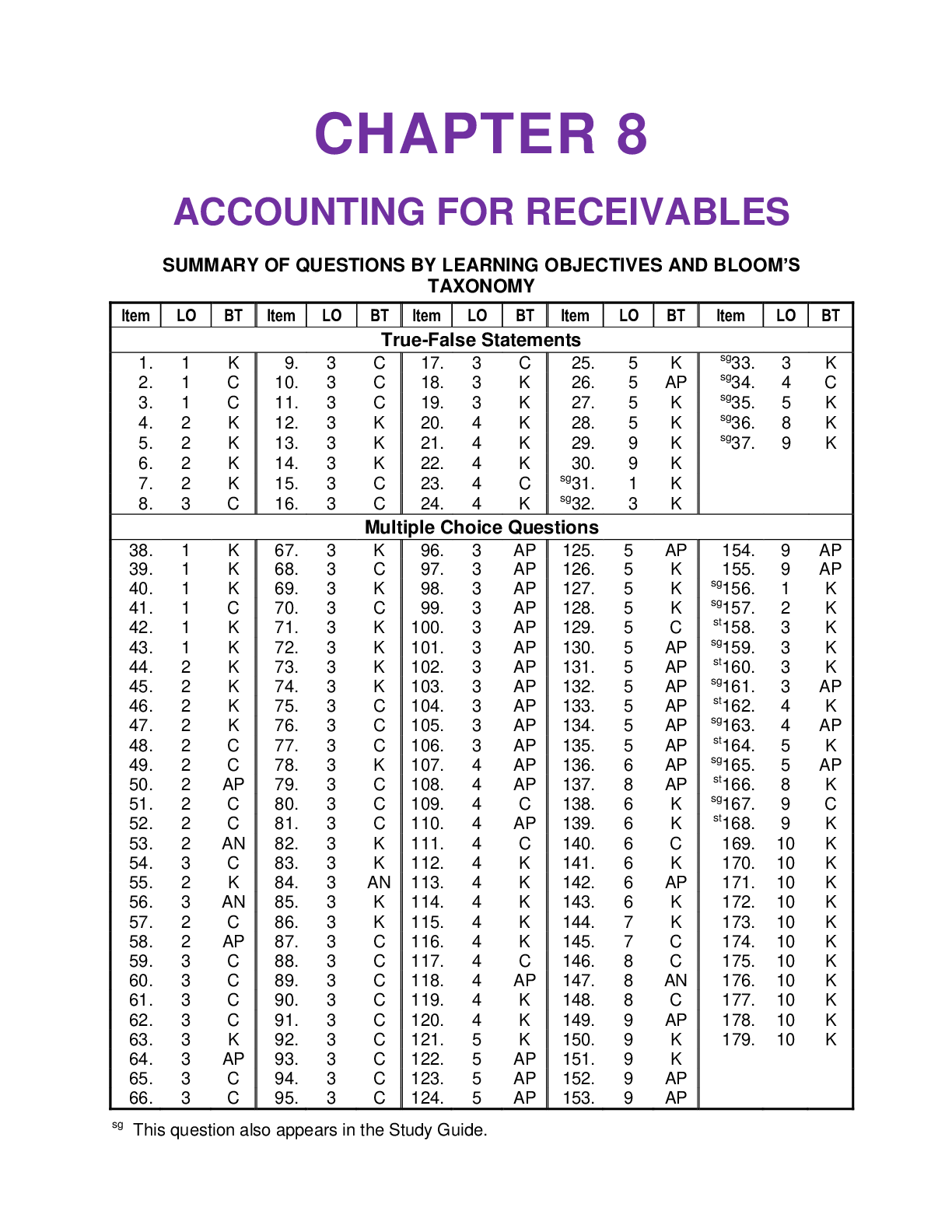

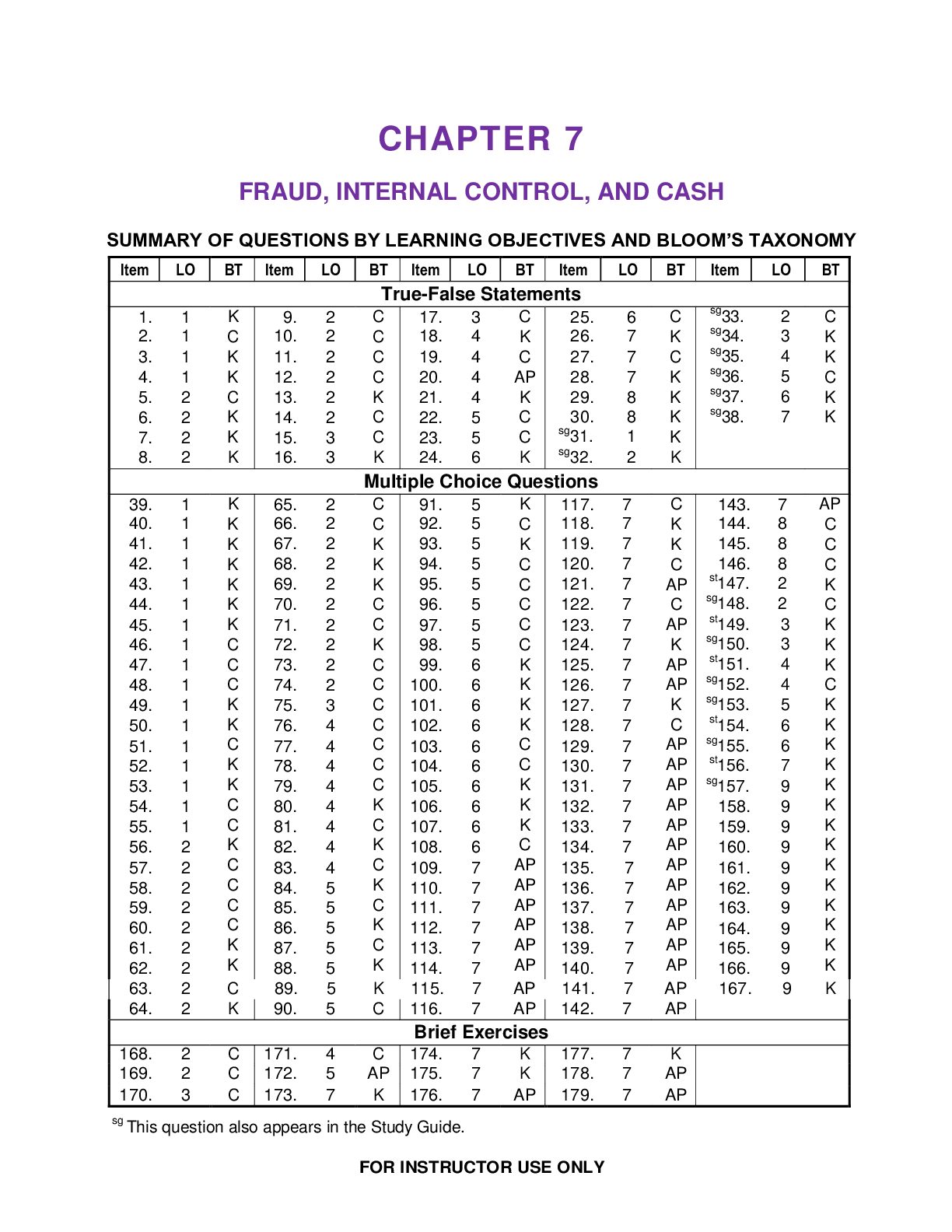

Financial Accounting > TEST BANK > CHAPTER 7 FRAUD, INTERNAL CONTROL, AND CASH: Test Bank for Accounting Principles, Eleventh Edition. (All)

CHAPTER 7 FRAUD, INTERNAL CONTROL, AND CASH: Test Bank for Accounting Principles, Eleventh Edition. This document/TEST BANK Contains 235 Questions With Answers, Worked Solutions and Essay Explanations

Document Content and Description Below