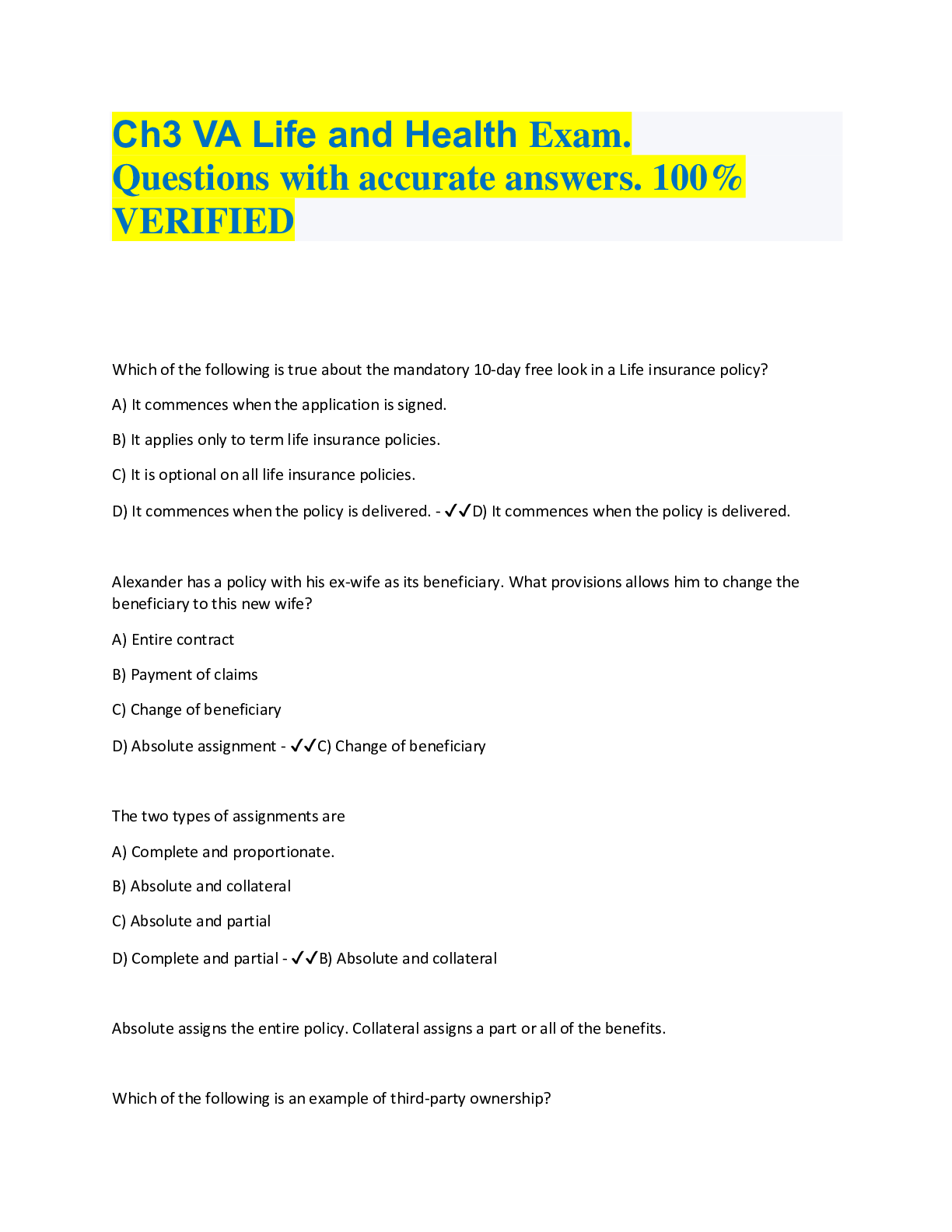

Health Care > QUESTIONS & ANSWERS > Ch3 VA Life and Health Exam. Questions with accurate answers. 100% VERIFIED (All)

Ch3 VA Life and Health Exam. Questions with accurate answers. 100% VERIFIED

Document Content and Description Below

Ch3 VA Life and Health Exam. Questions with accurate answers. 100% VERIFIED Which of the following is true about the mandatory 10-day free look in a Life insurance policy? A) It commences when ... the application is signed. B) It applies only to term life insurance policies. C) It is optional on all life insurance policies. D) It commences when the policy is delivered. - ✔✔D) It commences when the policy is delivered. Alexander has a policy with his ex-wife as its beneficiary. What provisions allows him to change the beneficiary to this new wife? A) Entire contract B) Payment of claims C) Change of beneficiary D) Absolute assignment - ✔✔C) Change of beneficiary The two types of assignments are A) Complete and proportionate. B) Absolute and collateral C) Absolute and partial D) Complete and partial - ✔✔B) Absolute and collateral Absolute assigns the entire policy. Collateral assigns a part or all of the benefits. Which of the following is an example of third-party ownership? A) 401(k) B) Group insurance C) Non-qualified annuity D) Modified Endowment Contract - ✔✔B) Group insurance Which of the following named beneficiaries would not be able to receive the death benefit directly from the insurer in the event of the insured's death? A) William, Jr., minor son of the insured B) Fred, a business partner of the insured C) Flossie, the present wife of the deceased D) Wilma, the former wife of the decease - ✔✔A) William, Jr., minor son of the insured A business owner went to the bank to obtain a loan in order to fund the purchase of a doughnut shop, but the bank needed more in trade than she had expected. Since the business owner has a $250,000 life insurance policy, she decided to use it to secure the loan. Which provision makes this possible? A) Modification clause B) Ownership provision C) Collateral assignment D) Insurable Interest - ✔✔C) Collateral assignment Which is NOT true about beneficiary designations? A) The beneficiary does not have to have an insurable interest in the insured. B) The policyowner does not have to name a beneficiary in order for the policy to be valid. C) Trusts can be valid beneficiaries, in order to manage life insurance proceeds for a minor. D) The beneficiary must have insurable interest in the insured. - ✔✔D) The beneficiary must have insurable interest in the insured. Which of the following statements is true about a policy assignment? A) It permits the beneficiary to designate the person or persons to receive the benefits. B) It is valid during the insured's lifetime only, because the death benefit is payable to the named beneficiary. C) It transfers the owner's rights under the policy to the extent expressed in the assignment form. D) It is the same as a beneficiary designation. - ✔✔C) It transfers the owner's rights under the policy to the extent expressed in the assignment form. An individual purchased a Whole Life Insurance policy and named his wife as the owner. After 20 years the policy has cash values of $12,000. Who has the right to the cash values? A) The original purchaser of the policy B) The policyowner C) The beneficiary named in the policy D) The insurance company - ✔✔B) The policyowner The Ownership provision entitles the policyowner to do all of the following EXCEPT A) Designate a beneficiary. B) Set premium rates. C) Receive a policy loan. D) Assign the policy. - ✔✔B) Set premium rates. The insurer sets premium rates based upon underwriting considerations. The sole beneficiary of a life insurance policy dies before the insured. If the policyowner fails to change the beneficiary before the insured's death, the proceeds of the policy will go to A) The beneficiary's estate. B) The insured's estate. C) Probate. D) The state. - ✔✔B) The insured's estate. When an insured dies, who has the first claim to the death proceeds of the insured life insurance policy? A) Policyowner B) Primary beneficiary C) Contingent beneficiary D) Estate - ✔✔B) Primary beneficiary What would be an advantage to naming a contingent (or secondary) beneficiary in a life insurance policy? A) It allows creditors to receive payment out of the proceeds B) It ensures the policy proceeds will be split between the primary and contingent beneficiaries C) It requires that someone who is not the primary beneficiary handles the estates. D) It determines who receives policy benefits if the primary beneficiary is deceased. - ✔✔D) It determines who receives policy benefits if the primary beneficiary is deceased. If a life insurance policy has an irrevocable beneficiary designation, A) The beneficiary cannot be changed. B) The beneficiary can only be changed with written permission of the beneficiary. C) The beneficiary cannot be changed for a least 2 years. D) The owner can always change the beneficiary at will. - ✔✔B) The beneficiary can only be changed with written permission of the beneficiary. Life insurance benefits for minors must be placed in the hands of either a guardian or a trustee. Which of the following is true? A) The guardian and trustee cannot be the same person B) The trustee is not accountable for assets C) The guardian may or may not be accountable for assets D) The guardian must also be the trustee - ✔✔C) The guardian may or may not be accountable for assets The guardian and trustee may be the same person of different people. The primary difference in function is that the trustee is accountable for assets, whereas the guardian may or may not be accountable for assets. A 40 year old man buys a whole life policy and names his wife as his only beneficiary. His wife dies 10 years later. He never remarries and dies at age 61, leaving 2 grown-up children. Assuming he never change the beneficiary, the policy proceeds will go to A) The insured's firstborn child B) Both children who share equally on a per-capita basis C) The insurance company D) The insured's estate - ✔✔D) The insured's estate Bonnie wants to name her husband as the beneficiary of her life policy. She also wishes to retain all of the rights of ownership. Bonnie should have her husband named as the A) Irrevocable beneficiary B) Revocable beneficiary C) Secondary beneficiary D) Tertiary beneficiary - ✔✔B) Revocable beneficiary An insured purchased a life insurance policy on his life naming his wife as primary beneficiary, and his daughter as contingent beneficiary. Under what circumstances could the daughter collect the death benefit? A) With the primary beneficiary's written consent B) If the insured died from accidental means C) If the primary beneficiary predeceases the insured. D) The primary and contingent beneficiaries share death benefits equally - ✔✔C) If the primary beneficiary predeceases the insured. Which of the following statements about the reinstatement provision is true? A) It provides for reinstatement of a policy regardless of the insured's health. B) It guarantees the reinstatement of a policy that has been surrendered for cash. C) It requires the policyowner to pay, with interest, all overdue premiums before the policy is reinstated. D) It permits reinstatement within 10 years after a policy has lapsed. - ✔✔C) It requires the policyowner to pay, with interest, all overdue premiums before the policy is reinstated. An insured misstates her age at the time the life insurance application is taken. This misstatement may result in A) No change whatsoever B) Automatic lapse. C) Recession of the policy. D) Adjustment in the amount of death benefit. - ✔✔D) Adjustment in the amount of death benefit. An insured purchases a policy in 2000 and dies in 2005. The insurance company discovers at that time that the insured concealed information during the application process. What can they do? A) Pay the death benefit B) Refuse to pay the death benefit because of the fraud. C) Pay a decreased death benefit D) Sue for the right to not pay the death beneift - ✔✔A) Pay the death benefit If a policy has an automatic premium loan provision, what happens if the policy owner dies before the loan if paid back? A) The policy s rendered null and void. B) The balance of the loan will be taken out of the death benefit. C) The balance of the loan is forgiven; the policy beneficiary receives the full death benefit. D) The policy beneficiary takes over the loan payments. - ✔✔B) The balance of the loan will be taken out of the death benefit. An employer provides a group life plan for its employees; it is $50,000 of term to age 65. When one of the employees was hired 10 years ago, he misstated his age and told the employer he was 50, when in fact he was 56 years old. The insured employee die last week. His beneficiary will receive A) Nothing, due to the misstatement of age. B) $50,000 C) Nothing, due the insured's reaching the maximum age. D) The amount of death benefit premium would have purchased at his correct age. - ✔✔C) Nothing, due the insured's reaching the maximum age. The life insurance policy clause that prevents an insurance company from denying payment of a death claim after a specified period of time is known as the A) Misstatement of Age clause. B) Incontestability clause. C) Reinstatement clause. D) Insuring clause. - ✔✔B) Incontestability clause. All of the following statements concerning Waiver of Premium riders are correct EXCEPT A) An insured who has recovered from a disabling injury will be required to repay the insurer for any premiums that were waived. B) Waiver of Premium riders require that disablement needs to last for a certain period of time. C) There is a maximum age limit for the Waiver of Premium rider to activate. D) Once activated, the Waiver of Premium will continue until the insured's recovery or the maturity of the policy, whichever occurs first. - ✔✔A) An insured who has recovered from a disabling injury will be required to repay the insurer for any premiums that were waived. The Waiver of Cost rider is found in what type of insurance? A) Universal Life B) Whole Life C) Joint and Survivor D) Juvenile Life - ✔✔A) Universal Life The rider that allows the company to forgo collecting the premium if the insured is disabled is called A) Payor benefit. B) Waiver of premium. C) Guaranteed insurability. D) Waiver of cost of insurance. - ✔✔B) Waiver of premium. What is the purpose of a suicide provision within a life insurance policy? A) To deter the policyowner from committing suicide. B) To protect the policyowner. C) To protect the insurer from persons who purchase life insurance with the intention of committing suicide. D) To limit the insurer's liability after the the 2 year waiting period. - ✔✔C) To protect the insurer from persons who purchase life insurance with the intention of committing suicide. An insured is involved in a car accident that damages his cervical vertebrae and surrounding nerves. As a result, the insured become quadriplegic. If the policy contains a Waiver of Premium rider, which of the following statements is true regarding the policy premiums? A) The insured will continue to pay the premiums in the same manner as before the accident. B) The premium rate will be substantially reduced for the rest of the insured's life. C) The insured will have to pay regular premiums fr 1 year, after which a reduced rate will apply. D) The insured will have to pay regular premiums for 6 months, after which the premiums will be reimbursed and subsequent premiums will be waived. - ✔✔D) The insured will have to pay regular premiums for 6 months, after which the premiums will be reimbursed and subsequent premiums will be waived. Which of the following terms is used to describe attachments made to policies that either add or delete provisions? A) Conditions B) Restrictions C) Exclusions D) Riders - ✔✔D) Riders All of the following are true regarding the guaranteed insurability rider EXCEPT: A) It allows the insured to purchase additional amounts of insurance without proving insurability only a specified dates or events B) This rider is available to all insured. C) The insured may purchase additional coverage the attained age. D) The insured may purchase additional insurance up to the amount specified in the base policy. - ✔✔B) This rider is available to all insured. At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to prove insurability. This rider is called A) Cost of living. B) Guaranteed insurability. C) Waiver of cost of insurance. D) Supplemental add on. - ✔✔B) Guaranteed insurability. [Show More]

Last updated: 3 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

ALL VA CHAPTERS Questions with accurate answers,100% verified, EASY WAY TO PASS.

ALL YOU NEED TO PASS THE CH VA QUESTIONS ALL VA CHAPTERS Questions with accurate answers,100% verified, EASY WAY TO PASS.

By Topmark 3 years ago

$32

14

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 13, 2022

Number of pages

15

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 13, 2022

Downloads

0

Views

158