For corrections and clarifications, just private message me, okay? ?

______________________________________________________________________________

Problem 1 The Joven Company owns 75% of the Jay Company. The following

...

For corrections and clarifications, just private message me, okay? ?

______________________________________________________________________________

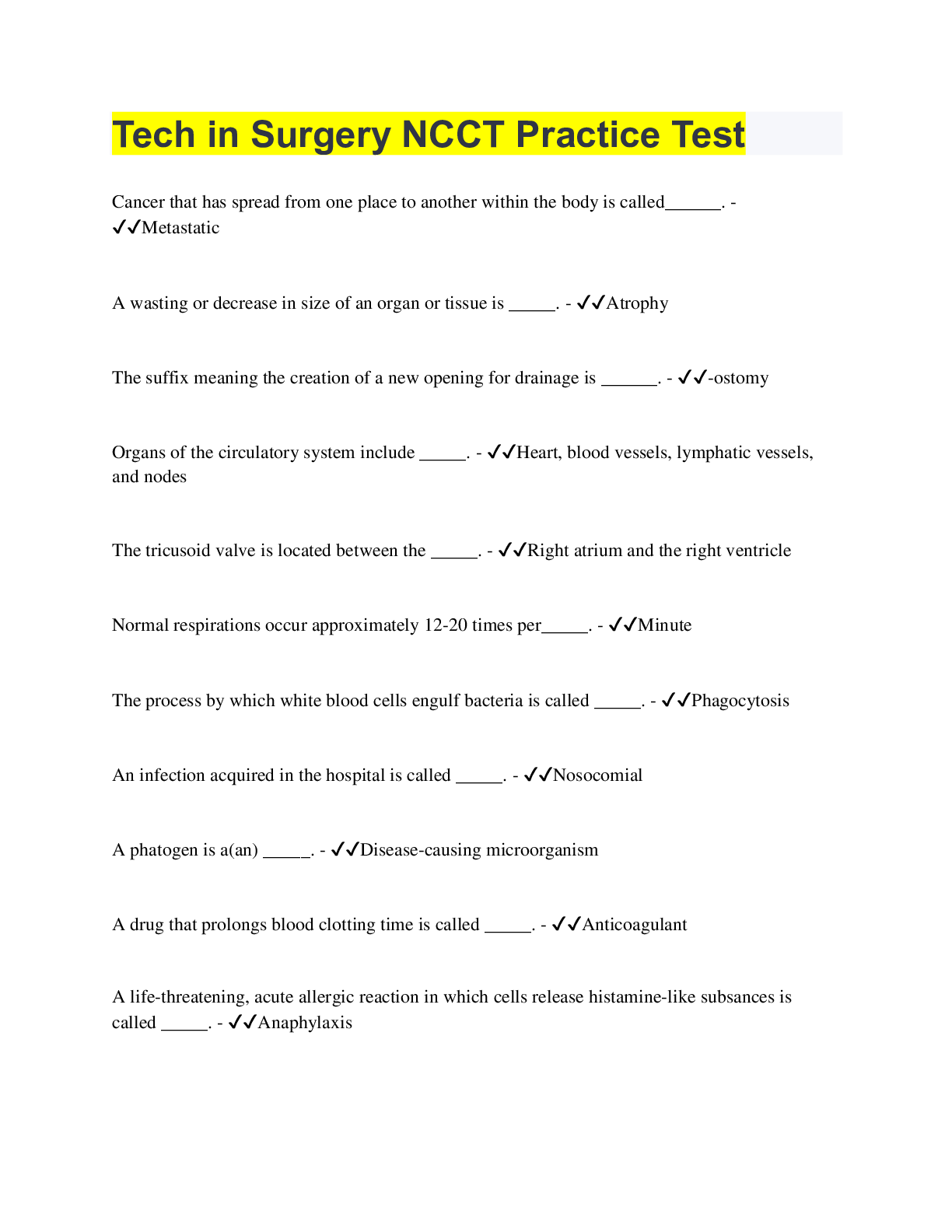

Problem 1 The Joven Company owns 75% of the Jay Company. The following figures are from

their separate financial statements:

Joven: Trade receivables P1,040,000, including P30,000 due from Jay.

Jay: Trade receivables P215,000, including P40,000 due from Joven.

1. According to PAS 27 Consolidated and separate financial statements, what figure in respect

should appear for trade receivables in Joven’s consolidated statement of financial position?

Suggested Solution

Joven (1,040,000 - 30,000) 1,010,000

Jay (215,000 - 40,000) 175,000

Total Trade Receivables 1,185,000

____________________________________________________________________________

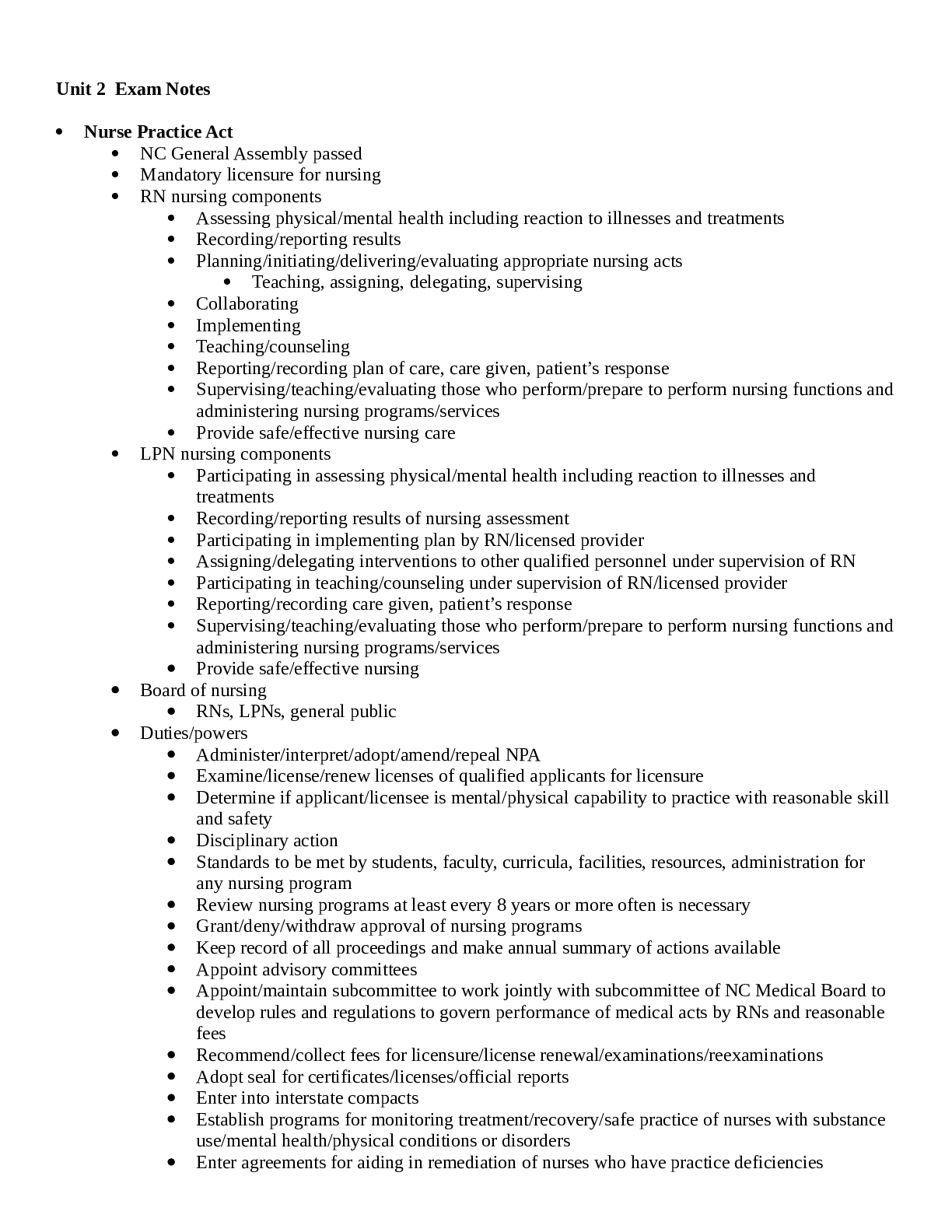

Problem 2 The Jenny Company acquired an 80% interest in the Mar Company when Mar’s equity

share capital of P500,000 and retained earnings of P2,500,000. Mar’s current statement of financial

position shows share capital of P500,000 and a revaluation reserve of P2,000,000 and retained

earnings of P7,000,000.

1. Under PAS 27 Consolidated and separate financial statements, what figure in respect of Mar’s

retained earnings should be included in the Consolidated statement of financial position?

(Hanapin mo yun change ng re ni S at share ni P)

Suggested Solution

Mar’s retained earnings, date of acquisition 2,500,000

Less: Mar’s retained earnings, end of the current reporting period 7,000,000

Total 4,500,000

X: controlling interest % 80%

Mar’s retained earnings included in the consolidated financial position 3,600,000

____________________________________________________________________________

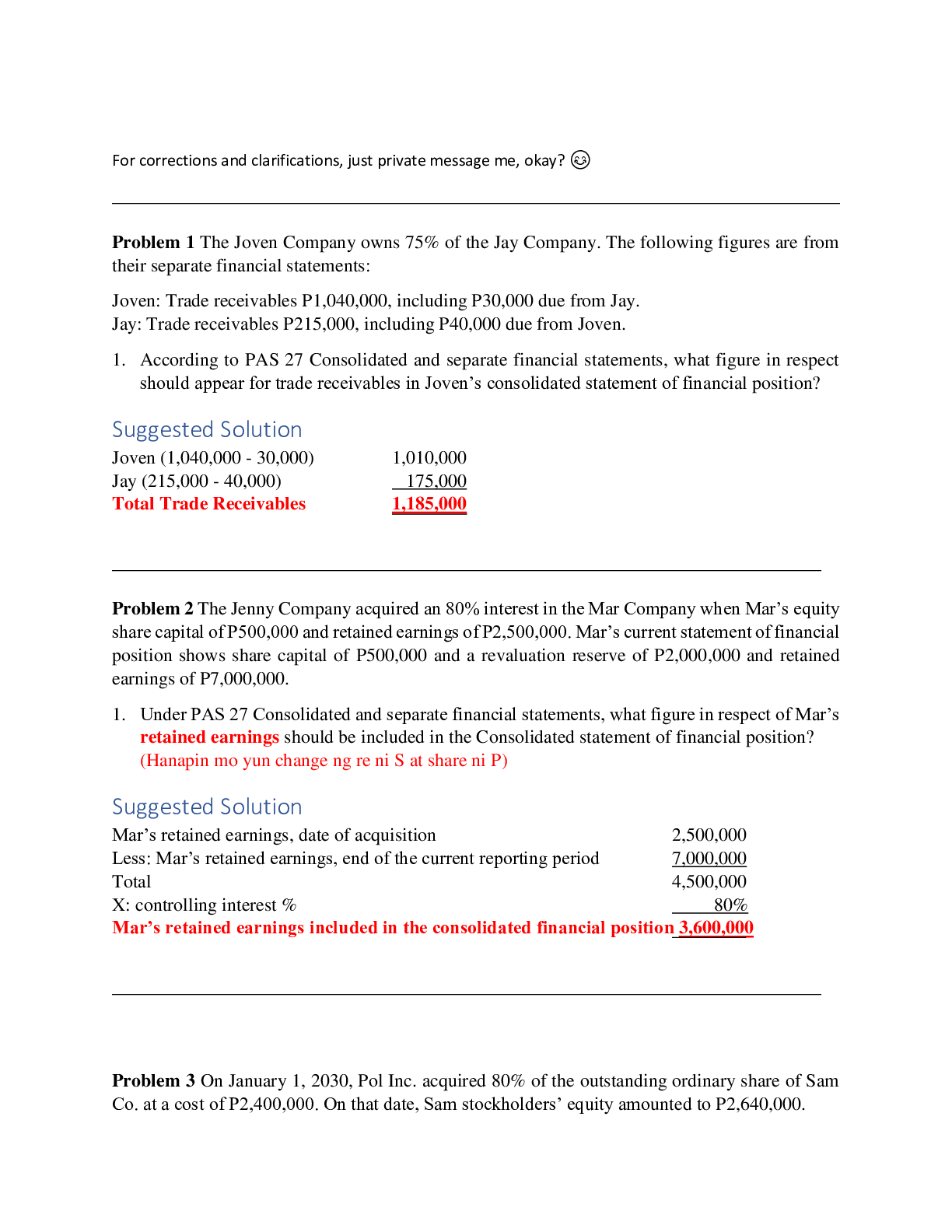

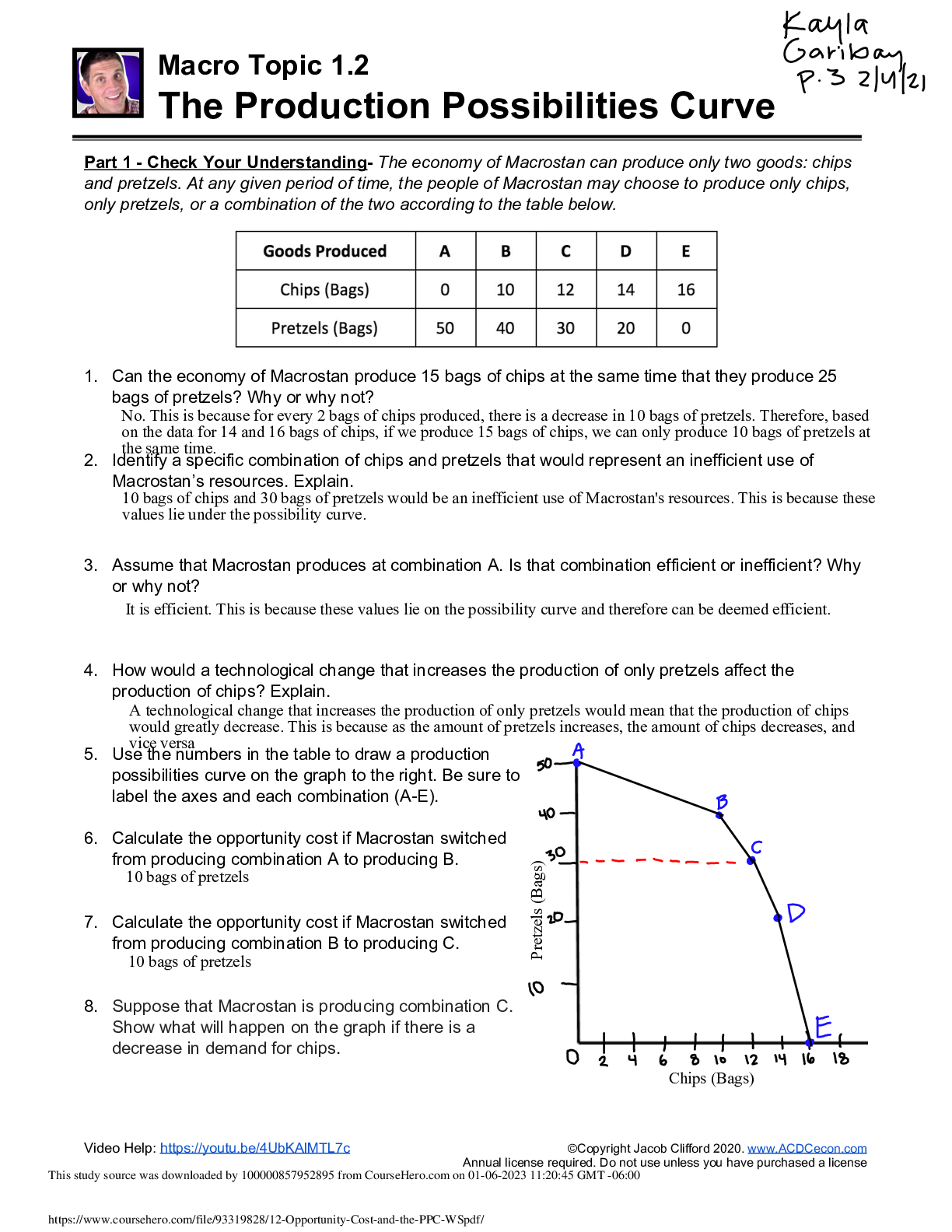

Problem 3 On January 1, 2030, Pol Inc. acquired 80% of the outstanding ordinary share of Sam

Co. at a cost of P2,400,000. On that date, Sam stockholders’ equity amounted to P2,640,000.

On April l, 2030, Pol sold a machine with book value of P150,000 to Sam for P270,000. The gain

included in the 2030 net income of Pol Inc. The machine has a remaining useful life of 5 years.

The net income from their own operation (KASI: from own operations daw, so although sinabi ni

prob nan aka equity method sya ibig parin sabihin wala pa dyan ang income from Sub and

remember acctg for S using equity method is the same sa conso dahil sa changes in na for fv and

amort chinacharge sa Investment income) of Pol and Sam are P1,500,000 and P787,500,

respectively. The dividend declared by Pol and Sam in year 2030 are P1,000,000 and P250,000.

Pol Inc. uses equity method to the accounts for its investment in Sam Co.

1. What is the total consolidated net income attributable to Pol Inc. in year 2030?

2. On December 31, 2030, what is the balance of investment income in Sam in the separate

books of Pol?

Suggested Solution

Req. 1

Net Income – Pol 1,500,000

Investment Income - Dec. 31, 2030 528,000

Consolidated Income attributable to Pol 2,028,000

Req. 2

Net income of Sam (787,500 x 80%) 630,000

Unrealized gain on sale of machine (270,000 -150,000) (120,000)

Realized gain (depreciation P120,000 / 5 years x 9/ 12) 18,000

Investment Income - Dec. 31, 2030 528,000

Downstream P to S kasi kaya 100%

____________________________________________________________________________

Problem 4 Bagani Inc. acquired 60% interest in Amaya Corp. several years ago. During 2030,

Amaya sold inventory costing P225,000 to Bagani for P300,000. A total of 16% of this inventory

were not sold to outsider until 2031. During 2031, Amaya sold inventory costing P288,000 to

Bagani for P360,000. A total of 35% of this inventory was not sold to outsider until 2032. In 2031,

Bagani reported cost of goods sold of P1,140,000 while Amaya reported P630,000.

1. What is the total consolidated cost of goods sold on 2031?

2. What is the realized profit on beginning inventory on 2031?

3. What is the unrealized profit on ending inventory on 2031?

Consolidated

Bagani 1,140,000

Amaya 630,000

Realized Profit on Beg. Inventory (300,000 x 16% x 25% GPR) (12,000)

Unrealized Profit on Ending Inventory (360,000 x 35% x 20%) 25,200

Intercompany sales for 2031 (360,000)

Consolidated COGS 1,423,200

GPR on Beg. Inventory: 300,000 - 225,000 = 75,000/300,000 = 25%

GP on ending Inventory: 360,000 - 288,000 = 72,000/360,000 = 20%

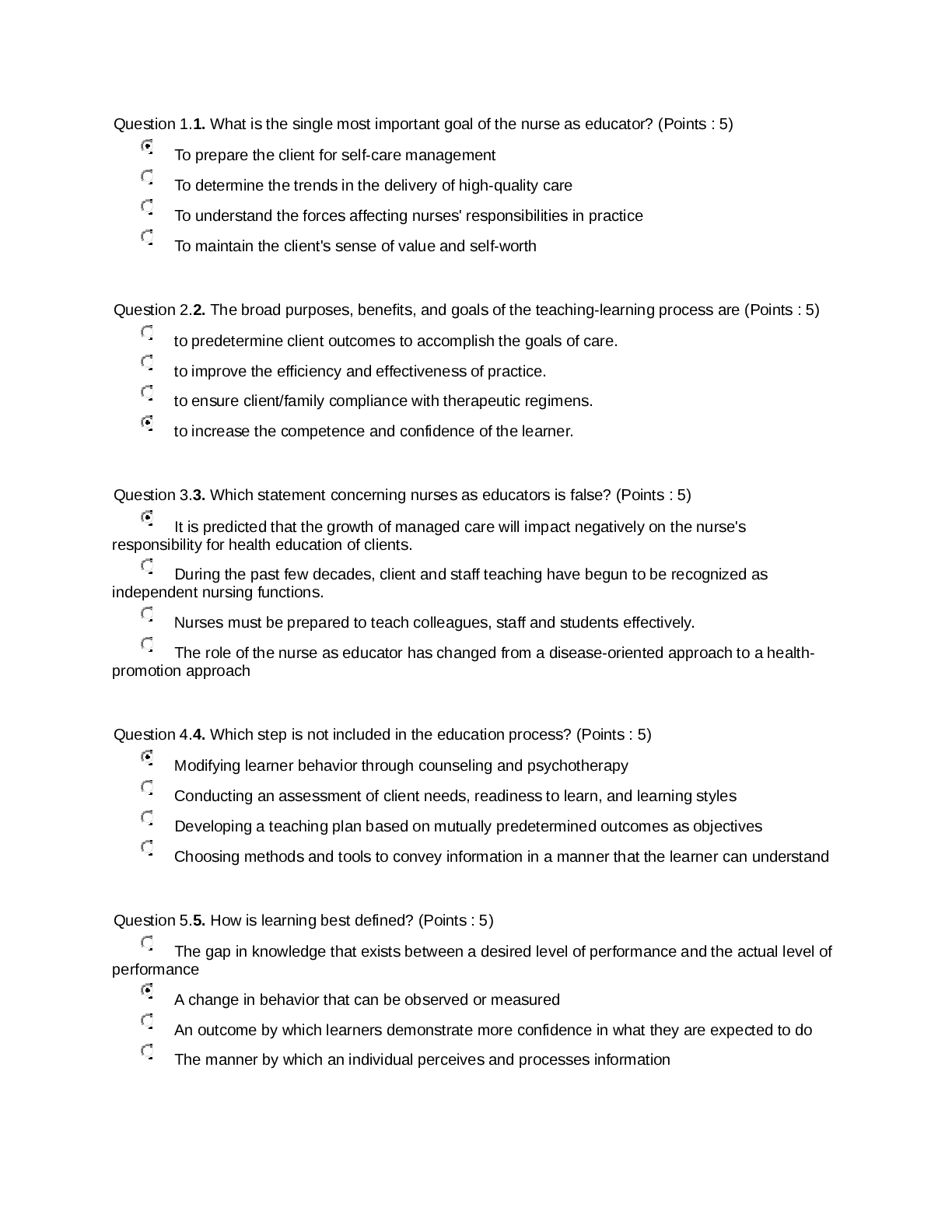

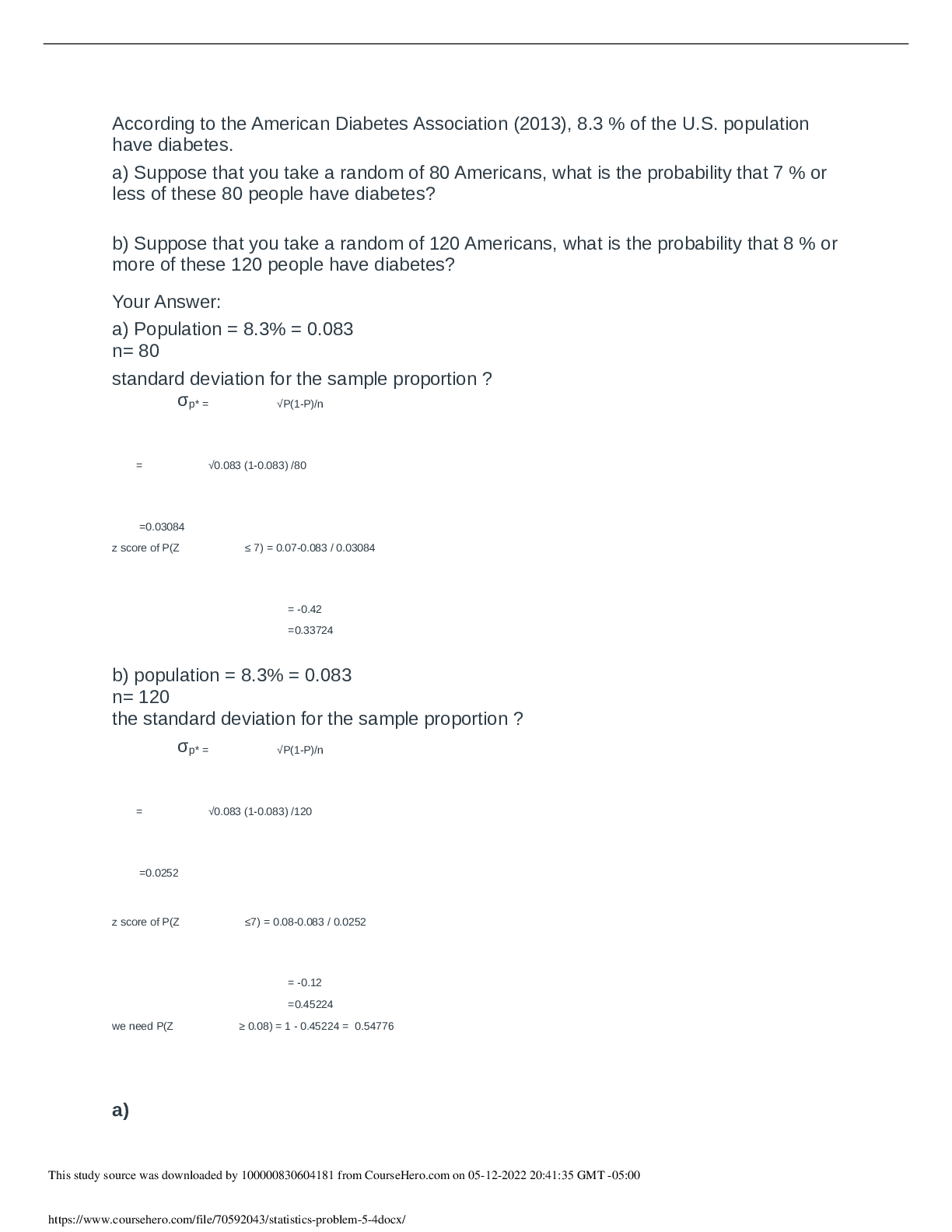

Problem 5 Papa acquired a 90% interest in Son Inc. at book value on January 2, 2030. The

intercompany profit and sale for 2030 and 2031 are as follows:

Intercompany profit on

Sales of Son to Papa inventory at Dec. 31

2030 6,750,000 540,000

2031 13,500,000 1,080,000

The selected data from the financial statements of Papa and Son for the year ended December 31,

2031 are as follows:

Statement of Financial position Papa Son

Inventory 6,750,000 3,600,000

Retained Earnings, Dec. 31, 2031 19,125,000 9,900,000

Ordinary Share 22,500,000 13,500,000

Statement of Comprehensive Income Papa Son

Sales 40,500,000 27,000,000

Cost of Sales 28,125,000 13,500,000

Expenses 10,125,000 6,750,000

Income from Son 5,589,000

1. How much is the consolidated sales for 2031?

2. How much is the consolidated cost of sales for 2031?

3. How much is the non-controlling interest in net income of subsidiary for 2031?

4. How much is the total consolidated net income for 2031?

5. How much is the total non-controlling interest in net assets subsidiary for 2031?

Suggested Sol

[Show More]

1.png)

.png)

.png)