Finance > EXAM > pearson vue practice exam ALL SOLUTION & ANSWERS ALL 100% CORRECT RATING 2022/2023 LATEST GUARANTEED (All)

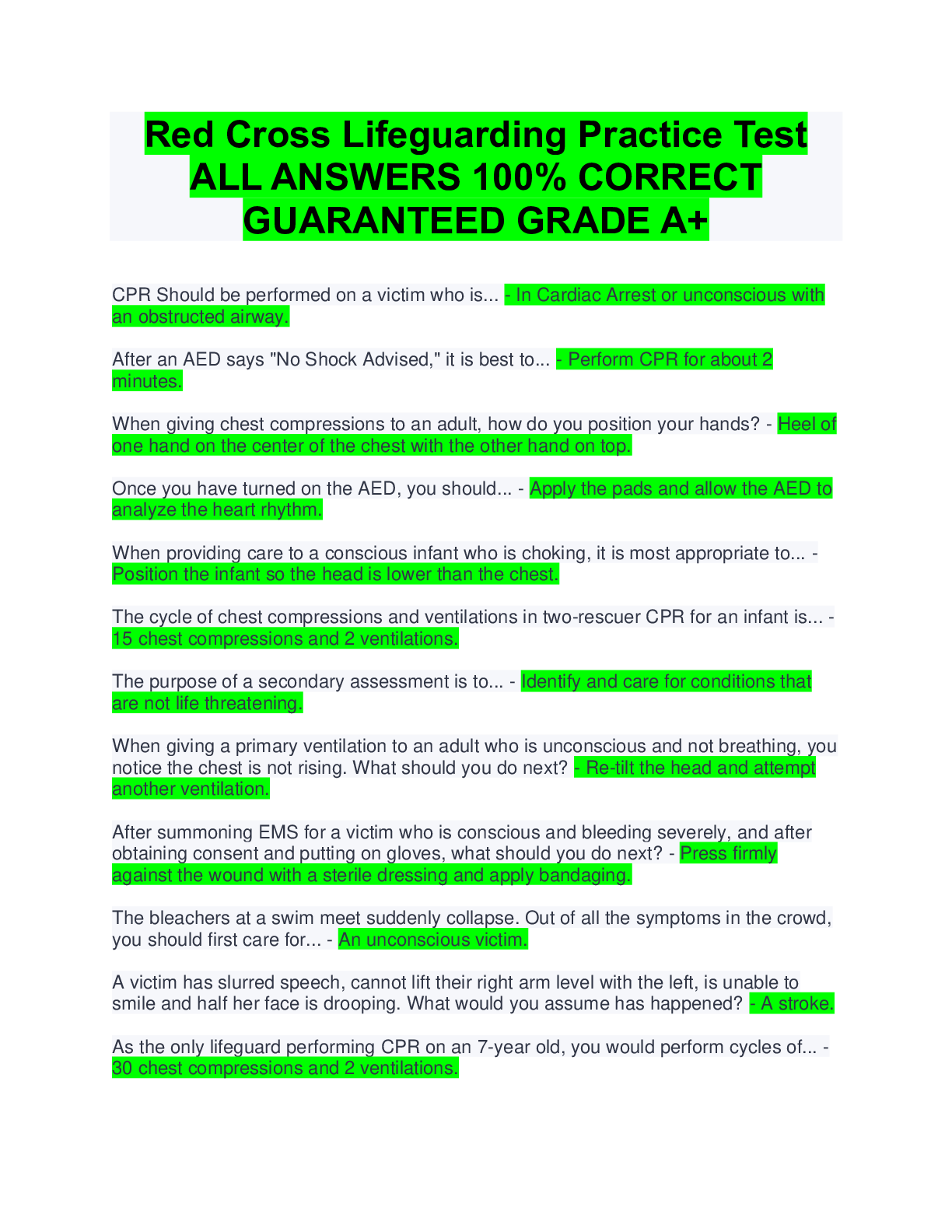

pearson vue practice exam ALL SOLUTION & ANSWERS ALL 100% CORRECT RATING 2022/2023 LATEST GUARANTEED GRADE A+

Document Content and Description Below

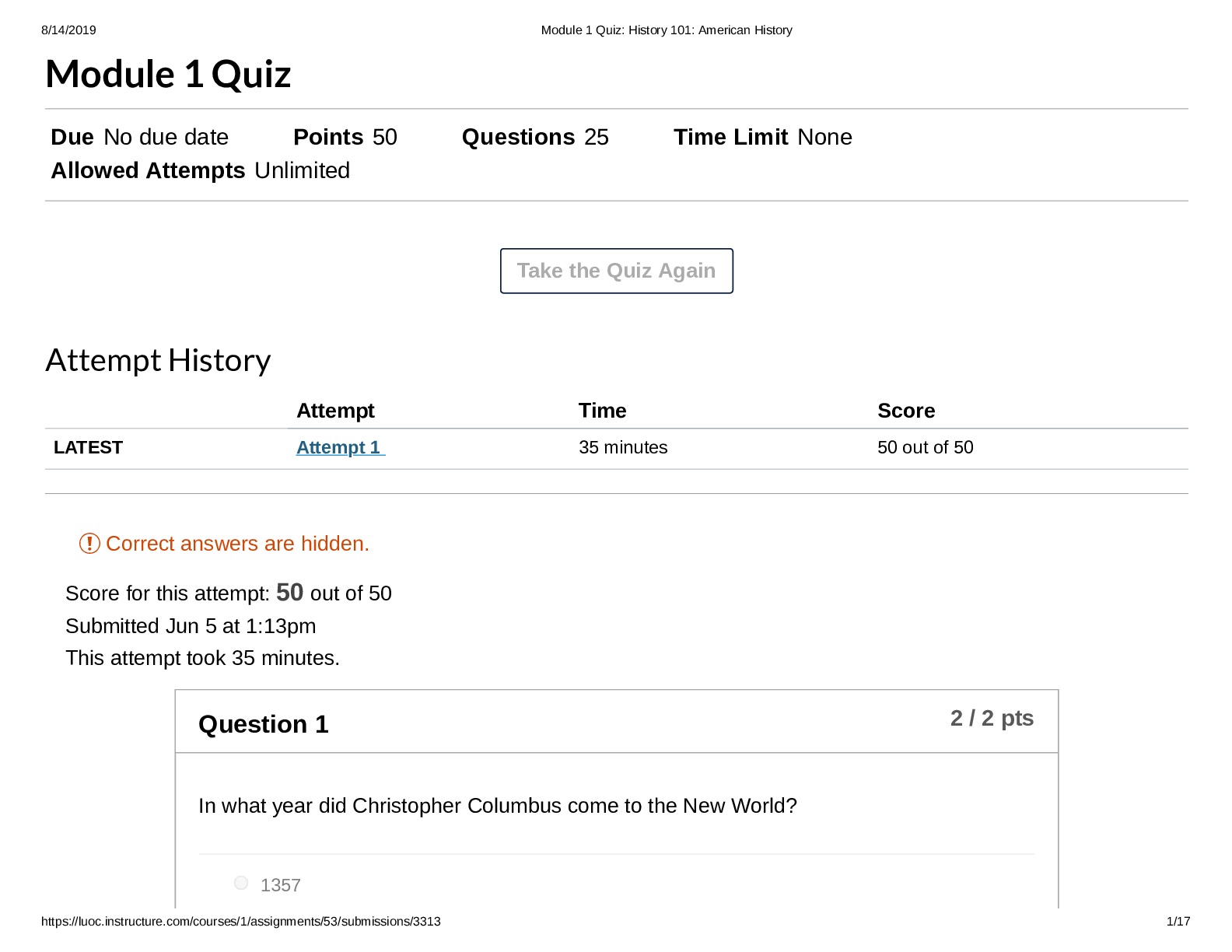

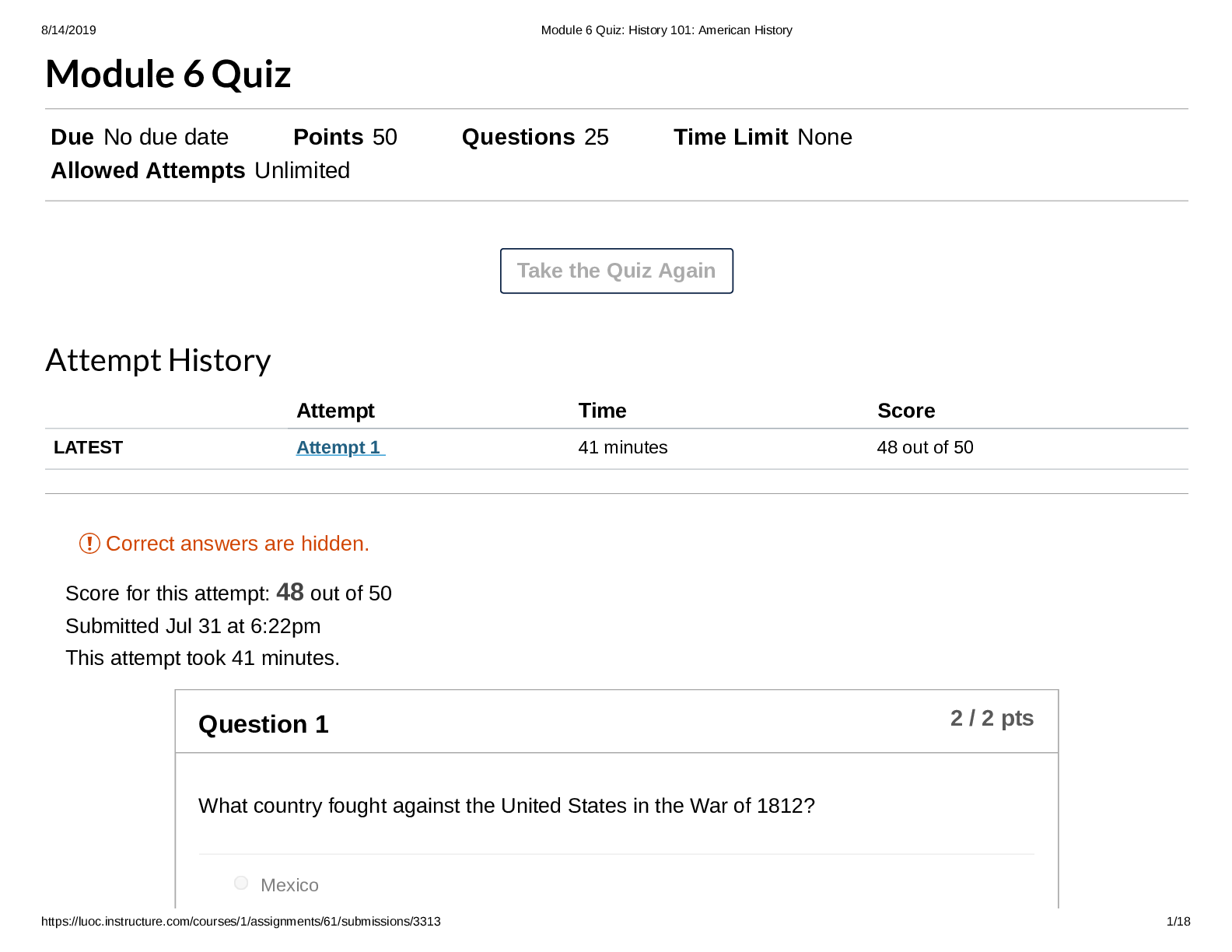

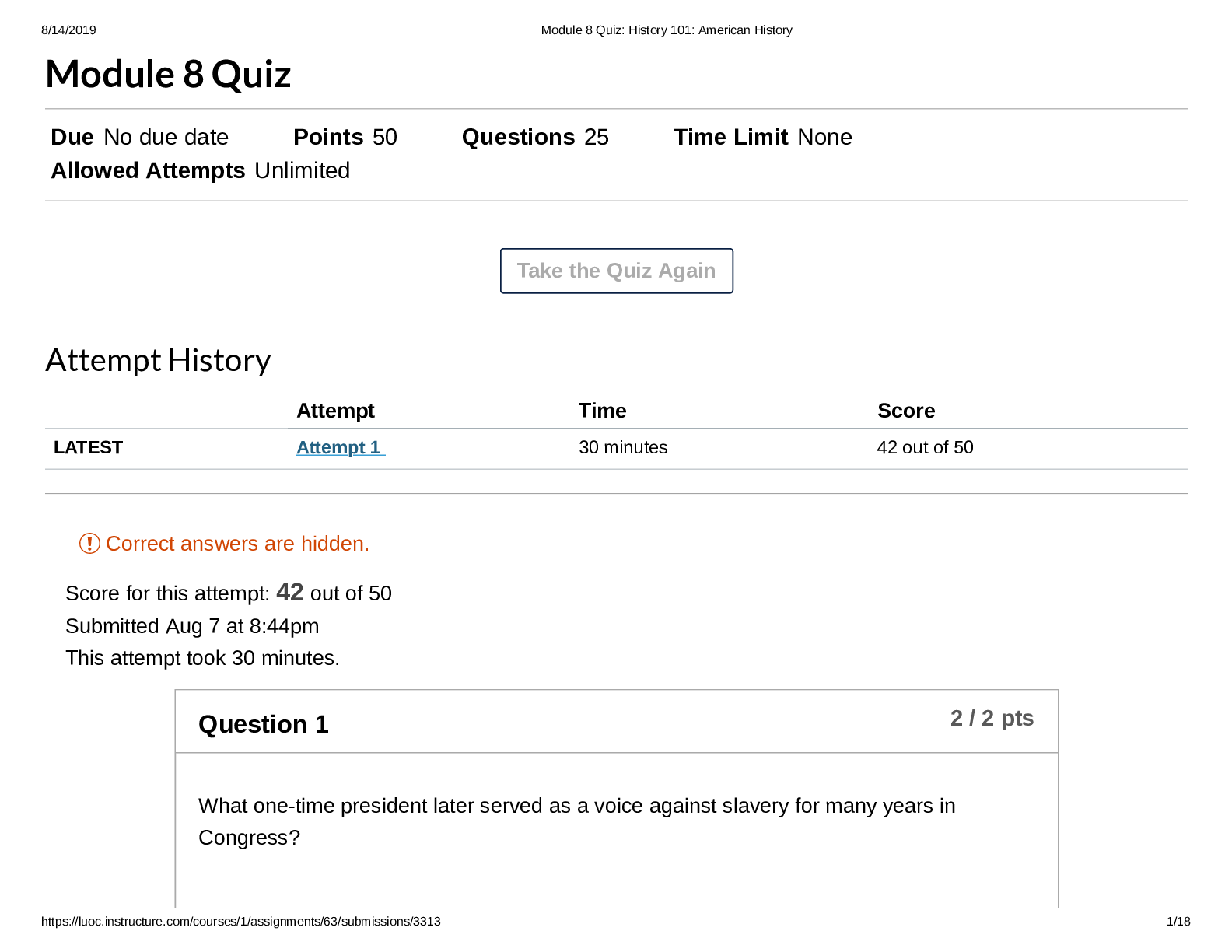

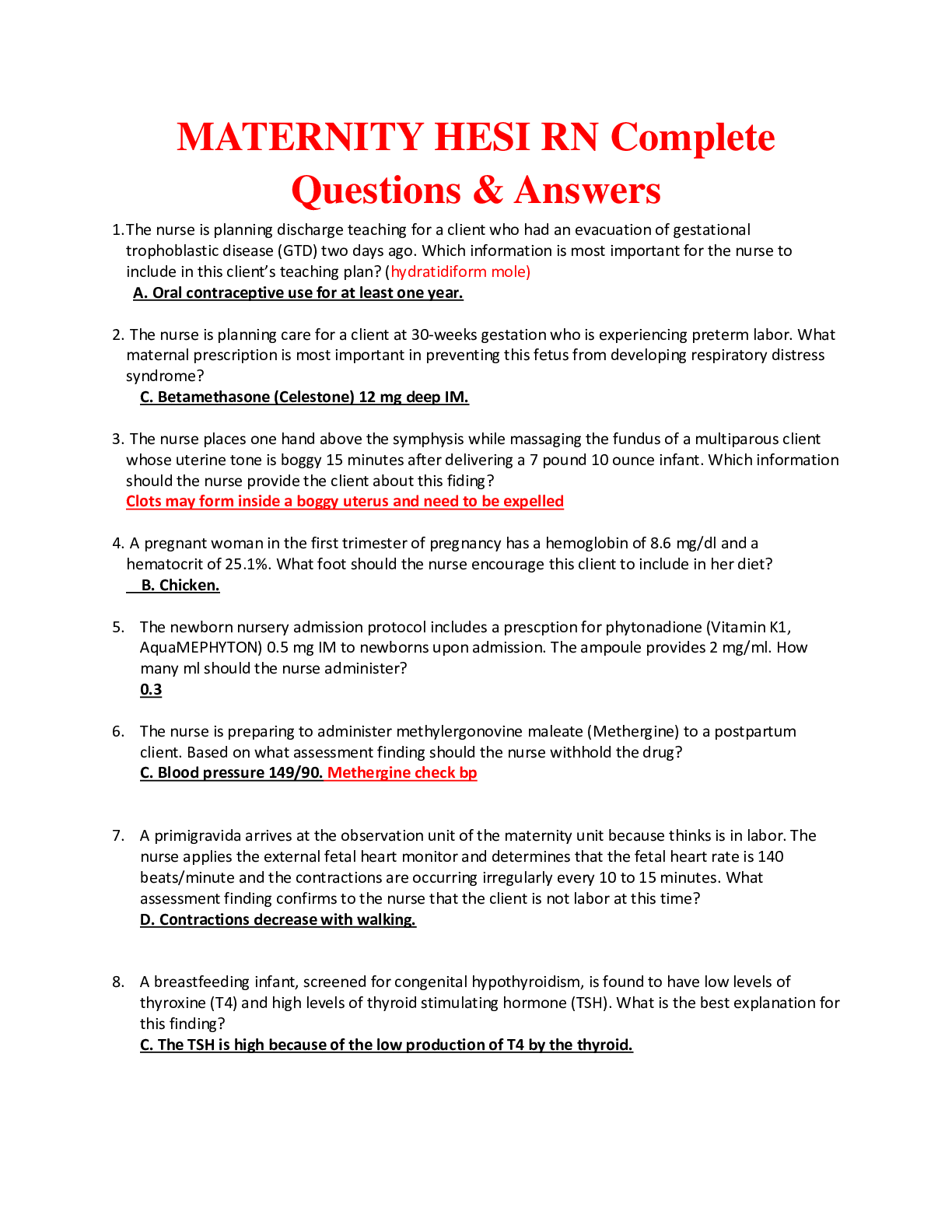

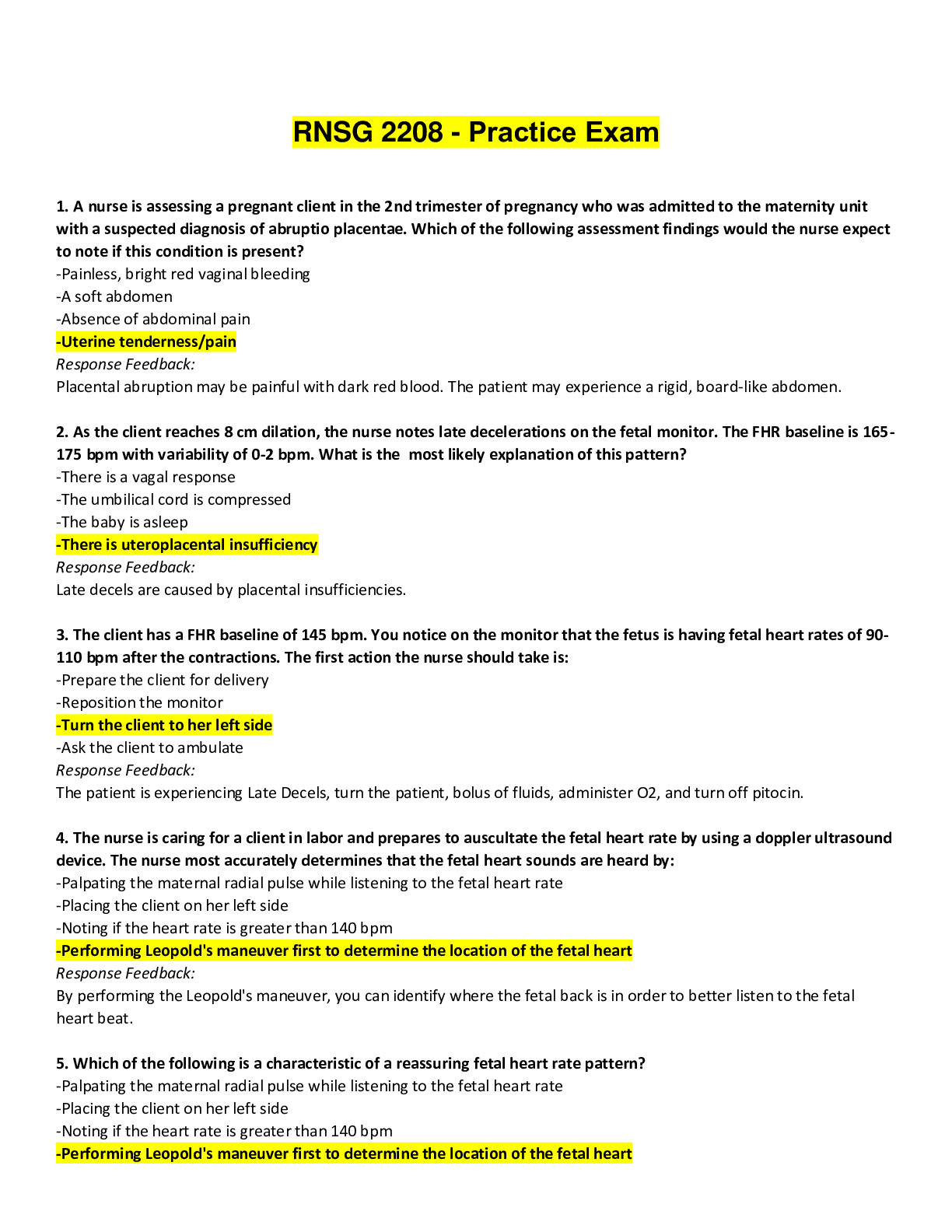

n stating a seller's price and terms to a prospective buyer, the seller's broker is required by the law of agency to state ONLY those terms that are a. included in the listing agreement b. based on... the brokers evaluation of prevailing prices and terms c. favorable for the seller, as determined by the broker d. attractive to buyers, as determined by the broker - a. included in the listing agreement a lot measuring 110 feet wide by 140 feet deep has a required setback of 30 feet in front, 20 feet in the rear, and 20 feet on each side. if a builder wants to put a one-story building on the lot, the MAXIMUM square footage it can contain is a. 3,300 sq ft b. 3,600 sq ft c. 6,300 sq ft d. 6,600 sq ft - c. 6,300 sq ft a house with a market value of $80,000 is located where property is assessed at 70% of market value. if the tax rate is $4 per $100 of assessed value, the property taxes are a. $224 b. $960 c. $2,240 d. $3,200 - c. $2,240 a broker charges a leasing fee of one-half of the first months rent and a management fee of 8% of all rents collected. the broker negotiates a two-year lease at a monthly rental of $550. which of the following amounts will the broker earn on this lease a. $1,378 b $1,331 c. $1,287 d. $1,056 - b. $1,331a property manager works in the BEST interests of the a. tenant b. owner c. agent d. bank - b. owner in reviewing the deed to a listed property, a licensee noted a number of limitations regarding its use. these limitations aare commonly known as: A. Codicils B. constraints C. building codes D. restricted covenants - D. Restricted covenants the price at which a willing and informed buyer would buy and a willing and informed seller would sell is called the a. assessed value b. book value c. income approach to value d. market value - d. market value the income approach is MOST likely to be used when determining the value of a A. vacant residential lot b. office building c. single-family home d. cooperative apartment - b. office building the G's purchased a house from the T's. the G's agreed to the following terms: monthly payments of $650 to the T's and the balance to be paid in full after 7 years. at the time the balance is paid, the T's will give the G's a warranty deed transferring title. in this situation, what type of financing was used a. fha loan b. wrap around mortgage c. package mortgage d. contract for deed - d. contract for deed the provision in a mortgage or deed of trust that gives the lender the right to call the entire balance due upon a default in any payment is called a: a. acceleration clause b. prepayment penalty clause c. prepayment priveledge claused. right of redemption clause - a. acceleration clause a broker who represents a buyer is trying to negotiate on the buyer's behalf in a potential transaction. the broker realizes that by negotiating a reduced price for the buyer, the broker's commission will also be reduced. in this situation, the broker is obligated to negotiate the BEST price for the A. buyer and broker b. buyer c. seller d. brokerage - b. buyer K and R bought a house as tenants in common. If K dies, which of the following statements about ownership of the house is CORRECT? a. it automatically becomes tenancy in severalty b. it is divided, with R retaining R's original interest and the balance going to K's estate C. R holds fee simple ownership in k's share of the property d. R holds life estate ownership in K's share of the property - B. it is divided, with R retaining R's original interest and the balance going to K's estate [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 24, 2022

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Sep 24, 2022

Downloads

0

Views

42

.png)

.png)