ACCT 251 Problem 7-5A Determine depreciation under three methods (LO7-4)/ Eastern Washington University

Document Content and Description Below

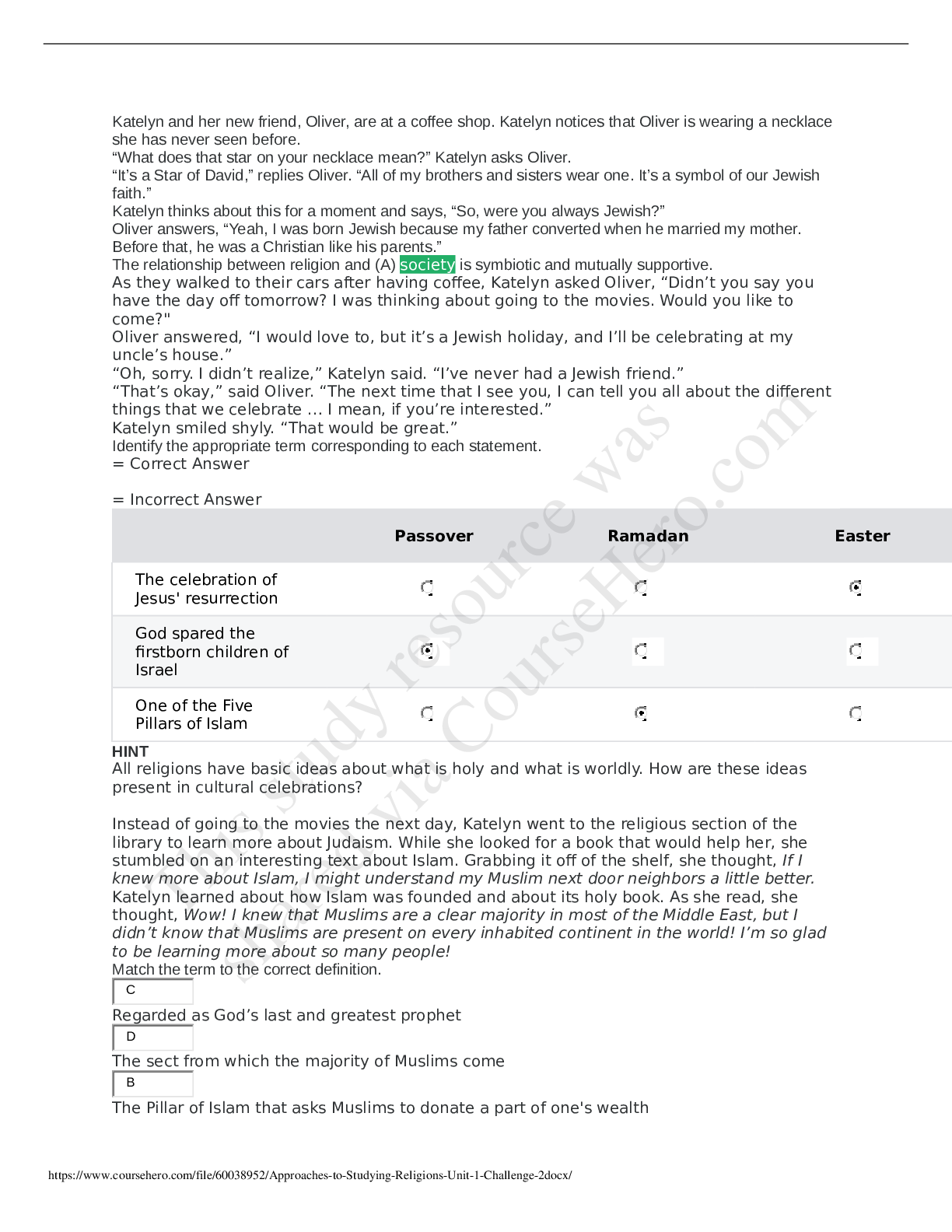

Problem 7-5A Determine depreciation under three methods (LO7-4)

[The following information applies to the questions displayed below.]

University Car Wash built a deluxe car wash across the stre

...

et from campus. The new machines cost

$270,000 including installation. The company estimates that the equipment will have a residual value of $24,000. University Car Wash also estimates it will use the machine for six years or about 12,000 total hours. Actual use per year was as follows:

Year Hours Used 1 3,100

2 1,100

3 1,200

4 2,800

5 2,600

6 1,200

References

Section Break Problem 7-5A

Determine depreciation under three methods (LO7- 4)

5. Award: 2 out of 2.00 points

Problem 7-5A Part 1

Required:

1. Prepare a depreciation schedule for six years using the straightline method. (Do not round your intermediate calculations.)

UNIVERSITY CAR WASH

Depreciation Schedule—StraightLine

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $ 41,000 $ 41,000 $ 229,000

2 41,000 82,000 188,000

3 41,000 123,000 147,000

4 41,000 164,000 106,000

5 41,000 205,000 65,000

6 41,000 246,000 24,000

Total $ 246,000

References

Worksheet Problem 75A Part 1

Learning Objective: 0704 Calculate depreciation of property, plant, and equipment.

UNIVERSITY CAR WASH

Depreciation Schedule—StraightLine

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $41,000+/0.02% $41,000+/0.02% $ +/0.005%

229,000

2 41,000+/0.02% 82,000+/0.02% 188,000+/0.01%

3 41,000+/0.02% 123,000+/0.02% 147,000+/0.02%

4 41,000+/0.02% 164,000+/0.02% 106,000+/0.03%

5 41,000+/0.02% 205,000+/0.02% 65,000+/0.1%

6 41,000+/0.02% 246,000+/0.02% 24,000+/0.2%

Total $ 246,000

Explanation:

University Car Wash Depreciation Schedule—StraightLine

Calculation End of Year Amounts Depreciable

Cost*

Depreciation

Depreciation

Accumulated

Book Value**

Year × Rate = Expense Depreciation

1 246,000 1/6 41,000 41,000 229,000

2 246,000 1/6 41,000 82,000 188,000

3 246,000 1/6 41,000 123,000 147,000

4 246,000 1/6 41,000 164,000 106,000

5 246,000 1/6 41,000 205,000 65,000

6 246,000 1/6 41,000 246,000 24,000

Total

246,000

* $270,000 – $24,000 = $246,000

** $270,000 cost minus accumulated depreciation

6. Award: 2 out of 2.00 points

Problem 7-5A Part 2

2. Prepare a depreciation schedule for six years using the doubledecliningbalance method. (Do not round your intermediate calculations.)

UNIVERSITY CAR WASH

Depreciation Schedule—DoubleDecliningBalance

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $ 90,000 $ 90,000 $ 180,000

2 60,000 150,000 120,000

3 40,000 190,000 80,000

4 26,667 216,667 53,333

5 17,778 234,445 35,555

6 11,555 246,000 24,000

Total $ 246,000

References

Worksheet Problem 75A Part 2

Learning Objective: 0704 Calculate depreciation of property, plant, and equipment.

UNIVERSITY CAR WASH

Depreciation Schedule—DoubleDecliningBalance

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $90,000+/0.02% $90,000+/0.02% $ +/0.005%

180,000

2 60,000+/0.02% 150,000+/0.02% 120,000+/0.02%

3 40,000+/0.05% 190,000+/0.01% 80,000+/0.02%

4 26,667+/0.01% 216,667+/0.01% 53,333+/0.03%

5 17,778+/0.02% +/0.005%

234,445 35,555+/0.03%

6 11,555+/1% 246,000 24,000

Total $ 246,000

Explanation:

University Car Wash

Depreciation Schedule—DoubleDecliningBalance

Calculation End of Year Amounts

Beginning

Depreciation

Depreciation

Accumulated

Year Book Value × Rate* = Expense Depreciation Book Value**

1 270,000 1/3 90,000 90,000 180,000

2 180,000 1/3 60,000 150,000 120,000

3 120,000 1/3 40,000 190,000 80,000

4 80,000 1/3 26,667 216,667 53,333

5 53,333 1/3 17,778 234,445 35,555

6 35,555 11,555*** 246,000 24,000

Total 246,000

* 2/6 years = 1/3 per year

** $270,000 cost minus accumulated depreciation

*** Amount needed to reduce book value to residual value.

This study source was downloaded by 100000849840424 from CourseHero.com on 09-10-2022 06:45:31 GMT -05:00

7. Award: 2 out of 2.00 points

Problem 7-5A Part 3

3. Prepare a depreciation schedule for six years using the activitybased method. (Round your "Depreciation Rate" to 2 decimal places and use this amount in all subsequent calculations.)

UNIVERSITY CAR WASH

Depreciation Schedule—ActivityBased

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $ 63,550 $ 63,550 $ 206,450

2 22,550 86,100 183,900

3 24,600 110,700 159,300

4 57,400 168,100 101,900

5 53,300 221,400 48,600

6 24,600 246,000 24,000

Total $ 246,000

References

Worksheet Problem 75A Part 3

Learning Objective: 0704 Calculate depreciation of property, plant, and equipment.

UNIVERSITY CAR WASH

Depreciation Schedule—ActivityBased

End of year amounts

Year Depreciation Expense Accumulated Depreciation Book Value

1 $ 63,550 $ 63,550 $ 206,450

2 22,550 86,100 183,900

3 24,600 110,700 159,300

4 57,400 168,100 101,900

5 53,300 221,400 48,600

6 24,600 246,000 24,000

Total $ 246,000

Explanation:

University Car Wash Depreciation Schedule—ActivityBased

Calculation End of Year Amounts

Year Hours Used

× Depreciation

Rate*

= Depreciation Expense Accumulated Depreciation Book

Value**

1 3,100 $20.50 63,550 63,550 206,450

2 1,100 $20.50 22,550 86,100 183,900

3 1,200 $20.50 24,600 110,700 159,300

4 2,800 $20.50 57,400 168,100 101,900

5 2,600 $20.50 53,300 221,400 48,600

6 1,200 $20.50 24,600 246,000 24,000

Total

12,000

246,000

* $246,000/12,000 hours = $20.50/hour

** $270,000 cost minus accumulated depreciation

This study source was downloaded by 100000849840424 from CourseHero.com on 09-10-2022 06:45:31 GMT -05:00

[Show More]

Last updated: 3 years ago

Preview 1 out of 7 pages

(1).png)

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)