Health Care > QUESTIONS & ANSWERS > VA Life and Health Exam Questions with accurate answers. 2023/2024 (All)

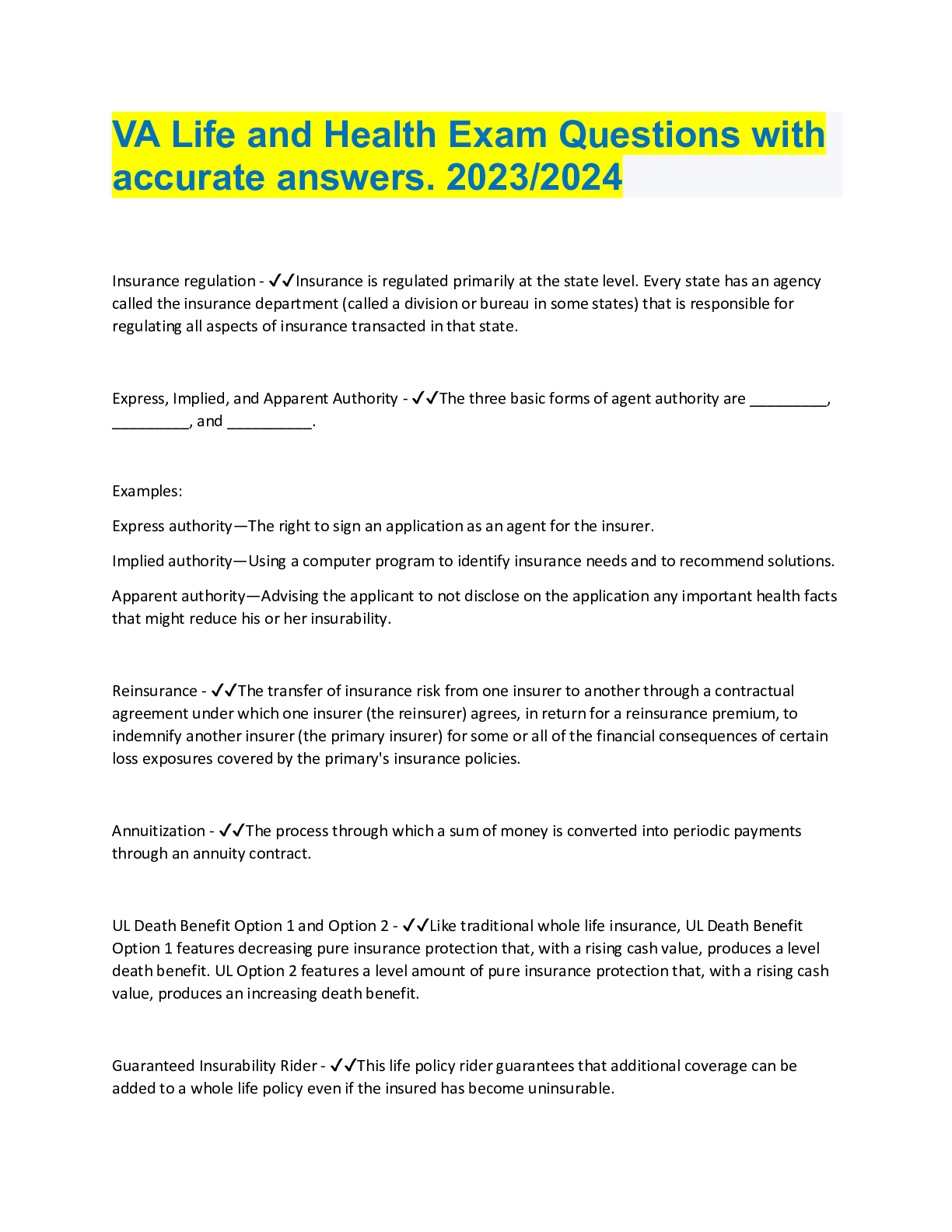

VA Life and Health Exam Questions with accurate answers. 2023/2024

Document Content and Description Below

VA Life and Health Exam Questions with accurate answers. 2023/2024 Insurance regulation - ✔✔Insurance is regulated primarily at the state level. Every state has an agency called the insuranc ... e department (called a division or bureau in some states) that is responsible for regulating all aspects of insurance transacted in that state. Express, Implied, and Apparent Authority - ✔✔The three basic forms of agent authority are _________, _________, and __________. Examples: Express authority—The right to sign an application as an agent for the insurer. Implied authority—Using a computer program to identify insurance needs and to recommend solutions. Apparent authority—Advising the applicant to not disclose on the application any important health facts that might reduce his or her insurability. Reinsurance - ✔✔The transfer of insurance risk from one insurer to another through a contractual agreement under which one insurer (the reinsurer) agrees, in return for a reinsurance premium, to indemnify another insurer (the primary insurer) for some or all of the financial consequences of certain loss exposures covered by the primary's insurance policies. Annuitization - ✔✔The process through which a sum of money is converted into periodic payments through an annuity contract. UL Death Benefit Option 1 and Option 2 - ✔✔Like traditional whole life insurance, UL Death Benefit Option 1 features decreasing pure insurance protection that, with a rising cash value, produces a level death benefit. UL Option 2 features a level amount of pure insurance protection that, with a rising cash value, produces an increasing death benefit. Guaranteed Insurability Rider - ✔✔This life policy rider guarantees that additional coverage can be added to a whole life policy even if the insured has become uninsurable. Insuring Clause - ✔✔Located on the schedule of benefits page of the insurance policy, this policy provision defines the insurance agreement between the policyowner and the company. Disability Income Benefit Rider - ✔✔This life policy rider pays a monthly benefit to the insured if s/he becomes permanently disabled. Exclusion Ratio - ✔✔method of determining which part of an annuity payment is taxable, and which part represents the tax-free return of the annuitant's after-tax cost basis. Deferred Compensation Plan - ✔✔A nonqualified benefit plan under which an employee agrees to defer a portion of his or her salary until a future date (typically retirement). Variable Annuity - ✔✔An investment-focused annuity whose contract values vary in response to the contract's underlying assets and are therefore not guaranteed. Return of Premium Rider - ✔✔This term life policy rider pays a sum equal to a portion of premiums paid if the insured is alive at the end of the policy term. Cash Value Loan - ✔✔Cash values loans are loans from the insurer, which uses the cash value as loan collateral. With fixed interest permanent life, the entire cash surrender value (less any prior policy debt) may be borrowed. With variable life insurance, loans are usually limited to 90% or less of the cash value. Universal Life Insurance (UL) - ✔✔This most extreme of the flexible permanent life policies lets the policyowner change the premium amount without first notifying or gaining approval of the insurer. Automatic Premium Loan (APL) Provision - ✔✔This optional policy provision prevents a whole life policy from lapsing by directing the insurer to pay overdue premiums through a policy loan. Roth Conversion - ✔✔Anyone can convert a traditional IRA to a Roth IRA. However, income taxes must be paid on the traditional IRA when the account is converted. From that point on, funds can be withdrawn tax free. Variable Life Insurance - ✔✔A form of life insurance in which policy values may rise and fall to reflect changes in equity-based subaccounts. The cash value is not guaranteed. Guaranteed Minimum Withdrawal Benefit - ✔✔A variable annuity rider that guarantees that the owner can withdraw a minimum amount annually without a surrender charge. Primary Insurance Amount - ✔✔Term for the amount of Social Security retirement benefit a worker will receive when he or she reaches full retirement age. Variable Annuity Annuitization - ✔✔The process by which a sum of money is converted into periodic payments through a variable annuity contract. Viator - ✔✔The policyowner in a viatical settlement To set up a viatical settlement, a policyowner (the viator) sells an existing policy to a third party, known as a viatical settlement provider. Indeterminate Premium Whole Life Insurance - ✔✔A type of whole life insurance that is issued with two premium rates: a low introductory rate and a guaranteed maximum rate. Premium adjustments may be made as often as once a year, though this varies by insurer. Life Insurance "Living Benefits" - ✔✔Refers generally to several benefits available through permanent life insurance while the insured is alive. Living benefits are made possible by the policy's cash value, which is always available to the policyowner through policy loans, withdrawals, and partial surrenders. The funds may be used for any purpose. Modified and Graded Premium Whole Life - ✔✔Two similar forms of whole life insurance in which premiums start at a lower level than standard but rise in time to a higher level. Rollover IRA - ✔✔A form of IRA into which a participant's retirement plan funds are transferred after the participant leaves the company. Modified Endowment Contract (MEC) - ✔✔A tax classification that is assigned to a life insurance policy that violates tax code funding rules, resulting in loss of some tax advantages common with life insurance. Any permanent life insurance policy becomes a MEC (and is thus subject to less favorable income tax treatment) if it fails to meet the 7-pay test. Do not confuse a MEC with a traditional endowment contract. Variable Universal Life Insurance - ✔✔This flexible permanent life insurance combines the premium flexibility of universal life insurance and the investment opportunity of variable life insurance. Waiver of Premium (WP) Rider - ✔✔This whole life policy rider waives the need to pay premiums if the policyowner becomes totally disabled. Equity Indexed Annuity - ✔✔A nonvariable annuity whose interest return is tied to the performance of a stock index, such as the S&P 500. Transfer-for-Value Rule - ✔✔This tax rule subjects a portion of a life policy's death benefit to income taxation if that policy had previously been sold to a different owner. Fixed Life Insurance - ✔✔A form of permanent life insurance that features a guaranteed death benefit and a guaranteed minimum rate of return on the policy's cash value. Spendthrift clause - ✔✔A life insurance policy provision that protects policy death benefits from the claims of the insured's or the beneficiary's creditors and gives the policyowner the right to stipulate the settlement option that will be used in distributing policy proceeds. FINRA - ✔✔The Financial Industry Regulatory Authority that regulates insurers and producers that sell variable life insurance and annuity contracts. Accidental Death Benefit (ADB) Rider - ✔✔This life policy rider provides additional death benefit coverage if the insured dies as a result of an accident. Current Assumption Whole Life - ✔✔A form of flexible whole life insurance in which premiums can change over time in response to the insurer's actual mortality, interest, and expense experience. Accelerated Benefit Rider - ✔✔This rider permits an insured suffering a terminal illness to access a portion of the life policy's death benefit while alive. ERISA - ✔✔The 1974 federal law that lays the foundation for employer retirement plan qualification. Joint (First-to-Die) Life Insurance - ✔✔A type of permanent life coverage that insures two persons under one policy and that pays the death benefit when the first insured dies. Guaranteed Minimum Income Benefit - ✔✔A variable annuity rider that provides a guaranteed minimum life income regardless of the contract's accumulated value. [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2022

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2022

Downloads

0

Views

123