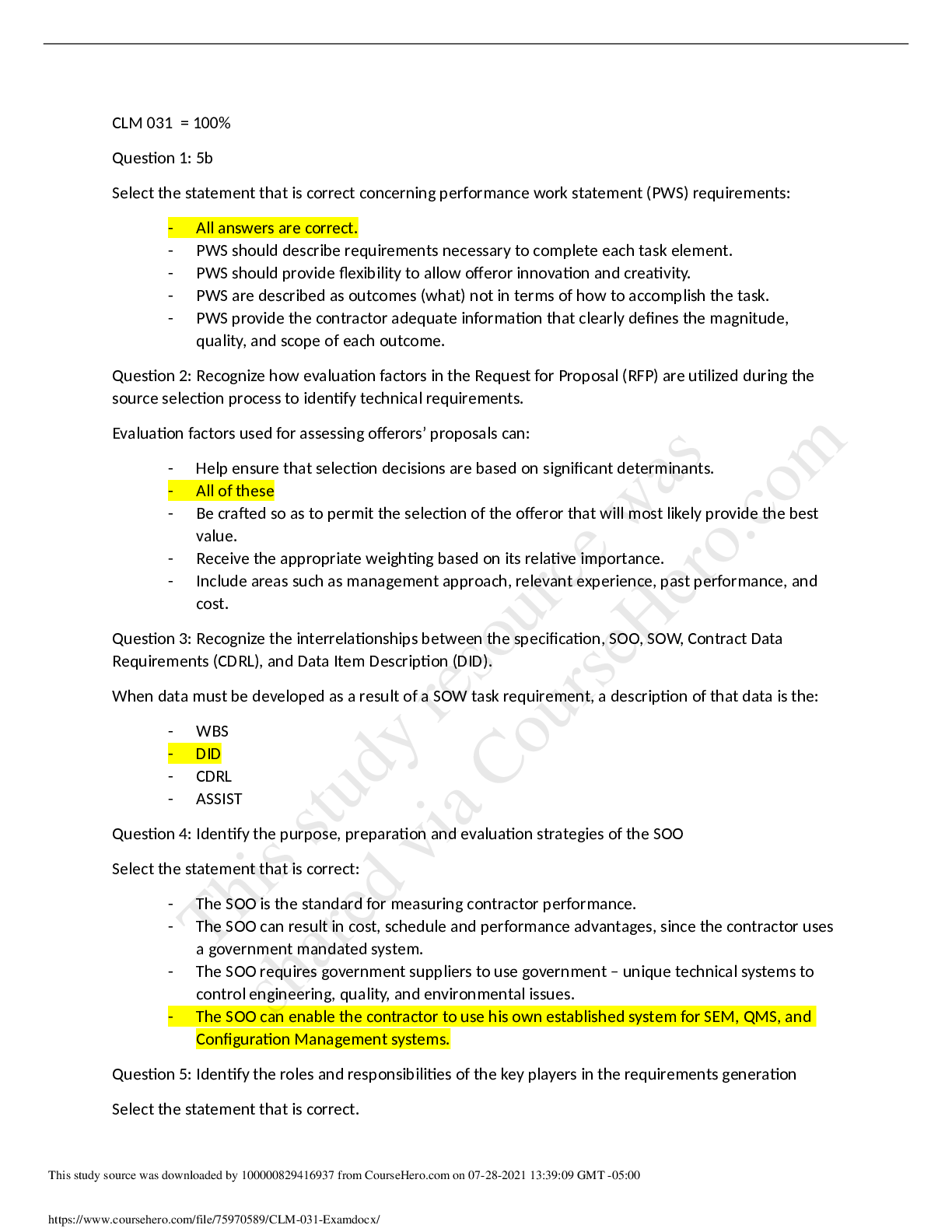

Business > QUESTIONS & ANSWERS > Module 4 Final Quiz (All)

Module 4 Final Quiz

Document Content and Description Below

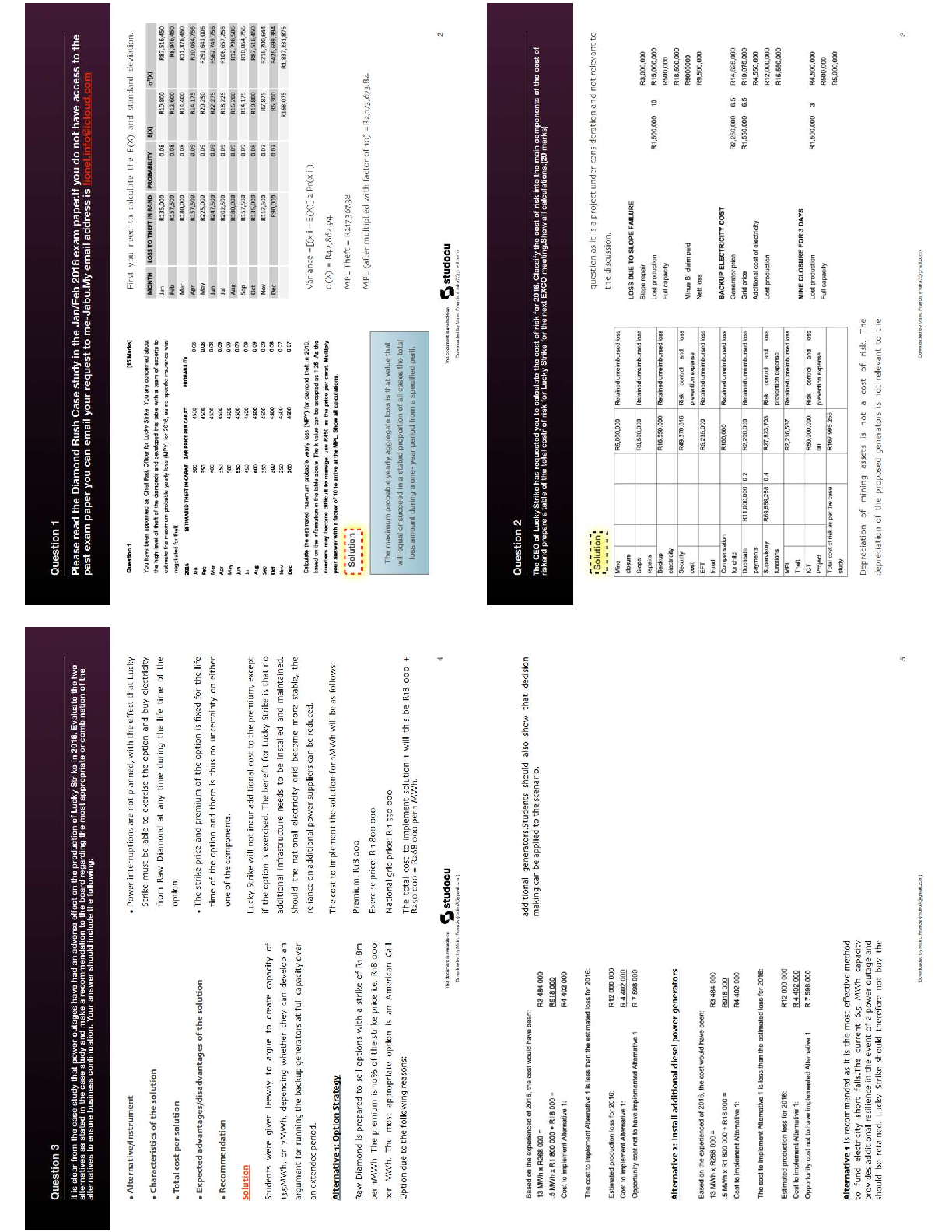

1 / 1 pts Question 1 Doc and Brewster are in a negotiation over royalties. The negotiations proceed as follows. Doc can make an offer that is either high (H), medium (M) or low (L). Having received ... the offer, Brewster can either accept (A) or reject (R) any offer received. The payoffs are as follows. If an offer of H is accepted, the payoffs are (30, 8) to Doc and Brewster, respectively. If an offer of H is rejected, the payoffs are (18, 16). If an offer of M is made and accepted, the payoffs are (20, 8). If an M offer is rejected the payoffs are (5, 5). If a low offer is made and accepted the payoffs are (30, 5) and if an of L is rejected the payoffs are (10, 15). In the subgame perfect equilibrium outcome Brewster receives a payoff of 1 / 1 pts Question 2 Chrissie owns a vintage guitar that she values at $0. Mark would like to buy the guitar and values it at $1000. The negotiations are as follows. Chrissie suggests a price to Mark. If Mark agrees trade takes place at the agreed price. If Mark rejects the offer, Mark buys an identical guitar from Angus for a price of $400 and Chrissie receives a payoff of $0. What is the outcome of the negotiations? 1 / 1 pts Question 3 Chrissie owns a vintage guitar that she values at $0. Mark would like to buy the guitar and values it at $1000. The negotiations are as follows. Chrissie suggests a price to Mark. If Mark agrees trade takes place at the agreed price. If Mark rejects the offer, negotiations end and each party receives a payoff of $0. What is the outcome of the negotiations? Ques 1 / 1 pts tion 4 JJ and PW are in a negotiation that involves each party simultaneously choosing their strategy. JJ can either offer a high (H) or a low (L) price. PW can opt to Accept (A) or reject (R). If JJ opts for H and PW A, the payoffs are 6 to JJ and 4 to PW. If JJ opts for H and PW R, the payoffs are 4 to JJ and 6 to PW. If JJ goes L and PW A, the payoffs are 8 to JJ and 3 to PW. Finally, if JJ goes L and PW R, the payoffs are 7 and 5, to JJ and PW, respectively. Which of the following statements are true? Consider the CBA negotiating with Myer regarding the rate of interest for a loan. The CBA can offer any interest rate r between 0 and 10. If Myer accepts the payoff to the CBA is r, and the payoff to Myer is 10 – r. If Myer rejects the offer the payoffs are 0 to both parties. What is the strategy of Myer in any credible equilibrium? Ainslie is in a team with Michelle and together they must produce a report for their boss. To determine who will do the work, they engage in the following negotiations: Ainslie can propose that either she does the work, or that Michelle does the work. Michelle can then accept or reject Ainslie’s offer. If Ainslie offers to do the work, and Michelle accepts this offer, Ainslie gets a payoff of 20 and Michelle a payoff of 40. If Michelle rejects this offer both get a payoff of 10. If Ainslie suggests Michelle do the work and Michelle accepts, the payoffs are 50 to Ainslie and 20 to Michelle. If Michelle rejects Ainslie’s suggestion that Michelle is the one who should complete the work, Ainslie has an opportunity to respond. At this juncture, Ainslie can opt not to do the work, and both workers get a payoff of 10. If Ainslie chooses to do the work, she receives a payoff of 15 and Michelle gets a return of 50. What is the outcome of this negotiation process? The Australian government is negotiating a trade deal with the EU. The use of terms like ‘fetta’ by Australian firms is one of the negotiating sticking points. Consider the following negotiation. The EU can offer “No Fetta” or “Status Quo” (that is allow Australia to continue to use such terms. Following either choice by the EU, Australia can choose “Accept” of “Reject”. If the EU offers “No Fetta” and Australia accepts, the payoffs are (50, 10) to the EU and Australia, respectively. If the EU offers “No Fetta” and Australia Rejects, the payoffs are (30, 20). Now consider the payoffs if the EU offers the “Status Quo”. If Australia “Rejects” this offer, the payoffs are (30, 20). If, on the other hand, Australia “Accepts” this offer, the payoffs are 40 to each region. What will be observe in the credible (subgame perfect) equilibrium of this negotiation? [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 03, 2022

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Nov 03, 2022

Downloads

0

Views

110