Finance > QUESTIONS & ANSWERS > CFA 60: Introduction to Alternative Investments. Questions with Accurate answers. Graded A+ (All)

CFA 60: Introduction to Alternative Investments. Questions with Accurate answers. Graded A+

Document Content and Description Below

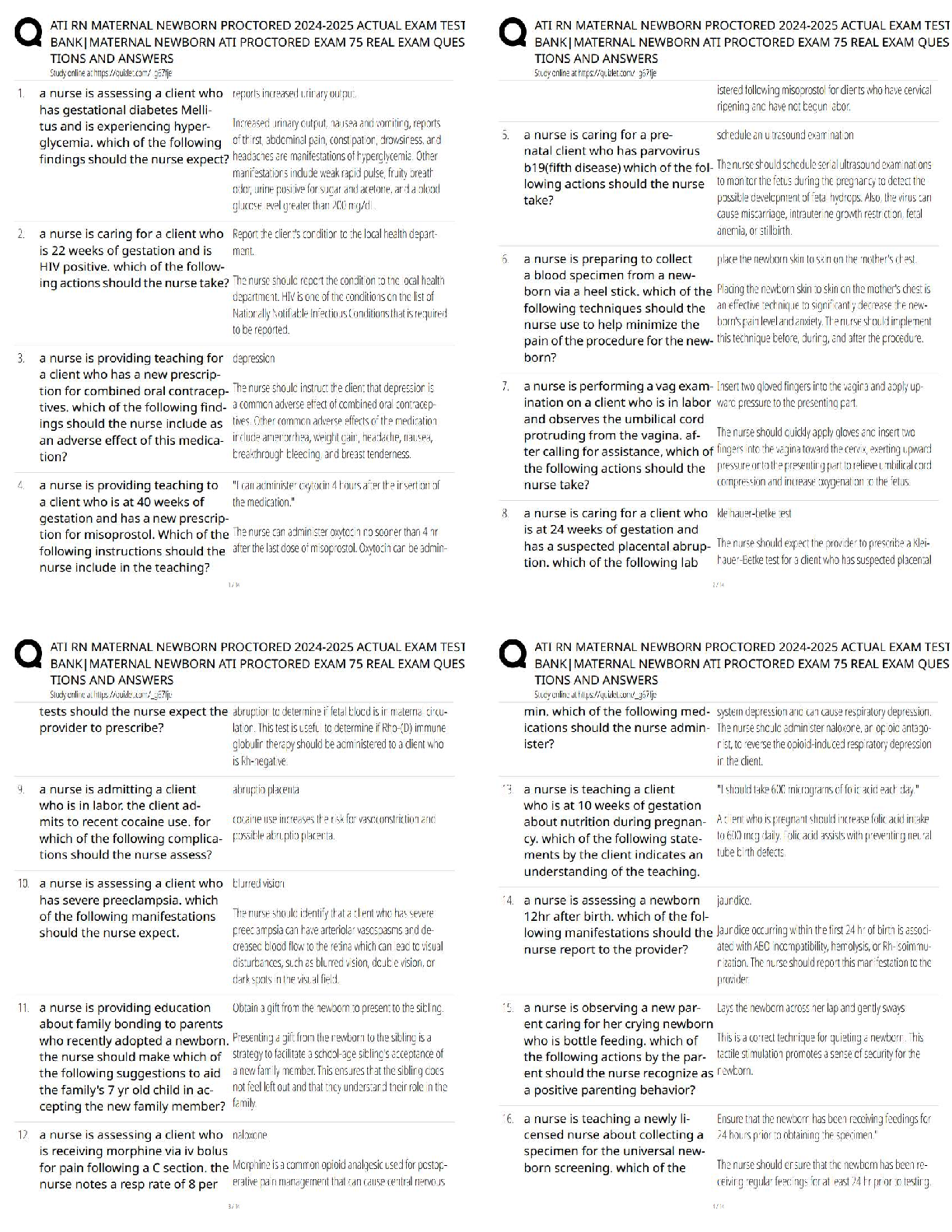

CFA 60: Introduction to Alternative Investments. Questions with Accurate answers. Graded A+ Which of the following is least likely to be considered an alternative investment? Real estate Co ... mmodities Long-only equity funds - ✔✔C is correct. Long-only equity funds are typically considered traditional investments and real estate and commodities are typically classified as alternative investments. An investor is seeking an investment that can take long and short positions, may use multi-strategies, and historically exhibits low correlation with a traditional investment portfolio. The investor's goals will be best satisfied with an investment in: real estate. a hedge fund. a private equity fund. - ✔✔B is correct. Hedge funds may use a variety of strategies (event-driven, relative value, macro and equity hedge), generally have a low correlation with traditional investments, and may take long and short positions. Relative to traditional investments, alternative investments are least likely to be characterized by: high levels of transparency. limited historical return data. significant restrictions on redemptions. - ✔✔A is correct. Alternative investments are characterized as typically having low levels of transparency. Alternative investment funds are typically managed: actively. to generate positive beta return. assuming that markets are efficient. - ✔✔A is correct. There are many approaches to managing alternative investment funds but typically these funds are actively managed and aim to generate positive alpha return. An investor is most likely to consider adding alternative investments to a traditional investment portfolio because: of their historically higher returns. of their historically lower standard deviation of returns. their inclusion is expected to reduce the portfolio's Sharpe ratio. - ✔✔A is correct. The historically higher returns to most categories of alternative investments compared with traditional investments result in potentially higher returns to a portfolio containing alternative investments. The less than perfect correlation with traditional investments results in portfolio risk (standard deviation) being less than the weighted average of the standard deviations of the investments. This has potential to increase the Sharpe ratio in spite of the historically higher standard deviation of returns of most categories of alternative investments. An investor may prefer a single hedge fund to a fund of funds if he seeks: due diligence expertise. better redemption terms. a less complex fee structure. - ✔✔C is correct. Hedge funds of funds have multi-layered fee structures, while the fee structure for a single hedge fund is less complex. Funds of funds presumably have some expertise in conducting due diligence on hedge funds and may be able to negotiate more favorable redemption terms than could an individual investor in a single hedge fund. Hedge funds are similar to private equity funds in that both: are typically structured as partnerships. assess management fees based on assets under management. do not earn an incentive fee until the initial investment is repaid. - ✔✔A is correct. Private equity funds and hedge funds are typically structured as partnerships where investors are limited partners (LP) and the fund is the general partner (GP). The management fee for private equity funds is based on committed capital whereas for hedge funds the management fees are based on assets under management. For most private equity funds, the general partner does not earn an incentive fee until [Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

CFA level 1 bundle, alternative investments, Questions and study sets, 100% pass rate.

Comprehensive documents on CFA Level 1. graded A+. Download to score.

By bundleHub Solution guider 3 years ago

$20

6

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 16, 2022

Number of pages

6

Written in

All

Seller

Reviews Received

Additional information

This document has been written for:

Uploaded

Aug 16, 2022

Downloads

0

Views

165