Business Law > QUESTIONS & ANSWERS > Va Property & Casualty, Questions with accurate answers. 100% verified. (All)

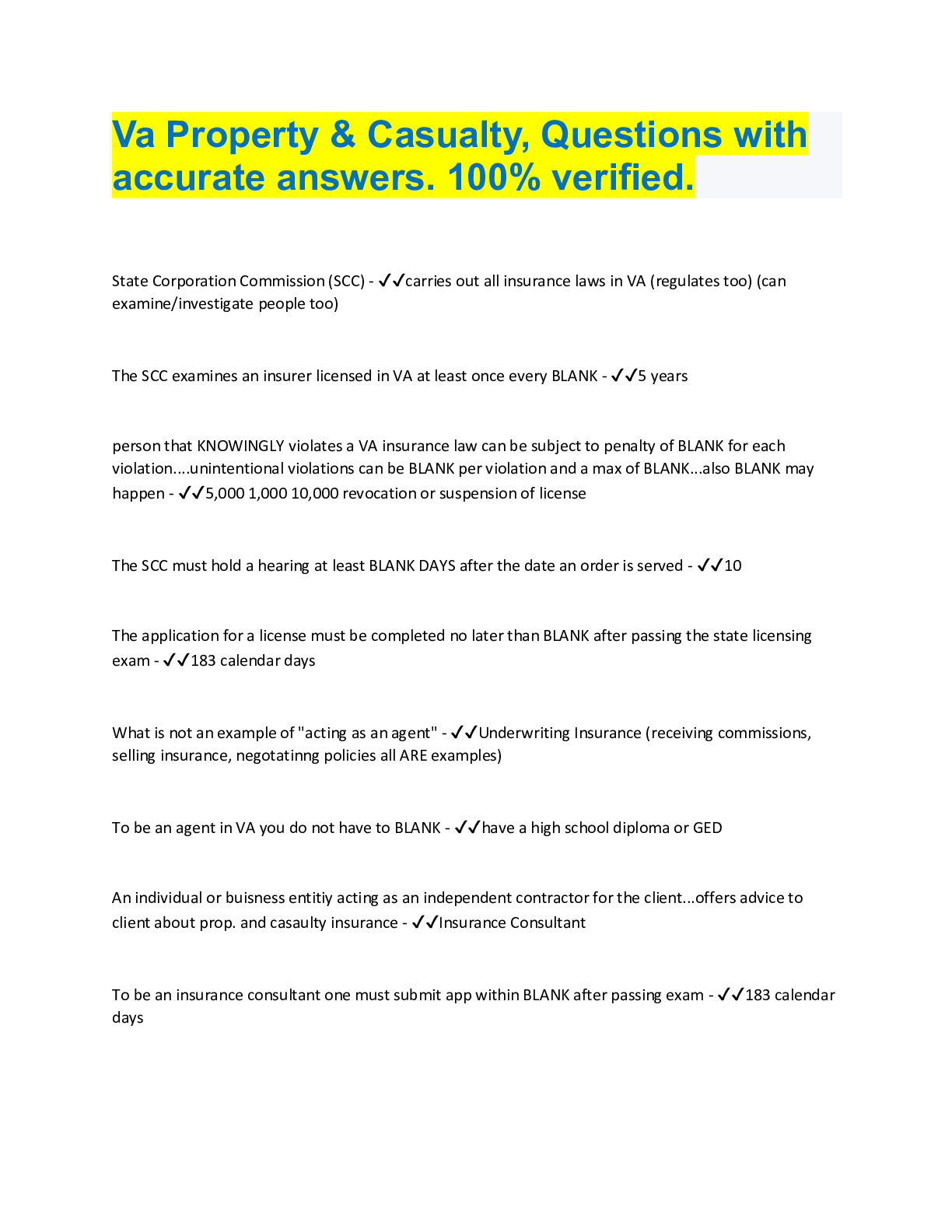

Va Property & Casualty, Questions with accurate answers. 100% verified.

Document Content and Description Below

Va Property & Casualty, Questions with accurate answers. 100% verified. State Corporation Commission (SCC) - ✔✔carries out all insurance laws in VA (regulates too) (can examine/investigate pe ... ople too) The SCC examines an insurer licensed in VA at least once every BLANK - ✔✔5 years person that KNOWINGLY violates a VA insurance law can be subject to penalty of BLANK for each violation....unintentional violations can be BLANK per violation and a max of BLANK...also BLANK may happen - ✔✔5,000 1,000 10,000 revocation or suspension of license The SCC must hold a hearing at least BLANK DAYS after the date an order is served - ✔✔10 The application for a license must be completed no later than BLANK after passing the state licensing exam - ✔✔183 calendar days What is not an example of "acting as an agent" - ✔✔Underwriting Insurance (receiving commissions, selling insurance, negotatinng policies all ARE examples) To be an agent in VA you do not have to BLANK - ✔✔have a high school diploma or GED An individual or buisness entitiy acting as an independent contractor for the client...offers advice to client about prop. and casaulty insurance - ✔✔Insurance Consultant To be an insurance consultant one must submit app within BLANK after passing exam - ✔✔183 calendar days Business Entity - ✔✔must be legally established before being licensed and appointed to act as insurance agents. Must submit certification. If business entity wants to use assumed or fictitious name it must put that in a notice on the license application or within BLANK from the date the name is adopted - ✔✔30 calender days In order for a business entity to obtain a producer license it MUST - ✔✔provide the name and address of all persons and corporations who own the business entity Validation (getting job with insurer I think): an insurer must file a notice of appointment with the commission within BLANK of the first insurance application taken by the agent - ✔✔30 days Within BLANK days of recieing the notice of appointment the commission must notify insurer if the appointment is valid, within BLANK of receiving the notice from the commission the insurer must notify the agent in writing if the appointment is invalid - ✔✔5 Days Insurers required to pay a BLANK BLANKLY for each appointment....with a penalty of BLANK per day when the insurer is overdue - ✔✔fee, quarterly, 50 bucks Termination notification: must stop selling insurance after BLANK of reciving it...fines typical apply if you dont stop - ✔✔10 calendar days Continuing education: agents must complete BLANK hours of approved continuing edu. courses during the required period......Agents with multiple licenses must complete BLANK hours....BLANK hours must be on ethics - ✔✔16, 24, 3 Failure to comply with continuing education requirements = termination of license, need to give BLANK - ✔✔30 days written notice For continuing education purposes, if an insurance consulatant obtains a new license within BLANK months of the previous license expiration,he/she will be considered to have renewed the og license in a timely manner - ✔✔12 months Request for waivers for getting out of continuing education requirements must be submitted BLANK days before end of the app biennium - ✔✔90 calendar days Change of address: must be reported within BLANK - ✔✔30 calendar days Exemptions to continuing edu: - ✔✔1. licensed 20 years (4 in va) 2. Licensed 20 of last 30 years in VA twisting - ✔✔Using misrepresentation to induce an insured to terminate an existing policy and purchase a new one (not allowed) If a license is denied, suspended, or revoked, the applicant cannot apply for another license for AT LEAST BLANK YEARS - ✔✔5 years When considering to deny suspend or revoke a license the commission must provide AT LEAST BLANK - ✔✔10 days notice A Fiduciary Account may be used for: - ✔✔1. depositing premiums and other funds received in the transaction of insurance 2. Advancing premiums 3. Establishing reserves for the payment of return premiums 4. Guaranteeing the account has sufficient funds to make all required payments An example of something not permitted usage of funds in a fiduciary account is...... - ✔✔Paying for office expenses such as internet service or shipping Exceptions from having to expressly state all fees and commissions of an insurance policy: - ✔✔1. the policy is fidelity, surety, title, or group insurance 2. Charges are made lawfully by an insurance consultant 3. Service charges are billed for premiums paid installments, so long as the service charges are disclosed to the insured in writing Licensed agents must disclose to SCC any FELONY convictions within BLANK DAYS or conviction - ✔✔30 days (anything felony related= 30 days) Record Retention: inurers must keep recoreds for/from BLANK - ✔✔3 previous calendar years OUTLAWED MARKETING PRACTICES in va include: (alot are from comm law) - ✔✔1. Rebating 2. Misrepresentation 3. Defamation 4. False Advertising 5. Unfair Discrimination 6. Twisting Rebating - ✔✔BASICALLY: giving shit to someone to induce them to take a policy, offering premium rebate, special favor, advantage, or any valuable consideration as an inducement for the purchase of a policy Misrepresentation - ✔✔Fraud, making issuing or circulating an estimate, illustration, statement, sales presentation, omission, or comparison that is misrepresentative of material facts Defamation - ✔✔Slander or libel with respect to the business of insurance or to any person in the insurance business IF the statement is intended to injur False Advertising - ✔✔False light, not allowed to make statements/announcements that are untrue, deceptive, misleading pertaining to business of insurance Unfair Discrimination - ✔✔What it sounds like, treating people differently for no just reason VA Property and Casualty Insurance Guaranty Association - ✔✔a non-profit organization that consists of all licensed P&C insurers in VA (obligatory membership)...PURPOSE is to reduce financial loss to residents in event an insurance company becomes insolvent 3 accounts of the VA P&C Insurance Guaranty Association - ✔✔1. Workers' Comp. insurance account 2. Automobile Insurance Account 3. Account for all other insurance Limits of VA P&C Insurance Guaranty Association Coverage - ✔✔300,000 per workers comp. claim, unearned premiums in excess of 50 If member of VA P&C Guaranty Association fails to pay an assessment when due the commission may.... - ✔✔1. suspend revoke license 2. Levy a fine up to 5% of the unpaid assessment PER MONT .....MINIMUM FINE= 100 per month Fair Credit Reporting Act (FCRA) - ✔✔Federal legislation regulating the collection, use, and disclosure of consumer information ( no va laws should be interpreted to replace/modify this) Adverse Underwriting Decision - ✔✔one of the following after underwriting policy: -declining insurance coverage -terminating coverage -failure to apply insurance in way asked for -placing insurance in the residual market -charging high rate Pretext interview 9preohibited - ✔✔an interview during which a person attempts to obtain info about a natural person by: pretending to be someone they not, misrepresenting true purpose of meeting, refusing to ID themselves upon request [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2022

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2022

Downloads

0

Views

166