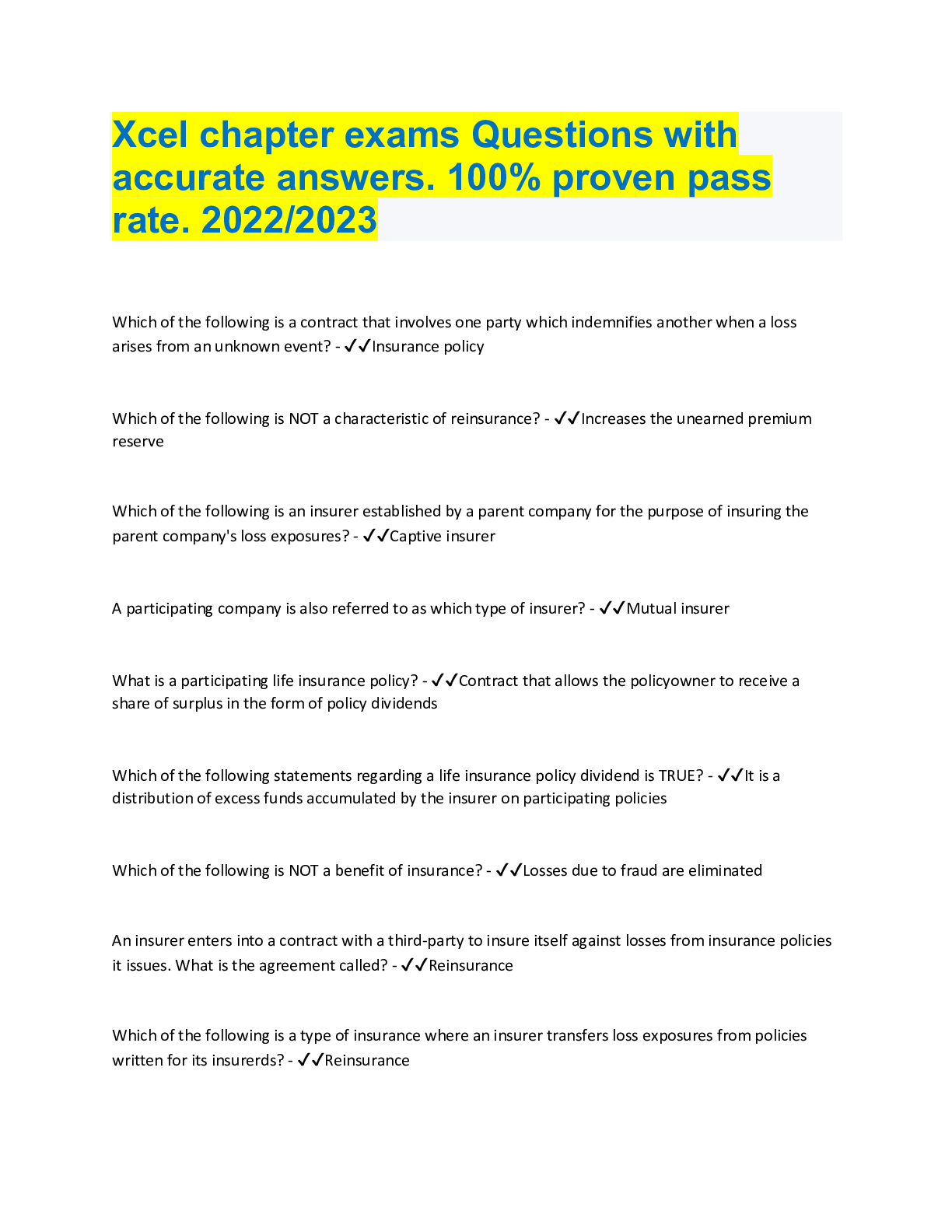

Business Law > QUESTIONS & ANSWERS > Xcel chapter exams Questions with accurate answers. 100% proven pass rate. 2022/2023 (All)

Xcel chapter exams Questions with accurate answers. 100% proven pass rate. 2022/2023

Document Content and Description Below

Xcel chapter exams Questions with accurate answers. 100% proven pass rate. 2022/2023 Which of the following is a contract that involves one party which indemnifies another when a loss arises from ... an unknown event? - ✔✔Insurance policy Which of the following is NOT a characteristic of reinsurance? - ✔✔Increases the unearned premium reserve Which of the following is an insurer established by a parent company for the purpose of insuring the parent company's loss exposures? - ✔✔Captive insurer A participating company is also referred to as which type of insurer? - ✔✔Mutual insurer What is a participating life insurance policy? - ✔✔Contract that allows the policyowner to receive a share of surplus in the form of policy dividends Which of the following statements regarding a life insurance policy dividend is TRUE? - ✔✔It is a distribution of excess funds accumulated by the insurer on participating policies Which of the following is NOT a benefit of insurance? - ✔✔Losses due to fraud are eliminated An insurer enters into a contract with a third-party to insure itself against losses from insurance policies it issues. What is the agreement called? - ✔✔Reinsurance Which of the following is a type of insurance where an insurer transfers loss exposures from policies written for its insurerds? - ✔✔Reinsurance When a mutual insurer becomes a stock company, the process is called - ✔✔Demutualization Which of the following describes the increase in the probability of a loss due to an insureds dishonest tendencies? - ✔✔moral hazard An insurer having a large number of similar exposure unit it's considered important because - ✔✔The greater the number insured, the more accurately the insurer can predict losses and set appropriate premiums Which of the following is considered to be any situation that has the potential for loss? - ✔✔Loss exposure Which of the following is a situation where there is a possibility of either a loss or a gain? - ✔✔Speculative risk Restoring an insured to the same condition as before a loss is known as - ✔✔principle of indemnity Which of these statements correctly describes risk? - ✔✔Pure risk is the only insurable risk Moral hazard is described as the - ✔✔increased chance of a loss because of an insured's dishonest tendencies Which of the following best describes the statement "The more times and event is repeated, the more predictable the outcome becomes"? - ✔✔Law of large numbers Which of the following refers to a condition that may increase the chance of a loss? - ✔✔hazard Which of the following would NOT be accomplished with the purchase of an insurance policy? - ✔✔Risk is eliminated All of the following circumstances must be met for a loss retention to be an effective risk management technique, EXCEPT - ✔✔Probability of loss is unknown Which of the following is NOT an element of an insurable risk? - ✔✔The loss must be catastrophic Which type of risk is gambling? - ✔✔Speculative risk Which of the following is NOT considered a definition of a risk? - ✔✔The cause of loss Which of the following is NOT a requirement of a contract? - ✔✔Equal consideration is required between the involved parties If a material warranty violation on the part of the insured is found, what recourse does an insurer have? - ✔✔Rescind the policy Restoring an insured to the same condition as before a loss is an example of the principle of - ✔✔Indemnity A unilateral contract is one in which - ✔✔only one party (the insurer) makes any kind of legally enforceable promise What does the insurance term "indemnity" refer to? - ✔✔Make whole Express power given to an agent in an agency agreement is - ✔✔the authority to represent the insurer Reasonably necessary acts that an agent must perform for carrying out his/her expressly authorized duties are covered by an agent's - ✔✔implied authority Which course of action is the insurer entitled to when deliberate concealment is committed by the insured? - ✔✔Rescinding the contract Which statement is CORRECT when describing a contract of adhesion? - ✔✔Contract may be accepted or rejected by the insured When handling premiums for an insured, an agent is acting in which capacity? - ✔✔fiduciary Which of the following contracts is defined as "One that restores an injured party to the condition that was present before the loss"? - ✔✔Indemnity contract Which principle is accurately described with the statement "Insureds are entitled to recover and amount NOT greater than the amount of their loss"? - ✔✔Indemnity The importance of a representation is demonstrated in what rule? - ✔✔Materiality of concealment A contract requires - ✔✔an offer and acceptance of the contract terms Which of the following is NOT required in the content of a policy? - ✔✔Probability of loss Which of the following statements do NOT apply to child coverage in a family policy? - ✔✔Only children born prior to policy's issue date may be included Scott has just purchased a new house. He is now shopping for a life insurance policy that provides a death benefit that matches the projected outstanding debt of his mortgage. Which life policy would best suit his needs? - ✔✔Mortgage redemption A life insurance policy that pays the face amount if the insured survives to a specified period of time is called - ✔✔endowment insurance Tom is shopping for a policy that covers two people and would pay the face amount ONLY when the first person dies. The type of life policy he is looking for is called a - ✔✔Joint Life Policy Mark, Age 45, has a modified endowment contract(MEC)t. What is the tax penalty for taking a loan against this policy prior to age 59 1/2? - ✔✔10% In a modified endowment contract, the penalty tax imposed on premature withdrawls is - ✔✔10% Which of the following is NOT true regarding a family policy that covers children? - ✔✔Conversion of child's coverage to permanent insurance requires evidence of insurability In a renewable term life insurance policy, the contract will usually - ✔✔require a higher premium payable at each renewal Lynn owns a life policy that guarantees the right to renew the policy each year, regardless of health, but at an increased premium. What kind of policy is this? - ✔✔Renewable term What is the proper order of initial life insurance premiums, from lowest to highest? - ✔✔Modified premium, ordinary life, single premium John and Mary have a handicapped child that is financially dependent upon them. The death of one of the parents would not be financially disastrous, however the death of both likely would be. Which policy would be best suited for them? - ✔✔Second-to-die policy Which of the following types of life insurance is normally associated with a mortgage loan? - ✔✔Decreasing term Which of the following is NOT a true description of non-medical life insurance? - ✔✔Applicants are not required to answer medical questions on the application A life insurance policy's limit of liability would be - ✔✔The policy's face amount A life insurance policy where that insured can choose where the cash value can be invested is called - ✔✔Variable life Which of the following is a life insurance policy that does NOT require a physical exam? - ✔✔Non-medical Which of the following types of life insurance combines a savings element along with a flexible premium option? - ✔✔Universal Life An insurance policy written after 1988 that fails to pass the seven-pay test is known as - ✔✔Modified Endowment Contract Which type of multiple protection policy pays on the death of the last person? - ✔✔Survivorship life policy Joe has a life insurance policy that has a face amount of $300,000. After a number of years, the policy's cash value accumulates to $50,000 and the face amount becomes $350,000. What kind of policy is this? - ✔✔Universal life policy In a life insurance policy, the entire contract consists of - ✔✔Policy and attached application How are acts of war and aviation treated under a group life insurance policy? - ✔✔Policy exclusion Jerry is an insured who understated his age on his life insurance application, paying $12 per $1000 of insurance instead of $15 per $1000. If he dies, how will the adjusted death benefit be calculated? - ✔✔12/15th of the policy's face amount Which of the following does a policy owner NOT have a right to change? - ✔✔Dividend schedule A life insurance policy can be surrendered for it's cash value under which policy provision? - ✔✔Nonforfeiture options Which provision will pay a portion of the death benefit prior to the insured's death due to a serious illness? - ✔✔Accelerated death benefit Which of the following is NOT a common life insurance policy rider? - ✔✔Extended term Which statement is true regarding policy dividends? - ✔✔A dividend option is selected by the insured at the time of policy purchase What are collateral assignments normally associated with? - ✔✔bank loans When a life insurance policy is surrendered, how does the cost recovery rule apply? - ✔✔The policy's cost basis is exempt from taxation What time period allows an insureds life insurance policy to remain in force even if the premium was not paid on the due date? - ✔✔grace period Which of these is NOT a valid policy dividend option? - ✔✔Monthly income payments What does the grace period allow a life insurance policy owner to do? - ✔✔Make a premium payment after the due date without any loss of coverage An insurer can be protected from adverse selection with which policy provision? - ✔✔Suicide clause How is a life insurance policy dividend legally defined? - ✔✔A return of excess premium and not taxable Bruce is involved in an accident and becomes totally and permanently disabled. His insurance policy continues in force without payment of further premiums. Which policy provision is responsible for this? - ✔✔Waiver of premium provision What does the guaranteed insurability option allow an insured to do? - ✔✔Purchase additional coverage with no evidence of insurability required When does a life insurance policy's waiver of premium take effect? - ✔✔Insured becomes totally disabled After a policy has lapsed, which provision allows the insured to continue coverage? - ✔✔Reinstatement provision Which policy provision protects the policyowner from unintentional lapse of the contract? - ✔✔grace period [Show More]

Last updated: 3 years ago

Preview 1 out of 18 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

XCEL BUNDLE. ALL VERSIONS OF EXAMS QUESTIONS WITH ANSWERS. GRADED A.

ALL VERSIONS OF THE XCEL EXAMS, GRADED A.

By Topmark 3 years ago

$29

17

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 14, 2022

Number of pages

18

Written in

All

Additional information

This document has been written for:

Uploaded

Oct 14, 2022

Downloads

0

Views

166