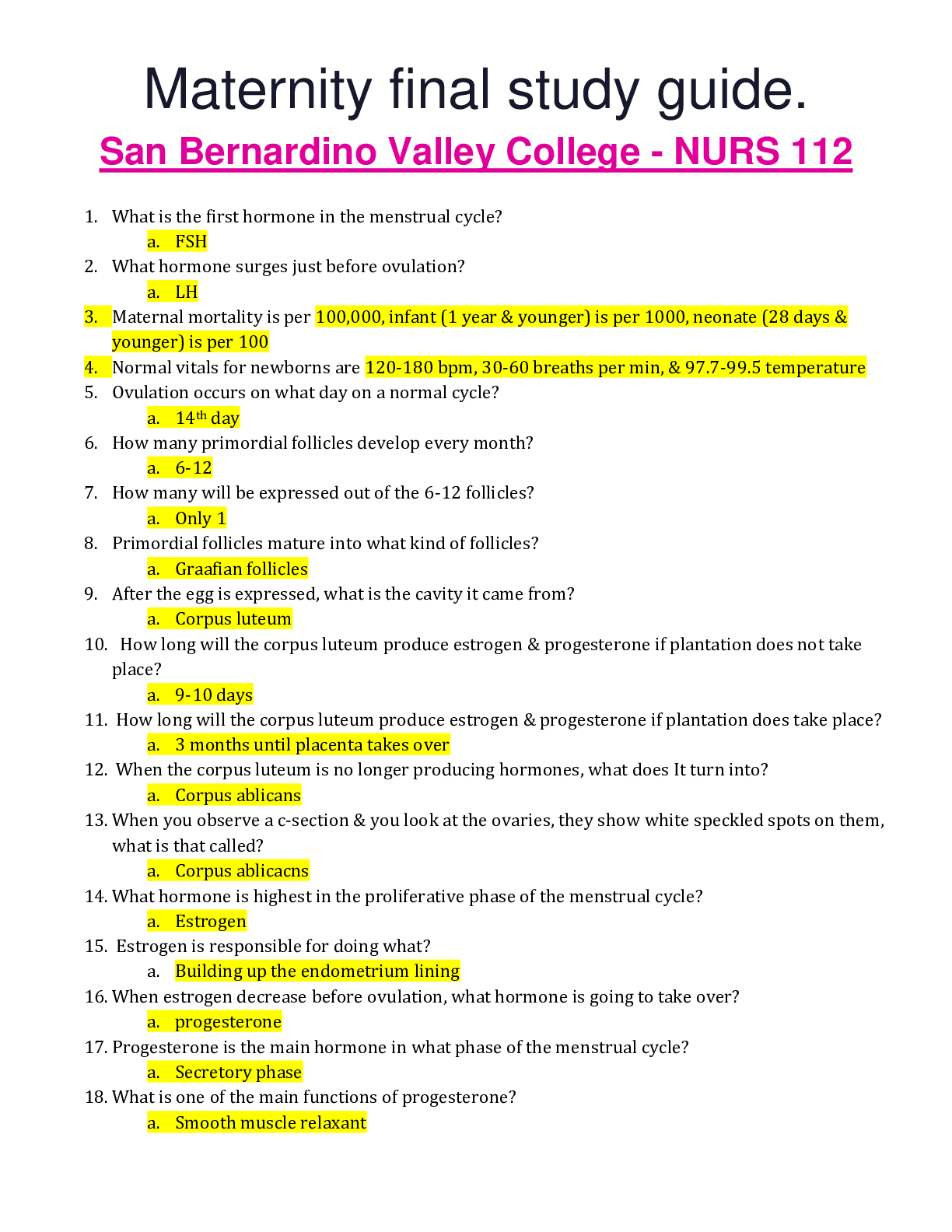

Accounting > EXAM > ACC30030 Accounting Questions & Answers 2020 /2021 (All)

ACC30030 Accounting Questions & Answers 2020 /2021

Document Content and Description Below

1. Which of the following statements best explains why the auditing profession has found it essential to promulgate ethical standards and to establish means for ensuring their observance? A. ... Ethical standards that emphasise excellence in performance over material rewards establish a reputation for competence and character. B. Vigorous enforcement of an established code of ethics is the best way to prevent unscrupulous acts. C. A distinguishing mark of a profession is setting appropriate fees. D. A requirement for a profession is to establish ethical standards that stress a responsibility to the public, clients and colleagues. 2. Which of the following bodies is able to impose penalties on auditors who have failed to carry out their duties properly? A. Financial Reporting Council. B. Companies Auditors and Liquidators Disciplinary Board. C. Auditing and Assurance Standards Board. D. Australian Securities Exchange. 3. Which of the following bodies monitors the operation of the Auditing and Assurance Standards Board? A. Financial Reporting Council. B. Companies Auditors and Liquidators Disciplinary Board. C. Australian Securities Exchange. D. Australian Securities and Investments Commission. 4. Australian auditing standards (ASAs) issued by the Australian Auditing and Assurance Standards Board (AUASB) are intended to be applied to: A. all audit, review, other assurance and related engagements conducted by external firms. B. only audits of entities listed on the Australian Securities Exchange. C. all audits of companies incorporated under the Corporations Act 2001. D. all audit, review, other assurance and related engagements where the entity has more than five shareholders. 5. Which of the following bodies monitors the operation of the Australian Accounting Standards Board? A. Australian Securities Exchange. B. Financial Reporting Council. C. Australian Securities and Investments Commission. D. Auditing and Assurance Standards Board. 6. To become a registered company auditor, a person must be: A. a fit and proper person. B. a member of one of the accounting bodies. C. ordinarily resident in Australia. D. All of the given answers are correct. 7. The types of actions by members of accounting bodies that may result in disciplinary action being taken by the member’s accounting body include: A. if the member is found guilty of a fraud. B. if the member practises while bankrupt or insolvent. C. if the member continues practising despite being declared of unsound mind. D. All of the given answers are correct. 8. Australian auditing standards (ASAs) issued by the Australian Auditing and Assurance Standards Board (AUASB) contain: A. the effective date of the standard. B. references to the enforcement provisions of the Corporations Act 2001. C. the penalties for non-compliance with the standard. D. specific audit procedures to meet the requirements of the standard. 9. An auditor of a company finds that there are rare and exceptional circumstances where they are unable to comply with a relevant requirement in an auditing standard. They are, however, able to perform appropriate alternative audit procedures. To whom do they have to report or document these circumstances? A. The auditor must report these circumstances to either management or the audit committee and obtain their agreement that the alternative procedures are appropriate. B. If the auditor can use appropriate alternative audit procedures, no reporting or documentation is required. C. The auditor is required to document the circumstances in the auditor’s report. D. The auditor is required to document the circumstances in the audit working papers. 10. Who is responsible for assessing whether company auditors meet the required competency standards for registration? A. Auditing and Assurance Standards Board. B. Australian Securities and Investments Commission. C. Companies Auditors and Liquidators Disciplinary Board. D. Financial Reporting Council. 11. Which of the following statements is correct? A. The Australian Securities and Investments Commission is a member of the International Forum of Independent Audit Regulators. B. International auditing standards are mandatory for all auditors. C. The Financial Reporting Council is a member of the International Federation of Accountants. D. Membership of the International Auditing and Assurance Standards Board is restricted to members of the Forum of Firms. 12. Which of the following is not a standard-setting board or committee of the International Federation of Accountants (IFAC)? A. International Auditing and Assurance Standards Board (IAASB). B. International Ethics Standards Board for Accountants (IESBA). C. International Public Sector Accounting Standards Board (IPSASB). D. International Accounting Standards Board (IASB). 13. Membership of the International Auditing and Assurance Standards Board (IAASB) consists of: A. international audit firms. B. International Federation of Accountants (IFAC) member bodies. C. non-auditor representatives. D. All of the given answers are correct. 14. Which of the following types of companies can only be used by an audit firm with the consent of the National Council of Chartered Accountants Australia and New Zealand? A. Nominee company. B. Service company. C. Practice company. D. All of the given answers are correct. 15. Which accounting body in Australia was established under Royal Charter? A. CPA Australia. B. Chartered Accountants Australia and New Zealand. C. Institute of Public Accountants. D. None of the given answers are correct. 16. The largest accounting organisation in Australia is: A. Chartered Accountants Australia and New Zealand. B. CPA Australia. C. Institute of Public Accountants. D. International Federation of Accountants. 17. Which of the following are elements of an audit firm’s quality control that should be considered in establishing its quality control policies and procedures? Personnel management Monitoring Engagement performance A. Yes Yes No B. Yes Yes Yes C. Yes No Yes D. No Yes Yes 18. The objective of quality control dictates that an audit firm should establish policies and procedures for professional development that provide reasonable assurance that all entry-level personnel: A. prepare working papers that are standardised in form and content. B. have the knowledge required to enable them to fulfil the responsibilities assigned. C. advance within the organisation. D. develop specialties in specific areas of assurance services. 19. A firm of independent auditors must establish and follow explicit quality control policies and procedures because these standards: A. are necessary to meet increasing requirements of auditors’ liability insurers. B. give reasonable assurance that the firm as a whole will conform to the auditing standards. C. include formal filing of records of such policies and procedures. D. are required by the Australian Securities and Investments Commission for auditors of all entities. 20. In pursuing its quality control objectives with respect to acceptance of a client, an audit firm is not likely to: A. make enquiries of the proposed client’s legal adviser. B. review financial reports of the proposed client. C. make enquiries of previous auditors. D. review the personnel practices of the proposed client. 21. The mandatory continuing professional education (CPE) requirement for members of Chartered Accountants Australia and New Zealand is: A. 120 CPE hours every year. B. 120 CPE hours every three years. C. 60 CPE hours every three years. D. 60 CPE hours every year. 22. Within the context of quality control, the primary purpose of continuing professional development and training activities is to enable an audit firm to provide personnel with: A. knowledge required to fulfil assigned responsibilities. B. technical training that assures proficiency as an auditor’. C. professional education to ensure that audit work is performed with due professional care. D. knowledge required to perform a peer review. 23. An auditor who is approached by their accounting body to undergo a quality control audit must: A. provide audit files to the investigators without delay. B. obtain the client’s permission to disclose information to the investigators prior to giving them any information. C. cooperate in every way without delay. D. disclose to the investigators any potential quality control problems that the member is aware of. 24. The primary purpose of establishing quality control policies and procedures for deciding whether to accept a new client is to: A. enable the audit firm to attest to the reliability of the client. B. satisfy the audit firm’s duty to the public concerning the acceptance of new clients. C. minimise the likelihood of association with clients whose management lacks integrity. D. anticipate before performing any fieldwork whether an unmodified opinion can be expressed. 25. In pursuing the audit firm’s quality control objectives, the firm may maintain records indicating which partners or employees of the firm were previously employed by the firm’s clients. Which quality control objective would this be most likely to satisfy? A. Professional relationship. B. Supervision. C. Independence. D. Advancement. 26. A basic objective of an audit firm is to provide professional services in conformance with professional standards. Reasonable assurance of achieving this basic objective is provided through: A. continuing professional education. B. a system of quality control. C. compliance with Australian Securities Exchange listing requirements. D. a system of peer review. 27. An auditor’s duty of care to a client would most likely be breached if the auditor failed to: A. meet their reporting deadline. B. detect all of a client’s fraudulent activities. C. conduct the audit for the most competitive price. D. comply with all relevant auditing standards. 28. Due professional care does not require: A. critical review at every level of supervision of work done and judgment exercised. B. good faith and integrity. C. appointment of the auditor by the shareholders. D. compliance with the auditing standards. 29. Common law requires that the auditor: A. guarantees their work. B. performs their work with due care. C. discovers all fraud. D. checks all transactions. 30. When performing an audit, an auditor would most likely be considered negligent if they failed to: A. detect all of the client’s fraudulent activities. B. include a negligence disclaimer in the client engagement letter. C. warn the client of any known internal control weaknesses. D. warn the client’s customers of embezzlement by the client’s employees. 31. Big Ltd wished to acquire the ordinary shares of Small Pty Ltd and engaged Albert & Associates to audit the financial report of Small Pty Ltd. Albert & Associates failed to discover a significant liability when performing the audit. In a common law action against Albert & Associates, Big Ltd, at a minimum, must prove: A. negligence on the part of Albert & Associates. B. fraud on the part of Albert & Associates. C. that Albert & Associates knew that the liability existed. D. All of the given answers are correct. 32. The court found that Roberts & Associates had performed a negligent audit of Pinnacle Ltd, but the plaintiff did not receive damages because the court found insufficient proof of causation. Causation means that: A. the auditor caused the misstatement of the financial report. B. the auditor’s failure to perform a proper audit caused the damages. C. the auditor was negligent, but the plaintiff suffered no real damages. D. the plaintiff was an unforeseen third-party user of the financial report. 33. The Pacific Acceptance case established that: A. reasonable care and skill means following the auditing standards. B. auditors have a duty to closely supervise and review the work of inexperienced audit staff. C. auditors are only liable for the proportion of damages attributable to their actions. D. auditors have a duty of care only to the shareholders as a group. 34. To which of the following parties does the auditor owe a duty of care under contract? A. The company itself. B. The board of directors. C. Shareholders as individuals. D. Potential investors. 35. The AWA case established that: A. reasonable care and skill means following the auditing standards. B. auditors have a duty to closely supervise and review the work of inexperienced audit staff. C. auditors are only liable for the proportion of damages attributable to their actions. D. auditors have a duty of care only to the shareholders as a group. 36. Contributory negligence: A. has always been available as a defence to the auditor. B. indicates the auditor has played no part in the plaintiff’s loss. C. will result in an apportionment of damages arising from the plaintiff’s loss between the defendant and the plaintiff. D. is used to describe the causal relationship between the actions of the auditor and any loss suffered by a plaintiff. 37. Cases that have allowed the auditor to use the defence of contributory negligence include: A. Kingston Cotton Mill. B. Pacific Acceptance. C. AWA. D. None of the given answers are correct. 38. ABC Ltd (ABC) engaged the accounting firm of Ace & King to perform its annual audit. Ace amp; King performed the audit in a competent, non-negligent manner and billed ABC for $30 000, the agreed fee. Shortly after delivery of the audited financial report, Sam Lloyd, the assistant controller, disappeared, taking with him $40 000 of ABC’s funds. It was then discovered that Sam had been engaged in a highly sophisticated, novel defalcation scheme during the past year. He had previously embezzled $50 000 of ABC’s funds. ABC has refused to pay the auditor’s fee and is seeking to recover the $90 000 that was stolen by Sam. Which of the following is correct? A. The auditor cannot recover the audit fee and is liable for $90 000. B. The auditor is entitled to collect the audit fee and is not liable for $90 000. C. ABC is entitled to recover the $40 000 defalcation of the current year and is not liable for the $30 000 fee. D. ABC is entitled to rescind the audit contract and thus is not liable for the $30 000 fee, but it cannot recover damages. 39. In the Caparo case, the court held that the auditor owes a duty of care to: A. all users of the published financial report. B. only those parties specified in the engagement letter. C. the shareholders as a body, but not individual shareholders or third parties. D. all shareholders, but not third parties. 40. An auditor can be sued for damages under which of the following Acts? A. Crimes Act 1914. B. ASIC Act 2001. C. Corporations Act 2001. D. None of the given answers are correct. 41. Privity letters are issued by auditors to: A. limit the auditor’s liability to a specified amount. B. disclaim any liability. C. establish proximity and foreseeability. D. None of the given answers are correct. 42. Simpson & Associates issued an unmodified auditor’s opinion on the financial report of Ridge Ltd (Ridge). Simpson & Associates did not detect material misstatements in the financial report as a result of negligence in the performance of the audit. Based upon the financial report, Clark purchased shares in Ridge. Shortly afterwards, Ridge became insolvent, causing the price of the shares to decline drastically. Clark has commenced legal action against Simpson amp; Associates for damages. Simpson & Associates’ best defence to such an action would be that: A. Clark lacks a contractual relationship as a basis to sue. B. the engagement letter specifically disclaimed all liability to third parties. C. there is no proof of proximity. D. there has been no subsequent sale of the shares for which a precise loss can be calculated. 43. A claim for a breach of duty of care might arise against an auditor if: A. an existing shareholder suffered losses because he increased his investment in the company based on figures in the audited financial report. B. a bank made a loss due to a loan made to the company based on figures in an audited financial report commissioned by the bank. C. a new investor suffered losses because she purchased shares in the company based on figures in the annual audited financial report. D. a finance company made a loss due to a loan made to the entity based on figures in an audited financial report commissioned by the entity. 44. Harry & Joseph rendered an unmodified auditor’s opinion on the financial report of a company that sold shares in a public offering. Based on a false statement in the financial report, Harry & Joseph is being sued by an investor who purchased shares in this public offering. Which of the following represents a viable defence? A. The investor has not met the burden of proving fraud by Harry amp; Joseph. B. The false statement is immaterial in the overall context of the financial report. C. Detection that the statement was false occurred after the date of the auditor’s report. D. The investor did not actually rely upon the false statement. 45. The CLERP 9 reforms now provide for limitation of auditor’s liability through: A. a statutory cap. B. proportionate liability. C. incorporation. D. All of the given answers are correct. [Show More]

Last updated: 2 years ago

Preview 1 out of 18 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 04, 2020

Number of pages

18

Written in

Additional information

This document has been written for:

Uploaded

Dec 04, 2020

Downloads

0

Views

164

.png)