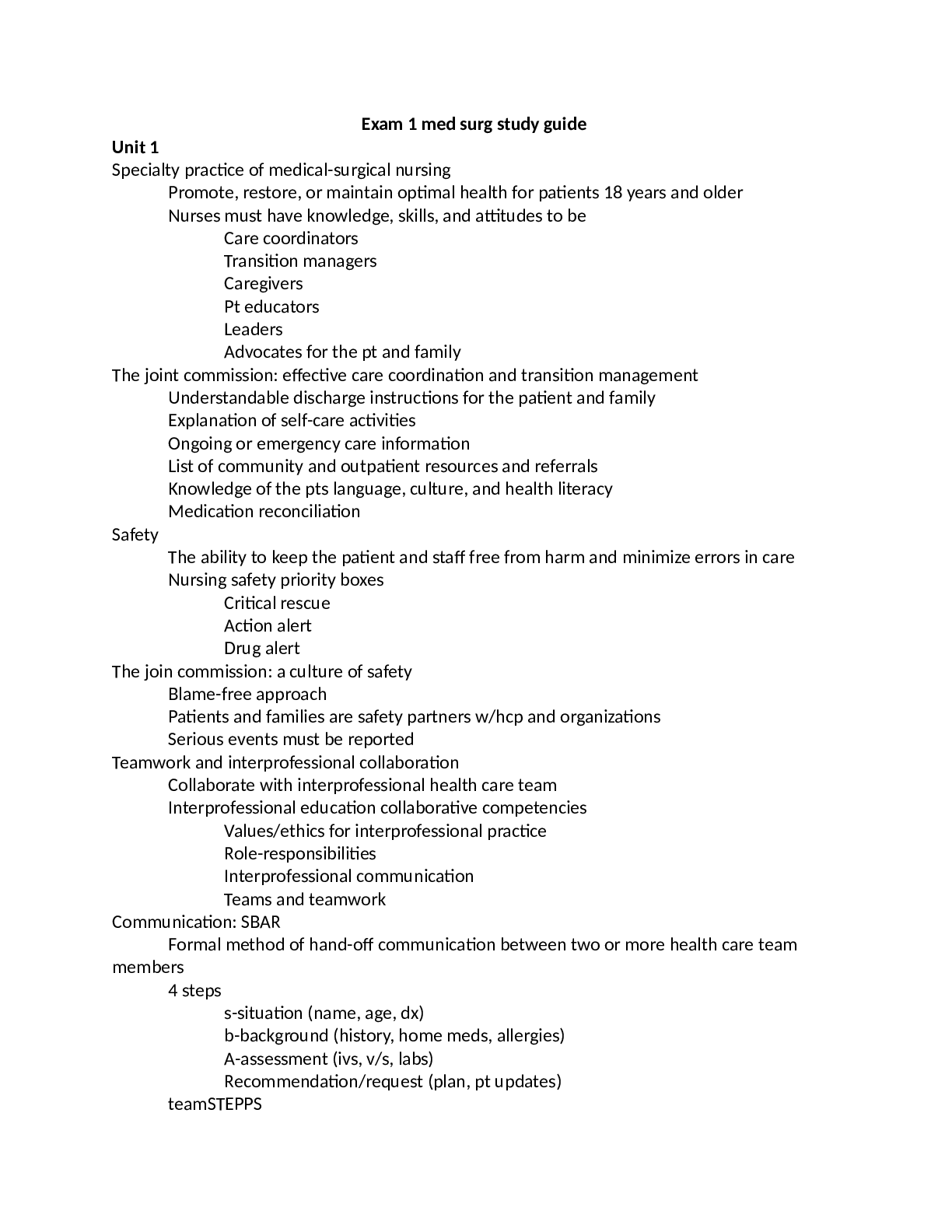

Med Surg Exam 2 Complete study guide|Galen College of Nursing - NUR 242 MS Exam 1

$ 12

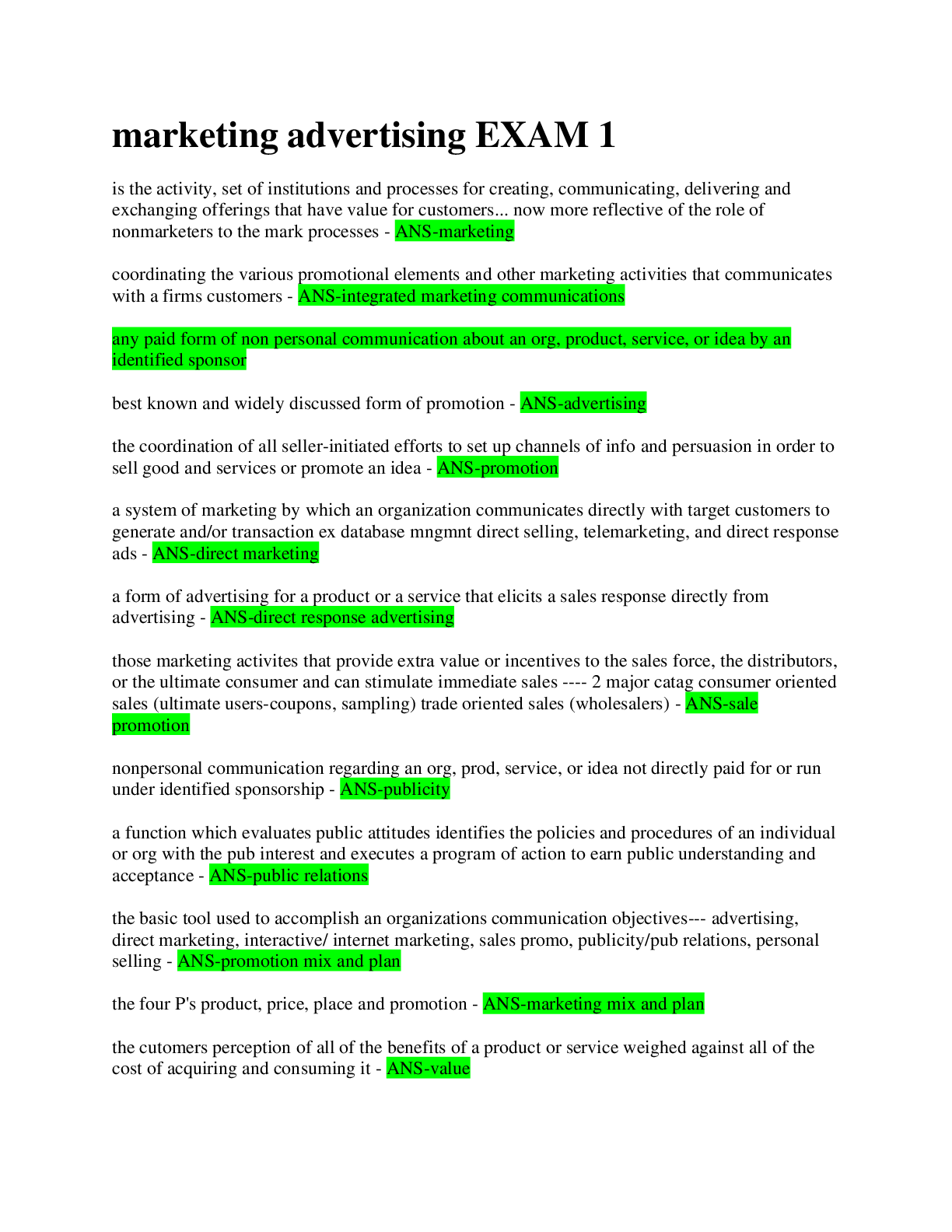

marketing advertising EXAM 1/COMPLETE SOLUTION

$ 1

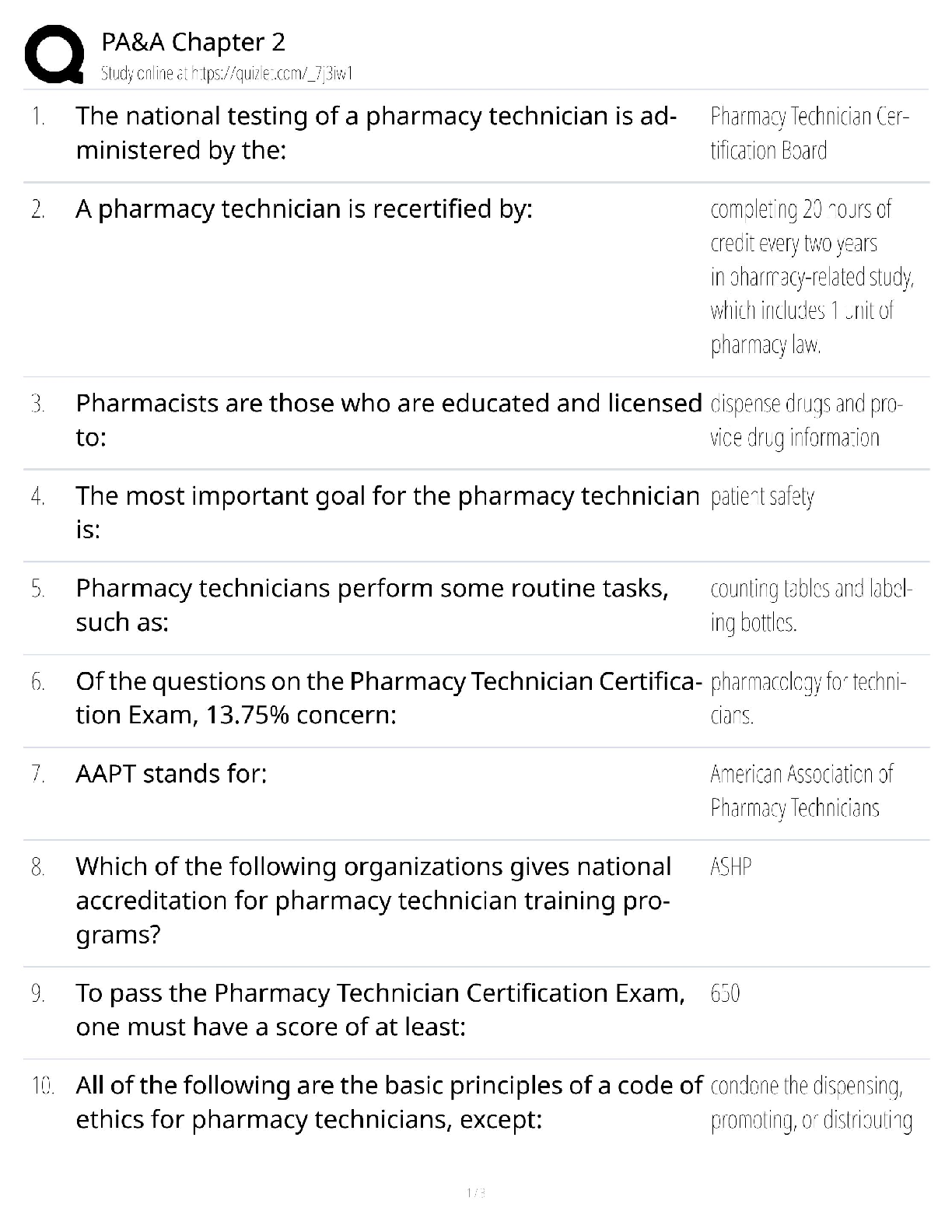

ACC 310 PA&A Chapter 2 / Professional Auditing Standards Study Guide / 2025 CPA Test Bank / Score 100%

$ 21

> A Level in Design and Technology: Design Engineering H404/02 Problem Solving in Design Engineering Question Paper October 2021

$ 6

MSSC - Maintenance Awareness | 150 Questions with 100% Correct Answers | Updated & Verified

$ 10

Ethics, Jurisprudence and Practice Management in Dental Hygiene 3rd Edition.

$ 11

BIOD 322 MOD 8 NEUROSCIENCE DISEASES LATEST REVIEW EXAM Q & A 2024

$ 11

MGT 5000 Quizzes (6 Versions) | Questions and Answers (Complete Solutions)

$ 15

>_ AS Level Physics B (H157)A Level Physics B (H557)Data, Formulae and Relationships Booklet OCT 2021

$ 5.5

BIOD 151 PORTAGE LEARNING ESSENTIAL HUMAN A & P MODULE 3 LATEST REVIEW EXAM Q & A 2024

$ 14

AQA_Biology_2019_Paper_2_Higher_Tier_Mark

$ 10

> GCE Design and Technology H404/02: Problem solving in Design Engineering Advanced GCE Mark Scheme for Autumn 2021

$ 6

WGU C170 Data Management Project - FULL SOLITION 2022

$ 7

NRS 410V Week 2 Assignment, Case Study: Mr. M

$ 11

ATI – NCLEX Predictor Remediation Study Guide 2019

$ 11.5

science ACT practice ALL ANSWERS 100% CORRECT SPRING FALL-2023/24 LATEST EDITION GUARANTEED GRADE A+

$ 12.5

PMHNP Certification Exam (Latest Solutions)

$ 15

Test Bank for Earth Portrait of a Planet, 6e Stephen Marshak

$ 25

NUR 2310 FINAL TEST QUESTIONS/TOP SCORE RATED A+

$ 10

PN Management Online Practice 2020 A with COMPLETE SOLUTION

$ 10

eBook Satellite Gravimetry and the Solid Earth Mathematical Foundations 1st Edition By Mehdi Eshagh

$ 29

8th Grade Science – Plants ALL ANSWERS 100% CORRECT SPRING FALL-2023/24 EDITION GUARANTEED GRADE A+