Kaplan Practice Questions Series 65

Document Content and Description Below

Kaplan Practice Questions Series 65

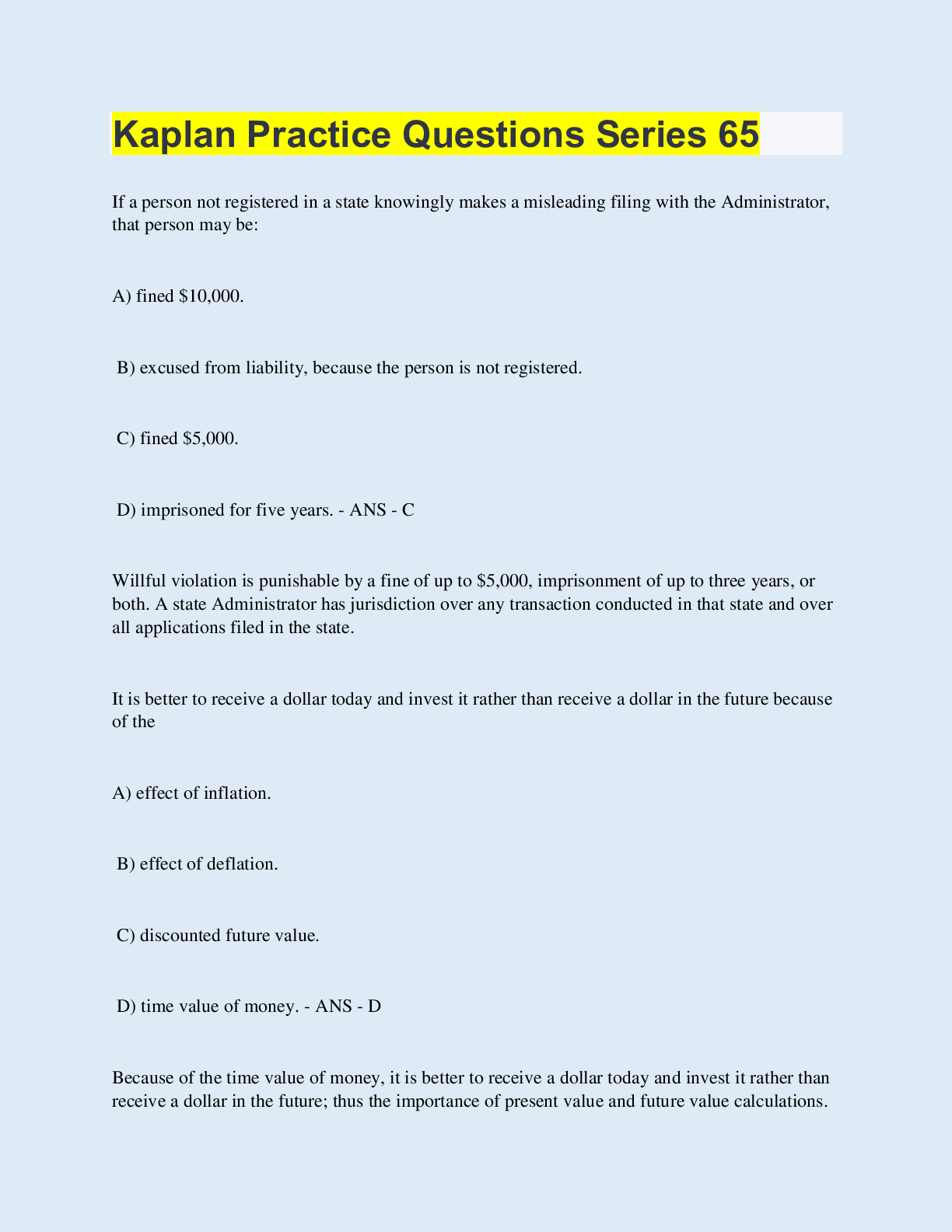

If a person not registered in a state knowingly makes a misleading filing with the Administrator,

that person may be:

A) fined $10,000.

B) excused from liabilit

...

y, because the person is not registered.

C) fined $5,000.

D) imprisoned for five years. - ANS - C

Willful violation is punishable by a fine of up to $5,000, imprisonment of up to three years, or

both. A state Administrator has jurisdiction over any transaction conducted in that state and over

all applications filed in the state.

It is better to receive a dollar today and invest it rather than receive a dollar in the future because

of the

A) effect of inflation.

B) effect of deflation.

C) discounted future value.

D) time value of money. - ANS - D

Because of the time value of money, it is better to receive a dollar today and invest it rather than

receive a dollar in the future; thus the importance of present value and future value calculations.

An investor interested in acquiring a convertible bond as part of his investment portfolio would:

A)

want the assurance of a guaranteed dividend on the underlying common stock.

B)

seek to minimize changes in the bond price during periods of steady interest rates.

C)

want the safety of a fixed-income investment along with potential capital appreciation.

D)

be interested in tax advantages available to convertible debt securities. - ANS - C

An investor who wants the safety of a fixed-income investment with the potential for capital

gains would be most interested in purchasing a convertible bond. However, because convertible

bonds can be exchanged for common stock, their market price tends to be more volatile during

times of steady interest rates than other fixed-income securities.

Ms. Libby Ralph sees a tombstone advertisement for a new issue of Southwest Barge

subordinated convertible debentures. The bonds will carry an 11-¼% coupon, are convertible

into common stock at $10.50, and are being issued to the public at 100. The proceeds of the issue

will be used specifically for purchasing new Southwest barges. Ms. Ralph's concerns about the

issue could include:

A)

the company might demand that she accept common stock for her bond.

B)

the issue may be junior-in-lien to another security issue.

C)

the new barges might sink, and the collateral would be gone.

D)

nothing, because the bonds will be first in liquidation. - ANS - B

The word "subordinated" is the key to the question. A subordinated bond has other debt holders

ahead of it in the event of liquidation. The barges do not serve as collateral because the bonds are

identified as debentures, and having to convert to common stock is not a threat because she is the

one that will exercise the conversion privilege if she desires.

A corporation has issued a 4% $60 par convertible stock with a conversion price of $20. With the

preferred stock selling at $66 per share, an investor holding 100 shares of this stock would

benefit by converting if the price of the common stock was

A)

above $18.20 per share

B)

above $20 per share

C)

below $22 per share

D)

above $22 per share - ANS - D

With a conversion price of $20 and a par value of $60, this preferred stock is convertible into 3

shares of the company's common stock. We divide the current price of the preferred ($66) by the

3 shares to arrive at the parity price of $22. If the common stock is selling for more than the

parity price, the investor can benefit by converting and selling the stock in the marketplace.

A bond, preferred stock, or debenture exchangeable at the option of the holder (for common

stock of the issuing corporation) is a:

A)

collateral-backed equity security.

B)

synthetic security.

C)

nondilutive stock.

D)

convertible security. - ANS - D

Discounted cash flow is commonly thought of as applying solely to fixed-income securities.

However, forms of DCF used for the valuation of common stock also include

I. the price-to-earnings ratio

II.the dividend discount model

[Show More]

Last updated: 3 years ago

Preview 1 out of 34 pages

.png)