Accounting > EXAMs > ACCT 212 Week 6 Homework Assignment (100% Guaranteed pass) (All)

ACCT 212 Week 6 Homework Assignment (100% Guaranteed pass)

Document Content and Description Below

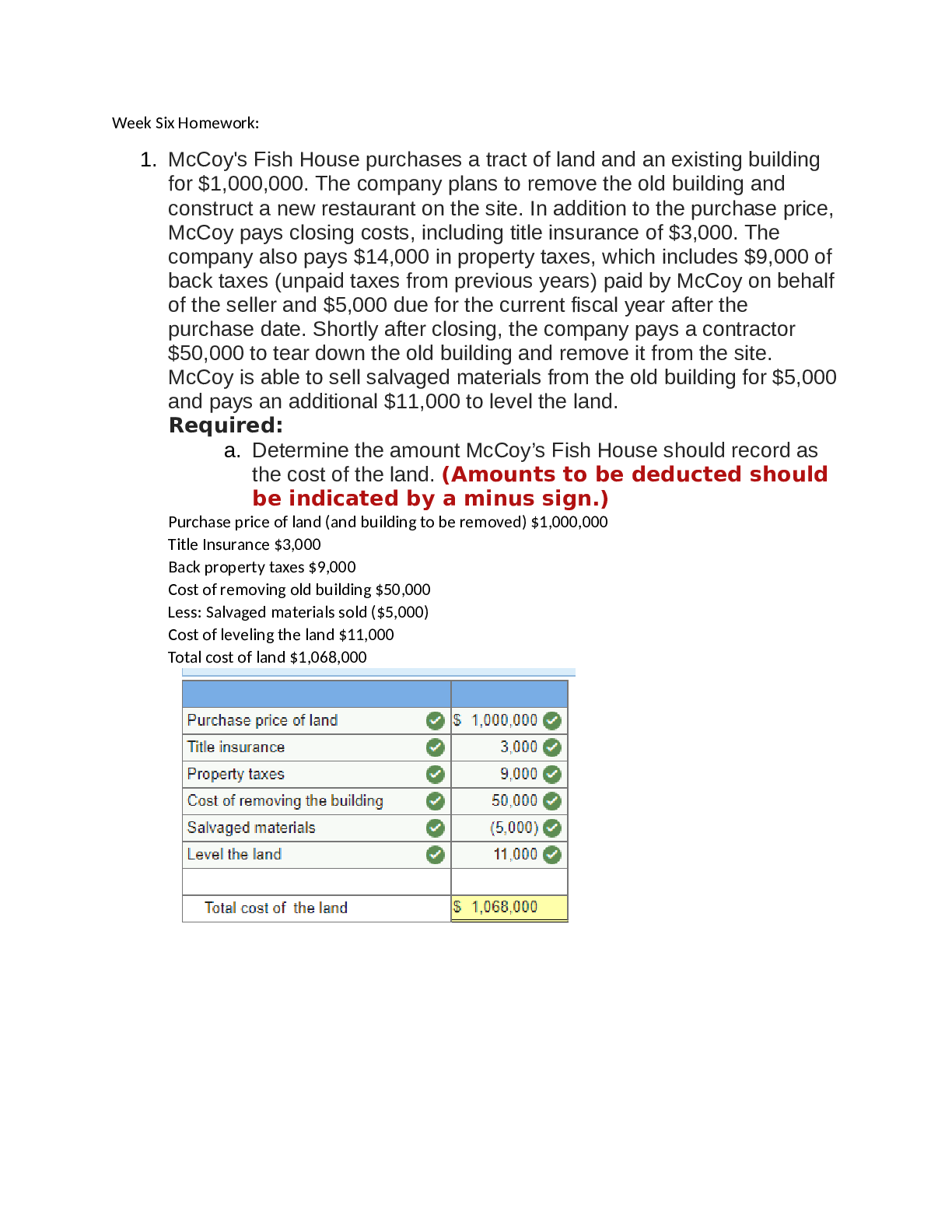

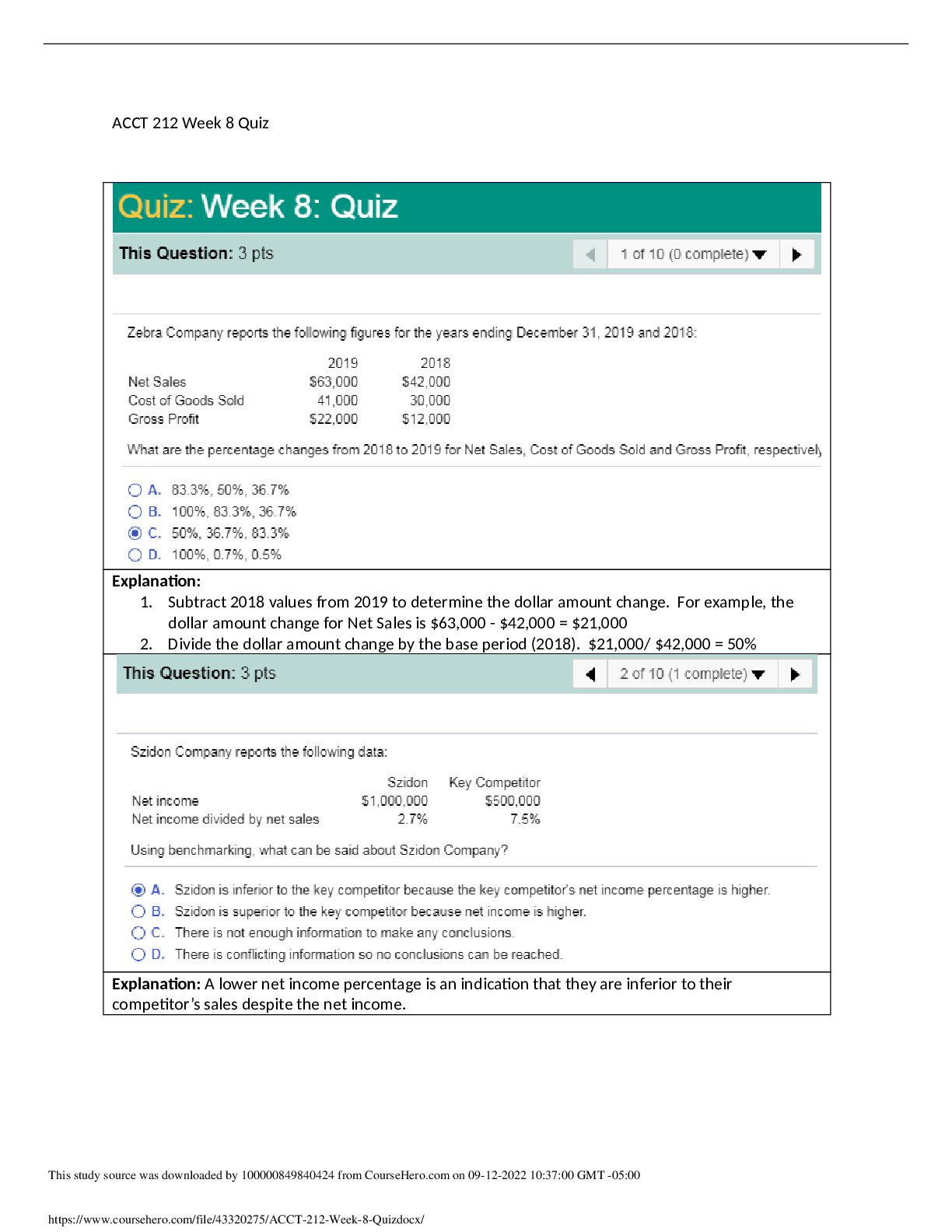

1. Question: McCoy’s Fish House purchases a tract of land and an existing building for $1,000,000. The company plans to remove the old building and construct a new restaurant on the site. In additio ... n to the purchase price, McCoy pays closing costs, including title insurance of $3,000. The company also pays $14,000 in property taxes, which includes $9,000 of back taxes (unpaid taxes from previous years) paid by McCoy on behalf of the seller and $5,000 due for the current fiscal year after the purchase date. Shortly after closing, the company pays a contractor $50,000 to tear down the old building and remove it from the site. McCoy is able to sell salvaged materials from the old building for $5,000 and pays an additional $11,000 to level the land. Required: a. Determine the amount McCoy’s Fish House should record as the cost of the land. (Amounts to be deducted should be indicated by a minus sign.) 2. Question: Required: a. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) Cost of the Machine $228,000 Less: salvage Value: $24,000 Depreciatble Value: $204,000 Estimated Life: 12,000 3. Question: b. Double Decline Method Annual Depreciation: 1/Life*2 Depreciation Rate: (1/6)*2 33% 0.3333333333333333 Book Value Depreciation Expenses @ 33% Accumulated Depreciation Book Value $228,000 $75,999 $75,999 $152,001 $152,001 $50,667 $126,666 $101,334 $101,334 $33,778 $160,444 $67,556 $67,556 $22,519 $182,963 $45,037 $45,037 $15,012 $197,975 $30,025 $30,025 $6,025 $204,000 24,000 4. Question: Prepare a depreciation schedule for six years using the activity-based method. (Round your “Depreciation Rate” to 2 decimal places and use this amount in all subsequent calculations.) $228,000 5. Question: Required: a. Calculate Sub Station’s return on assets, profit margin, and asset turnover ratio. (Enter your answers in thousands of dollars. (i.e. 6. Question: b. Calculate Planet Sub’s return on assets, profit margin, and asset turnover ratio. (Enter your answers in thousands of dollars. (i.e. 123,000 should be entered as 123).) 7. Question: a. Which company has the higher profit margin? Sub Station b. Which company has the higher asset turnover? Planet Sub c. Are the two ratios consistent with the primary business strategies of the two companies? Yes 8. Question: 1 November 01, 2021 ($55,000 x 6% x 2 / 12) = $550 2 December 31, 2021 ($55,000 x 6% x 1 / 12) = $275 3 February 01, 2022 ($55,000 x 6% x 2 / 12) = $550 9. Question: 1 January 31 Salaries Expense (D) $1,400,000 Income Tax Payable (C) $297,500 FICA Tax Payable (C) $107,100 Accounts Payable (C) $14,000 Salaries Payable (C) $981,400 2 January 31 Salaries Expense (D) $42,000 Accounts Payable (C) $42,000 3 January 31 Payroll Tax Expense (D) $193,900 FICA Tax Payable (C) $107,100 Unemployment Tax Payable (C) $86,800 10. Question: Face Value $40,900,000 Interest payment ($40,900,000 x 8% x 1/2year) = $1,636,000 Periods to maturity (15 years x 2 periods each year) = 30 Market interest rate (7%/2 periods each year) = 3.5 Issue Price = ($1,636,000 x 18.39205) + ($40,900,000 x 0.35628) = 44,661,245.80 Semiannual rate = Market rate / Semiannual periods 3.5 = 7 / 2 The bonds will issue at A Premium 11. Question: If the market rate is 8%, calculate the issue price. Face Value $40,900,000 Interest payment ($40,900,000 x 8% x 1/2year) = $1,636,000 Periods to maturity (15 years x 2 periods each year) = 30 Market interest rate (8%/2 periods each year) = 4 Issue Price = ($1,636,000 x 17.29203) + ($40,900,000 x 0.30832) = $40,900,049.08 Semiannual rate = Market rate / Semiannual periods 4 = 8 / 2 The bonds will issue at Face amount 12. Question: If the market rate is 9%, calculate the issue price. Face Value $40,900,000 Interest payment ($40,900,000 x 8% x 1/2year) = $1,636,000 Periods to maturity (15 years x 2 periods each year) = 30 Market interest rate (9%/2 periods each year) = 4.5 [Show More]

Last updated: 3 years ago

Preview 1 out of 18 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

ACCT 212 Financial Accounting Entire Course Week 1 – 8 BUNDLED (100% CORRECT ANSWERS)

Entire Course Week 1 – 8ACCT 212 Week 1 Homework (Collection) ACCT-212 Week 1 Quiz (Collection) ACCT 212 Week 2 Homework (Collection) ACCT-212 Week 2 Quiz (Collection) ACCT 212 Week 3 Homework...

By Prof. Goodluck 3 years ago

$15

24

Reviews( 0 )

$14.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 10, 2022

Number of pages

18

Written in

All

Additional information

This document has been written for:

Uploaded

Sep 10, 2022

Downloads

0

Views

120

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)