ACCT 3332 Final Exam 2022 with complete solution

P. Chang & Co. exchanged land and $9,000 cash for equipment. The book value and the fair value of the land were $106,000 and $90,000, respectively. Chang would record e

...

ACCT 3332 Final Exam 2022 with complete solution

P. Chang & Co. exchanged land and $9,000 cash for equipment. The book value and the fair value of the land were $106,000 and $90,000, respectively. Chang would record equipment at and record a gain/(loss) of:

Equipment Gain (loss)

$99,000 $(16,000)

$90,000 $(25,000)

$108,000 $16,000

$106,000 $(9,000) -Answer- $99,000 $(16,000)

Kross Co. exchanged land and $18,000 cash for equipment. The book value and the fair value of the land were $212,000 and $180,000, respectively. Assuming that the exchange has commercial substance, Kross would record equipment at and record a gain (loss) of

Equipment Gain (loss)

$198,000 $(32,000)

$180,000 $(50,000)

$216,000 $32,000

$212,000 $(18,000) -Answer- $198,000 $(32,000)

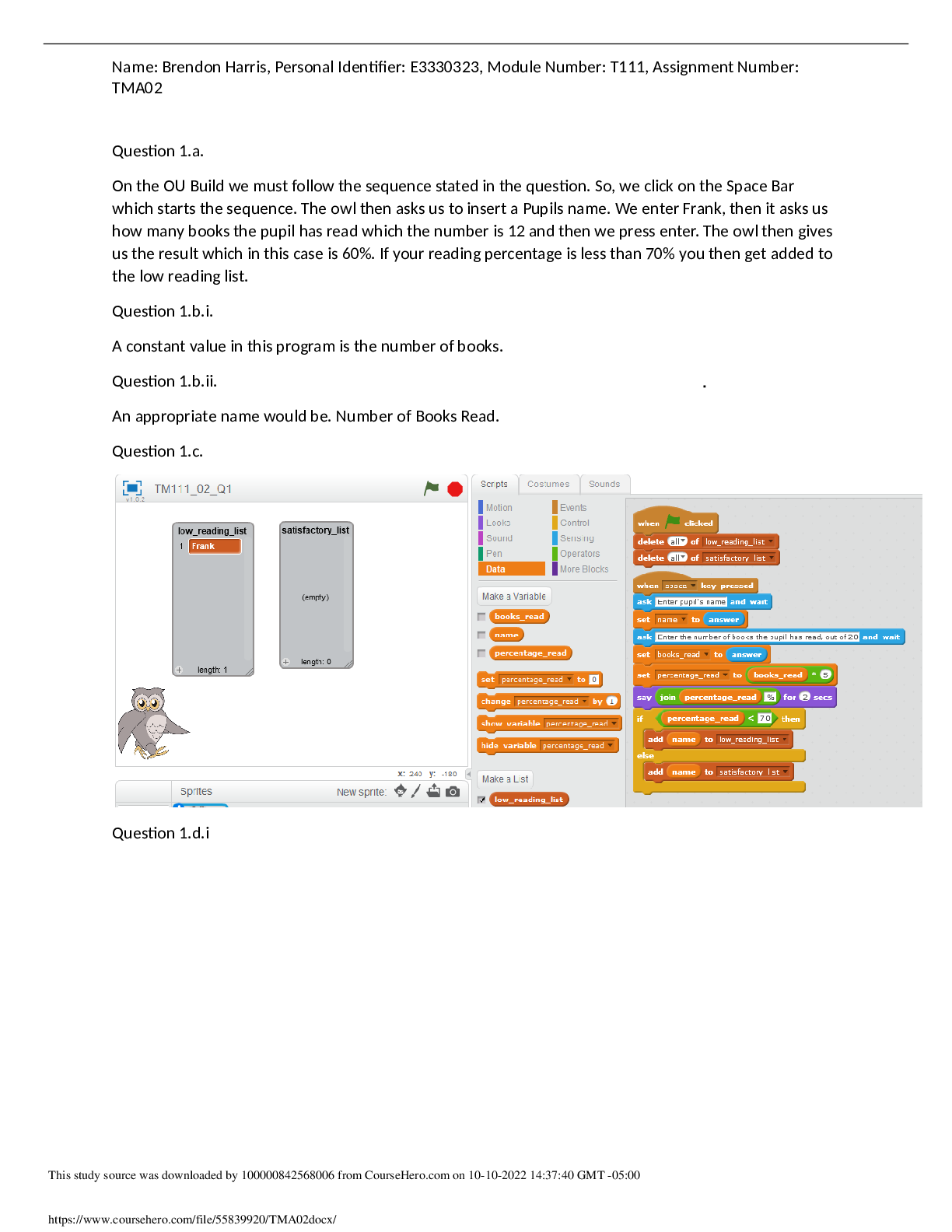

Software development costs are capitalized if they are incurred

Prior to point at which technological feasibility has been established

After technological feasibility has been established but prior to the product availability date

After commercial production has begun

None of these is correct. -Answer- After technological feasibility has been established but prior to the product availability date

Vijay Inc. purchased a 3-acre tract of land for a building site for $320,000. On the land was a building with an appraised value of $120,000. The company demolished the old building at a cost of $12,000, but was able to sell scrap from the building for $1,500. The cost of title insurance was $900 and attorney fees for reviewing the contract was $500. Property taxes paid were $3,000, of which $250 covered the period subsequent to the purchase date. The capitalized cost of the land is:

$336,400.

$336,150.

$334,650.

$201,150. -Answer- $334,650.

On July 1, 2009, Larkin Co. purchased a $400,000 tract of land that is intended to be the site of a new office complex. Larkin incurred additional costs and realized salvage proceeds during 2009 as follows:

Demolition of existing building on site $75,000

Legal and other fees to close escrow $12,000

Proceeds from asle of demolition scrap $10,000

What would be the balance in the land account as of December 31, 2009?

$400,000.

$475,000.

$477,000.

$487,000. -Answer- $477,000.

Asset retirement obligations:

Increase the balance in the related asset account.

Are measured at fair value in the balance sheet.

Are liabilities associated with the restoration of an operational asset.

All of these are correct. -Answer- All of these are correct.

Assets acquired under multi-year deferred payment contracts are:

Valued at the present value of the payments required by the contract

Valued at their fair value on the date of the final payment

Valued at the sum of the payments required by the contract

None of these -Answer- Valued at the present value of the payments required by the contract

The exclusive right to benefit from a creative work, such as film, is a:

Patent.

Copyright.

Trademark.

Franchise. -Answer- Copyright.

In a nonmonetary exchange of equipment, if the exchange has commercial substance, a gain is recognized if:

The fair value of the equipment received exceeds the book value of the equipment received.

The book value of the equipment received exceeds the fair value of the equipment surrendered.

The fair value of the equipment surrendered exceeds the book value of the equipment surrendered.

None of these is correct. -Answer- The fair value of the equipment surrendered exceeds the book value of the equipment surrendered.

Below are data relative to an exchange of similar assets by Grand Forks Corp. Assume the exchange has commercial substance.

Old Equipment Cash

Book Value Fair Value Paid

Case A $50,000 $60,000 $15,000

Case B $40,000 $35,000 $8,000

In Case B, Grand Forks would record a gain/(loss) of:

$ 5,000

$ 3,000

$(5,000)

$(3,000) -Answer- $(5,000)

Research and development expense for a given period includes:

The full cost of a newly acquired operational asset that has an alternative future use.

Depreciation on a research and development facility.

Research and development conducted on a contract basis for another entity.

Patent filing and legal costs. -Answer- Depreciation on a research and development facility.

If a company incurs disposition obligations as a result of acquiring an asset:

The company recognizes the obligation at fair value when the asset is acquired.

The company recognizes the obligation at fair value when the asset is disposed.

The company records the difference between the fair value of the asset and the obligation when the asset is acquired.

None of these. -Answer- The company recognizes the obligation at fair value when the asset is acquired.

Simpson and Homer Corporation acquired an office building on three acres of land for a lump-sum price of $2,400,000. The building was completely furnished. According to independent appraisals, the fair values were $1,300,000, $780,000, and $520,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be:

$1,300,000, $780,000, $520,000.

$1,200,000, $720,000, $480,000.

$720,000, $1,200,000, $480,000.

None of these. -Answer- $1,200,000, $720,000, $480,000.

Goodwill is:

Amortized over the greater of its estimated life or forty years.

Only recorded by the seller of a business.

The excess of the fair value of a business over the fair value of all net identifiable assets.

None of these. -Answer- The excess of the fair value of a business over the fair value of all net identifiable assets.

Donated assets are recorded at:

Zero (memo entry only).

The donor's book value.

The donee's stated value.

Fair value. -Answer- Fair value.

Productive assets that are physically consumed in operations are:

Equipment.

Land.

Land improvements.

Natural resources. -Answer- Natural resources.

Below are listed data relative to an exchange of equipment by Pensacola Inc. Assume the exchange has commercial substance.

Old Equipment Cash

Book Value Fair Value Paid

Case A $75,000 $80,000 $12,000

Case B $60,000 $56,000 $10,000

In Case A, Pensacola would record the new equipment at:

$68,000.

$63,750.

$67,250.

$80,000. -Answer- $68,000.

The acquisition costs of tangible operational assets do not include:

The ordinary and necessary costs to bring the asset to its desired condition and location for use.

The net invoice price.

Legal fees, delivery charges, installation, and any applicable sales tax.

Maintenance costs during the first 30 days of use. -Answer- Maintenance costs during the first 30 days of use.

Ruth Corporation acquired an office building on three acres of land for a lump-sum price of $1,200,000. The building was completed furnished. According to independent appraisals, the fair values were $650,000, $390,000 and $260,000 for the building, land, and furniture and fixtures, respectively. The initial values of the building, land, and furniture and fixtures would be:

$650,000, $390,000, $260,000

$360,000, $600,000, $240,000

$600,000, $360,000, $240,000

None of these -Answer- $600,000, $360,000, $240,000

Ro Stores exchanged land and cash of $15,000 for similar land. The book value and the fair value of the land were $270,000 and $300,000 respectively. Assuming that the exchange lacks commercial substance, Ro would record land-new at and record a gain (loss) of

Land Gain (loss)

$315,000 $ 0

$315,000 $30,000

$285,000 $30,000

$285,000 $ 0 -Answer- $285,000 $ 0

Research and development (R&D) costs:

Generally pertain to activities that occur prior to the start of production.

May be expensed or capitalized, at the option of the reporting entity.

Must be capitalized and amortized.

None of these is correct. -Answer- Generally pertain to activities that occur prior to the start of production.

Lake Incorporated purchased all of the outstanding stock of Huron Company paying $950,000 cash. Lake assumed all of the liabilities of Huron. Book values and fair values of acquired assets and liabilities were: Lake would record goodwill of:

$ 0.

$ 75,000.

$445,000.

$250,000 -Answer- $250,000

[Show More]