ACCT 212 Midterm exam (GRADED A) Questions and Answer elaborations

Document Content and Description Below

ACCT Midterm

Question 1.:

(TCO 1) The Accounting Equation is used to develop the organization's financial reports. (1) Describe what owners' equity values would be if Assets are $100,0

...

00 and Liabilities are $27,000 by showing the Accounting Equation (10 points) and (2) provide an explanation of what accounts could be found in owners' equity. (10 points)

Student Answer: Assets, liabilities, owners equity Owners equity = assets – liabilities Owners equity = 100,000 – 27,000 Owners equity = 73,000

Instructor Explanation:

Paid in capital: is capital outstanding for the period which are measured by book value also called preferred shares. -Retained earnings: is the earnings available to the share holders. It's the accumulated profits from past years that becomes available after all dividend and obligations are taken care of. -Treasury stock: the shares that are bought back by the company form share holders or the open market

Textbook pages 11-12. Owners' Equity = $100,000 - $27,000 =

$73,000. Stock, Additional Paid in Capital, and Retained Earnings are examples.

Question 2

.

Question :

(TCO 1) The financial statements present a company to the public in financial terms. (1) Which financial statement identifies where cash was generated and where it was spent during the year (10 points), and (2) identify the three major parts of this statement. (10 points)

Student Answer:

Instructor Explanation:

Statement of cash flows: is a financial statement that provides an overview of the cash inflows and outflows of the business during a certain period of time.

Operation, Investing and financing

Textbook pages 15-21. Statement of Cash Flows. Operating, Investing, and Financing.

Question 3

.

Question :

(TCO 1) The accounting profession follows a set of guidelines for measurement and disclosure of financial information called the Generally Accepted Accounting Principles (GAAP). (1) Explain what the International Financial Reporting Standards (IFRS) are (10 points) and (2) provide an example of its application. (10 points)

Student Answer: Accounting guidelines, formulated by the International Accounting Standards Board (IASB). By 2015, U.S. GAAP is expected to be harmonized with IFRS. At that time, U.S. companies are expected to adopt these principles for their financial statements, so that they can be compared with those of companies from other countries. It's a way to set a certain report that will make the global economy report using the same standard. It was intended to be used by third world businesses to make it easier raising capital.

Instructor Explanation:

Provision of loan losses -Impairment of investments -Consolidation of entities -Transfer pricing

Textbook pages 6-9. Standards that will make the global economy report using the same standards. The intention is to make raising capital easier for third-world businesses.

Question 4

.

Question :

(TCO 2) Transaction analysis results in the development of a journal entry. Supplies are purchased on account agreeing to pay $500 within 30 days. (1) Name the accounts impacted and how to use the format account name/debit or credit/dollar amount (10 points), and (2) explain how the Accounting Equation is impacted. (10 points)

Student Answer:

Instructor Explanation:

Supplies-Debits-$500.00 -Accounts Payable-Credit-$500.00

The assets and liabilities will increase and the accounting equation is in the balance.

Textbook page 65. Supplies/Debit/$500 and Account

Payable/Credit/$500. Assets and Liabilities increase and the Accounting Equation is in balance.

Question 5

.

Question :

(TCO 3) Adjusting Entries are required at the end of the period to ensure that accrual accounting principles are applied. At the beginning of the month, $1,350 of office supplies were purchased. There was not a beginning balance and the one purchase was the only one for the month. At the end of the month, $500 of supplies remained. Develop the adjusting entry. (1) Name the accounts impacted and how using the format account name/debit or credit/dollar amount (10 points), and (2) explain how the Accounting Equation is impacted. (10 points)

Student Answer:

Instructor Explanation:

Supplies expenses-Debits-$850 $1,350.00 - $500.00 = $850 -Office Supplies -Credit-$850

The assets and the owner's equity decrease and the accounting equation is in the balance.

Textbook page 143. Supplies Expense/Debit/$850 and Office Supplies/Credit/$850. Assets and Owners' Equity decrease and the Accounting Equation is in balance.

Question :

(TCO 5) E-commerce creates its own risks, and therefore special internal controls. (1) Identify and explain one pitfall and one security measure for an online business (10 points) and (2) provide examples of how your selected security measure will strengthen internal control. (15 points)

Student

Answer: Stolen credit card numbers Pitfall

How Fire walls work: Usually several firewalls are built into the system. Think of a fortress with multiple walls protecting the company’s computerized records in the center. At the point of entry, passwords, personal identification numbers (PINs), and signatures are used. More sophisticated firewalls are used deeper in the network.

Start with Firewall 1, and work toward the center.

Instructor Explanatio n:

(https://devry.vitalsource.com/#/books/9781269196536/cfi/10!/4/2/24/28/8/2/2@0:6 3.7) . It prevents unauthorized Internet users from accessing private networks connected to the Internet.

Textbook pages 239-242. Examples of pitfall are stolen credit card numbers and computer viruses, while examples of security measures are encryption and firewalls.

Question 2

.

Question :

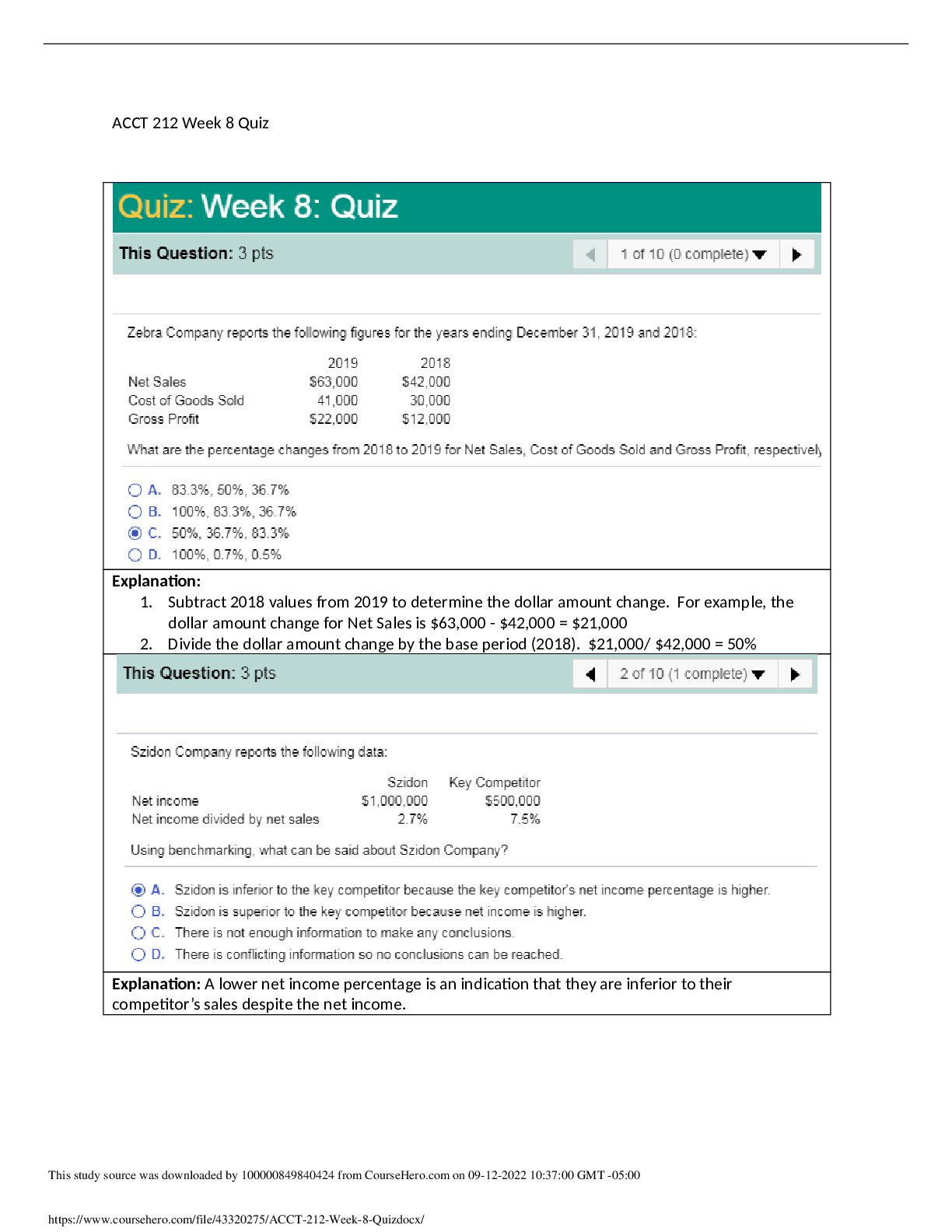

(TCO 5) The bank account as a control device helps to protect cash. One of the requirements is to conduct periodic bank statement reconciliations. Using the following data, complete the bank statement reconciliation for J & J Flooring, Inc. (Use the format shown on page 251 of your textbook.) (25 points)

•The bank statement indicated a service charge of

$56.

•J & J made a deposit on May 31, but this deposit did not appear on the bank statement, $1,451.

•A credit memo in the bank statement indicated a bank collection of a note for $1,300 with interest received of

$16. This item was dated May 18.

•Also included in the bank statement was a debit memo for a NSF check for $314 from Barney Smythe.

•Checks #1406 for $1,342, #1610 for $1,609, and #1825 for $857 were written by J & J and sent to the respective companies, but these checks do not appear on the bank statement.

•The balance on the bank statement as of May 31 was $13,019.

•The Cash account on Janus’ books showed an amount of $9,716.

Student Answer:

J&J Flooring, Inc Bank Reconciliation May 31, 2015 Bank: Balance, May 31, 2015

$13,019 Add: Deposit of May 31 in transit 1,451 14,470 Less: Outsatnding checks issued: 1406 ($1,342), 1610 ($1,609), 1825 ($857) -3,808 Adjusted bank balance 10,662 Books: Balance, May, 31 2015 $13,019 Add: Bank collection of note receivable 1,300 Interest revenue earned on bank balance 16 $14,335 Less: Service Charge $56 NSF Check 314 -370 Adjusted book balance, May 31, 2015

$10,662

Instructor Explanati on:

Bank Reconciliation for Janus Jutes, Inc. for May 31, 201X

Balance per book

ADD: $9,716 Balance per bank

ADD:

Note receivable collection 1,300 Deposits in transit

Interest revenue 16 1,316

LESS: LESS:

NSF check--Barney Smythe

314

Outstanding checks:

Bank service charge

56 370

1406

1,342

1610 1,609

Adjusted book balance $10,662 1825 857

Adj. bank balance

[Show More]

Last updated: 3 years ago

Preview 1 out of 5 pages

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)