Economics > QUESTIONS & ANSWERS > University Of Washington - ECON 475 - Multiple Choice Questions(all correct answers)100% (All)

University Of Washington - ECON 475 - Multiple Choice Questions(all correct answers)100%

Document Content and Description Below

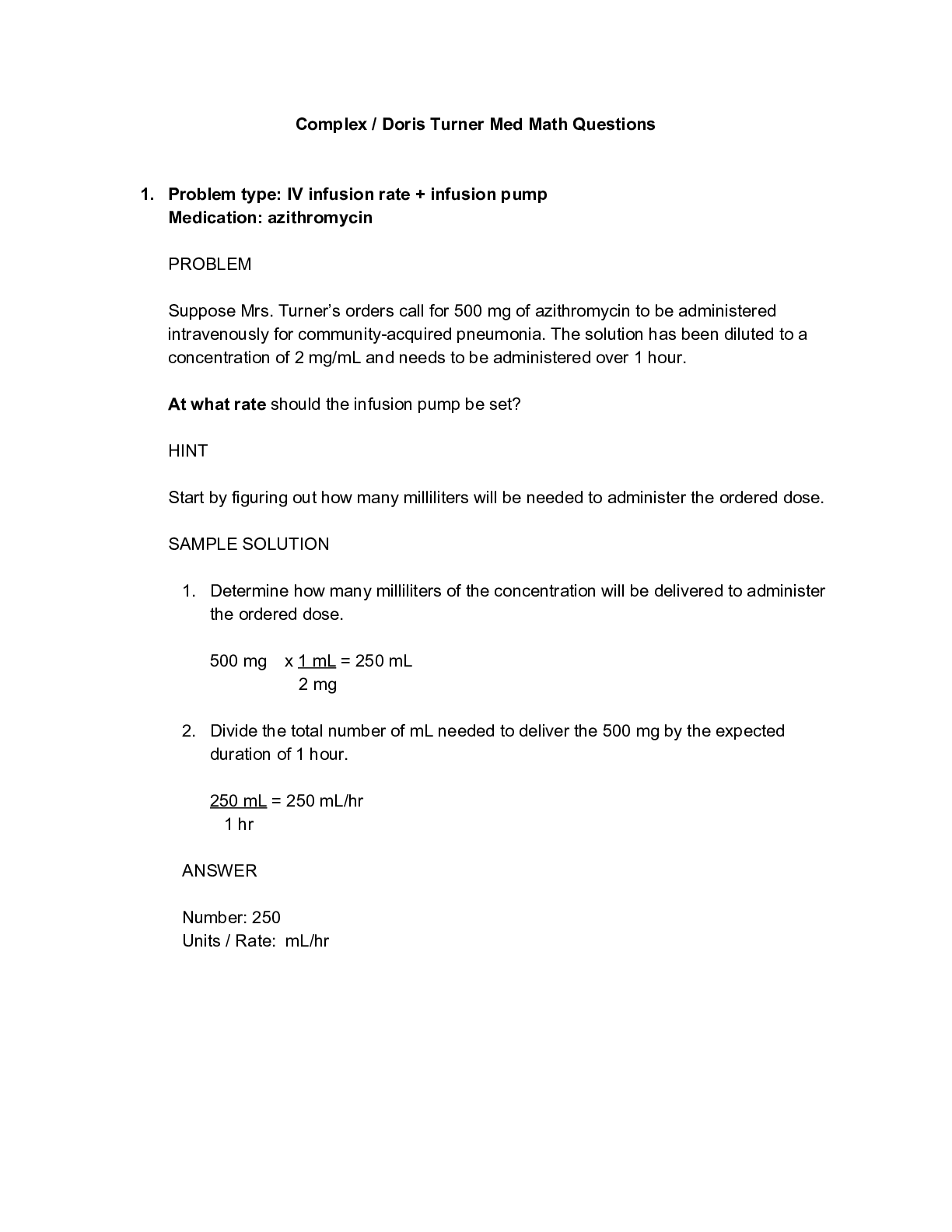

n Multiple Choice Questions 1. If a person’s required return does not change when risk increases, that person is said to be (a) risk-seeking. (b) risk-indifferent. (c) risk-averse. (d) risk-aw... are. Answer: B Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 2. If a person’s required return decreases for an increase in risk, that person is said to be (a) risk-seeking. (b) risk-indifferent. (c) risk-averse. (d) risk-aware. Answer: A Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 3. _________ is the chance of loss or the variability of returns associated with a given asset. (a) Return (b) Value (c) Risk (d) Probability Answer: C Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 4. The _________ of an asset is the change in value plus any cash distributions expressed as a percentage of the initial price or amount invested. (a) return (b) value (c) risk (d) probability Answer: A Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 5. Risk aversion is the behavior exhibited by managers who require a greater than proportional _________ (a) increase in return, for a given decrease in risk. (b) increase in return, for a given increase in risk. (c) decrease in return, for a given increase in risk. (d) decrease in return, for a given decrease in risk. Answer: B Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 6. If a person requires greater return when risk increases, that person is said to be (a) risk-seeking. (b) risk-indifferent. (c) risk-averse. (d) risk-aware. Answer: C Level of Difficulty: 1 Learning Goal: 1 Topic: Fundamentals of Risk and Return 7. Last year Mike bought 100 shares of Dallas Corporation common stock for $53 per share. During the year he received dividends of $1.45 per share. The stock is currently selling for $60 per share. What rate of return did Mike earn over the year? (a) 11.7 percent. (b) 13.2 percent. (c) 14.1 percent. (d) 15.9 percent. Answer: D Level of Difficulty: 2 Learning Goal: 1 Topic: Holding Period Return (Equation 5.1) 8. Prime-grade commercial paper will most likely have a higher annual return than (a) a Treasury bill. (b) a preferred stock. (c) a common stock. (d) an investment-grade bond. Answer: A Level of Difficulty: 2 Learning Goal: 1 Topic: Risk and Return Fundamentals 9. A common approach of estimating the variability of returns involving forecasting the pessimistic, most likely, and optimistic returns associated with the asset is called (a) marginal analysis. (b) sensitivity analysis. (c) break-even analysis. (d) financial statement analysis. Answer: B Level of Difficulty: 1 Learning Goal: 2 Topic: Measuring Single Asset Risk 10. The _________ is the extent of an asset’s risk. It is found by subtracting the pessimistic outcome from the optimistic outcome. (a) return (b) standard deviation (c) probability distribution (d) range Answer: D Level of Difficulty: 1 Learning Goal: 2 Topic: Measuring Single Asset Risk 11. The _________ of an event occurring is the percentage chance of a given outcome. (a) dispersion (b) standard deviation (c) probability (d) reliability Answer: C Level of Difficulty: 1 Learning Goal: 2 Topic: Measuring Single Asset Risk 12. _________ probability distribution shows all possible outcomes and associated probabilities for a given event. (a) A discrete (b) An expected value (c) A bar chart (d) A continuous Answer: D Level of Difficulty: 1 Learning Goal: 2 Topic: Measuring Single Asset Risk 13. The _________ measures the dispersion around the expected value. (a) coefficient of variation (b) chi square (c) mean (d) standard deviation Answer: D Level of Difficulty: 1 Learning Goal: 2 Topic: Standard Deviation 14. The _________ is a measure of relative dispersion used in comparing the risk of assets with differing expected returns. (a) coefficient of variation (b) chi square (c) mean (d) standard deviation Answer: A Level of Difficulty: 1 Learning Goal: 2 Topic: Coefficient of Variation 15. Since for a given increase in risk, most managers require an increase in return, they are (a) risk-seeking (b) risk-indifferent (c) risk-free (d) risk-averse Answer: D Level of Difficulty: 2 Learning Goal: 2 Topic: Risk and Return Fundamentals [Show More]

Last updated: 2 years ago

Preview 1 out of 48 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 10, 2021

Number of pages

48

Written in

Additional information

This document has been written for:

Uploaded

Jan 10, 2021

Downloads

0

Views

85