Finance > QUESTIONS & ANSWERS > Ryerson UniversitySchool name FIN 701 jusstin (All)

Ryerson UniversitySchool name FIN 701 jusstin

Document Content and Description Below

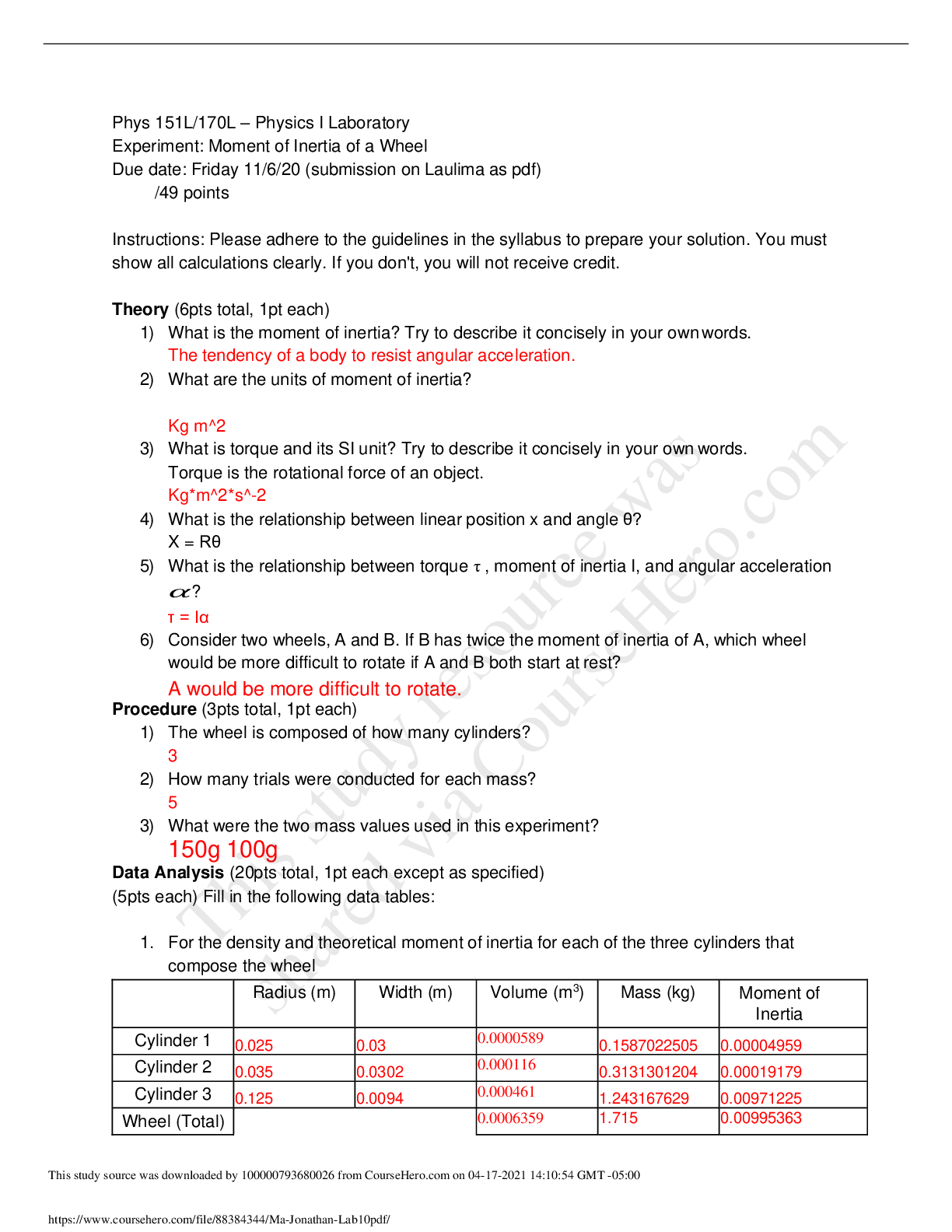

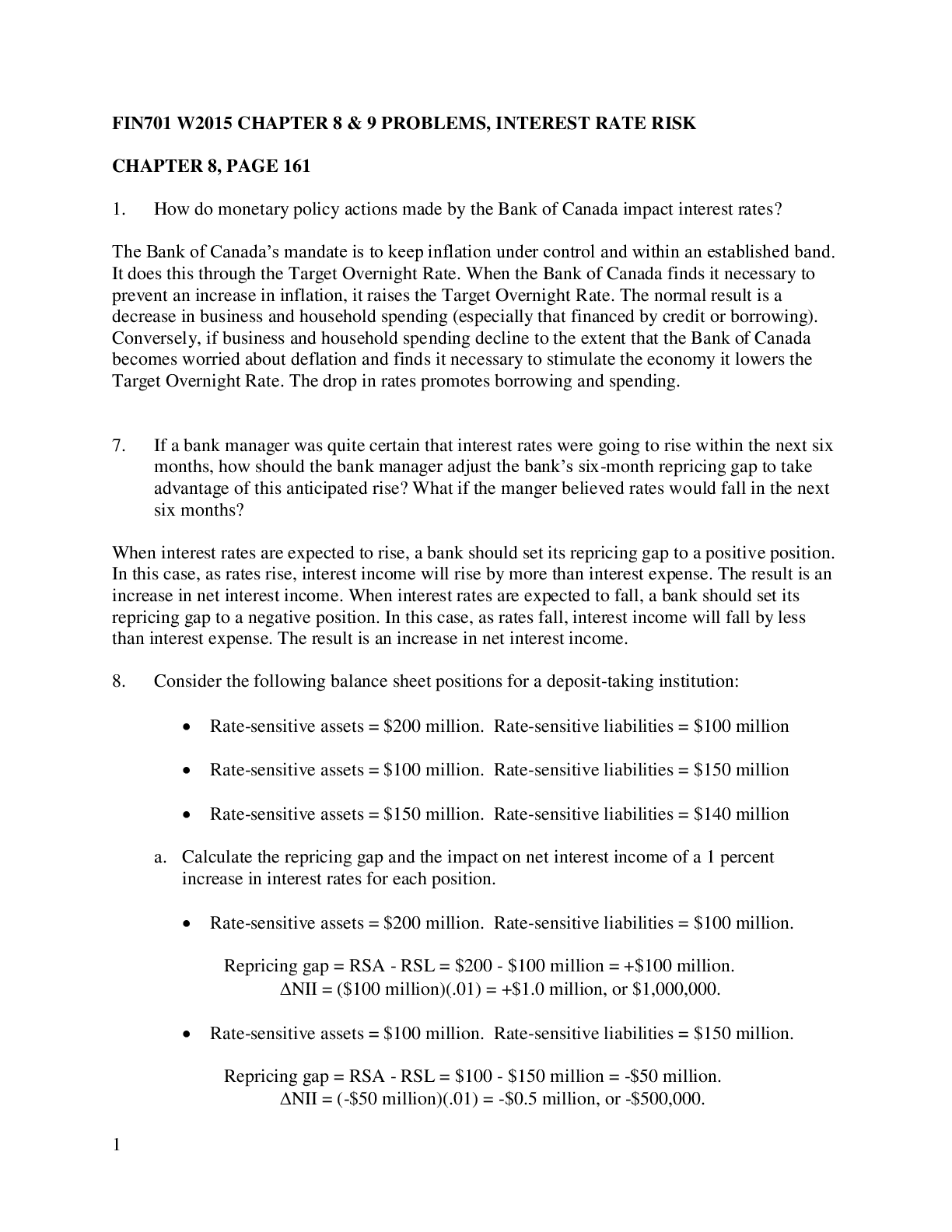

FIN701 W2015 CHAPTER 8 & 9 PROBLEMS, INTEREST RATE RISK CHAPTER 8, PAGE 161 1. How do monetary policy actions made by the Bank of Canada impact interest rates? The Bank of Canada’s mandate is to ... keep inflation under control and within an established band. It does this through the Target Overnight Rate. When the Bank of Canada finds it necessary to prevent an increase in inflation, it raises the Target Overnight Rate. The normal result is a decrease in business and household spending (especially that financed by credit or borrowing). Conversely, if business and household spending decline to the extent that the Bank of Canada becomes worried about deflation and finds it necessary to stimulate the economy it lowers the Target Overnight Rate. The drop in rates promotes borrowing and spending. 7. If a bank manager was quite certain that interest rates were going to rise within the next six months, how should the bank manager adjust the bank’s six-month repricing gap to take advantage of this anticipated rise? What if the manger believed rates would fall in the next six months? When interest rates are expected to rise, a bank should set its repricing gap to a positive position. In this case, as rates rise, interest income will rise by more than interest expense. The result is an increase in net interest income. When interest rates are expected to fall, a bank should set its repricing gap to a negative position. In this case, as rates fall, interest income will fall by less than interest expense. The result is an increase in net interest income. 8. Consider the following balance sheet positions for a deposit-taking institution: Rate-sensitive assets = $200 million. Rate-sensitive liabilities = $100 million Rate-sensitive assets = $100 million. Rate-sensitive liabilities = $150 million Rate-sensitive assets = $150 million. Rate-sensitive liabilities = $140 million a. Calculate the repricing gap and the impact on net interest income of a 1 percent increase in interest rates for each position. Rate-sensitive assets = $200 million. Rate-sensitive liabilities = $100 million. Repricing gap = RSA - RSL = $200 - $100 million = +$100 million. NII = ($100 million)(.01) = +$1.0 million, or $1,000,000. Rate-sensitive assets = $100 million. Rate-sensitive liabilities = $150 million. Repricing gap = RSA - RSL = $100 - $150 million = -$50 million. NII = (-$50 million)(.01) = -$0.5 million, or -$500,000. 2 Rate-sensitive assets = $150 million. Rate-sensitive liabilities = $140 million. Repricing gap = RSA - RSL = $150 - $140 million = +$10 million. NII = ($10 million)(.01) = +$0.1 million, or $100,000. b. Calculate the impact on net interest income on each of the above situations assuming a 1 percent decrease in interest rates. NII = ($100 million)(-.01) = -$1.0 million, or -$1,000,000. NII = (-$50 million)(-.01) = +$0.5 million, or $500,000. NII = ($10 million)(-.01) = -$0.1 million, or -$100,000. c. What conclusion can you draw about the repricing model from these results? The FIs in parts (1) and (3) are exposed to interest rate declines (positive repricing gap) while the FI in part (2) is exposed to interest rate increases. The FI in part (3) has the lowest interest rate risk exposure since the absolute value of the repricing gap is the lowest, while the opposite is true for part (1). 11. What is the gap to total assets ratio? What is the value of this ratio to interest rate risk managers and regulators? The gap to total assets ratio is the ratio of the cumulative gap position to the total assets of the bank. The cumulative gap position is the sum of the individual gaps over several time buckets. The value of this ratio is that it tells the direction of the interest rate exposure and the scale of that exposure relative to the size of the bank. [Show More]

Last updated: 2 years ago

Preview 1 out of 13 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$5.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 10, 2022

Number of pages

13

Written in

Additional information

This document has been written for:

Uploaded

Nov 10, 2022

Downloads

0

Views

41

.png)