Chapter 10: PARAMETRIC EQUATIONS AND POLAR COORDINATES. Work and Answers

*NURSING > QUESTIONS & ANSWERS > XCEL Final Exam, Questions and answers. Rated A. 2022/2023. Graded A (All)

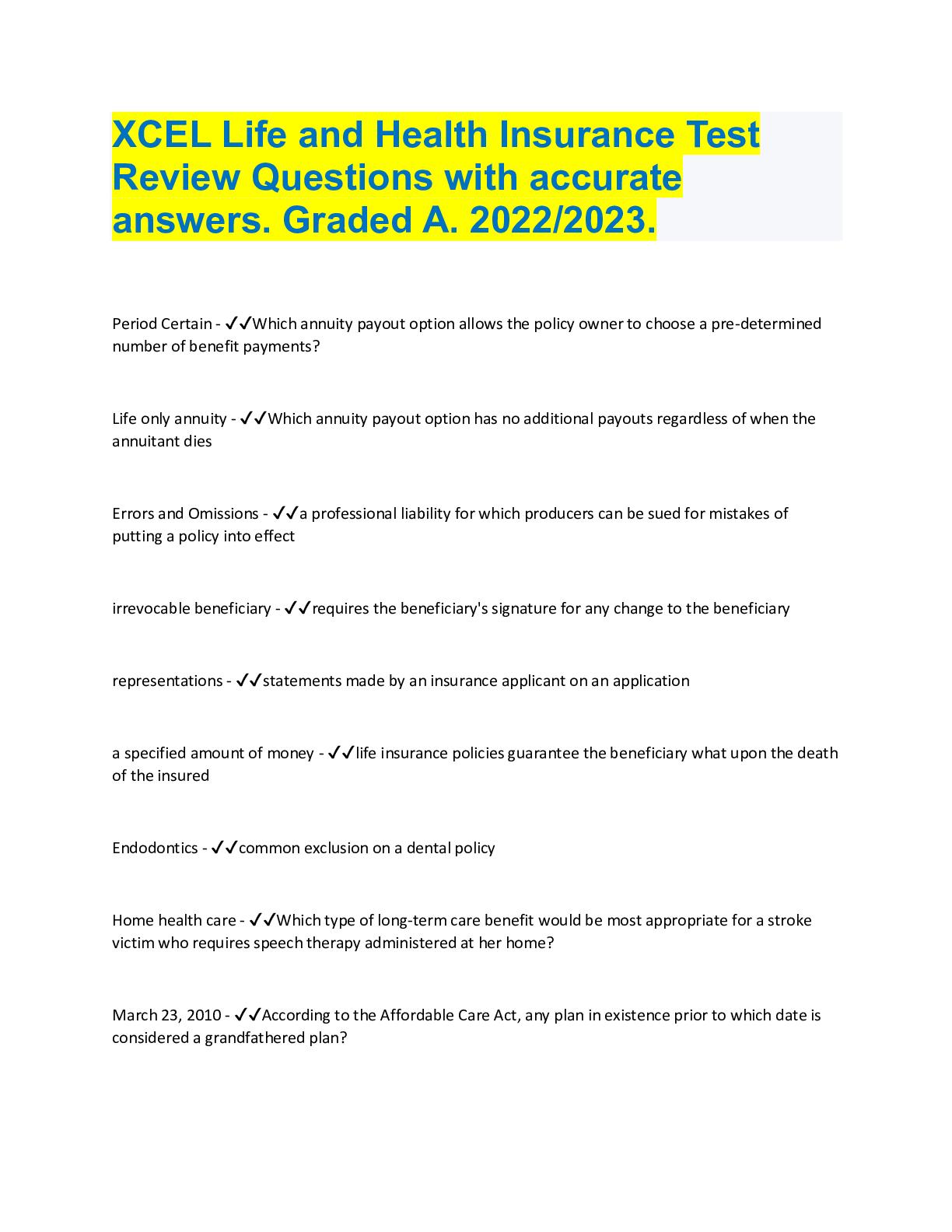

XCEL Final Exam, Questions and answers. Rated A. 2022/2023. Graded A Irrevocable beneficiary - ✔✔What kind of life insurance beneficiary requires his/her consent when a change of beneficiary ... is made? Anytime - ✔✔When can a policy-owner change a revocable beneficiary? Daughter - ✔✔K has a life insurance policy where her husband is beneficiary and her daughter is contingent beneficiary. Under the Common Disaster clause, if K and her husband are both killed in an automobile accident, where would the death proceeds be directed? 0 - ✔✔T and S are named co-primary beneficiaries on a $500,000 Accidental Death and Dismemberment policy insuring their father. Their mother was named contingent beneficiary. Five years later, S dies of natural causes and the father is killed in a scuba accident shortly afterwards. How much of the death benefit will the mother receive? If the primary beneficiary dies before the insured - ✔✔How would a contingent beneficiary receive the policy proceeds in an Accidental Death and Dismemberment (AD&D) policy? Irrevocable - ✔✔A policy would like to change the beneficiary on a Life insurance policy and make the change permanent. Which type of designation would fulfill this need? The early years are charged more than what is needed - ✔✔What is the underlying concept regarding level premiums? Premium Mode - ✔✔A policy-owner is able to choose the frequency of premium payments through what policy feature? Mode of Premium - ✔✔A policy owner is allowed to pay premiums more than once a year under which provision? Application will be returned to the writing agent. - ✔✔An incomplete life insurance application submitted to an insurer will result in which of these actions? Applicant - ✔✔Any changes made on an insurance application requires the initials of whom? Set up a meeting with the applicant to answer the remaining questions - ✔✔P is a producer who notices 5 questions on a life application were not answered. What actions should P take? Policy was returned within the free-look period, premium will be fully refunded. - ✔✔Q applied for life insurance and submitted the initial premium on January 1. The policy was issued February 1, but it was not delivered by the agent until February 7. Q is dissatisfied and returns the policy February 13. How will the insurer handle this situation? Beneficiary - ✔✔Who is NOT required to sign a life insurance application? Forward the application o the insurer without the initial premium. - ✔✔What action should a producer take if the initial premium is NOT Submitted with the application? applicant's physician - ✔✔An applicant's medical information received from the Medical Information Bureau (MIB) may be furnished to the To detect and deter terrorism - ✔✔What is the purpose of the USA Patriot Act The group was formed for a purpose other than acquiring insurance. - ✔✔Which requirement must be met for an association to be eligible for a group life plan? The policy proceeds will be paid if the employee dies during the conversion period. - ✔✔When an employee is terminated, which statement about a group term life conversion is true? Certificate - ✔✔A person who is insured within a group contract will be given a Immediate annuity - ✔✔W is a 39-year old female who just purchased an annuity to provide income for life starting at age 60. All of these would be acceptable annuity choices EXCEPT a(n) Single premium - ✔✔An immediate annuity consists of a Social Security - ✔✔What is Old Age and Survivors Health Insurance (OASDHI) also known as? Individual Retirement Account (IRA) - ✔✔Which of these retirement plans can be started by an employee, even if another plan is in existence? at future dates specified in the contract with no evidence of insurability required. - ✔✔When does a guaranteed Insurability Rider allow the insured to buy additional coverage? Reinstatement - ✔✔Which of these provisions require proof of insurability after a policy has lapsed? the initial premium. - ✔✔The consideration clause in a life insurance policy indicated that a policy owner's consideration consists of a completed application and Entire contract provision - ✔✔what provision in a life insurance policy states that the application is considered part of the contract? Contest a claim during the contestable period - ✔✔The incontestable clause allows an insurer to Must have a terminal illness to qualify - ✔✔Which of the following statements is correct about accelerated death benefits? payor clause - ✔✔Which of the following provisions guarantees that premiums will be waived if a juvenile life policy owner becomes disabled? Assign policy ownership to the bank - ✔✔What action can a policy owner take if an application for a bank loan requires collateral? Claims are denied under the suicide clause of the policy - ✔✔How do life insurance companies handle cases where the insured commits suicide within he contract's stated contestable period? additional Whole Life coverage at specific times - ✔✔B owns a Whole Life policy with a guaranteed insurability option that allows him to purchase, without evidence of insurabillity, stated amounts of $50,000 minus any outstanding policy loans - ✔✔P purchases a $50,000 term life insurance policy in 2005. One of the questions on the application ask if P engages in scuba diving, to which P answers "No". The policy is then issued with no scuba exclusions. In 2010, P takes up scuba diving and dies in a scuba-related accident in 2011. What will the insurer pay to P's beneficiary? The full face amount - ✔✔D was actively serving in the Marines when he was killed in an automobile accident while on leave. His $100,000 Whole life policy contains a war exclusion clause. How much will D's beneficiary's receive? A modified endowment contract - ✔✔Which type of policy is considered to be over funded, as stated by IRS guidelines? Conversion provision - ✔✔When a policy owner exchanges a term policy for a whole life policy providing proof of good health, which of these apply? 30 pay life - ✔✔N is a 40-year old applicant who would like to retire at age 70. He is looking to buy a life insurance policy with level premiums, permanent protection, and be paid-up at retirement. Which of these should N purchase? age 100 - ✔✔How long does the coverage normally remain on a limited-pay life policy? does not guarantee a return on its investment accounts - ✔✔A variable insurance policy issued in an amount not to exceed the amount of the loan - ✔✔Credit life insurance is Expires at the end of the policy period - ✔✔Term insurance has which of the following characteristics? Family Maintenance Policy - ✔✔What kind of insurance policy supplies an income stream over a set period of time that starts when the insured dies? level - ✔✔What kind of premium does a whole life policy have? Level term - ✔✔D needs life insurance that provides coverage for only a limited amount of time while also paying the lowest possible premium. What kind of policy is needed? 20-pay life - ✔✔What type of policy would offer a 40-year [Show More]

Last updated: 3 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

ALL VERSIONS OF THE XCEL EXAMS, GRADED A.

By Topmark 3 years ago

$29

17

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Oct 14, 2022

Number of pages

10

Written in

All

This document has been written for:

Uploaded

Oct 14, 2022

Downloads

1

Views

344

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·