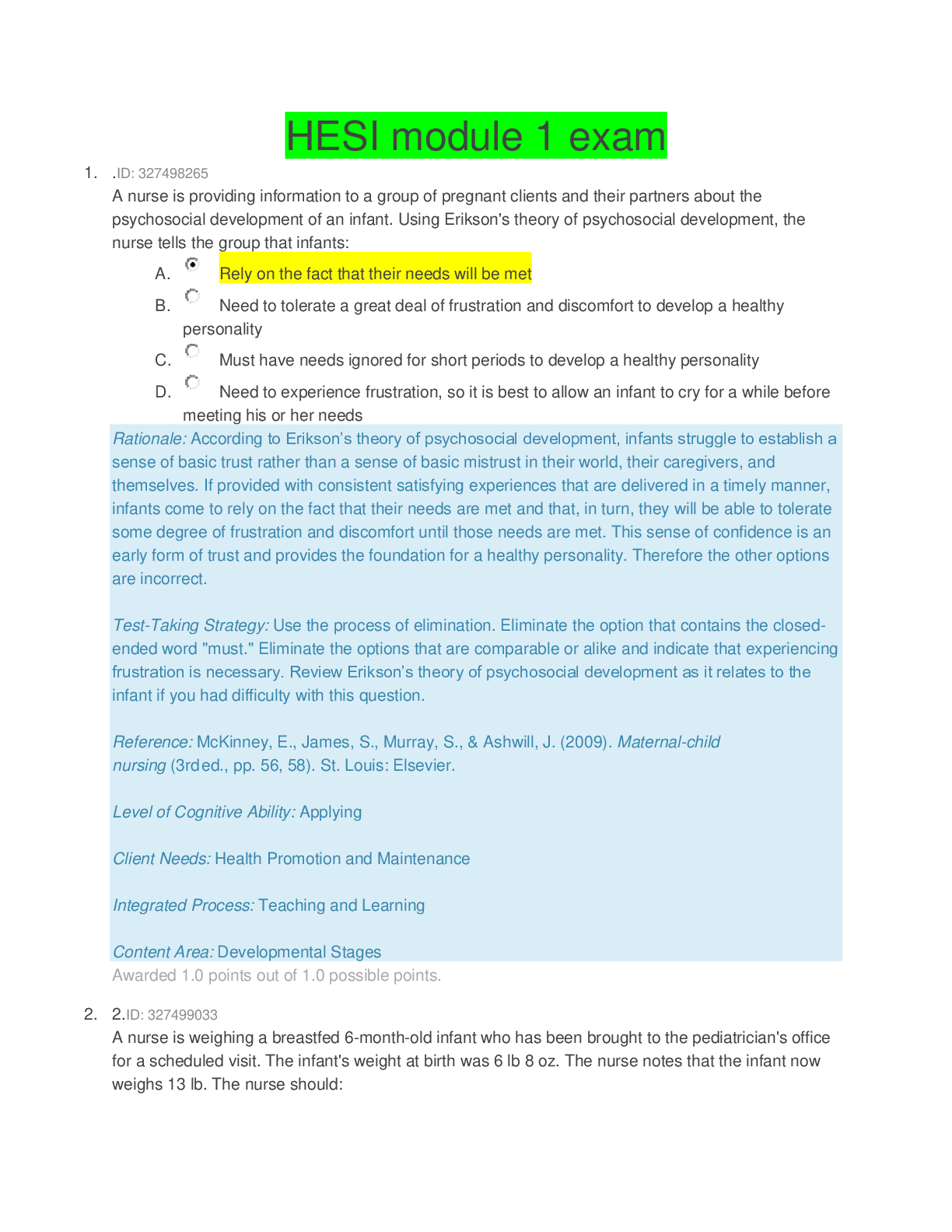

Health Care > QUESTIONS & ANSWERS > AHIP 2020-2021 Module 1 EXAM WITH CORRECT ANSWERS (All)

AHIP 2020-2021 Module 1 EXAM WITH CORRECT ANSWERS

Document Content and Description Below

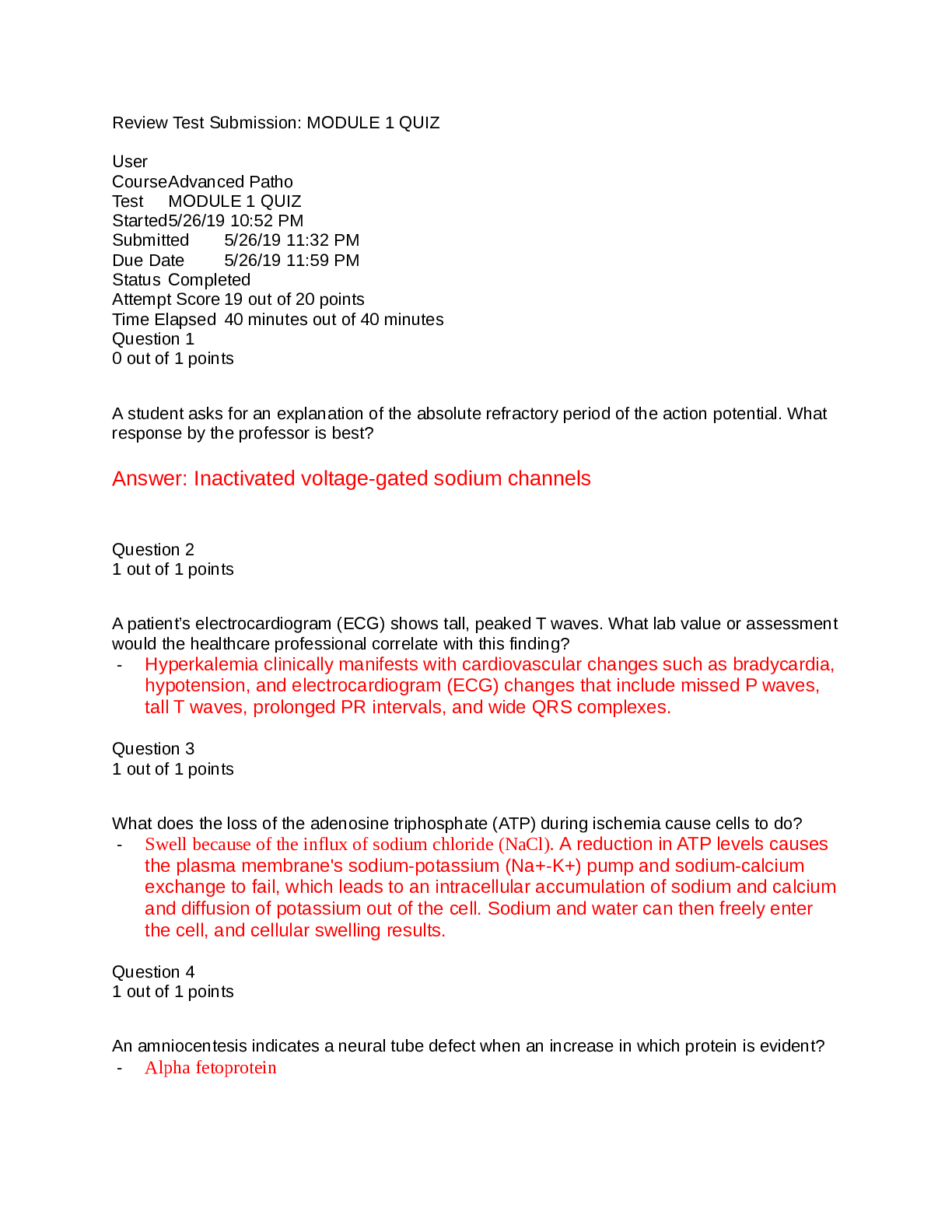

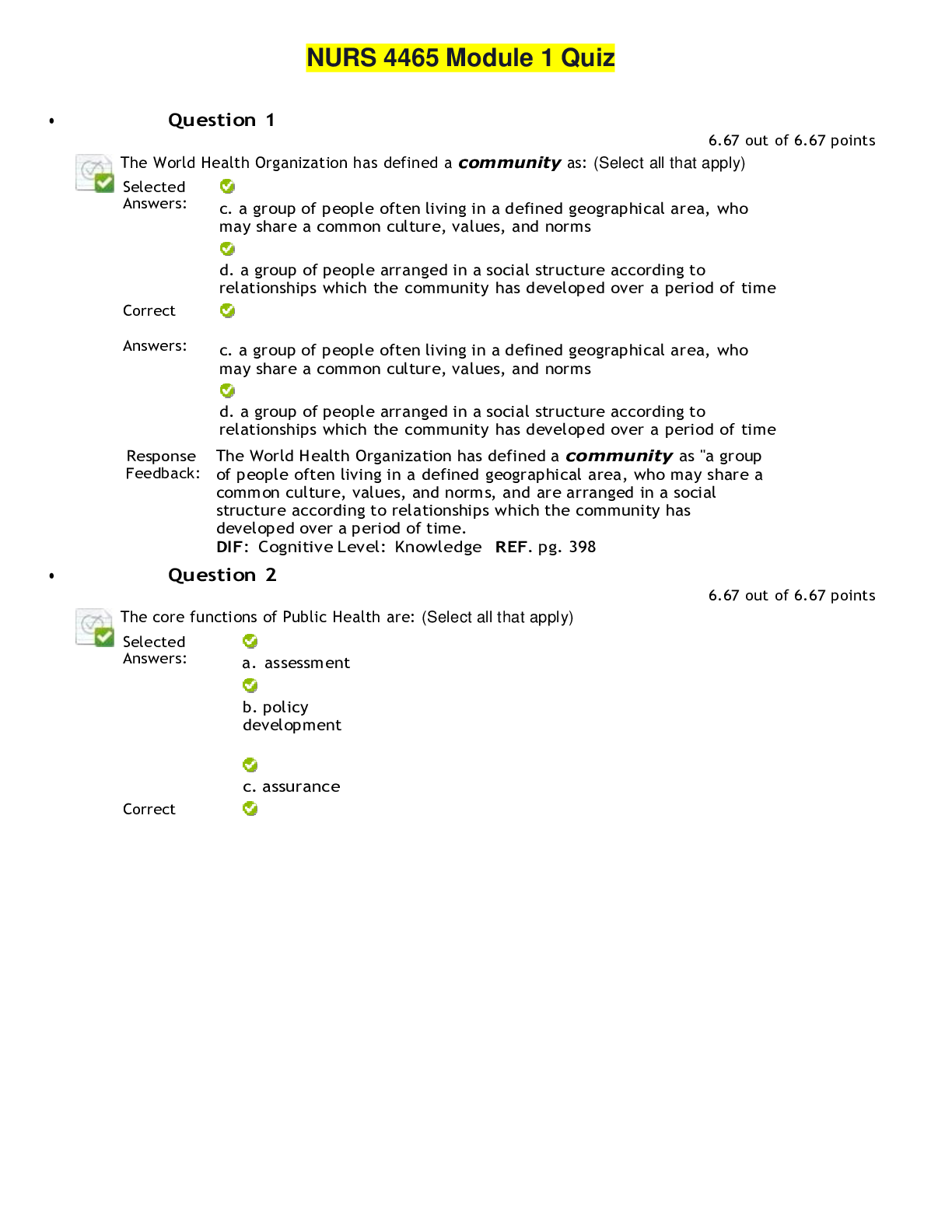

Mrs. Turner is comparing her employer's retiree insurance to Original Medicare and would like to know which of the following services Original Medicare will cover if the appropriate criteria are met? ... What could you tell her? c. Original Medicare covers ambulance services. Madeline Martinez was widowed several years ago. Her husband worked for many years and contributed into the Medicare system. He also left a substantial estate which provides Madeline with an annual income of approximately $130,000. Madeline, who has only worked part-time for the last three years, will soon turn age 65 and hopes to enroll in Original Medicare. She comes to you for advice. What should you tell her? b. You should tell Madeline that she will be able to enroll in Medicare Part A without paying monthly premiums due to her husband's long work record and participation in the Medicare system. You should also tell Madeline that she will pay Part B premiums at more than the standard lowest rate but less than the highest rate due her substantial income. 00:02 01:11 Juan Perez, who is turning age 65 next month, intends to work for several more years at Smallcap, Incorporated. Smallcap has a workforce of 15 employees and offers employer-sponsored healthcare coverage. Juan is a naturalized citizen and has contributed to the Medicare system for over 20 years. Juan asks you if he will be entitled to Medicare and if he enrolls how that will impact his employer-sponsored healthcare coverage. How would you respond? d. Juan is likely to be eligible for Medicare once he turns age 65 and if he enrolls Medicare would become the primary payor of his healthcare claims and Smallcap does not have to continue to offer him coverage comparable to those under age 65 under its employer-sponsored group health plan. Mr. Wu is eligible for Medicare. He has limited financial resources but failed to qualify for the Part D low-income subsidy. Where might he turn for help with his prescription drug costs? b. Mr. Wu may still qualify for help in paying Part D costs through his State Pharmaceutical Assistance Program. Mrs. Quinn recently turned 66 and decided after many years of work to begin receiving Social Security benefits. Shortly thereafter Mrs. Quinn received a letter informing her that she has been automatically enrolled in Medicare Part B. She wants to understand what this means. What should you tell Mrs. Quinn? d. Part B primarily covers physician services. She will be paying a monthly premium and, with the exception of many preventive and screening tests, generally will have 20% coinsurance for these services, in addition to an annual deductible. Mrs. Paterson is concerned about the deductibles and co-payments associated with Original Medicare. What can you tell her about Medigap as an option to address this concern? c. Medigap plans help beneficiaries cover coinsurance, co-payments, and/or deductibles for medically necessary services. Agent John Miller is meeting with Jerry Smith, a new prospect. Jerry is currently enrolled in Medicare Parts A and B. Jerry has also purchased a Medicare Supplement (Medigap) plan which he has had for several years. However, the plan does not provide drug benefits. How would you advise Agent John Miller to proceed? d. Tell prospect Jerry Smith that he should consider adding a standalone Part D prescription drug coverage policy to his present coverage. [Show More]

Last updated: 2 years ago

Preview 1 out of 3 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 20, 2022

Number of pages

3

Written in

Additional information

This document has been written for:

Uploaded

Aug 20, 2022

Downloads

0

Views

158

.png)

.png)