CPCO 2017 CPC/; Final Exam Prep Questions And Answers3

$ 14.5

PUBLIX DELI ASSISTANT MANAGER

$ 21

OM 300 FINAL EXAM 2025

$ 20

Applied Calculus Solutions EIGHTH EDITION

$ 15

.png)

NR 283 Advanced Pathophysiology Study Guide 2019 (Chapter 1 & 2)

$ 15

CET 345W Materials Testing Laboratory: TESTING AND INSPECTION OF CONSTRUCTION MATERIALS. All the reports combined together.

$ 20

NCC EFM Exam Breakdown and Study Guide 100% Verified

$ 10

The Luciferian Book

$ 2.5

CALCULUS 1 LIMITS AND CONTINUITY FULL GUIDE 2023

$ 11

Public Speaking: An Audience-Centered Approach, 11th Edition, By Steven A. Beebe, Susan J. Beebe (Test Bank )

$ 25

TICO Practice Test

$ 10

mod 7 exam mod 7 exam

$ 15

Ebook PDF SQL : 2 Books in 1 - The Ultimate Beginner & Intermediate Guides To Mastering SQL Programming Quickly

$ 8

BLS CPR Certification Lesson 1 / Foundational Concepts Guide / 2025 Update / Score 100%

$ 18.5

Aetna Individual Prescription Drug Plans -- Mastery Test (2022/2023) Already Passed

$ 10

AS.180.101 COMMUNICATION PROCESS MODELS STUDY GUIDE 2024

$ 12

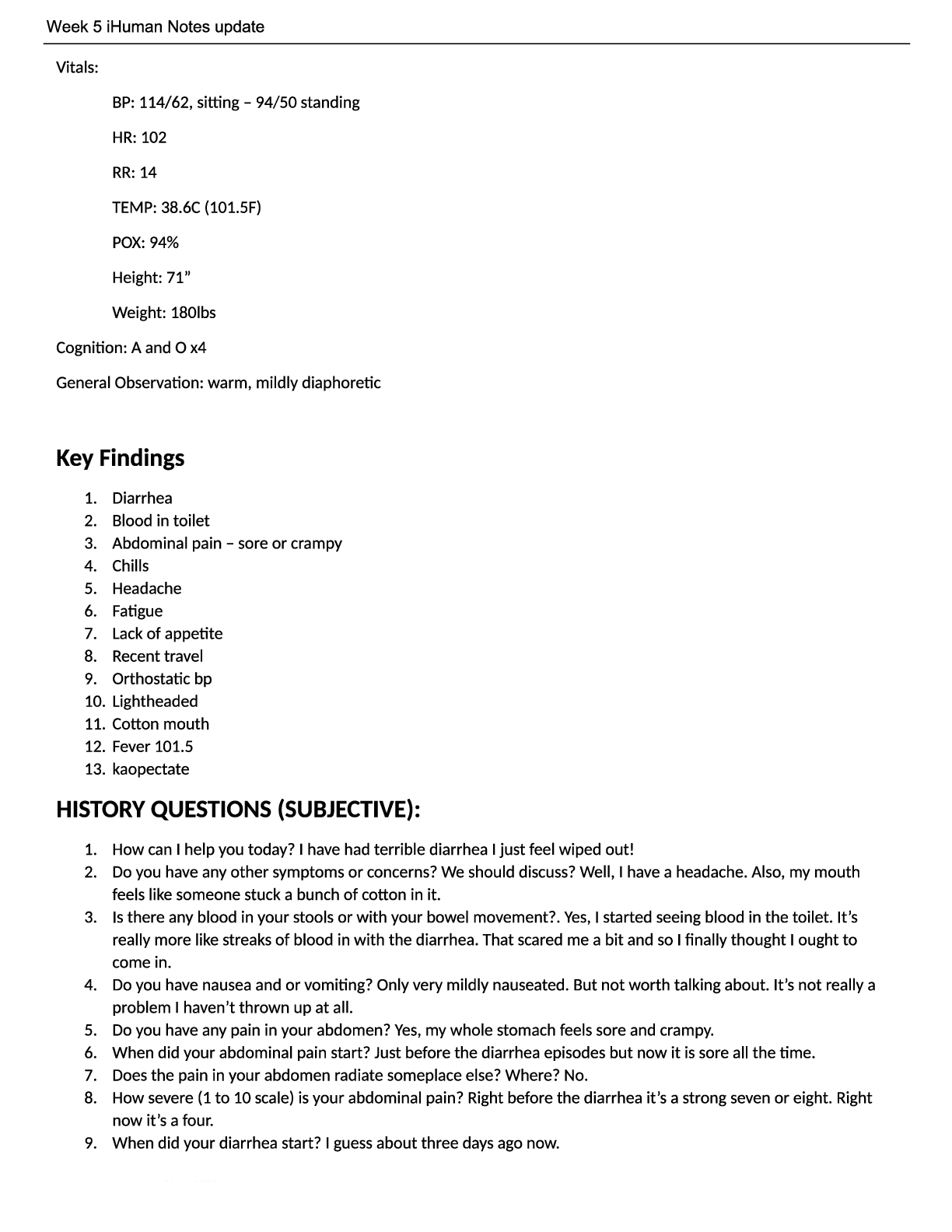

Week 5 iHuman Notes update

$ 19

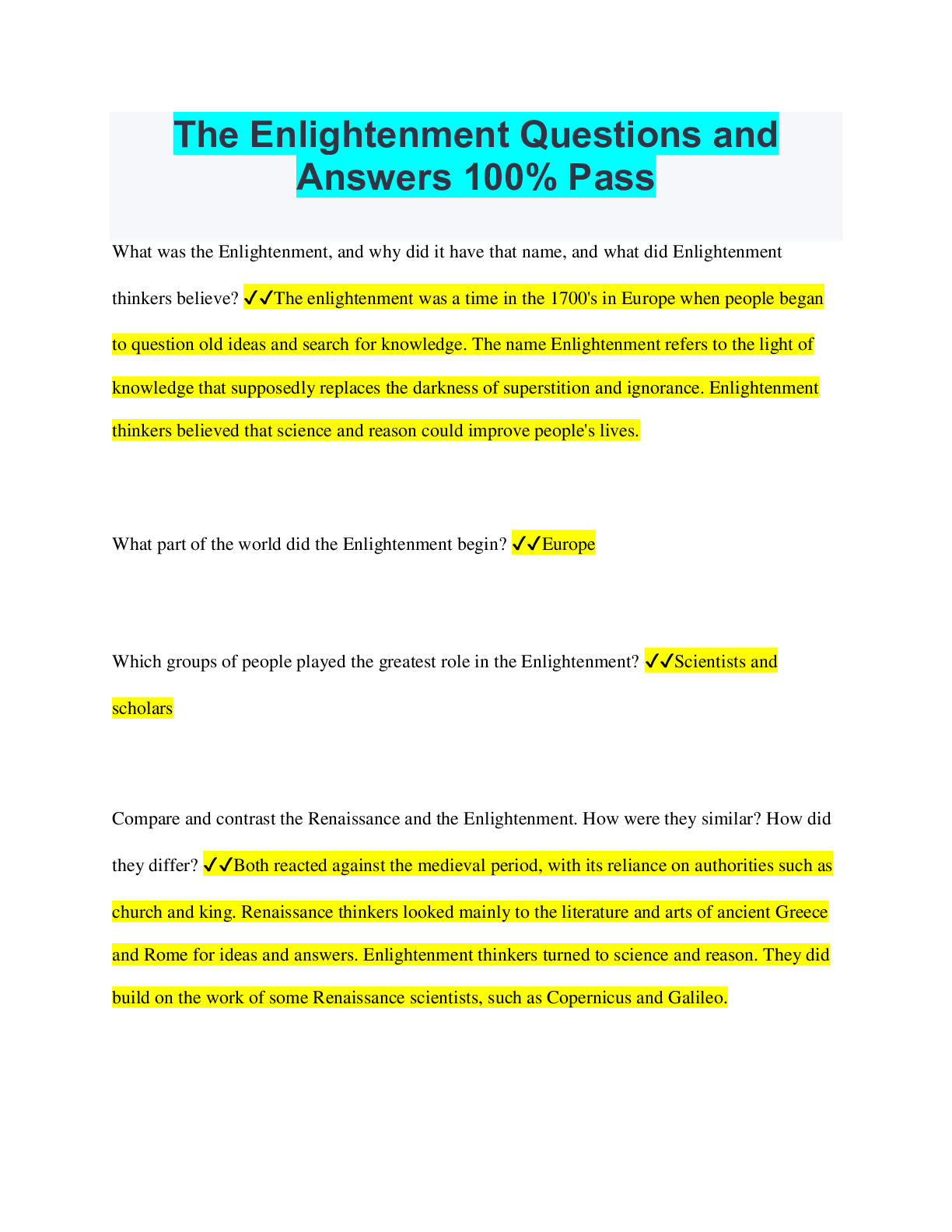

The Enlightenment Questions and Answers 100% Pass

$ 6

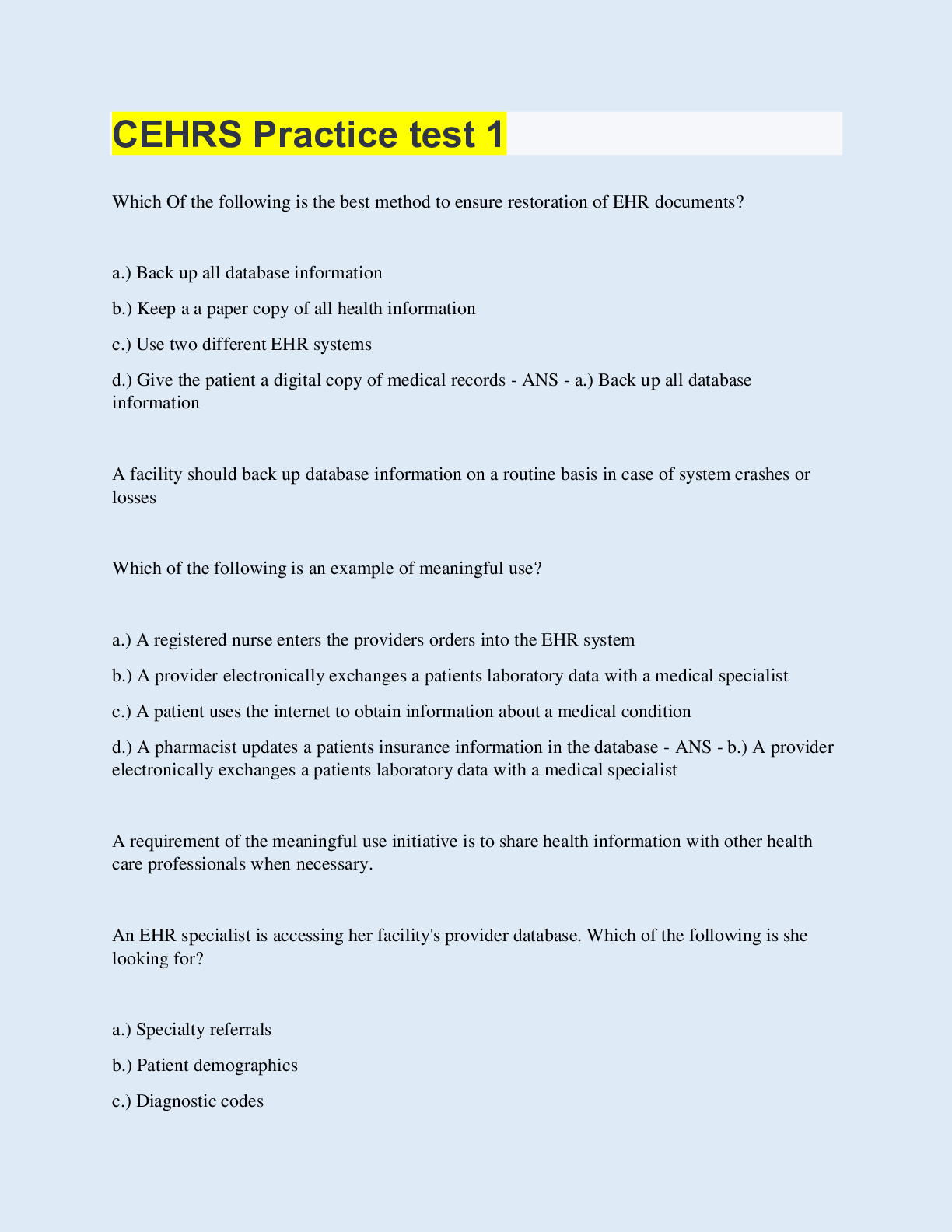

CEHRS Practice test 1

$ 10

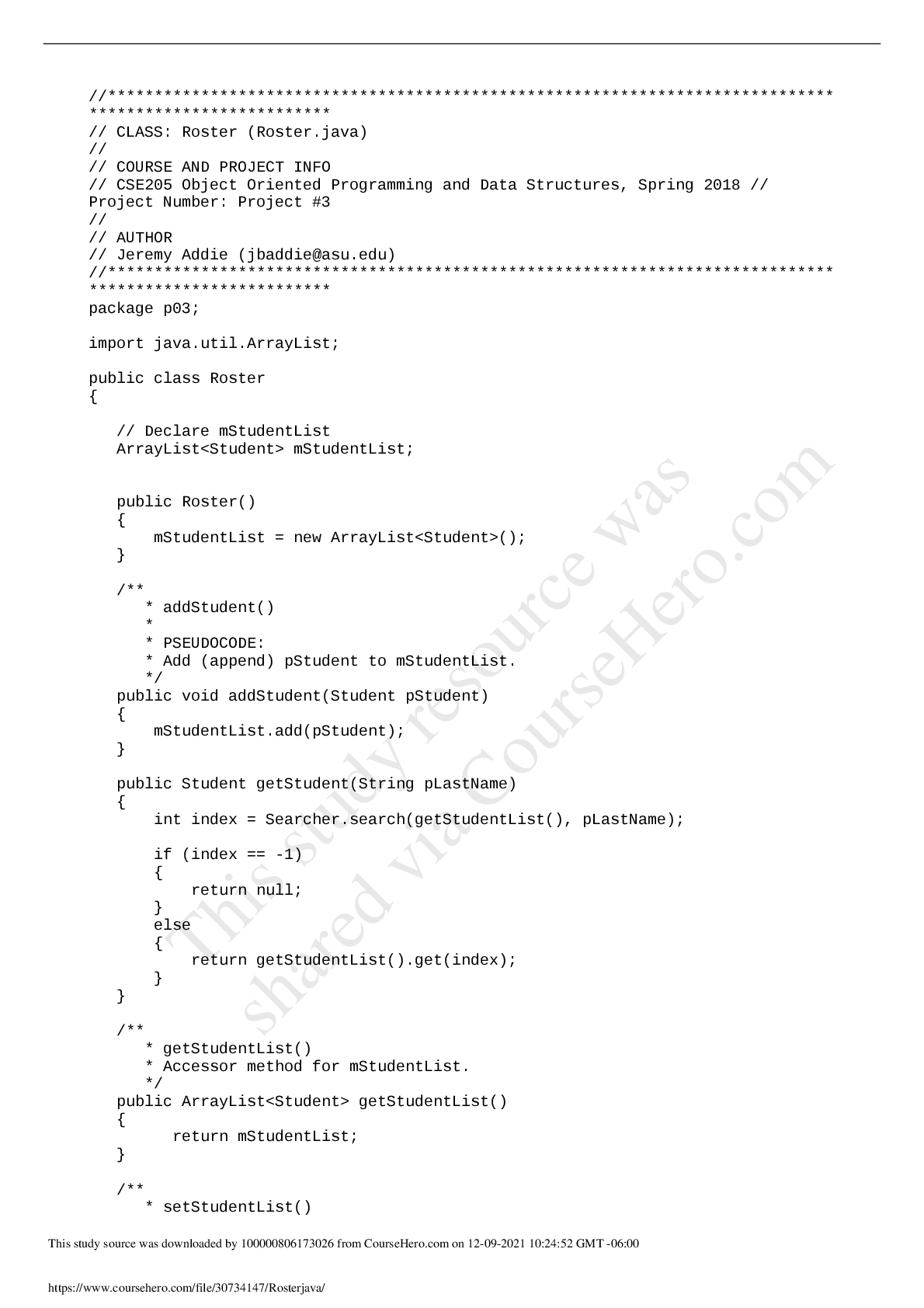

, Tempe Campus CSE 205 Roster.java (//Complete Code)

$ 8

NR341 Exam 1 Study Guide-comprehensive

$ 14

Sitecore Developer Certification

$ 10

Dosage Calculation Packet Caylor School of Nursing

$ 18

UGBA 103 PRACTICE EXAM I

$ 11

.png)

ISYE 6501 - Final Prep - Midterm 1 and 2 Review Latest Update Already Passed

$ 2

Head to Toe Assessment

$ 11

[eBook][PDF] Mechanics of materials, SI Edition, 9th Edition By Barry Goodno, James Gere

$ 14.5

NURS 301 Health Assessment Exam 1 Focus Topics Spring 2019/2020; A+ Work - Nevada State College.

$ 22

Anatomy MCQ ( PDFDrive )

$ 18

NR503-Population Health Epidemiology and Statistical Principles Midterm (Chamberlain.edu)

$ 9

AQA A-level FRENCH 7652/2 Paper 2 Writing Mark scheme June 2021

$ 12

PSYC 101 MODULE 6 EXAM | PORTAGE LEARNING

$ 10

MATHEMATICS

$ 10

AQA 2022 MATHEMATICS A LEVEL MARKSCHEME PAPER 3

$ 9

.png)

WGU C777 – PA Questions and Answers with Complete Solutions

$ 10

Test Bank Fundamentals of Electric Circuits 7th Edition By Charles Alexander, Matthew Sadiku

$ 30

BIOD 171 EXAM MODULE 5

$ 11

Microsoft AZ-104 Exam Microsoft Azure Administrator Exam

$ 10

Test Bank Technology Of Machine Tools 9th Edition By Steve Krar, Arthur Gill, Peter Smid, Robert Gerritsen, John Gill

$ 30

TAMIS Actual Test

$ 8.5

NURS 6550 FINAL EXAM

$ 12

INTL 102 Final Exam Study Guide final.

$ 10

.png)

Medicare Certification

$ 8

ATI RN COMPREHENSIVE EXIT EXAM STUDY GUIDE

$ 10

[eBook-PDF] Microgrids: Theory and Practice by Peng Zhang ISBN13: 9781119890850

$ 28.5

University of DelawareMISY 262MISY+262+Exam+3+Instructions+and+Study+Guide

$ 5

Supply Chain Management MID-TERM Study Guide latest Update

$ 7

MEMO FORMAT (DOWNLOAD FOR CLASS PRACTICE)

$ 5

Test Bank for Today's Technician Automotive Electricity and Electronics, Classroom and Shop Manual Pack 8th Edition By Barry Hollembeak (All Chapters, 100% Original Verified, A+ Grade)

$ 29

DATA ANALYSIS BASIC DATA DESCRIPTORS LATEST ASSESSMENT MODULE 2 Q & A 2024

$ 11

.png)

COCA-COLA INTERNAL CONTROL

$ 6

NUR-634 FINAL EXAM TEST PREP

$ 13

eBook Tiny Python Projects Learn coding and testing with puzzles and games by Ken Youens-Clark

$ 29

Test Bank for Developing the Curriculum 9th Edition By William Gordon, Rosemarye Taylor, Peter Oliva (All Chapters, 100% Original Verified, A+ Grade)

$ 29

SQL (Structured Query Language) QUESTIONS AND ANSWERS ALL CORRECT

$ 10

Nurs 6531 final exam 1 Microsoft

$ 30

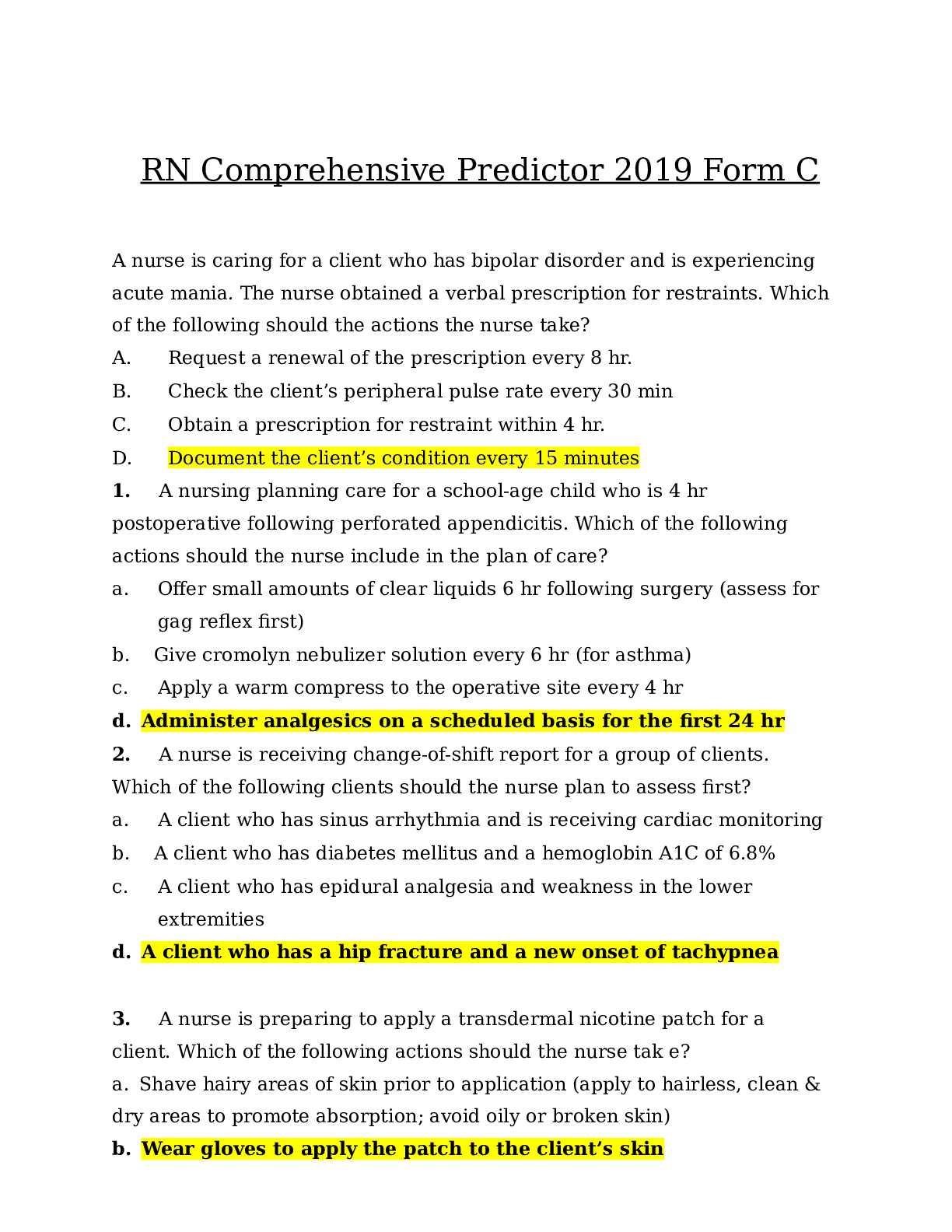

RN Comprehensive Predictor 2019 Form C

$ 15

Gente A task-based approach to learning Spanish 4th Edition By María J. de la Fuente, Carola Goldenberg, Ernesto J. Martín, Neus Sans (Test Bank )

$ 25

Mark Scheme Results Summer 2022 Pearson Edexcel GCSE In Physics (1PH0) Paper 1F Edexcel and BTEC Qualifications

$ 8

US Civics Test (2019-20)

$ 7

Nurs 6531 final exam 1 Microsoft

$ 18

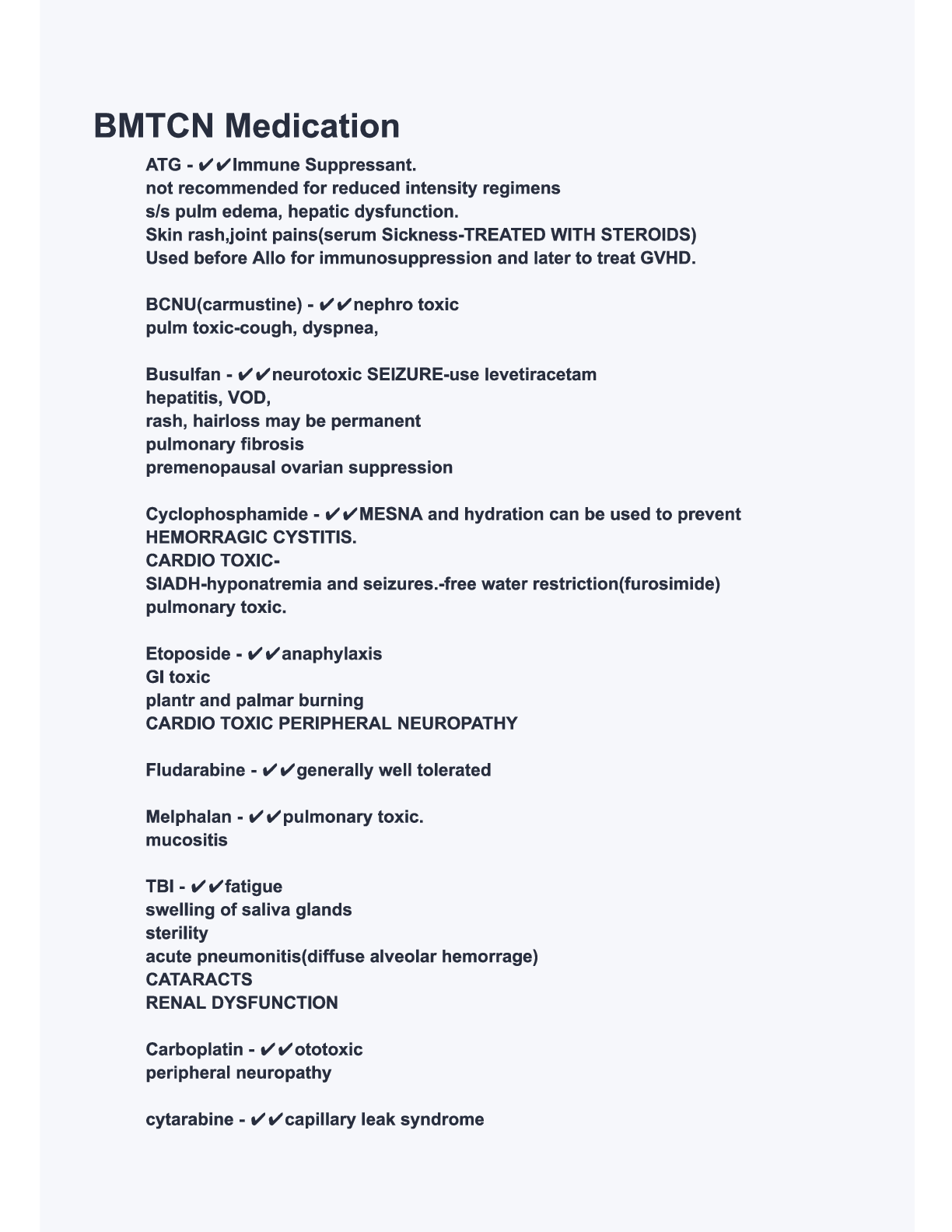

BMTCN Medication

$ 1

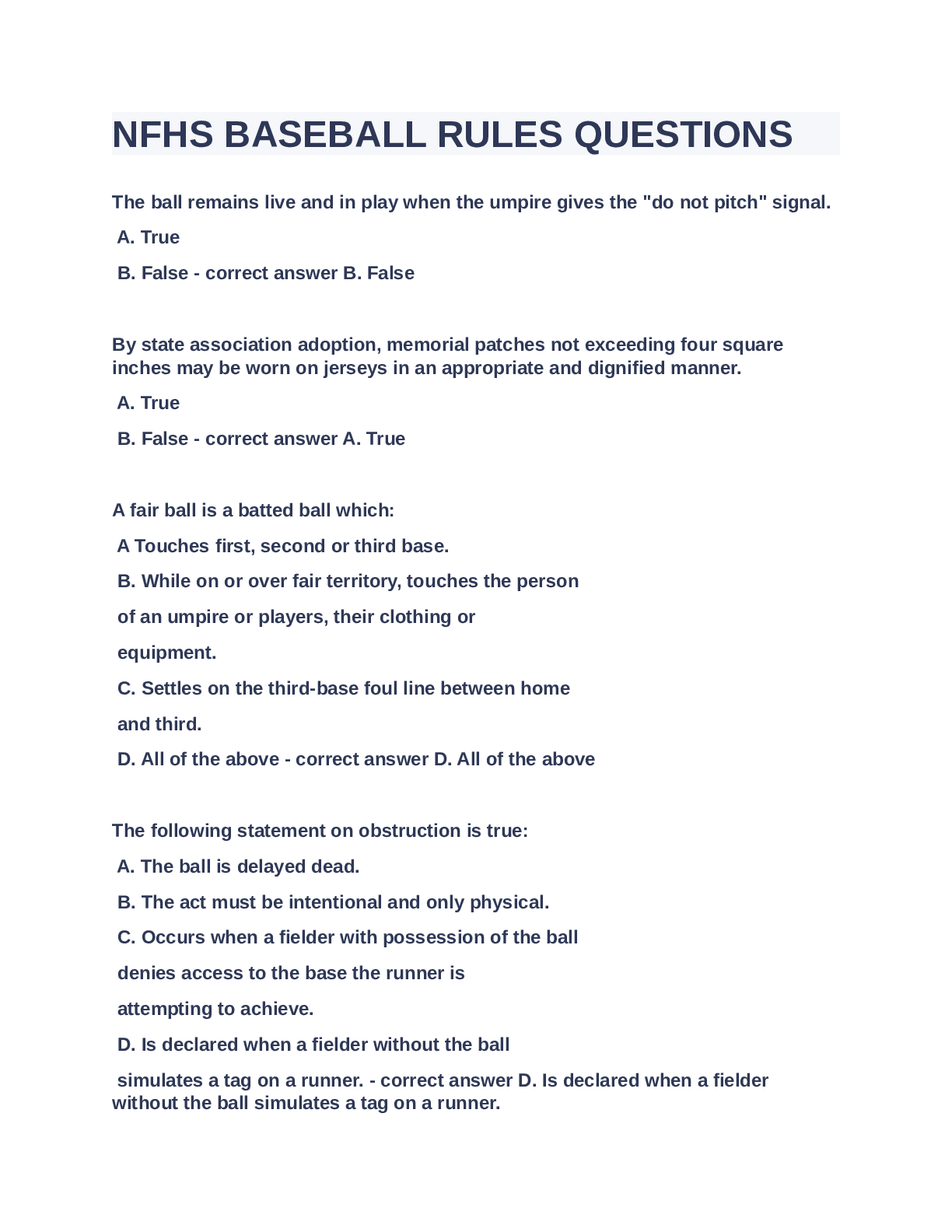

NFHS BASEBALL RULES QUESTIONS 2023

$ 11

PTBC Law Exam

$ 7

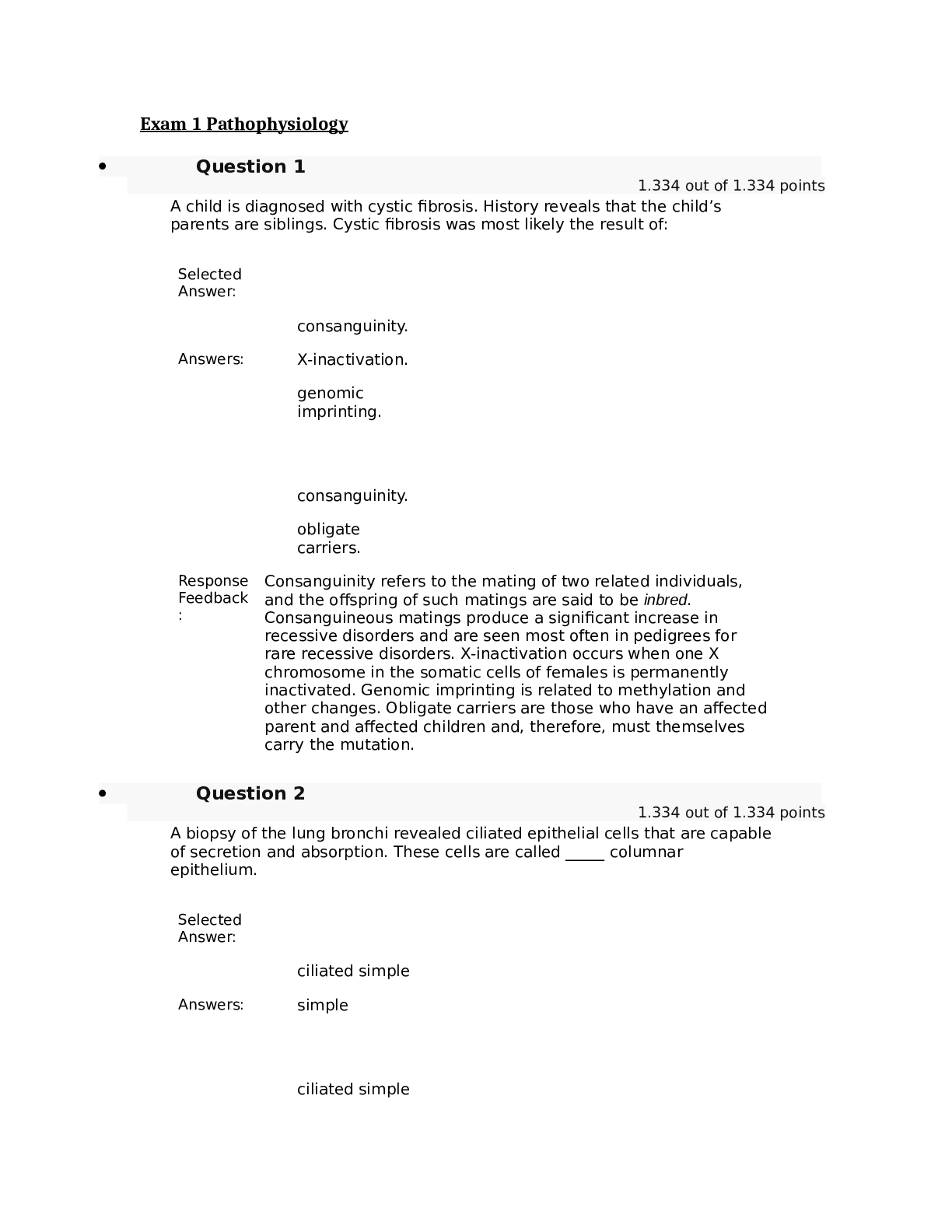

Exam 1 Pathophysiology

$ 18.5

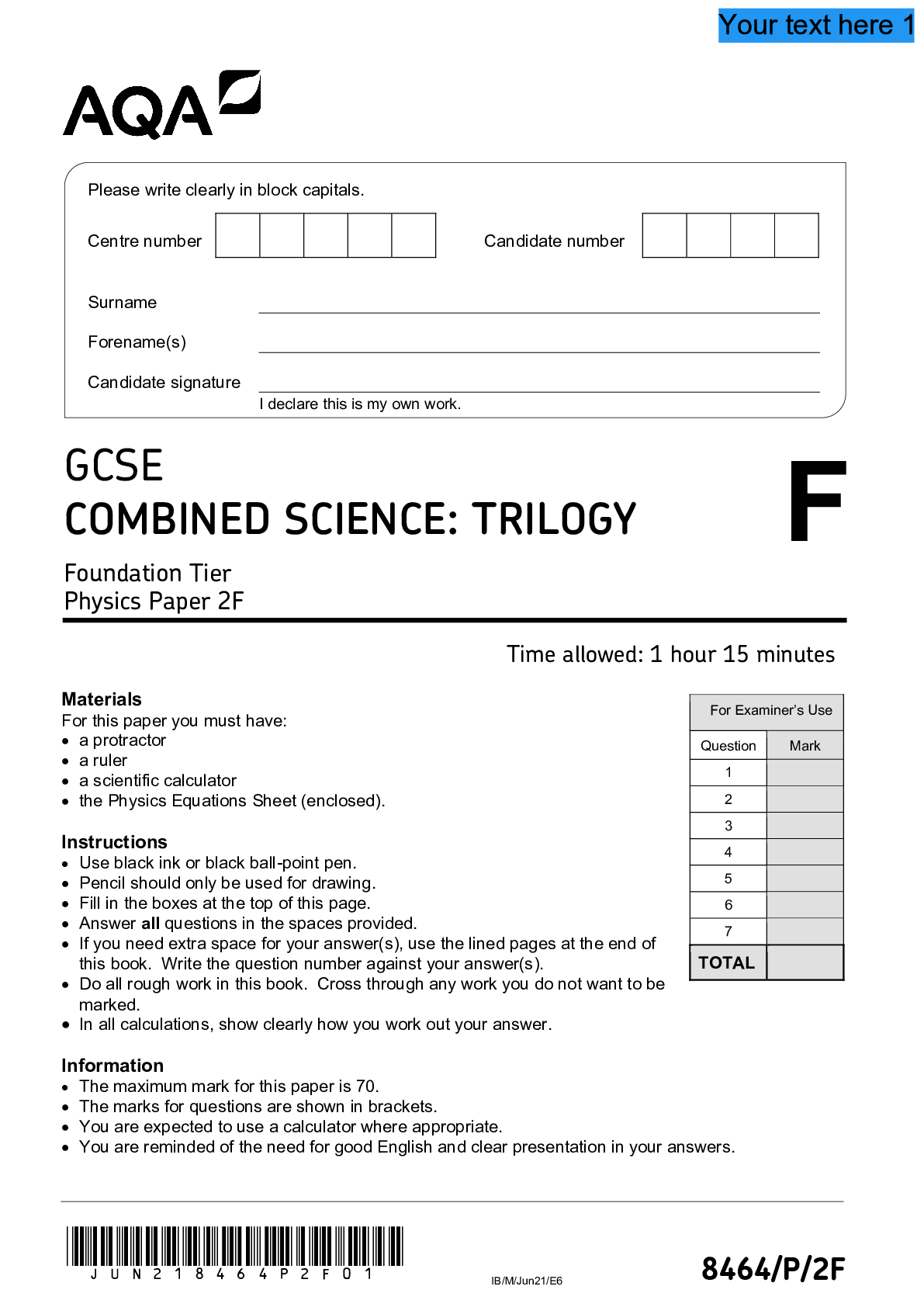

AQA GCSE COMBINED SCIENCE: TRILOGY Foundation Tier Physics Paper 2F QP 2021

$ 10

Homework 7 solutions

$ 7

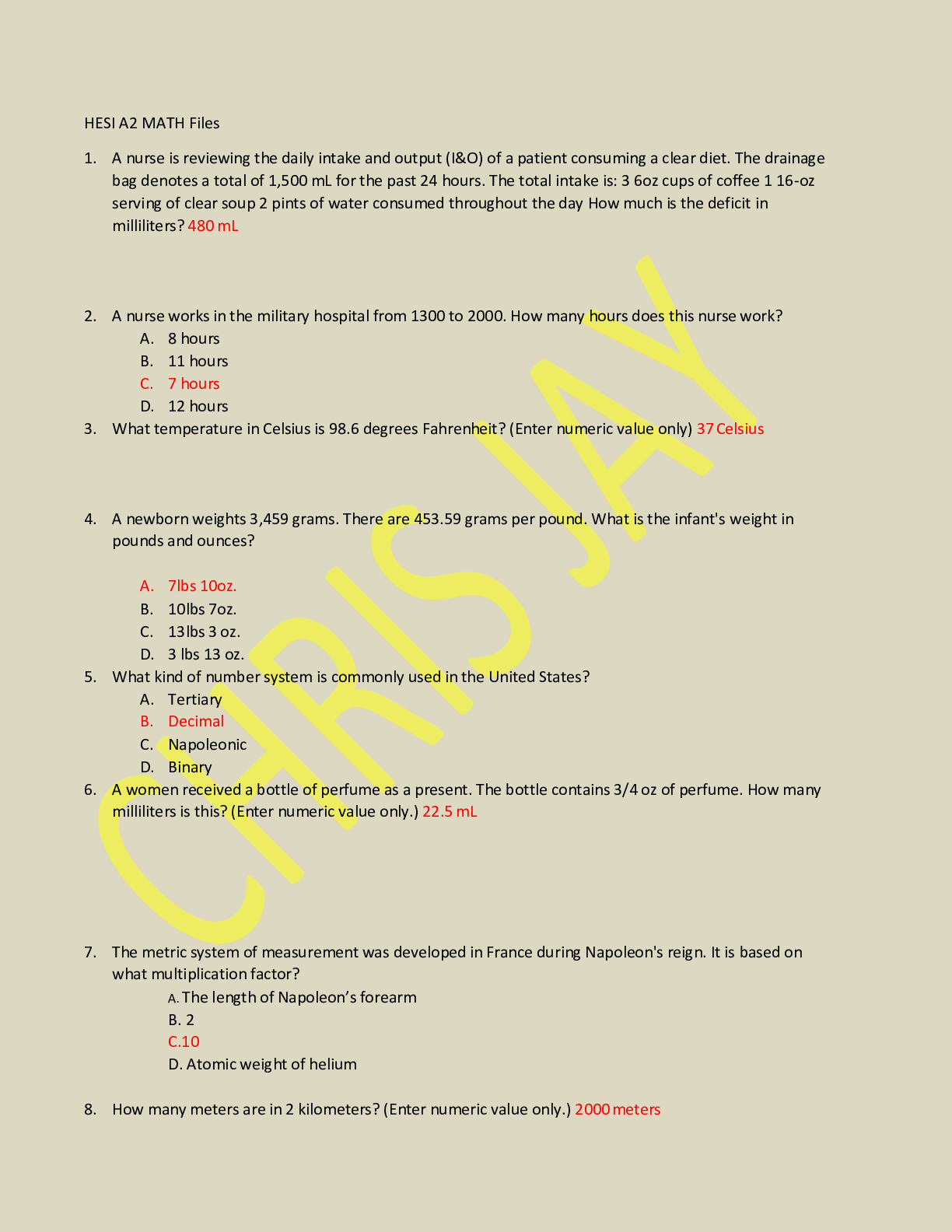

HESI A2 MATH FILES 2023

$ 11

AQA AS Level Physics Paper 2 2023 Mark Scheme

$ 11

.png)

C268 Practice Exam Questions and Answers (Complete Solution)

$ 16.5

eBook Adult Development and Aging Growth, Longevity, and Challenges 1e Julie Hicks Patrick, Bert Hayslip, Lisa Hollis-Sawyer

$ 29

MGT 6203 Homework 1 - Solutions | All Answers are Correct

$ 9

POOL OPERATORS TEST WITH COMPLETE SOLUTION

$ 8

NR 601 Quiz 5 NR 601 MATURE AND AGING ADULT- SCORE AN A GRADE

$ 11

70-646 Server Admin Ch 5 & 6

$ 12

eBook Marine Biology (Volume 1), 1st Edition By Jerónimo Pan, Paula Pratolongo

$ 30

TMC 470 Exam 2

$ 5

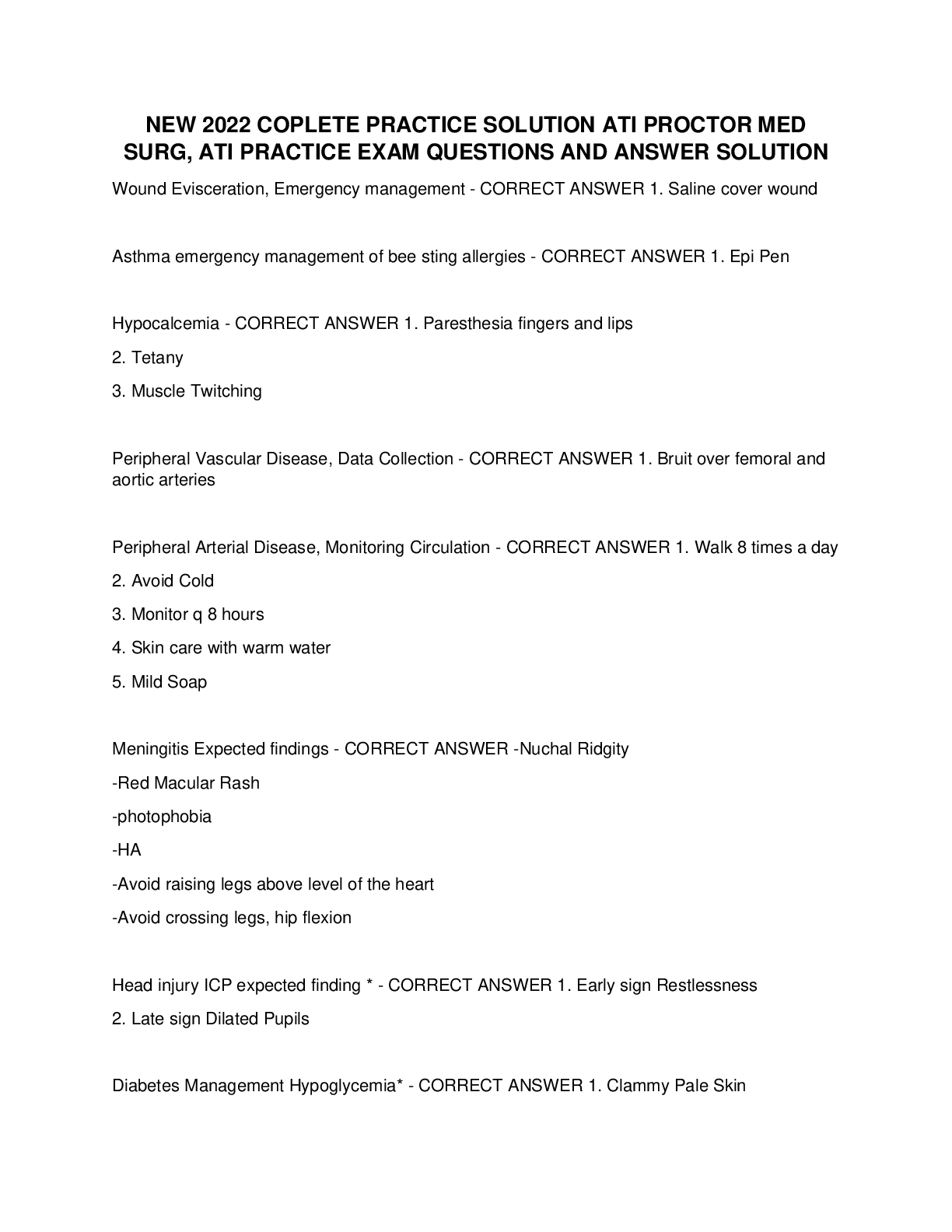

NEW 2022 COMPLETE PRACTICE SOLUTION ATI PROCTOR MED

$ 11

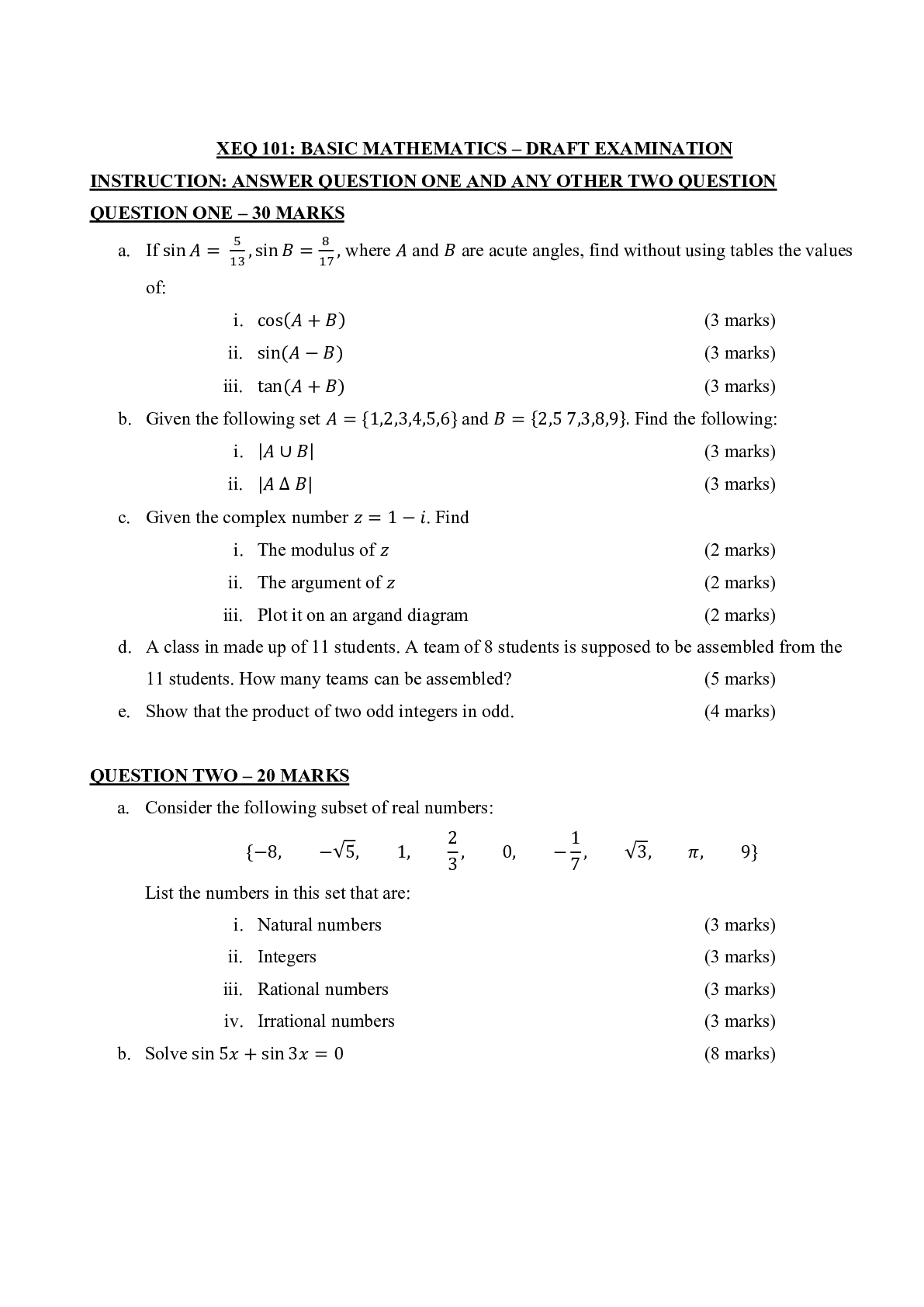

BASIC MATHEMATICS FINAL EXAMS YEAR 1