DeVry University

ACCT346 Weekly Assignment

Week 1

Directions: Your assignment this week is to answer the four questions below. Please note that Question 4 contains multiple parts. Please show your work for full cr

...

DeVry University

ACCT346 Weekly Assignment

Week 1

Directions: Your assignment this week is to answer the four questions below. Please note that Question 4 contains multiple parts. Please show your work for full credit on Questions 4b - 4e.

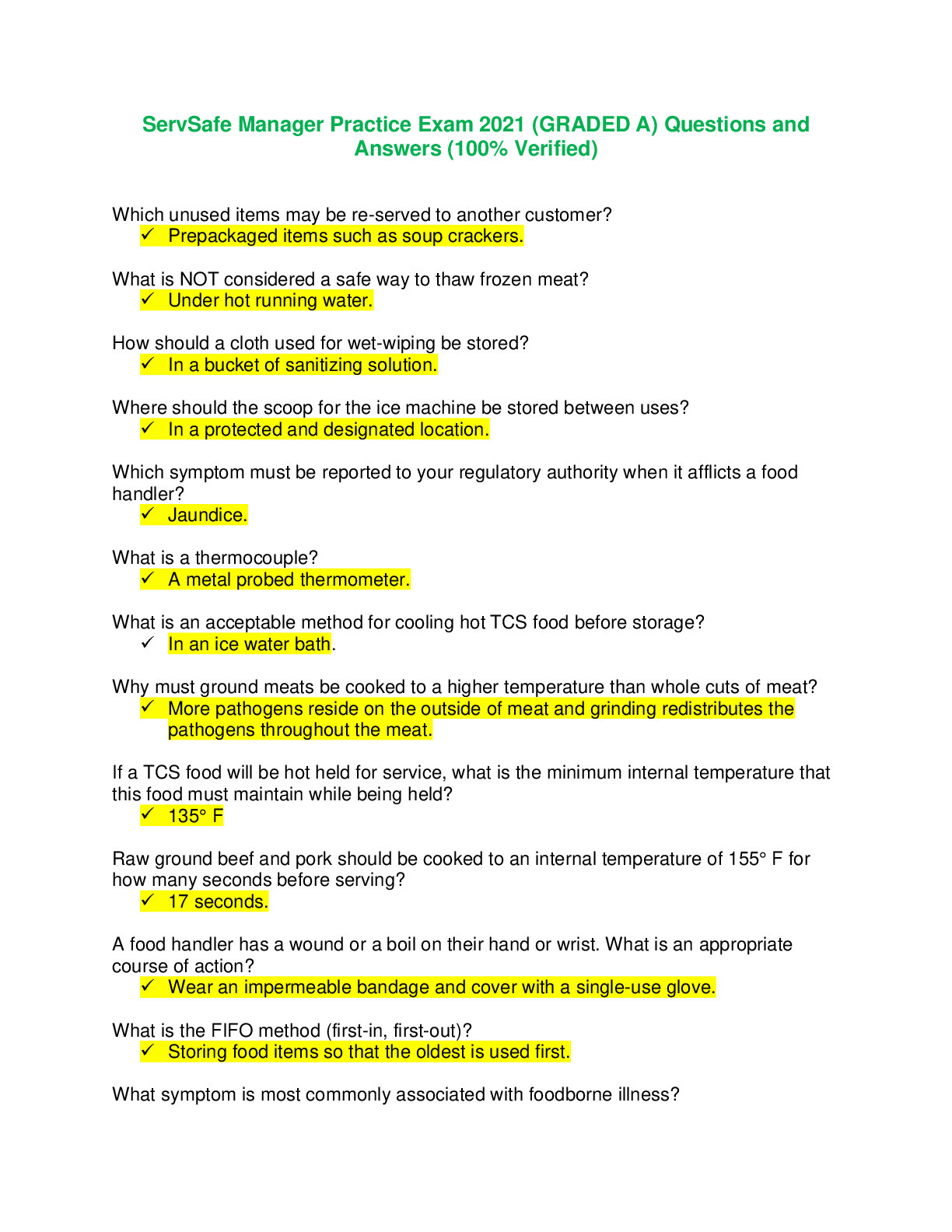

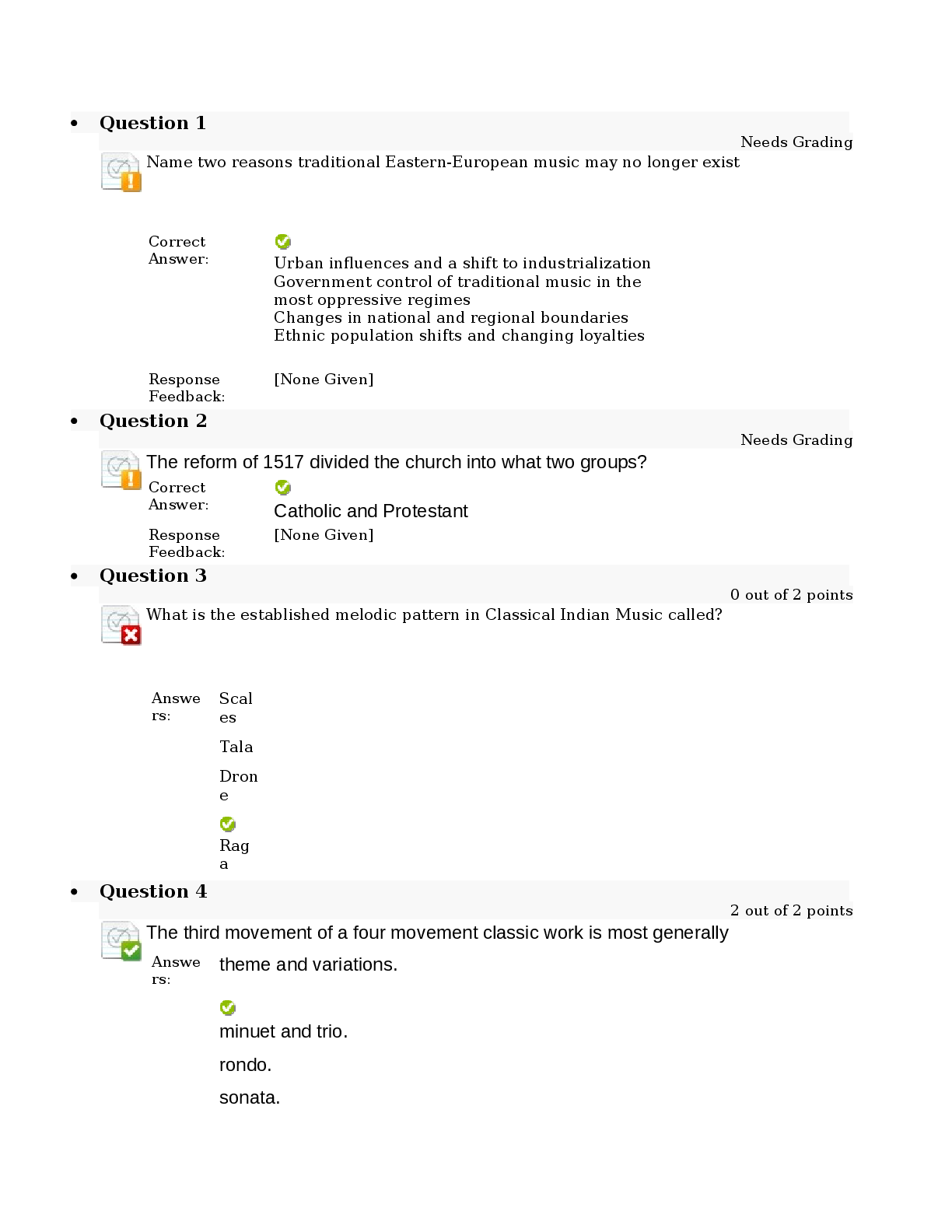

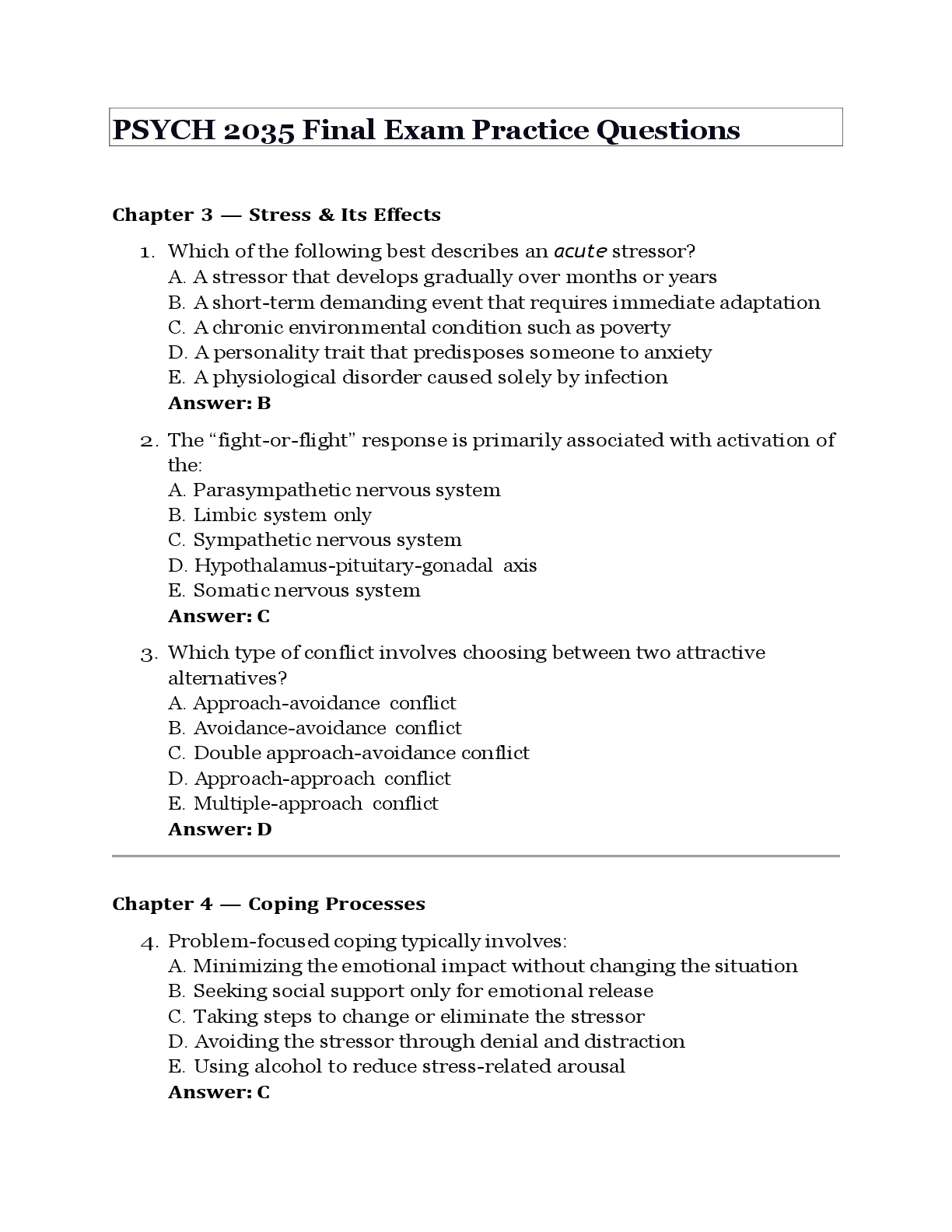

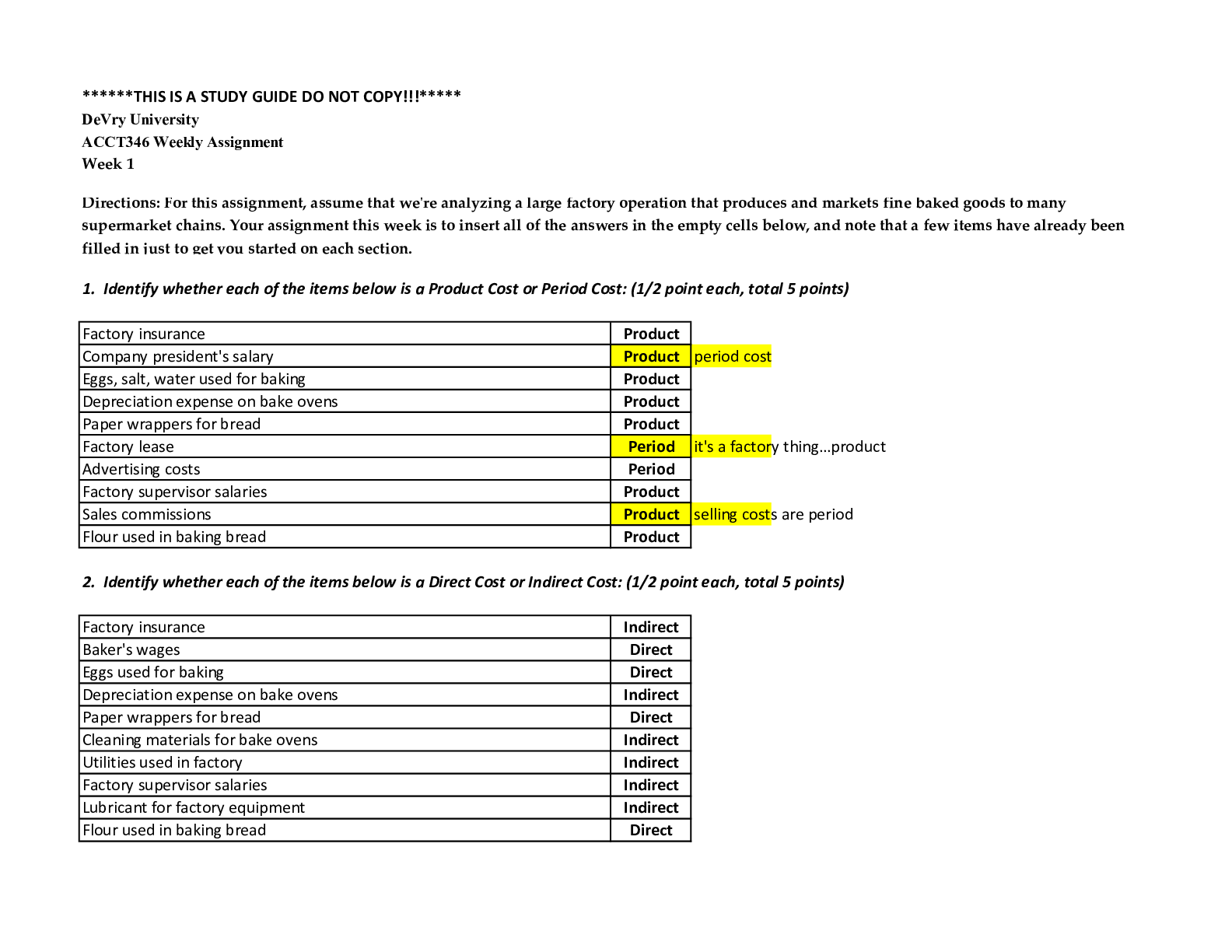

1. Identify whether each of the items below is a Product Cost or Period Cost: (1/2 point each, total 5 oints)

Factory insurance Product

Interest on bank loan Period

Eggs, salt, water used for baking Product

Depreciation on bake ovens Product

Paper wrappers for bread Product

Delivery truck costs Period

Advertising costs Period

Factory supervisor salaries Product

Sales Commissions Period

Flour used in baking bread Product

2. Identify whether each of the items below is a Direct Cost or Indirect Cost: (1/2 point each, total 5 points)

Factory insurance Indirect

Baker's wages Direct

Eggs used for baking Direct

Depreciation on bake ovens Indirect

Paper wrappers for bread Indirect

Cleaning materials for bake ovens Indirect

Utilities used in factory Indirect

Factory supervisor salaries Indirect

Small amount of salt used Indirect

Flour used in baking bread Direct

3. Identify whether each of the below is a Fixed Cost or Variable Cost: (1/2 point each, total 5 points)

Shipping costs for bread Variable

Cost of fuel for delivery truck Fixed

Factory rent Fixed

Factory insurance Fixed

Maintenance on delivery truck Fixed

Sales commissions Variable

Hourly wages paid to baker's assistant Variable

Oven depreciation Fixed

Cost of fruit for cake topping Variable

Factory utilities Fixed

4. Classify each as direct material, direct labor, indirect labor, indirect labor, other manufacturing

overhead or period cost, and then answer the 5 questions below:

4a. Classify each cost (the first one is done for you): (5 points total)

An airline manufacturer incurred the following costs last month (in thousands of dollars): Direct Material Direct Labor Indirect Material Indirect Labor Other Manufacturing

Overhead Period Cost

a. Depreciation on forklifts ........................................................................... $60 $60

b. Property tax on corporate marketing office ............................................. $30 $30

c. Cost of warranty repairs ............................................................................ $220 $220

d. Factory janitors’ wages ............................................................................. $10 $10

e. Cost of designing new plant layout .......................................................... $190 $190

f. Machine operators’ health insurance ....................................................... $40 $40

g. Airplane seats ........................................................................................... $270 $270

h. Depreciation on administrative offices ..................................................... $70 $70

i. Assembly workers’ wages ......................................................................... $670 $670

j. Plant utilities ............................................................................................. $110 $110

k. Production supervisors’ salaries ................................................................ $160 $160

l. Jet engines ................................................................................................ $1,100 $1,100

m. Machine lubricants .................................................................................... $20 $20

Indirect materials + Indirect labor + Other Manufacturing Overhead

Direct maerials + Direct labor + Indirect materials + Indirect labor + Other Manufacturing Overhead Direct maerials + Direct labor

Direct labor + Indirect materials + Indirect labor + Other Manufacturing Overhead

[Show More]

(1).png)

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)