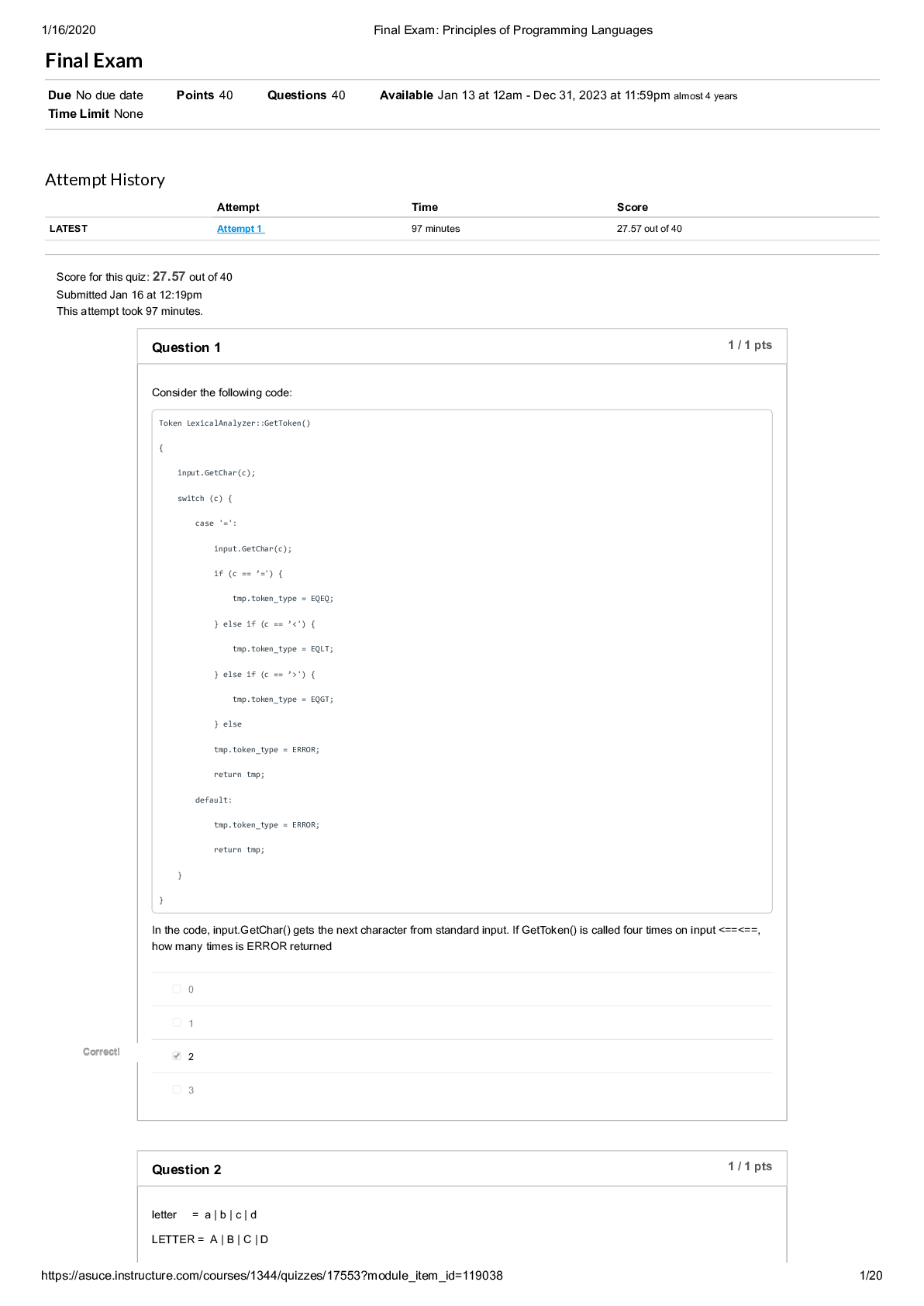

Final_Exam__Principles_of_Programming_Language_saveeeee. Arizona State University CSE 47708

$ 10

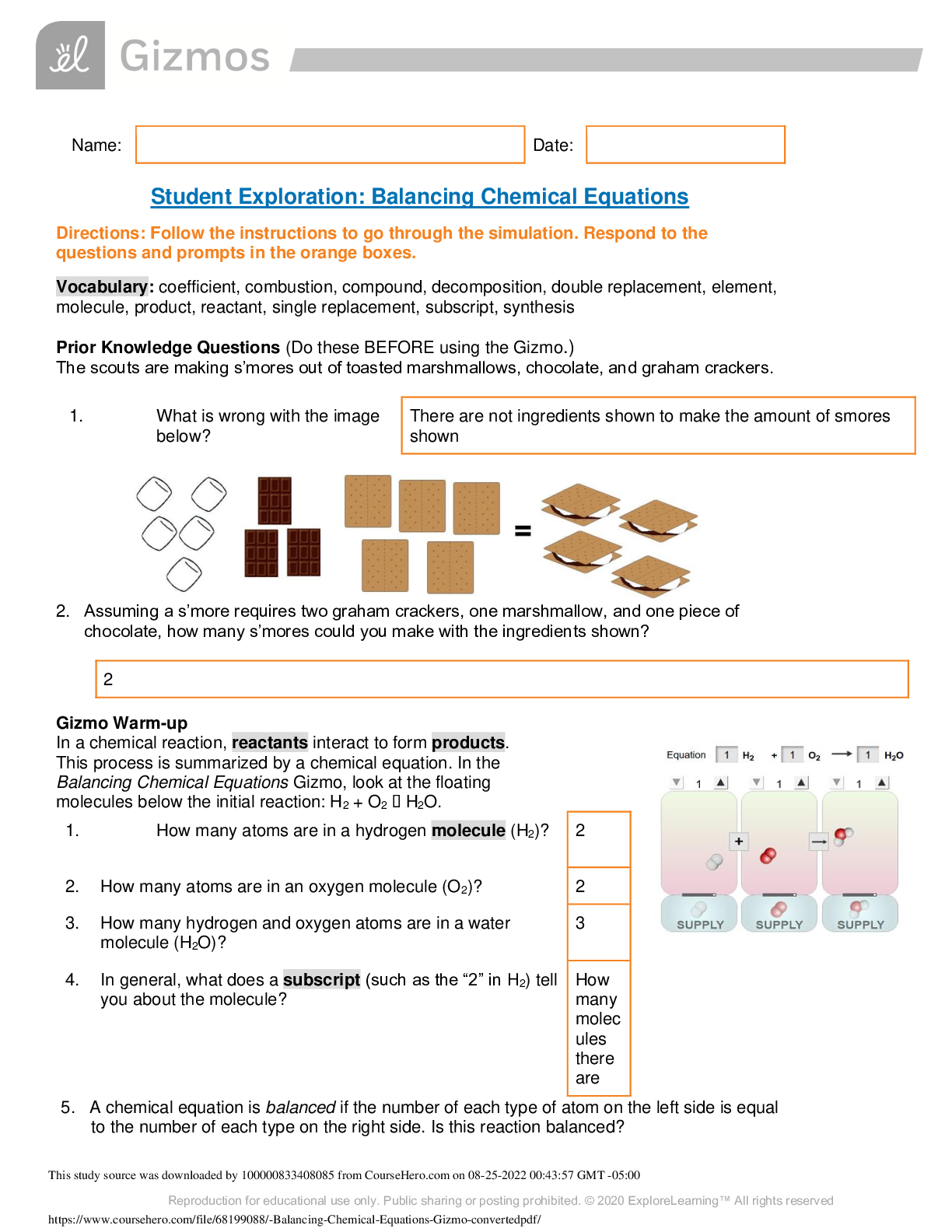

Balancing Chemical Equations Gizmo converted | all answers 100% correct | 4 pages

Health Care > QUESTIONS & ANSWERS > Primerica exam review Questions with accurate answers, Rated A. 2022/2023 (All)

Primerica exam review Questions with accurate answers, Rated A. 2022/2023 If an insurer meets the state's financial requirements and is approved to transact business in the state, it is considere ... d to be - ✔✔Authorized A participating insurance policy may do which of the following? - ✔✔Pay dividends to the policy owner An insured owns a life insurance policy. To be able to pay some of her medical bills, she withdraws a portion of the policy's cash value. There is a limit for a withdrawal and the insurer charges a fee. What type of policy does the insured most likely have? - ✔✔Universal life All of the following are examples of third-party ownership of a life insurance policy EXCEPT - ✔✔An insured borrows money from the back and makes a collateral assignment of a part of the death benefit to secure the loan. Which statement is NOT true regarding a Straight Life policy? - ✔✔Its premium steadily decreases over time, in response to its growing cash value. An individual purchased a $100,000 Joint Life policy on himself and his wife. Eight years later, he died in an automobile accident. How much will his wife receive from the policy? - ✔✔$100,000 A person takes out a loan in order to pay off his house. He dies several years later, having paid off only a small portion of the debt. Which of the following is true? - ✔✔If the lender has credit insurance, this amount will be paid to the lender. Two individuals are in the same risk and age class; yet, they are charged different rates of their insurance policies die to an insignificant factor. What is this called? - ✔✔Discrimination A man decided to purchase a $100,000 Annually Renewable Term Life policy to provide additional protection until his children finished college. He discovered that his policy - ✔✔Required a premium increase each renewal. If a consumer requests additional information concerning an investigation consumer report, how long does the insurer or reporting agency have to comply? - ✔✔5 days How is the Insurance Guaranty Association funded? - ✔✔By its members-authorized insurers An individual has just borrowed $10,000 from his bank on a 5-year installment loan requiring monthly payments. What type of life insurance policy would be best suited to this situation? - ✔✔Decreasing term After a back injury, an insured is disabled for a year. His insurance policy carries a Disability Income Benefit rider. Which of the following benefits will he receive? - ✔✔Monthly premium waiver and monthly income All of the following could be considered rebates if offered to an insured in the sale of insurance EXCEPT - ✔✔Dividends from a mutual insurer. The type of policy that can be changed from one that does not accumulate cash value to the one that does is a - ✔✔Convertible Term Policy. After its issuance, the temporary work authority expires after how many days - ✔✔180 days not 60 All of the following would be considered an insurance transaction EXCEPT - ✔✔Obtaining an insurance license. The requirement that agents must account for all insurance funds collected, and are not permitted to comingle those funds with their own is known as - ✔✔Fiduciary responsibility. What is the purpose of a fixed-period settlement option? - ✔✔To provide a guaranteed income for a certain amount of time During policy replacement, the replacing insurer must notify existing insurers within what time period? - ✔✔5 business days What significance did U.S. vs. South-Eastern Underwriters have on the insurance industry? - ✔✔It reversed the decision of Paul vs. Virginia, determining that insurance is interstate commerce and should be regulated federally. Items stipulated in the contract that the insurer will not provide coverage for are found in the - ✔✔Exclusions clause. When a life insurance policy is cancelled and the insured has selected the extended term nonforfeiture option, the cash value will be used to purchase term insurance that has a face amount - ✔✔Equal to the original policy for as long a period of time that the cash values will purchase. All of the following are characteristics of group life insurance EXCEPT - ✔✔Premiums are determined by the age, sex and occupation of each individual certificate holder. An individual applied for an insurance policy and paid the initial premium. The insurer issued a conditional receipt. Five days later the applicant had to submit to a medical exam. If the policy is issued, what would be the policy's effective date? - ✔✔The date of medical exam For a retirement plan to be qualified, it must be designed for the benefit of - ✔✔Employees. Which of the following statements about a life insurance policy would be allowed in an insurance advertisement? - ✔✔This is a term life insurance policy. Which of the following is a generic consumer publication that explains life insurance in general terms in order to assist the applicant in the decision-making process? - ✔✔Buyer's Guide Which of the following employees insured under a group life plan would be allowed to convert to individual insurance of the same coverage once the plan is terminated? - ✔✔Those who have been insured under the plan for at least 5 years The interest earned on policy dividends is - ✔✔taxable A rider that may be attached to a life insurance policy that will adjust the face amount based upon a specific index, such as the Consumer Price Index, is called - ✔✔Cost of living rider. According to the Entire Contract provision, a policy must contain - ✔✔A copy of the original application for insurance. Which is NOT true about beneficiary designations? - ✔✔The beneficiary must have insurable interest in the insured. Which of the following factors determines the amount of each installment paid in a Life Income Option arrangement? - ✔✔Recipient's life expectancy and amount of principal An insured pays $1,200 annually for her life insurance premium. The insured applies this year's $300 worth of accumulated dividends to the next year's premium, thus reducing it to $900. What option does this describe? - ✔✔Reduction of Premium Who is the owner and who is the beneficiary on a Key Person Life Insurance policy? - ✔✔The employer is the owner and beneficiary. What is reinsurance? - ✔✔An agreement between a ceding insurer an assuming insurer The McCarran Act stated that the federal government would not regulate insurance as long as an adequate job of regulating the industry was done by the - ✔✔States On a participating insurance policy issued by a mutual insurance company, dividends paid to policyholders are - ✔✔Not taxable since the IRS treats them as a return of a portion of the premium paid. When a producer was reviewing a potential customer's coverage written by another company, the producer made several remarks that were maliciously critical of that other insurer. The producer could be found guilty of - ✔✔Defamation Which of the following determines the cash value of a variable life policy? - ✔✔The performance of the policy portfolio Which provision of a life insurance policy states the insurer's duty to pay benefits upon the death of the insured, and to whom the benefits will be paid? - ✔✔Insuring clause Which of the following types of insurance policies is most commonly used in credit life insurance? - ✔✔Decreasing term If a producer has been convicted of a crime, he or she must notify the Commissioner within - ✔✔30 days Traditional IRA contributions are - ✔✔tax deducted What do individuals use to transfer their risk of loss to a larger group? - ✔✔Insurance If an applicant for a life insurance policy and person to be insured by the policy are two different people, the underwriter would be concerned about - ✔✔Whether an insurable interest exists between the individuals. Proceeds from life insurance policies are protected from the beneficiary's debts under all of the following circumstances EXCEPT - ✔✔Some of the premiums were paid in an attempt to defraud creditors. Which of the following is TRUE about the 10-day free look period in the Life Insurance Policy> - ✔✔It begins when the policy is delivered The National Do Not Call Registry was created to regulate - ✔✔telemarketers The insured under a $100,000 life insurance policy with a triple indemnity rider for accidental death was killed in a car accident. It was determined that the accident was his fault. The triple indemnity rider in the policy specifies that the death must not be contributed to by the insured in this case, what will the policy beneficiary receive? - ✔✔$100,000 All of the following are unfair claims settlement practices EXCEPT - ✔✔Suggesting negotiations in settling a claim All of the following information about the applicant is identifies in the General Information section of a life Insurance application Except - ✔✔Education Which of the following statements is TRUE about the policy assignment? - ✔✔It transfers rights of ownership from the owner to another person Life insurance death proceeds are - ✔✔Generally not taxed as income What describes the specific information about a policy? - ✔✔Policy summary Death benefits payable to a beneficiary under a life insurance policy are generally - ✔✔Not subject to income taxation by Federal Government Under which nonforfeiture option does the company pay the surrender value and have no further obligations to the policy owner? - ✔✔Cash surrender Which of the following types of insurance would be written by a limited lines agent? - ✔✔Credit Insurance if an insurer issued a policy based on the application that held unanswered questions, which of the following will be TRUE? - ✔✔The policy will be interpreted as if the insurer waived its right to have an answer on the application A producer's license was revoked as a result of the Insurance Code violation. Which the following is TRUE? - ✔✔The producer will have to wait 5 years before applying for license reinstatement Which of the following would be considered false advertisement? - ✔✔Implying that the agent is the insurer If an insurance company wished to order a consumer report on an applicant to assist in the underwriting process, and if a notice of insurance information practices has been provided, the report may contain all of the following information EXCEPT the applicants - ✔✔Ancestry A life insurance policy does not have a war clause. Of the insured is killed during a time of war, what will the beneficiary receive from the policy? - ✔✔The full death benefit Which rider, when attached to a permanent life insurance policy, provides an amount of insurance on every family member? - ✔✔Family Term Rider Which Universal Life option has a gradually increasing cash value and a level death benefit? - ✔✔Option A If a telemarketer wants to make an unsolicited sales call to a potential customer whaat is the earliest time the telemarketer can call the prospects residence? - ✔✔8 am Most agents try to collect the initial premium for submission with the application. When an agent collects the initial premium from the applicant, the agent should issue the applicant a - ✔✔Premium receipt Why is an equity indexed annuity considered to be a fixed annuity? - ✔✔It has a guaranteed minimum interest rate Which of the following are NOT fundable by annuities? - ✔✔Death benefits Which of the following best describes an insurance company that as been formed under the laws of this state? - ✔✔Domestic An insured purchased a life insurance policy on his life naming his wife as primary beneficiary, and his daughter as contingent beneficiary. Under what circumstances could the daughter collect the death benefit? - ✔✔If the primary beneficiary predeceases the insured The insurer must maintain copies of Notice Regarding Replacement and the comparative information form, policy summary, and all sales materials until the next regular examination by the Department of Banking and Insurance or for at least - ✔✔5 years Agents who persuade insureds to cancel a policy in favor of another one when it might not be in the insured's best interest are guilty of - ✔✔Twisting At the time the insured purchased her life insurance policy, she added a rider that will allow her to purchase additional insurance in the future without having to prove insurability. This rider is called - ✔✔Guaranteed Insurability If a violation of the New Jersey insurance code were to occur, a cease and desist order and/or penalty may be issued. Who may issue a cease and desist order? - ✔✔Commissioner Provided that it is a first offense, what is the maximum penalty for failing to respond to a subpoena? - ✔✔$5000 What method do insurers use to protect themselves against catastrophic losses? - ✔✔Reinsurance In order to become a producer in New Jersey, after submitting a licensing applicatoin, candidates must pass a licensing examination with - ✔✔1 year What is the fine for violating the Commissioner's cease and desist order? - ✔✔5000 Which of the following describes the tax advantage of a qualified retirement plan? - ✔✔The earnings in the plan accumulate tax deferred. Twin brothers are starting a new business. They know it will take several years to build the business to the point that they can pay off the debt incurred in starting the business. What type of insurance would be the most affordable and still provide a death benefit should one of them die? - ✔✔Joint Life Which of the following is the legal name of a corporation or partnership under which a licensee conducts insurance business? - ✔✔Business name Circulating deceptive sales material to the public is what type of Unfair Trade Practice? - ✔✔False advertising All of the following are true regarding the guaranteed insurability rider EXCEPT - ✔✔This rider is available to all insureds with no additional premium. Under an extended term nonforfeiture option, the policy cash value is converted to - ✔✔The same face amount as in the whole life policy. An insurer wants to begin underwriting procedures for an applicant. What source will it consult for the majority of its underwriting information? - ✔✔application Licensees must notify the Department within how many days of any change of address? - ✔✔30 Which life insurance settlement option guarantees payments for the lifetime of the recipient, but also specifies a guaranteed period, during which, if the original recipient dies, the payments will continue to a designated beneficiary? - ✔✔Life income with period certain Which of the following factors determines the amount of each installment paid in a Life Income Option arrangement? - ✔✔Recipient's life expectancy and amount of principal An insurer cancelled a contract with a producer on April 1st. By what date must the insurer notify the Commissioner of this action? - ✔✔April 15th Which is true about a spouse term rider? - ✔✔The rider is usually level term insurance. All of the following are TRUE regarding the convertibility option under a term life insurance policy EXCEPT - ✔✔Upon conversion, the death benefit of the permanent policy will be reduced by 50%. Which of the following entities is held responsible for the contents of an insurer's advertisement on local TV station? - ✔✔The insurance company Which of the following riders is often used in business life insurance policies when the policyowner needs to change the insured under the policy? - ✔✔Substitute insured rider Producer's and insurer's actions related to insurance transactions, from selling insurance to processing claims are referred to as - ✔✔Insurance-related conduct [Show More]

Last updated: 3 years ago

Preview 1 out of 33 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

all you need to pass the primerica exams PRIMERICA EXAMS BUNDLE. CONSISTS OF EXAMINABLE QUESTIONS AND ANSWERS. RATED A

By Topmark 3 years ago

$32

16

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Oct 14, 2022

Number of pages

33

Written in

All

This document has been written for:

Uploaded

Oct 14, 2022

Downloads

0

Views

329

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·