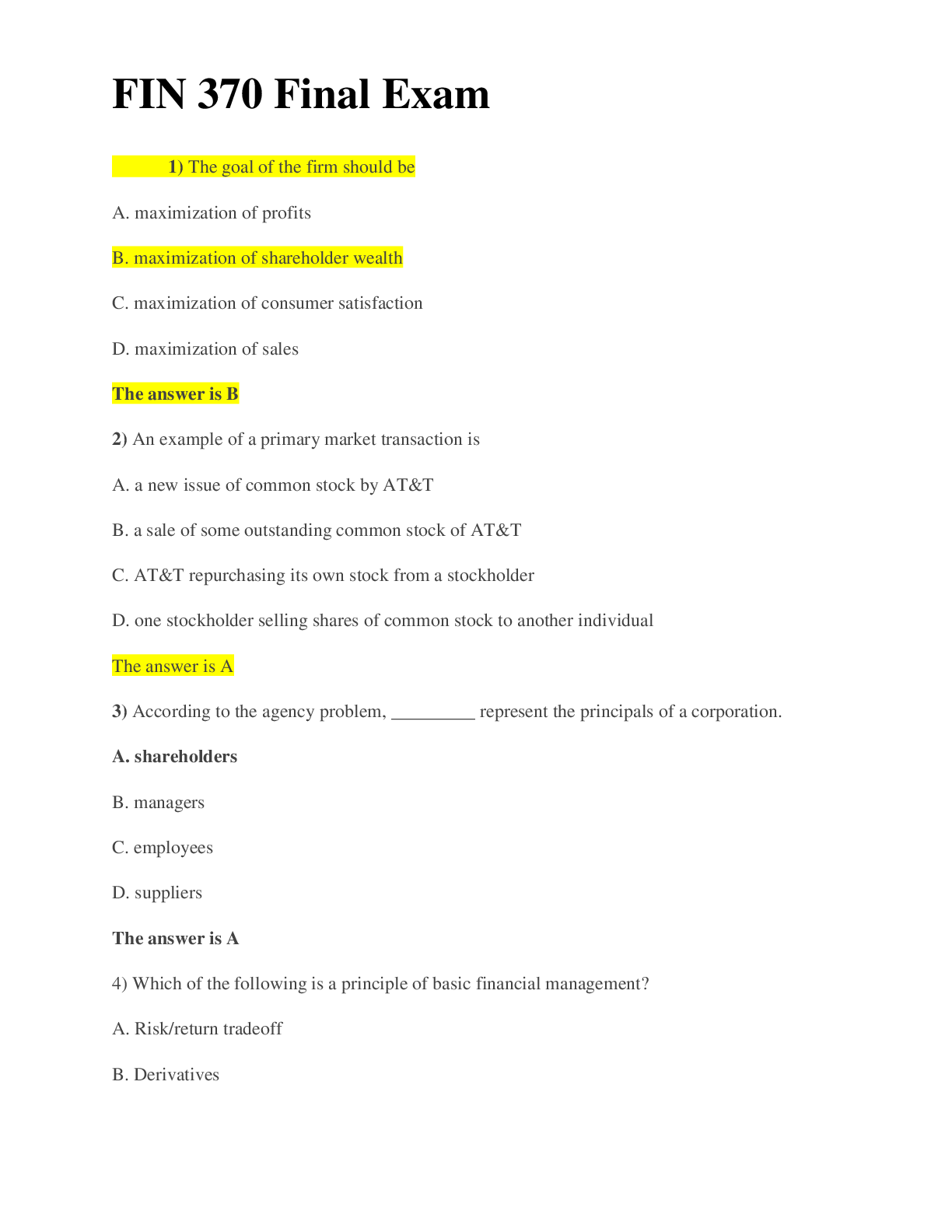

Finance > EXAM > University of Phoenix - FIN 370 FIN370_WK3_P1 APLCTN & THEORY. Contains 66 questions all fully a (All)

University of Phoenix - FIN 370 FIN370_WK3_P1 APLCTN & THEORY. Contains 66 questions all fully answered and explained.

Document Content and Description Below

WK3 – P2 APLCTN & THEORY 1. Which of these statements is correct? During 2015, the average daily trading volume of the U.S. bond market exceeded $730 billion. 2. Which of these are common feat... ures of a corporate bond? 3. What is the purpose of a call premium? To compensate bondholders who have their bonds redeemed prior to maturity. 4. Which of the following securities pay income which is exempt from federal income taxes? 5. A TIPS was issued with a face value of $1,000 and a reference CPI of 204.89. The current par value of this TIPS is $1,001.37. Which is the current CPI? Formula: Current Price = $1000 x (Current CPI/204.89) = $1001.37; Current CPI – 205.17 6. Which one of these characteristics designates a premium bond? 7. True or false: The financial status of the issuer will affect the coupon rate that issuer pays on the bonds. 8. A $1000 corporate bond has an asked price of 97.82 and a bid price of 97.81. What price will you receive if you sell this bond now? 9. What is the price of a $100,000 par value U.S. Treasury security if the price quote is 102.1446? 10. Which one of these correctly defines a bond feature? The principal value of a bond is referred to as the par value, or face value. 11. Which of the following affect the coupon rate a firm must set on its bond if the bonds are to be sold at par? 12. You want to compute the value of a 5 year, zero-coupon corporate bond given a market rate of 5.5%. What are your inputs? (the assumed par value of a corporate bond is $1000) (5x2 because semiannual compounding) 13. The market rate of interest that is used to compute the present PV of a bond is affected by which of the following? 14. Which one of these is the best description of a 5-year zero coupon bond? 15. What is the definition of yield to maturity? 16. Which of these are basic assumptions that should be used when valuing a corporate coupon bond unless the problem states otherwise? 17. A corporate bond matures in 11 years and carries a 6% coupon. What’s the correct calculator input to find the bonds current value at a discount rate of 5%? 18. A corporate bond pays $45 in interest every 6 months and matures in 11 years. what’s the YTM if the bond currently sells for $1,213? 19. A 7.5 percent corporate bond matures in 16 years and has a price quote of 102.3. What is the yield to maturity? Annual Coupon Rate = 7.50% Semiannual Coupon Rate = 3.75% Semiannual Coupon = 3.75% * $1,000 Semiannual Coupon = $37.50 Time to Maturity = 16 years Semiannual Period = 32 Let semiannual YTM be i% $1,023 = $37.50 * PVIFA(i%, 32) + $1,000 * PVIF(i%, 32) Using financial calculator: 20. Which of these statements correctly applies to the NYSE bond market? - Corporate bonds are the primary source of bond trading volume on the NYSE - The NYSE operates the largest centralized U.S. bond market 21. If you expect interest rates to increase significantly within the next two years, which one of these bonds would you prefer to own? 22. For a typical bond, which of the following values are expressed in semiannual terms when computing 23. Which one of these is the correct formula for computing the current value of a $1000, 20-year, zero coupon bond if the discount rate is 8 percent? Formula 24. A corporate bond matures in 14 years and pays a 6.75 percent coupon. What is its current value if the market rate of interest is 7.5 percent? Formula: 25. Which one of the following bonds is subject to the greatest interest rate risk? 26. Assume a corporate bond pays a 5 percent coupon and matures in ten years. What will be the change in the current price of this bond if market interest rates increase from 5 to 5.5 percent? 5.5 percent is: N=20 (10 years x 2) I = 2.75; (5.5 / 2) PMT = 25; ((5 / 2) / 100) x 1000 FV = 1000, CPT PV; PV = -961.93 $961.93 - $1000 = ($38.07) 27. What is interest rate risk? 28. Corporate bond A has a 6 percent coupon and matures in 3 years. Corporate bond B has a 6 percent coupon and matures in 15 years. The current interest rate is 6 percent. By how much will Bond A and Bond B change in price if the market rate increases to 6.5 percent? Assume both bonds are currently selling at par which is $1000. 29. Which of the following apply to high-yield bonds? 30. Which of the following are commonly included in an indenture agreement? 31. What does a bond rating measure? 32. Which of the following may be financed with corporate bonds? - Plants and equipment - Research and development -Inventory 33. The internet and par value payments of mortgage-backed securities originate from Real estate mortgage payments. 34. A 20-year corporate bond is callable beginning in year 7 at a premium of $100. The coupon rate is 6 percent and the market rate is 5.5 percent. What is wrong with the following computation? Select all that apply. The interest rate, I, should be 0.0275 in three places 35. Which one of these characteristics fits the definition of an agency bond? Issued to support a sector of the U.S. economy. 36. Which of the following are classified as asset-backed securities? Debt security with payments originating from a pool of auto loans 37. Which of these represents the compensation earned by a bond dealer? Bid-ask spread 38. Franco purchased a $10000 bond at a price quote of 100.23 and sold it at a price quote of 99.87. what is his capital gain/loss 39. Sue purchased a 3.5 percent, $100,000 U.S. Treasury bond 6 months ago when the bid quote was 124.1850 and the asked quote was 124.2025. Today, she sold that bond when the bid quote was 124.2175 and the asked quote was 124.2225. What was her total dollar return on this investment? 40. A municipal bond quote displays a price of 98.67. How is this quote interpreted? The municipal bond is selling at a discounted price of $4933.50 41. Which specific characteristic identifies a security as an asset-backed security? Repayment based on a pool of debt securities. 42. Will purchased a 5 percent, $3000 corporate bond when the asked quote was 101.16 and the bid quote was 101.15. He sold the bond when the asked quote was 101.08 and he bid quote was 101.06. What was his capital gain/loss? 43. A typical municipal bond is selling at a price of $5114.20. What is the price quote for this bond? 44. Which of the following are sources of information on the bond markets? Internet Merrill Lynch The Wall Street Journal 45. How does the yield to call differ from the yield to maturity for the same bond? 46. Which of the following statements are correct? 47. What is the definition of yield to maturity? The rate that will be earned if a bond is purchased today and held until maturity 48. Which one of these terms indicates a bond is unsecured? 49. Why are U.S. treasury bonds considered to be safe? 50. Which one of the following types of bonds is used to implement national monetary policy? 51. Which one of these descriptions defines a treasury inflation-protection security (TIPS)? 52. A TIPS was issued with a face value of $5000, a coupon rate of 3 percent, and a reference CPI of 201.42. The current CPI is 203.14. What is the current interest payment 53. A TIPS was issued with a $1000 par value, a 2 percent coupon rate, and a reference CPI of 204.39. You bought the bond on January 1, 2012 at a CPI of 205.26. You sold the bond on January 1, 2013 at a CPI of 204.98. What was your total return if the July 2012 CPI was 205.32$? 1000 205.26 204.39 $ 1,004.26 2% 2 $ 10.04 $ (1.37) $ 20.07 $ 0.0186 1000 205.32 204.39 $ 1,004.55 2% 2 $ 10.05 1000 204.98 204.39 $ 1,002.89 2% 2 $ 10.03 54. A bond has a par value of 1000 a call premium of one year's interest, a call provision after 5 years, a coupon rate of 5 percent, semiannual interest payments, and a maturity of 20 years. Which of these is (are) correct? 55. A TIPS was issued with a par value of $1000, a coupon rate of 2.5 percent, and a reference CPI of 204.89. Which one of these is the correct calculation of the current interest payment if the CPI is now 205.44? 56. Which one of these is a key reason why issuers call bonds? 57. You manage a trust fund and have a fiduciary responsibility to only purchase investment grade bonds. Which bond rating indicates a bond you could not purchase? 58. A 10-year treasury bond has a 4 percent coupon and a yield to maturity of 4.62 percent. A 10-year, A-rated corporate bond has a 4.5 percent coupon and a yield to maturity of 5.98 percent. What is the yield spread between these two bonds? 59. Which one of these is the current yield formula? 60. Which one of these formulas correctly computes the equivalent taxable yield? 61. What rate does an investor need to earn on a corporate bond to earn the same return as he can on a 3.5 percent muni if his tax rate is 28 percent? 4 62. At what tax rate will an investor be indifferent between a 4.2 municipal bond and a 7% corporate bond? 63. What is correct if a bond is selling at premium? 64. You need to select one of two premium bonds to purchase. You plan to hold whichever bond you select until it matures in 10 years. Which bond should you select and why? 65. A 10-year corporate bond has a 6 percent coupon, a call premium of $60, and a first call date in year 4. Market interest rates are 6.5 percent and are expected to rise for an extended period. If you plan to hold the bond, which yield should you most consider before buying the bond? 66. What are the taxable equivalent yields at tax rates of 25 percent and 35 percent if the muni yield is 3.5 percent? Formula: [Show More]

Last updated: 2 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 19, 2020

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Dec 19, 2020

Downloads

0

Views

108

.png)