Business > TEST BANKS > Test Bank for Investments: An Introduction, 13th Edition by Herbert Mayo (All)

Test Bank for Investments: An Introduction, 13th Edition by Herbert Mayo

Document Content and Description Below

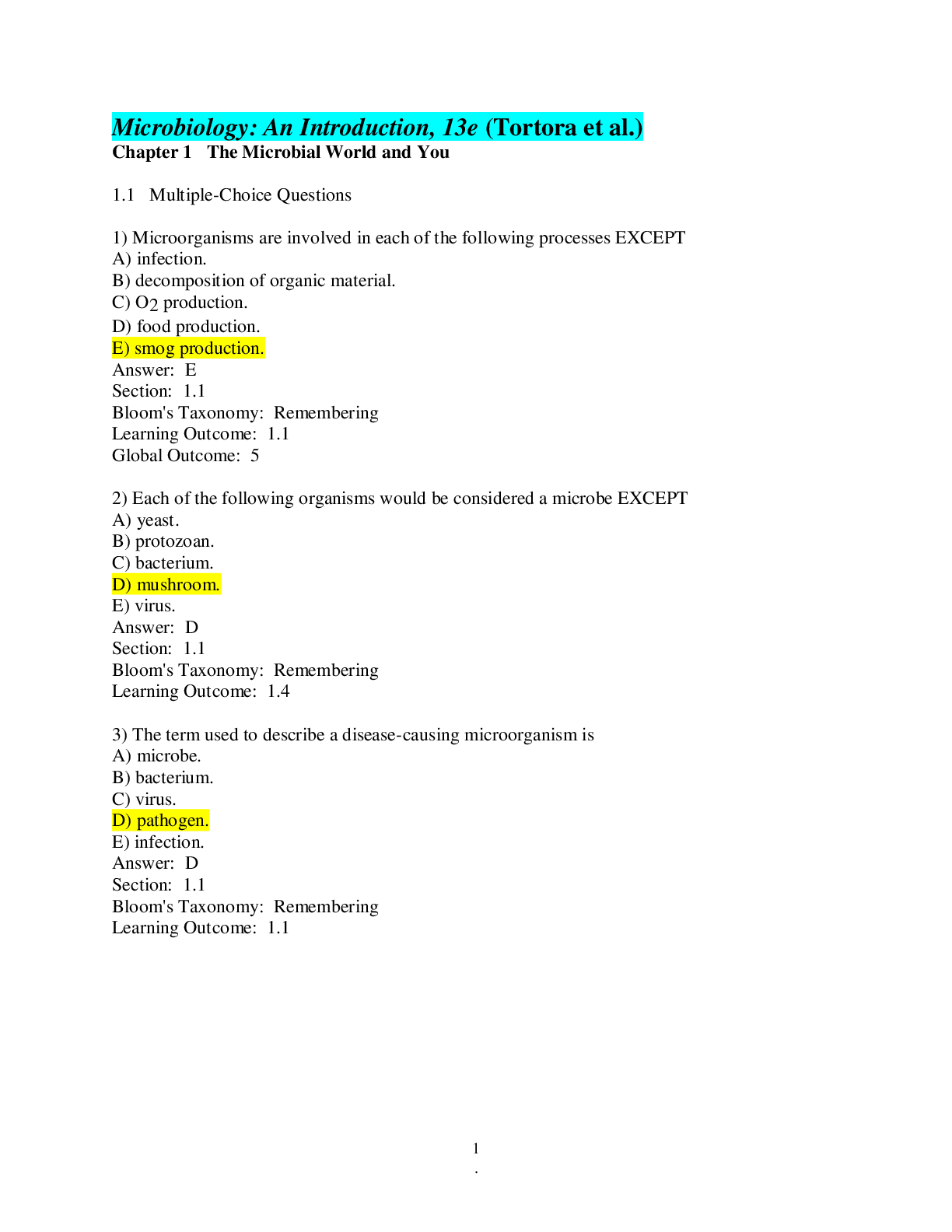

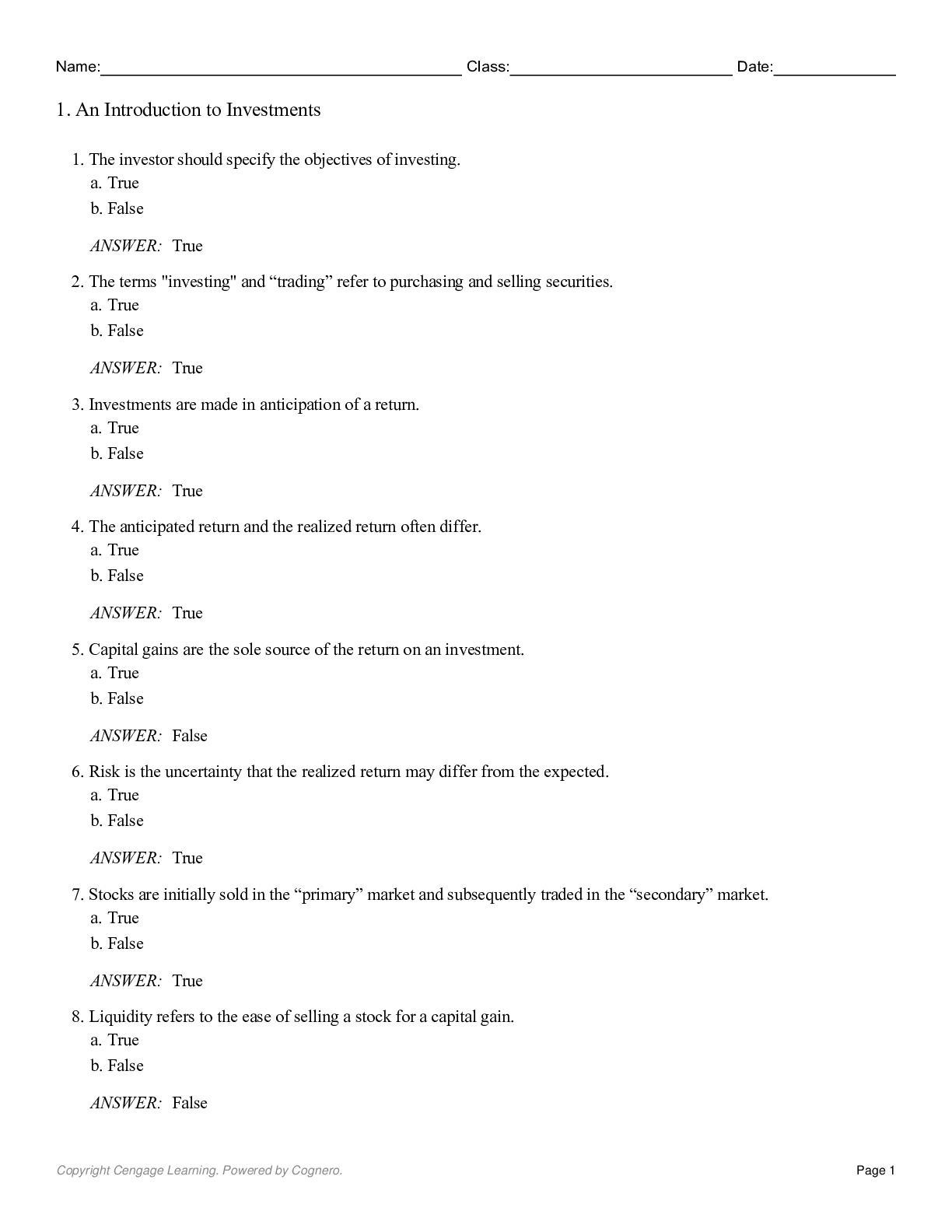

Test Bank for Investments An Introduction, 13th Edition, 13e by Herbert B. Mayo TEST BANK ISBN-13: 9780357128367 Full chapters included Part 1: The Investment Process and Financial Concepts Ch... apter 1: An Introduction to Investments Portfolio Construction and Planning Preliminary Definitions Diversification and Asset Allocation Efficient and Competitive Markets Portfolio Assessment "Trading" versus "Investing" Assumptions Professional Designations and Certifications The Internet The Plan and Purpose of This Text Summary Chapter 2: Securities Markets Secondary Markets and the Role of Market Makers The Mechanics of Investing in Securities The Short Sale Foreign Securities Regulation Securities Investor Protection Corporation Initial Public Offerings Summary Questions Relationships and Illustrated Fundamental Problems Problems Chapter 3: The Time Value of Money The Future Value of $1 The Present Value of $1 The Future Sum of an Annuity The Present Value of an Annuity Illustrations of Compounding and Discounting Equations for the Interest Factors Nonannual Compounding Uneven Cash Flows Summary Questions Relationships and Illustrated Fundamental Problems Problems Appendix 3: Using Excel to Solve Time Value Problems Chapter 4: Financial Planning, Taxation, and the Efficiency of Financial Markets The Process of Financial Planning Asset Allocation Taxation Pension Plans The Efficient Market Hypothesis Summary Questions Relationships Problems Appendix 4: The Deductible versus the Nondeductible IRA Chapter 5: Risk and Portfolio Management Return Sources of Risk Total (Portfolio) Risk The Measurement of Risk Risk Reduction through Diversification: An Illustration Portfolio Theory The Capital Asset Pricing Model Beta Coefficients Arbitrage Pricing Theory Summary Questions Relationships and Illustrated Fundamental Problems Problems Investment Assignment (Part 2) Appendix 5: Statistical Tools Part 2: Investment Companies Chapter 6: Investment Companies: Mutual Funds Investment Companies: Origins and Terminology Mutual Funds The Portfolios of Mutual Funds Money Market Mutual Funds Selecting Mutual Funds Taxation Redeeming Mutual Fund Shares Measures of Risk-Adjusted Performance Summary Questions Relationships and Illustrated Fundamental Problems Problems Chapter 7: Closed-End Investment Companies, Real Estate Investment Trusts (REITs), and Exchange-Trad Closed-End Investment Companies Real Estate Investment Trusts (REITs) Exchange-Traded Funds (ETFs) Hedge Funds and Private Equity Firms Investment Companies and Foreign Investments Summary Questions Relationships and Illustrated Fundamental Problems Problems Part 3: Investing in Common Stock Chapter 8: Stock The Corporate Form of Business and the Rights of Common Stockholders Cash Dividends Stock Dividends The Stock Split Stock Repurchases and Liquidations Preferred Stock Analysis of Financial Statements Liquidity Ratios Activity Ratios Profitability Ratios Leverage (Capitalization) Ratios Coverage Ratios Analysis of Financial Statements, Securities Selection, and the Internet Analysis of Cash Flow Summary Questions Relationships and Illustrated Fundamental Problems Problems Investment Assignment (Part 3) Chapter 9: The Valuation of Common Stock The Logical Process of Securities Valuation The Investor's Expected Return Stock Valuation: The Present Value of Dividends Risk-Adjusted Required Return and Stock Valuation Stock Valuation: Discounted Earnings or Cash Flow Stock Valuation: Analysis of Financial Statements and Price Multiples Valuation and the Efficient Market Hypothesis Summary Questions Relationships and Illustrated Fundamental Problems Problems Investment Assignment (Part 4) Appendix 9: Testing the Efficient Market Hypothesis: The Event Study Chapter 10: Investment Returns and Aggregate Measures of Stock Markets Measures of Stock Performance: Averages and Indexes The Dow Jones Industrial Average Other Indexes of Aggregate Stock Prices Rates of Return on Investments in Common Stock Studies of Investment Returns Reducing the Impact of Price Fluctuations: Averaging Summary Questions Relationships and Illustrated Fundamental Problems Problems Chapter 11: The Macroeconomic Environment for Investment Decisions The Economic Environment Measures of Economic Activity The Consumer Price Index The FED Fiscal Policy The 2008-2012 Economic Environment Summary Questions Relationships Chapter 12: Behavioral Finance and Technical Analysis Behavioral Finance Technical Analysis Market Indicators Specific Stock Indicators Technical Analysis in an Efficient Market Context The Dogs of the Dow Summary Questions Relationships Investment Assignment (Part 5) Part 4: Investing in Fixed-Income Securities Chapter 13: The Bond Market General Features of Bonds Risk The Mechanics of Purchasing Bonds Variety of Corporate Bonds High-Yield Securities Accrued Interest, Zero Coupon Bonds, Original-Issue Discount Bonds, and Income Taxation Retiring Debt Obtaining Information on Bonds Summary Questions Relationships Problems Appendix 13: The Term Structure of Interest Rates Chapter 14: The Valuation of Fixed-Income Securities Perpetual Securities Bonds with Maturity Dates Fluctuations in Bond Prices The Valuation of Preferred Stock Yields Risk and Fluctuations in Yields Realized Returns and the Reinvestment Assumption Duration Bond Price Convexity and Duration Management of Bond Portfolios Summary Questions Problems Appendix 14A: Bond Discounts/Premiums and Duration Compared Appendix 14B: Using the Structure of Yields to Price a Bond Chapter 15: Government Securities The Variety of Federal Government Debt STRIPS Inflation-Indexed Treasury Securities Federal Agencies' Debt State and Local Government Debt Authority Bonds Foreign Government Debt Securities Government Securities and Investment Companies Summary Questions Relationships Problems Appendix 15: Using Yield Curves Chapter 16: Convertible Bonds and Convertible Preferred Stock Features of Convertible Bonds The Valuation of Convertible Bonds Premiums Paid for Convertible Debt Convertible Preferred Stock Selecting Convertibles The History of Selected Convertible Bonds Calling Convertibles Contingent Convertible Bonds Put Bonds Bonds with Put and Call Features Compared Investment Companies and Convertible Securities Summary Questions Relationships and Illustrated Fundamental Problems Problems Part 5: Derivatives Chapter 17: An Introduction to Options Call Options Leverage Writing Calls Puts LEAPS Price Performance of Puts and Calls The Chicago Board Options Exchange Stock Index Options Currency and Interest Rate Options Warrants Summary Questions Relationships Problems Investment Assignment (Part 6) Chapter 18: Option Valuation and Strategies Black-Scholes Option Valuation Expensing Employee Stock Options and Option Valuation Put-Call Parity The Hedge Ratio Additional Option Strategies Buying the Call and a Treasury Bill versus Buying the Stock-An Alternative to the Protective Put Summary Questions Problems Appendix 18: Binomial Option Pricing Chapter 19: Commodity and Financial Futures Investing in Commodity Futures Leverage Hedging The Selection of Commodity Futures Contracts The Pricing of Futures Financial Futures and Currency Futures Futures for Debt Instruments Currency Futures Swaps Summary Questions Relationships and Illustrated Fundamental Problems Problems Part 6: An Overview Chapter 20: Financial Planning and Investing in an Efficient Market Context Portfolio Planning, Construction, and Risk Management [Show More]

Last updated: 2 months ago

Preview 10 out of 239 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$26.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 27, 2022

Number of pages

239

Written in

Additional information

This document has been written for:

Uploaded

Sep 27, 2022

Downloads

0

Views

238