Auditing > QUESTIONS & ANSWERS > Audit Final Exam Practice Questions with 100% Correct Answers 2022/2023 (All)

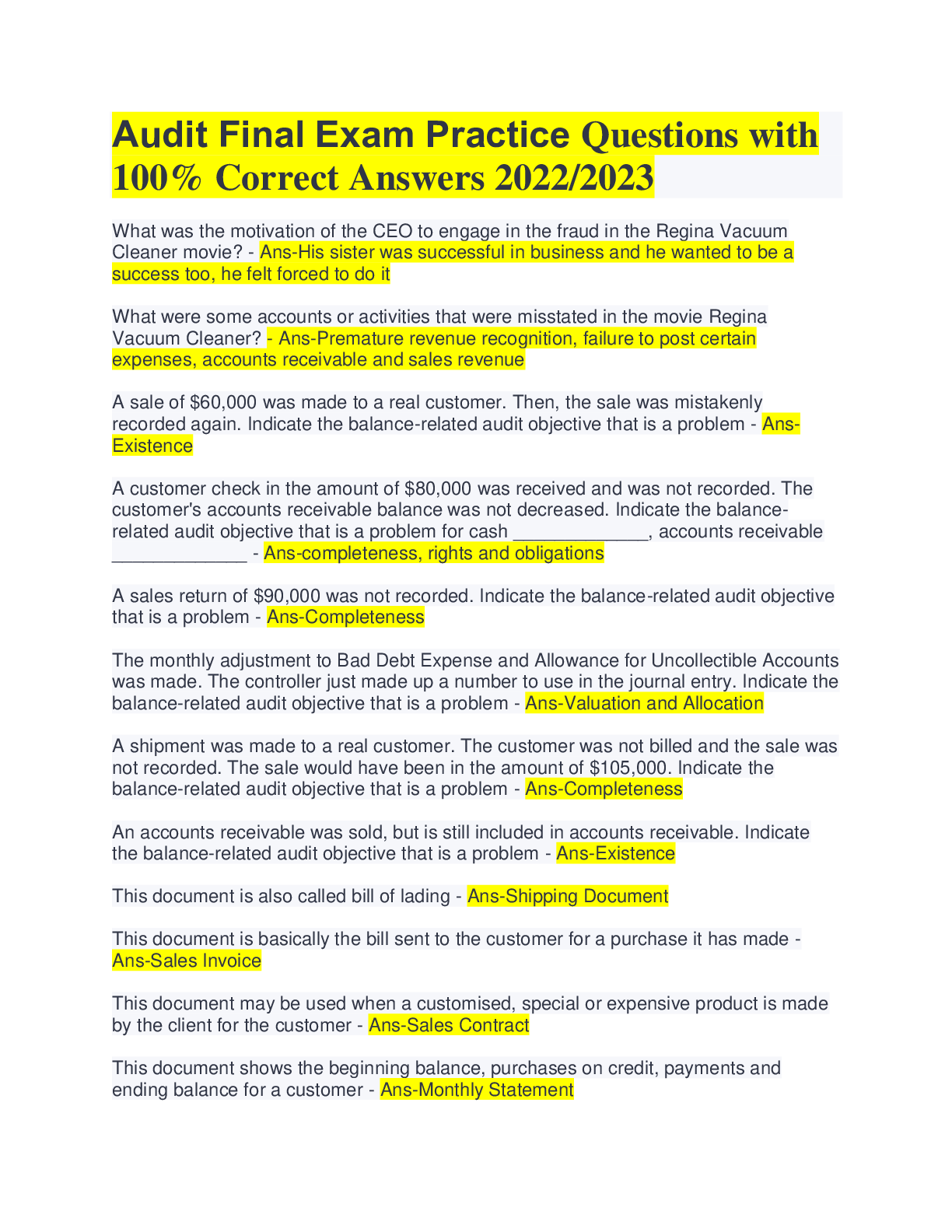

Audit Final Exam Practice Questions with 100% Correct Answers 2022/2023

Document Content and Description Below

Audit Final Exam Practice Questions with 100% Correct Answers 2022/2023 What was the motivation of the CEO to engage in the fraud in the Regina Vacuum Cleaner movie? - Ans-His sister was successful ... in business and he wanted to be a success too, he felt forced to do it What were some accounts or activities that were misstated in the movie Regina Vacuum Cleaner? - Ans-Premature revenue recognition, failure to post certain expenses, accounts receivable and sales revenue A sale of $60,000 was made to a real customer. Then, the sale was mistakenly recorded again. Indicate the balance-related audit objective that is a problem - AnsExistence A customer check in the amount of $80,000 was received and was not recorded. The customer's accounts receivable balance was not decreased. Indicate the balancerelated audit objective that is a problem for cash _____________, accounts receivable _____________ - Ans-completeness, rights and obligations A sales return of $90,000 was not recorded. Indicate the balance-related audit objective that is a problem - Ans-Completeness The monthly adjustment to Bad Debt Expense and Allowance for Uncollectible Accounts was made. The controller just made up a number to use in the journal entry. Indicate the balance-related audit objective that is a problem - Ans-Valuation and Allocation A shipment was made to a real customer. The customer was not billed and the sale was not recorded. The sale would have been in the amount of $105,000. Indicate the balance-related audit objective that is a problem - Ans-Completeness An accounts receivable was sold, but is still included in accounts receivable. Indicate the balance-related audit objective that is a problem - Ans-Existence This document is also called bill of lading - Ans-Shipping Document This document is basically the bill sent to the customer for a purchase it has made - Ans-Sales Invoice This document may be used when a customised, special or expensive product is made by the client for the customer - Ans-Sales Contract This document shows the beginning balance, purchases on credit, payments and ending balance for a customer - Ans-Monthly StatementThis document shows the type of product and the quantity the customer wants to purchase - Ans-Customer Sales order This document is returned with the customer check in payment of accounts receivable - Ans-Remittance Advice The accounting document that shows all the activity in sales revenue for a year - AnsSales Journal The result is a decrease in accounts receivable and an increase in sales returns and allowances - Ans-Credit Memo How could lapping be detected? - Ans-Too much activity on credit sale, and compare amount on remittance advice What conditions at the company could allow lapping to happen? - Ans-Weak separation of duties, custody and accounting have been combined, and independent checks on performance are not supervised Analysis of responses for A/R Confirmations; year-end is December 31, 2015: We paid the balance, $50,000, on January 3, 2016 - Ans-Timing difference, sales issue, shipping documents, subsequent cash receipts Analysis of responses for A/R Confirmations; year-end is December 31, 2015: We already paid off this balance of $40,000 - Ans-Timing difference, subsequent cash receipts, sales invoice, shipping documents Analysis of responses for A/R Confirmations; year-end is December 31, 2015: We did buy products, but we are contesting the prices of two items. ABC says we owe $100,000 for these items, but we think the value of the products is $80,000 - AnsException, sales invoices, shipping documents, sales contract, emails or calls on file Analysis of responses for A/R Confirmations; year-end is December 31, 2015: I'm glad you wrote; we can use some help here. We still have not received these goods. We did place an order, around December 1, 2015, which will cost us $85,000, but we have not yet received this order. Can you check on this order for us? Please give a call to our purchasing manager with update. - Ans-Timing difference, compare $85,000 for customer, shipping document, figure when product shipped, see what client has recorded Analysis of responses for A/R Confirmations; year-end is December 31, 2015: Hello Anyone there? Our inventory manager returned those around December 27, 2015. We are still waiting to get our debit memo, which should be around $75,000 - Ans-Timing difference, would want to see the credit memo. End of the year, may not have had timeto go through the inventory. Customer calls it a debit memo because they are expecting to get money back for their return and decrease their A/P What is typically not found in the sales and collections cycle? - Ans-Interest expense The audit objective of most concern to the auditor for sales revenue is usually _________, The audit objective of most concern to the auditor for cash receipts is usually __________ - Ans-Existence, completeness Accounts receivable are __________ assets - Ans-current In the revenue cycle, an auditor may conduct some cutoff tests. Cutoff tests primarily determine if - Ans-activity in an account was recorded in the correct year Which account is found, usually, in the sales and collection cycle? - Ans-Allowance for uncollectible accounts The audit objective of completeness for sales revenue means - Ans-If an actual sale took place, it is recorded T/F: Bad Debt Expense is going to increase net income - Ans-False T/F: Bad Debt expense is part of the sales and collection cycle - Ans-True T/F: Bad debt expense is used to "match" revenues and expenses in the same year - Ans-True T/F: Bad debt expense is used to recognise that some accounts receivable will not be collected - Ans-True T/F: The top executive at Regina Vacuum Cleaner wanted to be successful in business - Ans-True T/F: The federal government put the Regina Vacuum Cleaner company out of business - Ans-False T/F: The main focus of the fraud for Regina Vacuum Cleaner was in capital leases - Ans-false T/F: One part of the Regina Vacuum Cleaner fraud was overstated sales returns - Ansfalse What is the best description of a sales invoice? - Ans-It is a document that shows the amount owed for an individual saleWhat is the best description of the account, sales returns and allowances? - Ans-It is a contra-revenue which shows as a negative to sales revenue Suppose you are concerned about the existence of accounts receivable. What does existence mean, in this situation? - Ans-If an individual account receivable is recorded, it represents an amount actually owed by a real customer There is a mix of customers, some with small balances and some with large balances would indicate that negative confirmations should - Ans-not be used in the audit engagement An audit program is a list of audit procedures to be performed for an audit area, or the entire audit. To investigate the collectibility of account balances would be found on the audit program for the ______________ - Ans-sales and collection cycle If sales returns and allowances are not recorded gross profit will be - Ans-overstated If Upper misstatement is greater than tolerable misstatement you would say that accounts receivable is - Ans-materially misstated If upper misstatement is less than tolerable misstatement you would say that accounts receivable is - Ans-fairly presented Why might an auditor be more concerned about overstatements than understatements in accounts receivable? - Ans-If A/R is overstated, total assets will be overstated and the balance sheet will look better than it really is. Sales revenue on Income statement will also be overstated, so net income will look better Suppose the upper misstatement bound is computed as $50,000 and the lower misstatement bound is computed as $50,000. The tolerable misstatement is $60,000. What should the auditor do now? - Ans-Say A/R is fairly stated Suppose the upper misstatement bound is computed as $80,000 and the lower misstatement bound is computed at $80,000. The tolerable misstatement is $60.000. What should the auditor do now? - Ans-Say A/R is materially misstated The risk the auditor is willing to take of accepting an account balance as correct when the true error in the balance is greater than the tolerable misstatement is - Ans-sampling risk T/F: MUS should be used when the population is likely to be seriously misstated - Ansfalse T/F: MUS should be used when the auditor is not looking at dollar amounts - Ans-False T/F: MUS is a type of judgmental or non statistical sampling - Ans-FalseT/F: MUS is applicable for populations without negative amounts included - Ans-True If the upper misstatement bound is $400,000, and the tolerable misstatement is $300,000, and the confidence level is 95%, the auditor could say: - Ans-the population is not fairly stated, with a 95% confidence level If the upper misstatement bound is $500,000 and the tolerable misstatement is $700,000, and the confidence level is 95%, the auditor could say: - Ans-The population is fairly stated, with a 95% confidence level If the point estimate of the population is $175,000 and the tolerable misstatement is $250,000, the auditor could say: The population is - Ans-fairly stated Which account is not in the acquisition and payment cycle? (Purchase discounts, accounts receivable, selling expenses, accounts payable) - Ans-accounts receivable A receiving report gives information on the - Ans-description and quantity of goods received by the client Locked storerooms would be included in the control activity of _____________ - Ansphysical control over assets and records Suppose you think that accounts payable are incomplete, in that the audit objective of completeness is not met. One effect of this could be ________________ general and administrative expenses - Ans-understated An approval process to pay suppliers would be included in the control activity of - Ansproper authorization of transactions Restricting access to the computer used to print checks would be included in the control activity of - Ans-physical control over assets and records Required time off would be included in the control activity of - Ans-independent checks on performance Accounts payable are - Ans-current liabilities T/F: the account, accounts payable, is often part of the search for unrecorded liabilities - Ans-true T/F: one audit objective that is relevant when searching for unrecorded liabilities is completeness - Ans-true T/F: one type of document involved in the search for unrecorded liabilities is receiving reports - Ans-trueT/F: the main concern when searching for unrecorded liabilities is overstatement - Ansfalse Suppose you find that your audit client has paid for inventory that it did not receive. T/F: the company is wasting money - Ans-True Suppose you find that your audit client has paid for inventory that it did not receive. T/F: It is likely that the receiving department does not consistently count the inventory when it comes to the receiving dock - Ans-True Suppose you find that your audit client has paid for inventory that it did not receive. T/F: this situation involves a problem with existence of inventory - Ans-True Suppose you find that your audit client has paid for inventory that it did not receive. T/F: The client should allow any warehouse employee to enter in the address where the inventory should be shipped - Ans-false Suppose you suspect that company checks are being written and then paid by the bank, but not recorded at the audit client. T/F: Independent checks on performance could help detect this problem - Ans-True Suppose you suspect that company checks are being written and then paid by the bank, but not recorded at the audit client. T/F: completeness is a problem - Ans-True Suppose you suspect that company checks are being written and then paid by the bank, but not recorded at the audit client. T/F: an employee may be stealing cash - Ans-True Suppose you suspect that company checks are being written and then paid by the bank, but not recorded at the audit client. T/F: a bank reconciliation will not catch this problem - Ans-False FOB destination - Ans-title passes when the product gets to its destination; the seller - supplier owns the inventory while in transit FOB shipping point - Ans-title passes when the product is shipped; the buyer - customer owns the inventory while in transit Inventory master file - Ans-an accounting document that shows the activity in inventory; the beginning balance, increases, decreases, and ending balance is shown for many types of inventory Shipping document - Ans-an accounting document showing the date of shipment and the quantity shoppedShipping document is used to ________ inventory and ___________ cost of goods sold expense - Ans-decrease, increase A letter of ___________ is signed by the audit client and states that the client prepared the financial statements in accordance with GAAP, included adequate footnotes and answered all of the auditor's questions - Ans-representation An auditor may prepare a management letter. A management letter is - Ans-option and is intended to help the client with its operations The time frame for subsequent events is - Ans-between the balance sheet date and the audit report date The Enron company is an example of a subsequent discovery because - Ans-material misstatements in the financial statements were found after the audited financial statements had been issued The audit report includes a date. This date refers to - Ans-the day the auditor has finished the fieldwork at the client's facilities A phrase which describes subsequent discovery is - Ans-recall, revise, reissue T/F: A partner from the same accounting firm must do the independent review for SEC clients - second partner review - Ans-True T/F: An official from the SEC must do the independent review for SEC clients - second partner review - Ans-False T/F: A partner from another accounting firm must do the independent review for SEC clients - second partner review - Ans-False T/F: an internal auditor from the client must do the independent review for SEC clients - second partner review - Ans-False General discontent among employees is least likely to be disclosed in the footnotes as a - Ans-subsequent event Analytical procedures in the completion state of the audit are - Ans-required Subsequent events and subsequent discovery are different, because - Ans-subsequent discovery means the financial statements have been issued Vouch a sample of recorded sales from the sales journal to shipping documents is the audit procedure most effective in testing - Ans-credit sales for overstatementTo determinate whether internal control relative to the revenue cycle of a wholesaling entity is operating effectively in minimising the failure to prepare sales invoices, an auditor would most likely select a sample of transactions from the population represented by the - Ans-shipping document file The client's accounting system will not post a sales transaction to the sales journal without a valid bill of lading number. This control is more relevant to which audit assertion for sales? - Ans-Occurrence Analyze transactions occurring within a few days before and after year-end is the best description of the overall approach used when performing a __________ - Ans-cut-off review [Show More]

Last updated: 3 years ago

Preview 1 out of 14 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 21, 2022

Number of pages

14

Written in

All

Seller

Reviews Received

Additional information

This document has been written for:

Uploaded

Sep 21, 2022

Downloads

0

Views

189