1. Question: BelvidereSelf Storage purchased land, paying $160,000cash as a down payment and signing a $155,000note payable for the balance. Belviderealso had to pay delinquent property tax of $2,500,title insurance cost

...

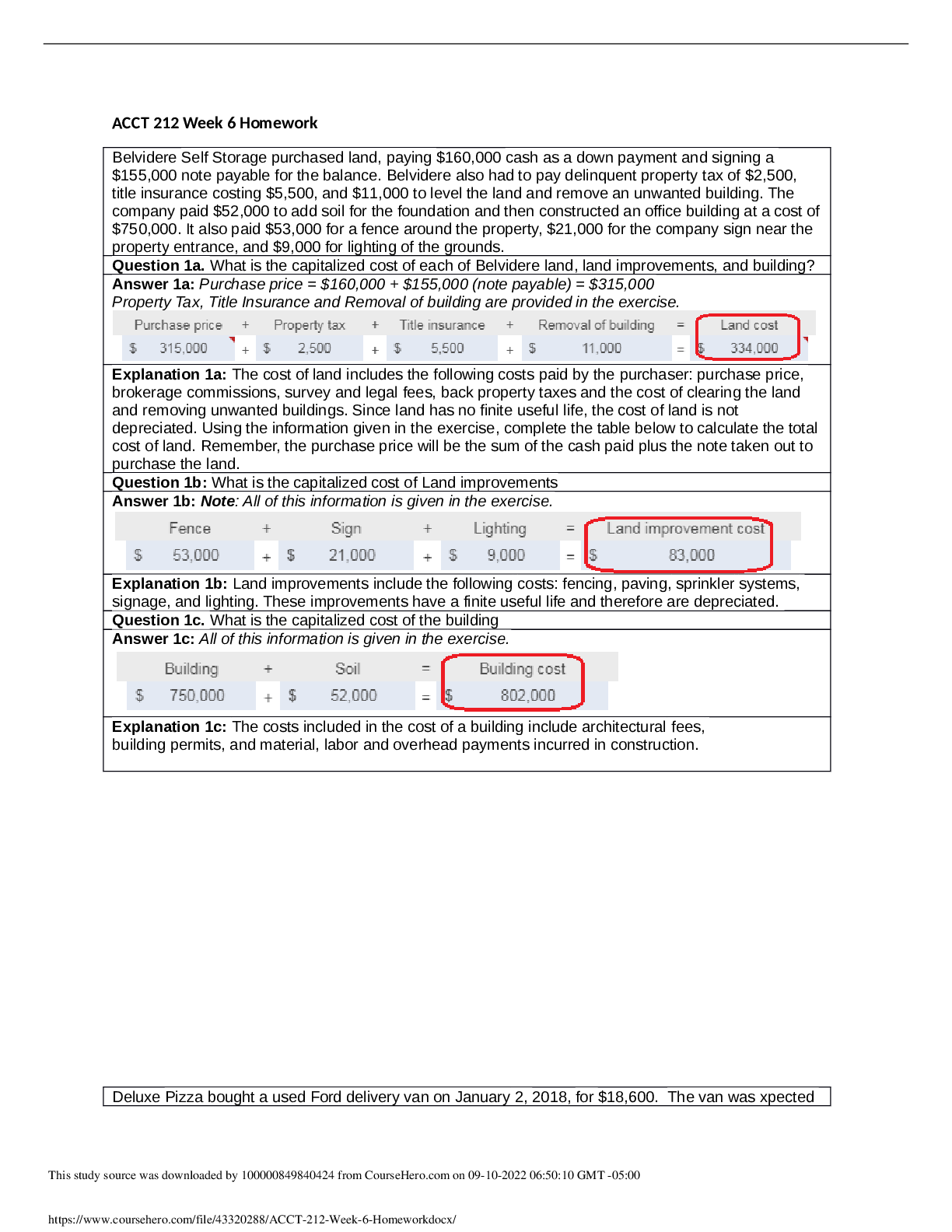

1. Question: BelvidereSelf Storage purchased land, paying $160,000cash as a down payment and signing a $155,000note payable for the balance. Belviderealso had to pay delinquent property tax of $2,500,title insurance costing $5,500, and $11,000to level the land and remove an unwanted building. The company paid $52,000 to add soil for the foundation and then constructed an office building at a cost of $750,000. It also paid $53,000 for a fence around the property, $21,000 for the company sign near the property entrance, and $9,000 for lighting of the grounds.

What is the … cost of each of Belvidere land, land improvements, and building?

What is the capitalized cost of Land improvements

What is the capitalized cost of the building.

2. Question: DeluxePizza bought a used Ford delivery van on January 2, 2018, for $18,600. The van was … to remain in service for four years (57,000miles). At the end of its useful life, Deluxemanagement estimated that the van’s residual value would be $1,500. The van traveled 20,500 miles the first year, 16,000 miles the second year, 15,400 miles the third year, and 5,100 miles in the fourth year.Prepare a schedule of depreciation expense per year for the van under the three depreciation methods.(For units-of-production and double-declining-balance methods, round to the nearest two decimal places after each step of the)

Straight-Line method.

Units of Production Method.

Double declining balance method

Which method best tracks the wear and tear on thevan?

Thedouble-declining-balance (DDB) method.

3. Question: EastSales Company completed the following note payable transactions:

How much interest expense must be accrued at December 31, 2018? (Round your answer to the nearest whole dollar.)

Determine the amount of EastSales’ final payment on April1, 2019

Compute the final payment

How much interest expense will EastSales report for 2018 and for 2019? (If needed, round your answer to the nearest whole dollar.)

4. Question: WesternElectronics completed these selected transactions during June 2018

Report these items on Western Electronics’ balance sheet at June 30,

Then begin calculating the actual expenses for each account. Remember Sales of $2,200,000 are subject to an accrued warranty cost of 7%. The accrued warranty payable at the beginning of the year was $40,000,and warranty payments for the year totaled $62,000.Now calculate the warranty expense.

Calculate the Accrued Warranty balance reported on the balance sheet at June 30.

On June 1, Western Electronics signed a $65,000 note payable that requires annual payments of $13,000 plus 4%interest on the unpaid balance beginning June 1, 2019.(Enter the interest rate as a whole number. Round your answer to the nearest whole)

Bonita,Inc., a chain of discount stores, ordered $120,000 worth of wireless speakers and related products. With its order, Bonita, , sent a check for $120,000 in advance, and Westernshipped $45,000 of the goods. Western will ship the remainder of the goods on July 3, 2018.Calculate the unearned revenue at the date of the balance sheet.

The June payroll of $220,000 is subject to employee withheld income tax of $31,000 and FICA tax of 65%. On June 30,Western pays employees their take-home pay and accrues all tax amounts.Calculate the FICA tax payable now.

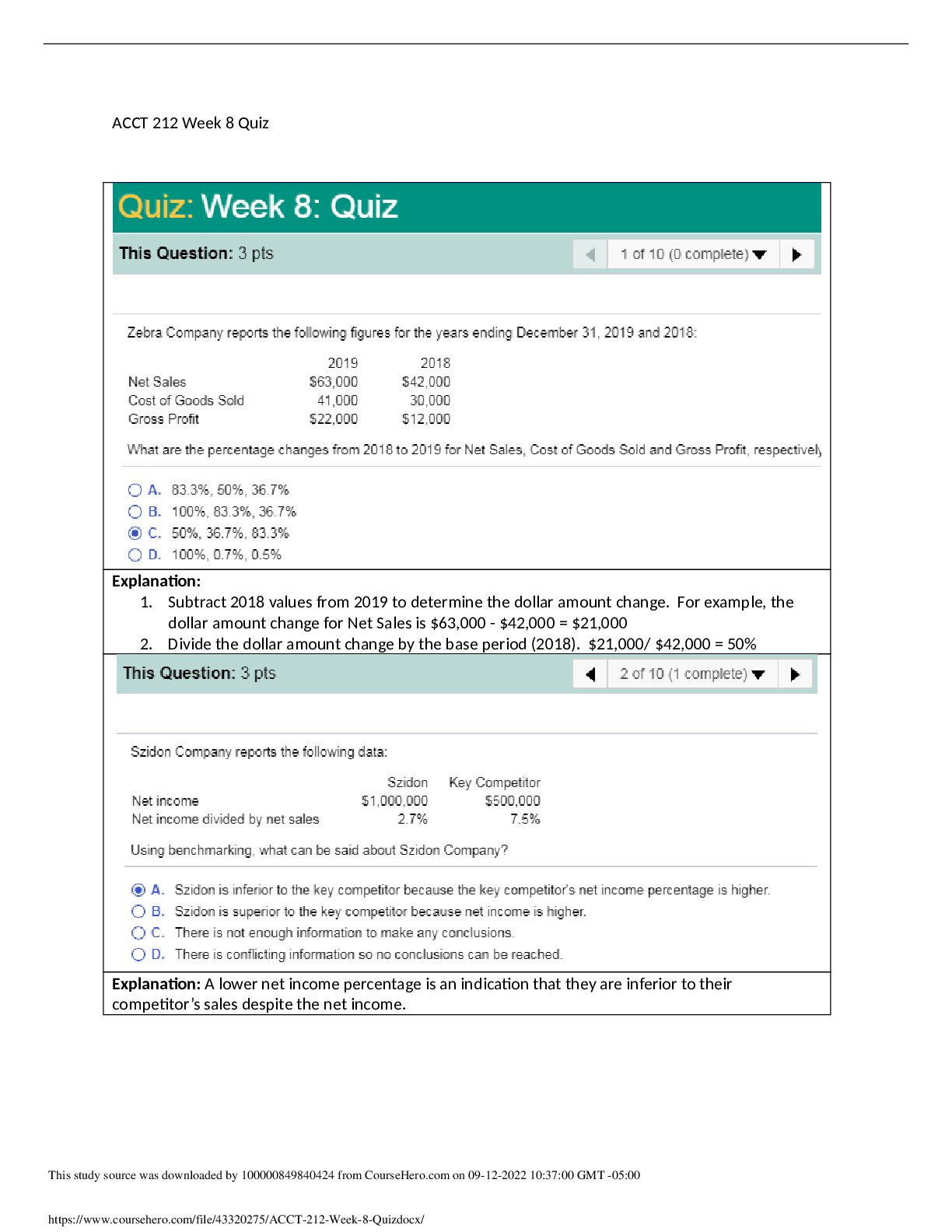

5. Question: Companies that operate in different industries may have very different financial ratio values. These differences may grow even wider when we compare companies located in different countries. Review the following financial statements.

Compare three fictitious companies (Accord, Malcomb, and Reamer) by calculating the following ratios: current ratio, debt ratio, leverage ratio, andtimes-interest-earned ratio. Use year-end figures in place of averages where … for calculating the ratios in this exercise. Based on the debt ratios, which company is the least risky?

First calculate the current ratios for Accord,Malcomb, and Reamer.

Then calculate the debt ratios.

Calculate the leverage ratio.

Calculate the times-interest earned ratio.

ACCT 212 Week 6 Homework

[Show More]

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)