Health Care > EXAM > HSM 340 Week 4 Midterm Questions and Answers (100% Guaranteed) (All)

HSM 340 Week 4 Midterm Questions and Answers (100% Guaranteed)

Document Content and Description Below

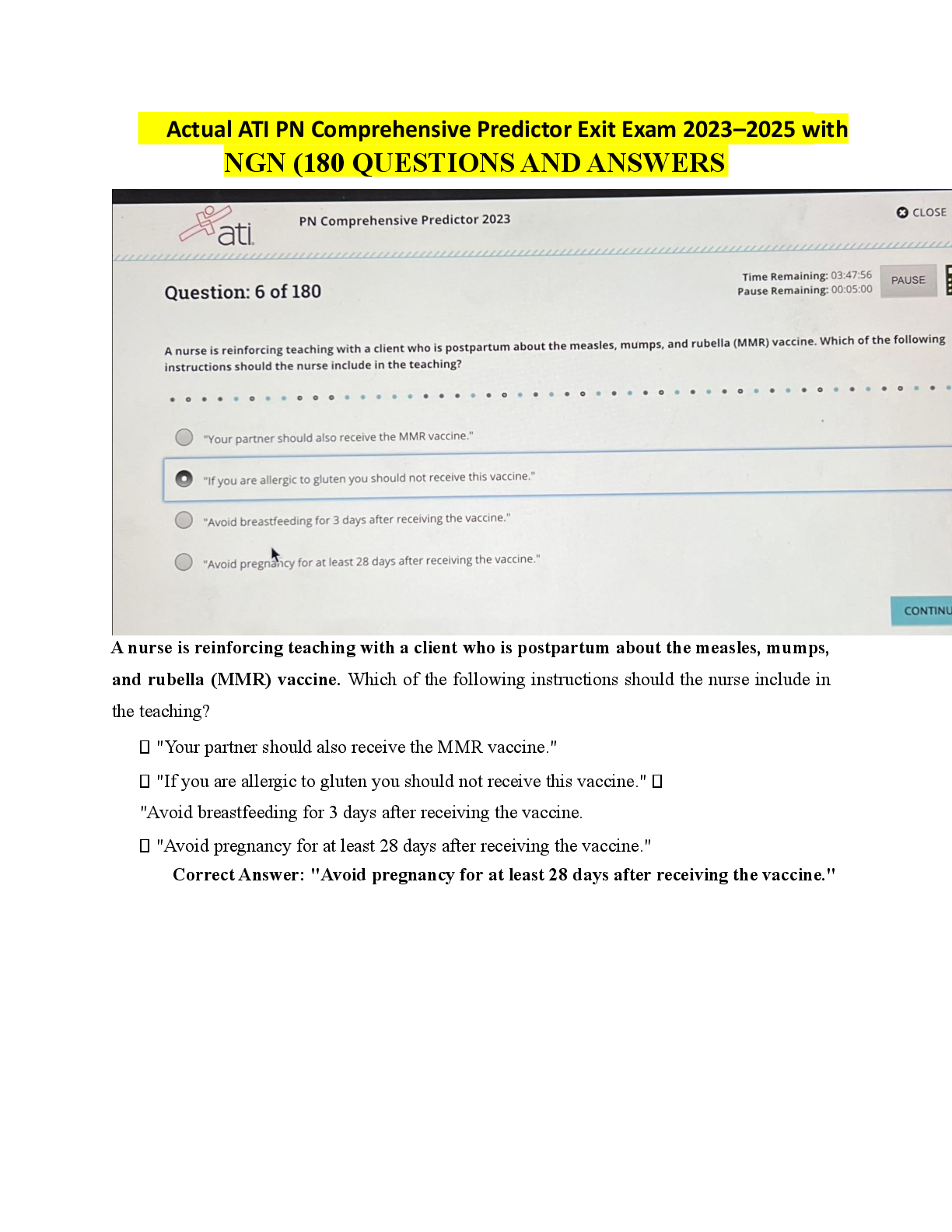

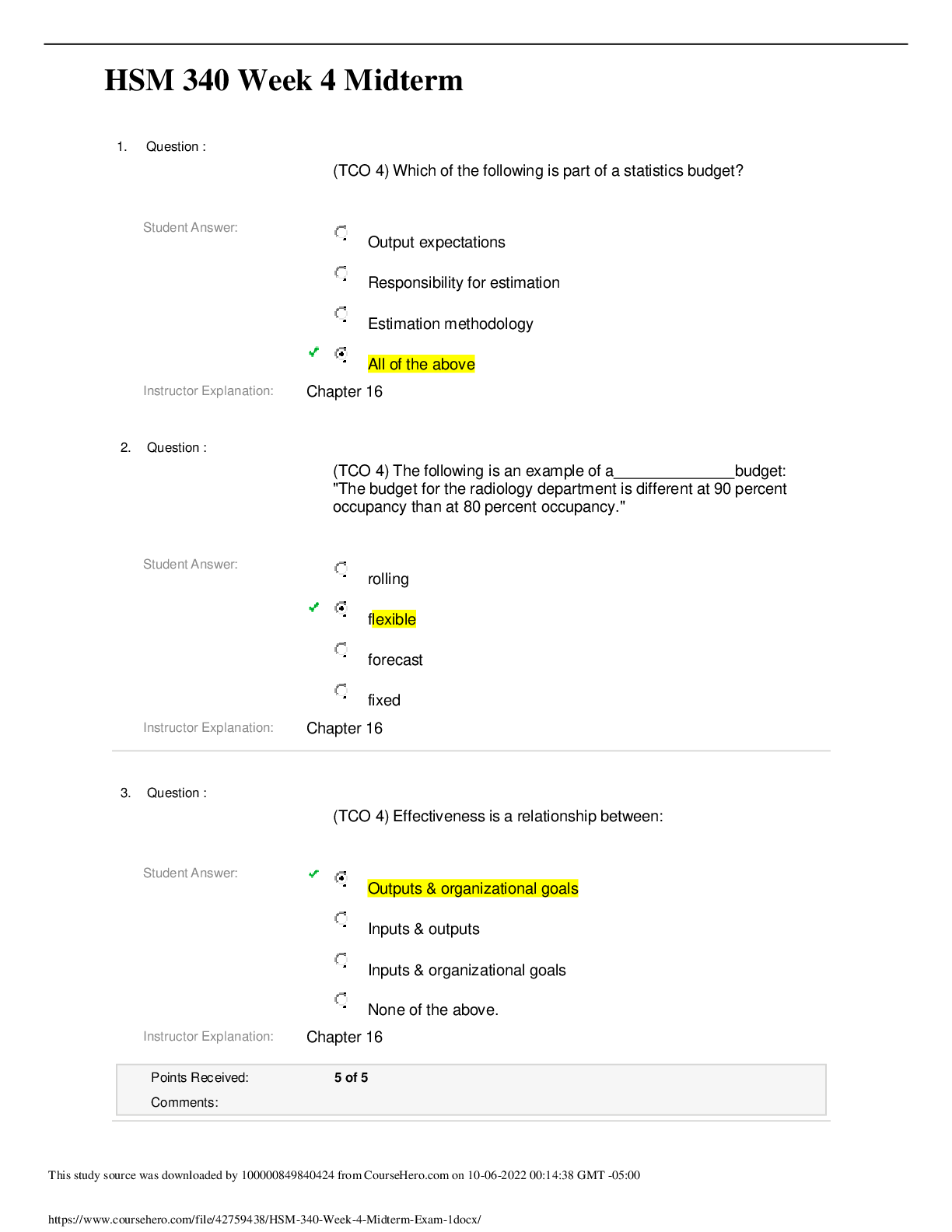

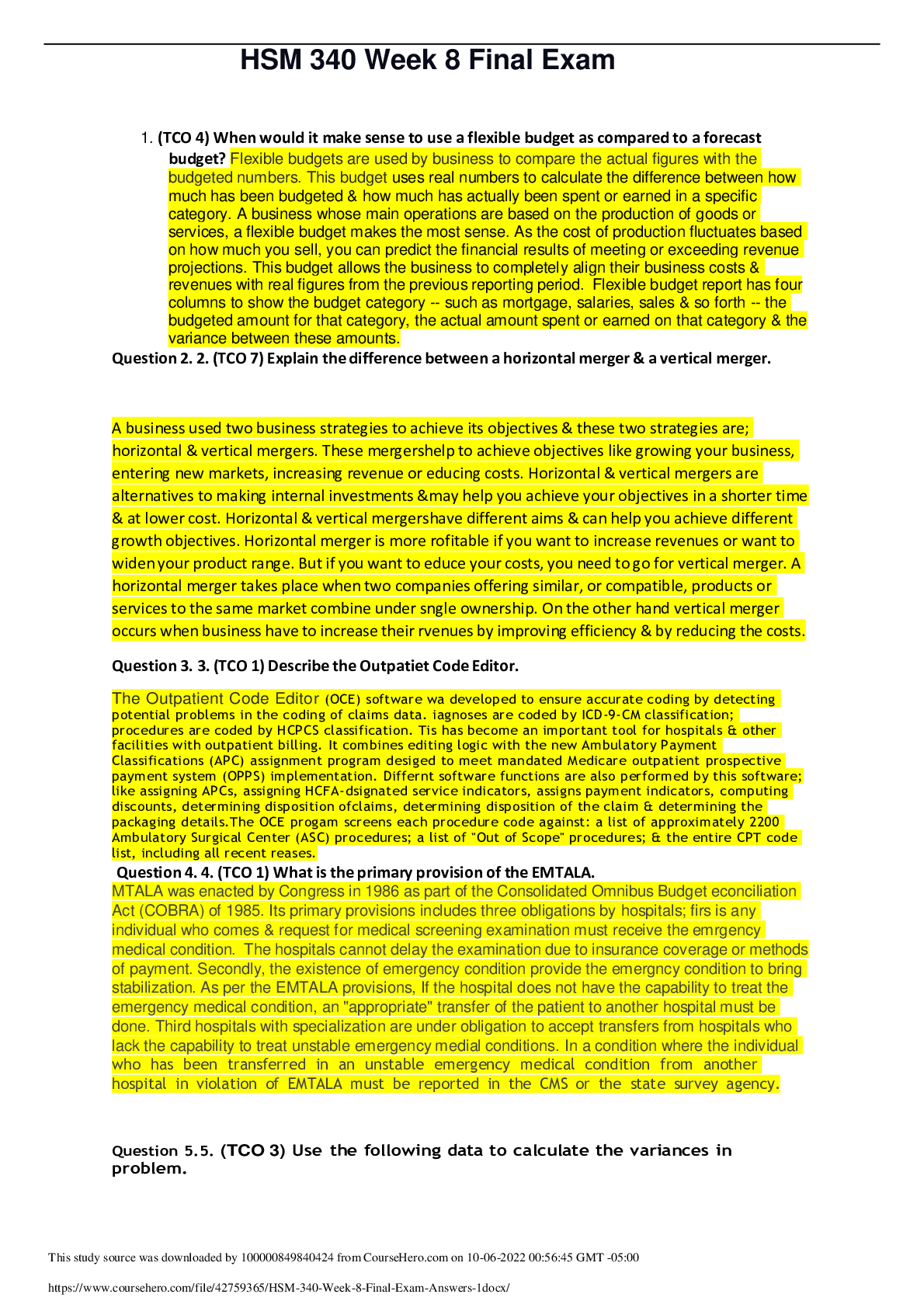

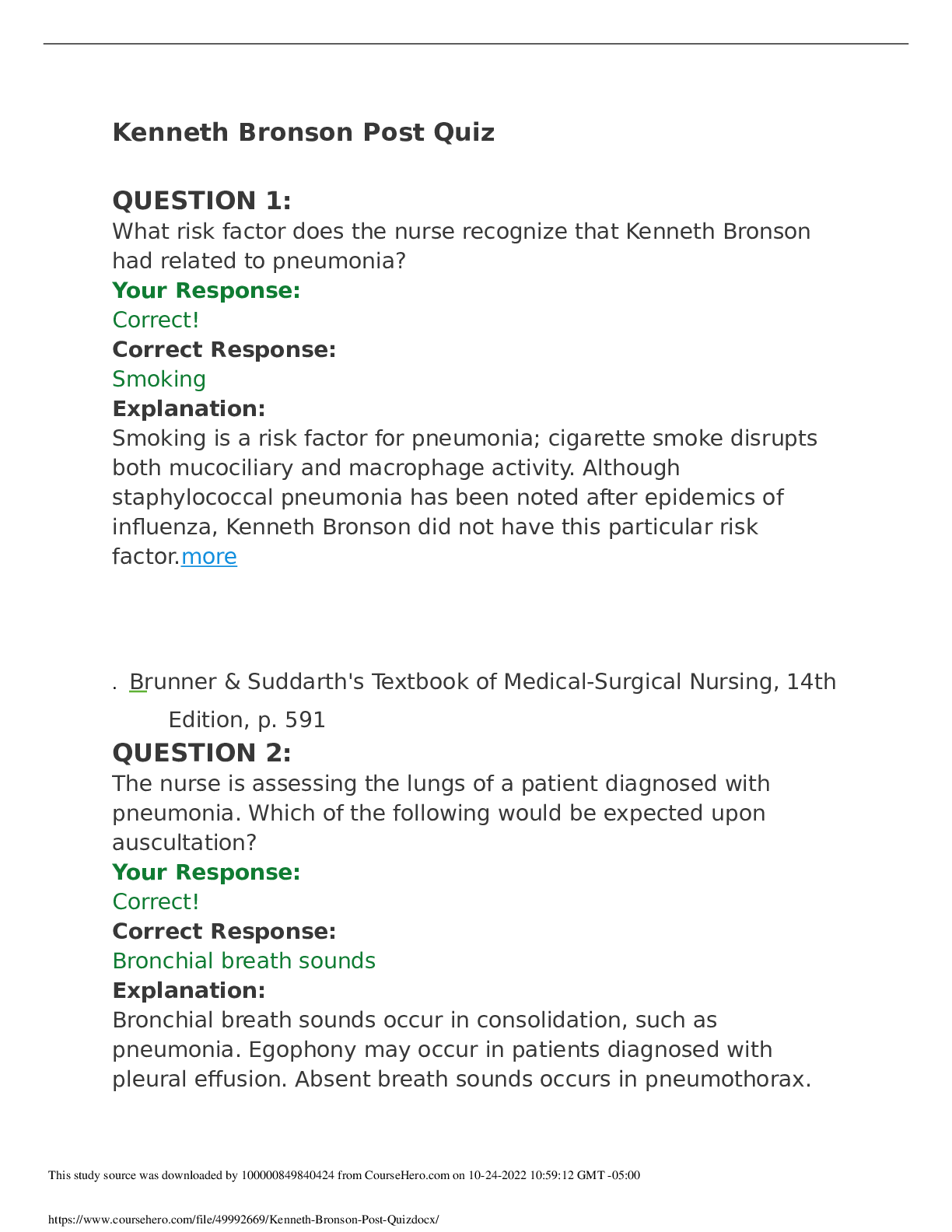

HSM 340 Week 4 Midterm 1. Question : (TCO 4) Which of the following is part of a statistics budget? Student Answer: Output expectations Responsibility for estimation Est ... imation methodology All of the above Instructor Explanation: Chapter 16 2. Question : (TCO 4) The following is an example of a budget: "The budget for the radiology department is different at 90 percent occupancy than at 80 percent occupancy." Student Answer: rolling flexible forecast fixed Instructor Explanation: Chapter 16 3. Question : (TCO 4) Effectiveness is a relationship between: Student Answer: Outputs & organizational goals Inputs & outputs Inputs & organizational goals None of the above. Instructor Explanation: Chapter 16 4. Question : (TCO 3) What is the main reason that relative value units (RVUs) often are used in health care? Student Answer: Not all standard units show up in a standard treatment protocol. RVUs enable more accurate pricing. RVUs are the optimal way to estimate the costs of the resources consumed by cost objects such as products & customers. Some departments or cost centers may have large numbers of outputs, which make individual costing very time consuming & expensive. Instructor Explanation: Chapter 15 5. Question : (TCO 3) Your controller has told you that the marginal profit of DRG 209 (major joint procedure) for a Medicare patient exceeds the marginal profit for an average charge patient. Why might this occur? Student Answer: High fixed costs of treatment Low Medicare payment High prices Low prices Instructor Explanation: Chapter 14 6. Question : (TCO 2) The heading of every financial statement should contain the: Student Answer: name, title, & place of business name, title, & specific date of statement title, name, type of ownership, & unit of measurement title of statement, name of entity, & unit of measurement name, title, specific date of statement, & unit of measurement Instructor Explanation: Chapter 9 7. Question : (TCO 2) Which of the following is the BEST example of a financial metric? Student Answer: Degree of innovation Employee empowerment Accreditation by the Joint Commission on Accreditation of Healthcare Organizations Total margin Length of stay Instructor Explanation: Chapter 11 1. Question : (TCO 4) Formulate your answer based on the below information. Costs per case increased to $4,900 from a budgeted value of $4,750. This increased actual total costs by what amount? You have been asked by management to explain the variances in costs under your inpatient capitated contract. The following data is provided. Use the following data to calculate the variances. Budget Actual Inpatient Costs $12,568,5 00 $16,618,3 50 Member s Admissi on Rate Case Mix Index 42,000 42,000 0.070 0.095 0.90 0.85 Cost per Case (CMI = 1.0) $4,750 $4,900 Student Answer: The increased actual total costs went up $4,049,850 from what the budget was. Instructor Explanation: ($4,900 - $4,750) × 0.85 × 42,000 × 0.095 = $508,725 Increase 2. Question : (TCO 4)Based on the information below, assume that the only change in the original example data is that Blue Cross raises their discount to 20 percent. What price should be set? You have been asked to establish a pricing structure for radiology on a per-procedure basis. Present budgetary data is presented below: Budgeted Procedures $10,000 Budgeted Cost $400,000 Desired Profit $80,000 It is estimated that Medicare patients comprise 40 percent of total radiology volume & will pay on average $38.00 per procedure. Approximately 10 percent of the patients are cost payers. The remaining charge payers are summarized below: Payer Volume% Discount% Blue Cross 20 4 Unity PPO 15 10 Kaiser 10 10 Self Pay 5 40 50% Student Answer: 40% x 10,000= 4,000 procedures 4,000 x $38.00= 152,000 10% x 10,000=1,000 procedures 4,150 x P = 4,150P (152,000+1,000P+4,150P)-400,000 = 80,000 1,000P + 4,150P = 80,000 – 152,000 + 400,000 5,150P = 328,000 P = $63.69 Instructor Explanation: 3. Question : (TCO 4) What is the amount of variance that can be attributed to the difference between budgeted & actual volume? Use the following data to calculate the variances. The following information has been prepared for a home health agency. Budget Actual Wage Rate per Hour $16.00 $17.00 Fixed Hours 320 320 Variable Hours per Relative 1.0 1.1 Value Unit (RVU) Relative Value Units (RVUs) 1,000 1,200 Total Labor Hours 1,320 1,640 Labor Costs $21,120 $27,880 Cost per RVU $21.12 $23.23 Budgeted costs at actual volume would be $25,344 ($21.12 × 1,200), & the total variance to be explained is $2,536 Unfavorable ($27,880 - $25,344). Be sure to specify whether the variance is favorable or unfavorable. Student Answer: $27,880 ($23.23 x 1,200) Unfavorable. The actual variance that can be attributed to the difference between budgeted & actual volume would be 1 Instructor Explanation: (Budgeted Volume - Actual Volume) X Budgeted Fixed Cost per Unit = (1,000 - 1,200) × $5.12 = $1,024 Favorable Budgeted Fixed Cost per Unit = (320 Hours X $16.00)/1,000 Units= $5.12 4. Question : (TCO 2) Explain the difference between the accrual basis of accounting & the cash basis of accounting.? Student Answer: With accrual accounting, you record all transactions in the books when they occur, even if no cash changes hands. With cash-basis accounting, you record all transactions in the books when cash actually changes hands, meaning when cash payment is received by the company from customers or paid out by the company for purchases or other services.The main difference between these two accounting processes is in how you record your cash transactions. Instructor Explanation: The cash basis of accounting records revenues when cash is received & expenses when cash is paid out. The accrual basis of accounting records revenues when they are earned & expenses when resources are used. 5. Question : (TCO 2) What is an audit (in the context of financial accounting)? Student Answer: Financial accounting provides the financial statements that inform outside parties such as shareholders & lenders about the financial performance & position of a firm. Auditing is the process used to assess the integrity of the financial statements & operations; a report providing assurances regarding that integrity is then made. An audit is not specifically designed to ensure that fraud & theft are not present in the accounting system; nonetheless, an audit is the best protection available to the public for the discovery of fraud. Instructor Explanation: An audit is an examination of the financial reports to assure that they represent what they claim & conform with generally accepted accounting principles. The audit function performed by an independent certified public accountant (CPA). Contrary to popular belief, an audit is not specifically designed to ensure that fraud & theft are not present in the accounting system; nonetheless, an audit is the best protection available to the public for the discovery of fraud. 6. Question : (TCO 1) What are social responsibility & ethics as they relate to business-oriented organizations? How should social responsibility & ethics affect the decisions of even for-profit companies? Student Answer: Businesses who conduct themselves in an ethical manner pass their values, morals, & beliefs down to the employees & even to the customers. The effect can be felt throughout the community, which has a profound impact on local schools, community centers, & other groups. Companies such as Enron & WorldCom are classic examples of what can happen when corporations disregard or neglect the importance of business ethics. Ethical behavior is one of the most important things we can have when we are in a leadership role. Social responsibility is about caring for the workers, giving back to the community, being financially, environmentally, & socially responsible. Common practices of social responsibility include recycling, reducing emissions, treating all employees fairly, giving back to the community by providing services or support, assisting the less fortunate in the given area, as well as being honest & disclosing appropriate information. Even for-profit organizations should base their decisions on things such as social responsibility & being ethical because it's just good practice. More people will want to do business with you because they know you are a legitimate organization that not only things ethically, but also gives back to the community. People will also want to work within your business because there is a good environment within the facility with high ethical standards as well as being as "eco-friendly" as possible. Instructor Explanation: Social responsibility is the concept that businesses should be partly responsible for, & thus bear the costs of, the welfare of society at large. Business ethics can be thought of as a company's attitude & conduct toward its employees, customers, community, & stockholders. A firm's commitment to business ethics can be measured by the tendency of the firm & its employees to adhere to laws & regulations relating to such factors as product safety & quality, fair employment practices, & the like. Most executives believe that there is a positive correlation between ethics & long-run profitability. Conflicts often arise between profits & ethics. Companies must deal with these conflicts on a regular basis, & a failure to handle the situation properly can lead to huge product liability suits & even to bankruptcy. The class might want to discuss the ethical aspects of the Enron—Arthur Andersen accounting/auditing irregularities. If social responsibility costs the company more than it saves, it can be financially difficult for one company to increase its social responsibility costs unless the entire industry does so. Chapter 1 7. Question : (TCO 2) Define & describe the purpose of fund accounting (now called net assets). Student Answer: Fund accounting is a system where the assets & liabilities of an entity are segregated within the accounting records. Each & every fund may be looked at as an independent entity that has its own self balancing set of accounts. The accounting equation used for fund accounting is as follows: assets must equal liabilities plus net assets for the particular fund that is in question. Three classifications of fund balance or net assets can be used for voluntary not-for-profit healthcare organizations: unrestricted net assets, temporary restricted net assets, & permanently restricted net assets. Temporarily restricted net assets are funds that are used for specific purpose only, released for specific purpose only, or released after a passage of time to the general public. Permanently restricted net assets are when only the income of the fund can be used, & can't be used to fund any purpose. Instructor Explanation: Fund accounting is a system of accounting in which economic resources & related obligations of an organization are separated in the accounting records into funds. Funds are used to recognize the specific purposes to which certain resources are restricted. HSM 340 Week 3 Quiz 1.(TCO 3) From a hospital's perspective, what is most likely to be the highest risk arrangement with a payer? 2. TCO 3) SKF Primary Care Clinic is deciding whether to purchase MRI equipment that would enable it to perform MRI imaging services in-house rather than sending its patients to its competitor's hospital three miles away. From a financial position, if SKF were to make its decision without using net present value analysis, the clinic would need to know (or at least reasonably estimate) which of the following information? 3. TCO 3) Assume that the clinic used the price that they need to exactly break even at 10,000 shots. Fewer people than expected showed up & purchased the flu shot. The clinic would: 4. (TCO 3) Which of the following is the first step in any budgetary process? 5. (TCO 3) David Jones, the new administrator for a surgical clinic, was trying to determine how to allocate his indirect expenses. His staff was complaining that the current method of taking a percentage of revenues was unfair. He decided to try to allocate utilities based on square footage of each department, administration based on direct costs, & laboratory based on tests. Use the information in the chart below to answer the question. 6. (TCO 3) Your hospital has been approached by a major HMO to perform all their MS-DRG 470 cases (major joint procedures). They have offered a flat price of $10,000 per case. You have reviewed your charges for MS-DRG 470 during the last year & found the following profile: 7. (TCO 3) How are costs classified? [Show More]

Last updated: 3 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

HSM 340 - Health Services Finance /Entire Course Week 1 – 8 BUNDLE (100% CORRECT ANSWERS)

HSM 340 Week 1 Assignment: Financial Laws and Regulation HSM-340 Week 1 Discussion Question 1 – Finance and the Regulatory Components HSM 340 Week 1 Discussion Question 2 – Reimbursement and Payment...

By Prof. Goodluck 3 years ago

$14

16

Reviews( 0 )

$13.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 06, 2022

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 06, 2022

Downloads

0

Views

104

Questions and Answers 100% VERIFIED.png)

Questions and Answers 100% correct Solutions.png)