*NURSING > QUESTIONS & ANSWERS > Xcel Final Exam, Questions and answers. 100% proven pass rate. 2022/2023 (All)

Xcel Final Exam, Questions and answers. 100% proven pass rate. 2022/2023

Document Content and Description Below

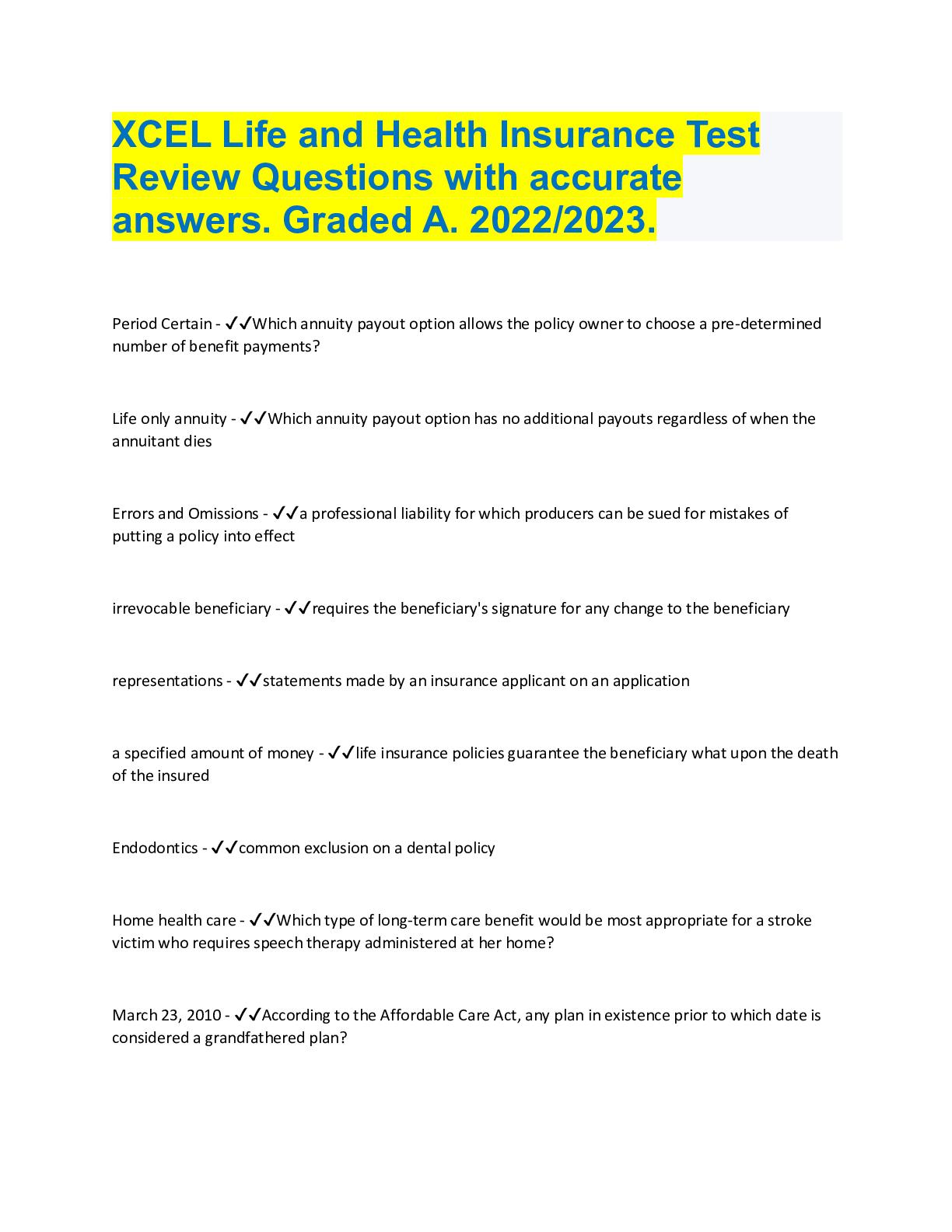

Xcel Final Exam, Questions and answers. 100% proven pass rate. 2022/2023 Typically, Long-Term Disability benefits are coordinated with which benefit plan? - ✔✔Social Security The focus of ... major medical insurance is providing coverage for - ✔✔medical and hospitalization expenses An insured under a Major Medical expense plan with a zero deductible and 80/20 coinsurance provision files a $1,000 claim. How much of this claim is the insured responsible for? - ✔✔$200 because this policy has a zero deductible, the insures is only responsible for the 20% coinsurance on this claim, or $200 An insured has a stop-loss limit of $5,000 and an 80/20 coinsurance. The insured incurs $25,000 of covered losses. How much will the insured pay? - ✔✔$5,000 Which type of plan would be the most appropriate for an individual on Medicare and concerned that Medicare will NOT pay for charges exceeding the approved amount? - ✔✔Medicare supplement Plan F When can a group health policy renewal be denied according to the Health Insurance Portability and Accountability Act (HIPAA)? - ✔✔when contribution or participation rules have been violated What does the word "level: in Level Term describe? - ✔✔the face amount A non-contributory health insurance plan helps the insurer avoid - ✔✔adverse selection because all eligible employees are usually covered, non-contributory plans are desirable from an underwriting standpoint because adverse selection is minimized. To qualify for a resident producer license in the state of Michigan, an individual - ✔✔must complete the required pre-licensing education within 12 months of license application Under an expense-incurred individual health policy, what is the MAXIMUM length of time after issuance of the policy that an insurer can exclude coverage for a pre-existing condition? - ✔✔12 months pre-existing conditions may be excluded for a maximum of 12 months from the date of enrollment. An insured has a health plan that pays established amounts in accordance with a list of injuries, surgical procedures, or other losses. This list is called a - ✔✔benefit schedule benefits schedule set predetermined limits or maximums on how much money and insured can be reimbursed for a covered loss. Who is the individual paid on a fee-for-service basis? - ✔✔Provider Which of the following is NOT an illegal inducement? - ✔✔Giving the insured an article of merchandise printed with the producer's name costing $5 $5 or less of tokens or merchandise to applicants is allowed. Making a statement that is false or maliciously critical of the financial condition of an insurer is known as - ✔✔defamation Which of the following is NOT a required provision in an accident and health insurance policy? - ✔✔change of occupation the change of occupation provision is considered an OPTIONAL provision Which of these statements about Medicaid is CORRECT? - ✔✔Funded by federal, sate, and local taxes Medicaid is funded by federal, state, and local taxes but is administered by each state. All of these are considered key factors in underwriting life insurance EXCEPT - ✔✔Marital Status Correct: tobacco use, health history, age The time limit for filing claim disputes is addressed in which provision of an accident and health policy? - ✔✔legal actions All of the following plans allow for employee contributions to be taken on a pre-tax basis EXCEPT - ✔✔Health reimbursement Arrangement plan employers contribute to health reimbursement Arrangement planz (HRA's), not employees. Which of the following gifts from a producer would NOT be considered rebating? - ✔✔$5 pen A producer quoting life insurance may give an applicant an article of merchandise having an invoice value of $5.00 or less. Written notice for a health claim must be given to the insurer ___ days after the occurrence of the loss. - ✔✔20 Chris is an insured bricklayer who severed his left hand in an automobile accident. Although his primary duty cannot be performed, Chris is also a substitute high school teacher. He collects a full disability income check every month. How does his policy define total disability? - ✔✔own occupation the "own occupation" definition of total disability requires that the insured be unable to perform the insured's current occupation as a result of an accident or sickness. Which approach predicts a person's earning potential and determines how much of that amount would be devoted to dependents? - ✔✔Human life value approach The human life value approach predicts an individual's future earning potential and determines how much of that amount would be devoted to dependents. Index whole life insurance contains a securities component that acts as a(n) - ✔✔hedge against inflation Phil is shopping for an annuity that guarantees he CANNOT outlive the benefits. Which of these benefit options would he choose? - ✔✔Guaranteed lifetime withdrawal benefit The guaranteed lifetime withdrawal benefit normally requires a fee, but it ensures that the income benefit will be paid for life without actually annuitizing the contract. Which of these factors would an insurer consider when determining whether to accept a group life plan? - ✔✔average age and insurer would consider the average age when determining whether to accept a group Life Plan. This MANDATORY health policy provision states that the policy, including endorsements and attached papers, constitutes - ✔✔the entire insurance contract between the parties The monthly benefit for an individual disability income policy is usually limited to a percentage of the insured's income in order to avoid - ✔✔over insurance When an insurance licensee changes his or her address under the Michigan Insurance Code, who MUST be notified? - ✔✔the commissioner of the Department of Insurance and financial services (DIFS) Jonas is a whole life insurance policyowner and would like to add coverage for his two children. Which of the following products would allow him to accomplish this? - ✔✔Child term rider A child term rider is a level term insurance that can be added to an existing policy. The typical long-term care insurance policy is designed to provide a minimum of __ year(s) of coverage. - ✔✔1 How many employees must an employer have for a terminated employee to be eligible for COBRA? - ✔✔20 Which of the following policies does NOT build cash value? - ✔✔Term CORRECT: straight life, endowment, variable life Which type of annuity stops all payments upon the death of the annuitant? - ✔✔Life annuity The type of annuity in which all payments cease upon the death of an annuitant is referred to as a life annuity. Under the subrogation clause, legal action can be taken by the insurer against the - ✔✔responsible third party Disability Income plans which require that the insurer can NEVER change or alter premium rates are usually considered - ✔✔Noncancellable A noncancellable policy cannot be cancelled nor can its premium rates be increased under any circumstances. Coordination of Benefits regulation applies to all of the following plans EXCEPT - ✔✔preferred provider organization plan CORRECT: group vision plan, self-funded group health plan, group health plan A spouse and child can be added to the primary insured's coverage as what kind of rider? - ✔✔Family term Amy has a group medical policy through her employer with a $500 deductible and a 90% coinsurance provision. She incurs $1,500 in covered health care services. How much will her group insurance carrier pay? - ✔✔$900 In this situation, the group insurance carrier will pay 90% of the covered loss after the deductible has been applied. In order to save on premiums, a Life Insurance policy can legally be backdated up to - ✔✔6 months Statements made by an insurance applicant on an application are considered to be - ✔✔representations To receive proceeds from a death benefit, a minor - ✔✔must have an appointed guardian In the interest of protecting the assets of a minor, state law requires that a guardian be appointed to administer the proceeds payable to the minor child. Which of the following services MUST be provided by HMO plans? - ✔✔Home health care Home health services is an HMO mandatory benefit in Michigan. The unfair trade practice of replacing an insurance policy from one insurer to another based on misrepresentation is called - ✔✔twisting In determining whether a pre-existing condition applies, the enrollee CANNOT have more than how many days' gap in health insurance? - ✔✔63 A business will typically use which type of life insurance to cover their employees? - ✔✔Group policy Within how many days must a Traditional IRA be rolled over to another IRA in order to avoid tax consequences? - ✔✔60 Ron has a life insurance policy with a face value of $100,000 and a cost of living rider. If the consumer price index has gone up 4%, how much may Ron increase the face value of the policy? - ✔✔$4,000 In this situation, Ron may increase the face value of his policy by $4,000. $100,000 X .04 = $4,000. When an accident and health policy requires payment of an additional premium to provide coverage for a newborn, how many days after the birth is the first payment due? - ✔✔31 Peter has a policy where 80% to 90% of the premium is invested in traditional fixed income securities and the remainder of the premium is invested in contracts tied to a stipulated stock index. What kind of policy is this? - ✔✔Equity index whole life A life insurance policy that contains a guaranteed interest rate with the chance to earn a rate that is higher than the guaranteed rate is called - ✔✔universal life What is issued to each employee of an employer health plan? - ✔✔Certificate Ted has a health insurance plan that requires him to pay a specific sum out of pocket before any benefits are paid in a calendar year. Which of these does his health plan have? - ✔✔Calendar-year deductible A calendar-year deductible is paid before any benefits are paid in a calendar year. An insurer would be committing Unfair Discrimination if coverage was denied based upon - ✔✔marital status A licensee who is required to take continuing education MUST include how many ethics coursework hours? - ✔✔3 A licensee is required to take 24 hours of continuing education every two years. Of the 24 hours, 3 must be in ethics Barbara's policy includes a rider which allows her to purchase additional insurance at specific dates or events without evidence of insurability. This rider is called a(n) - ✔✔Guaranteed insurability rider When calculating the amount of life insurance needed for an income earner, what has to be determined when using the Needs Approach? - ✔✔the family's Financial objectives if the income earner were to die or become disabled Dorian exercised a nonforfeiture option by using his life policy's cash value to purchase an extended term insurance option. When the term insurance expires, - ✔✔the protection ends When the insured gives birth, coverage for eligible newly born children consists of coverage of injury or sickness including - ✔✔birth abnormalities Which of these is NOT considered to be a purpose of an annuity? - ✔✔Annuities are intended to create an estate CORRECT: annuities are indented to liquidate an estate, annuities are intended for the tax-free growth of principal, and annuities are intended to distribute accumulate principal What is the purpose for having an accelerated death benefit on a life insurance policy? - ✔✔it allows for cash advances to be paid against the death benefit if the insured becomes terminally ill Donald is the primary insured of a life insurance policy and adds a children's term rider. What is the advantage of adding this rider? - ✔✔can be converted to permanent coverage without evidence of insurability Life insurance policies will normally pay for losses arising from - ✔✔commercial aviation Medical Expense Insurance would cover - ✔✔an injury occurring at the insured's residence A clause that allows an insurer the right to terminate coverage at any anniversary date is called a(n) - ✔✔optional renewability clause An optional renewability clause allows an insurer the unrestricted right to terminate coverage at any anniversary or at any premium due date. Which of these is NOT considered to be a risk factor in life insurance underwriting? - ✔✔Number of children CORRECT: health history, hobbies, occupation Which of these is NOT a characteristic of the Accelerated Death Benefit option? - ✔✔the benefit can be offered as a writer and a specific extra cost or may be at no cost CORRECT: the face amount and policy premium are not affected by the payment, before payment of the benefit is made, specific conditions must exist, such as suffering from a terminal illness, there may be a dollar amount on the maximum benefit The branch of dentistry which deals with the replacement of missing parts is called - ✔✔Prosthodontics Prosthodontics is the branch of dentistry concerned with the design, manufacture, and fitting of artificial replacements for teeth and other parts of the mouth. Under long-term care insurance, which of the following MUST an insurer offer to each policyowner at the time of purchase? - ✔✔An inflation protection feature How is a health provider reimbursed if they do NOT have an agreement in place with the insurance company? - ✔✔With a usual, customary, and reasonable fee Which of the following provides Medicare supplement policies? - ✔✔Private insurance companies Sonya applied for a health insurance policy on April 1. Her agent submitted the information to the insurance company on April 6. She paid the premium on May 15 with the policy indicating the effective date being May 30. On which date would Sonya have coverage? - ✔✔May 30 The "effective date" is the health insurance coverage start date. A producer MUST be appointed by the insurer within how many days from the date the agency contract application is submitted? - ✔✔15 Which of the following is a reinstatement condition? - ✔✔proof of insurability A policyowner may change two policy features on what type of life insurance? - ✔✔adjustable life adjustable life allows the policyowner to change to policy features: premium and face amount. A notice of cash surrender value must be sent to a Universal [Show More]

Last updated: 3 years ago

Preview 1 out of 30 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

XCEL BUNDLE. ALL VERSIONS OF EXAMS QUESTIONS WITH ANSWERS. GRADED A.

ALL VERSIONS OF THE XCEL EXAMS, GRADED A.

By Topmark 3 years ago

$29

17

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 14, 2022

Number of pages

30

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 14, 2022

Downloads

1

Views

387