Business > QUESTIONS & ANSWERS > BUSINESS COMBINATION AND CONSOLIDATED FIINANCIAL STATEMENTS (All)

BUSINESS COMBINATION AND CONSOLIDATED FIINANCIAL STATEMENTS

Document Content and Description Below

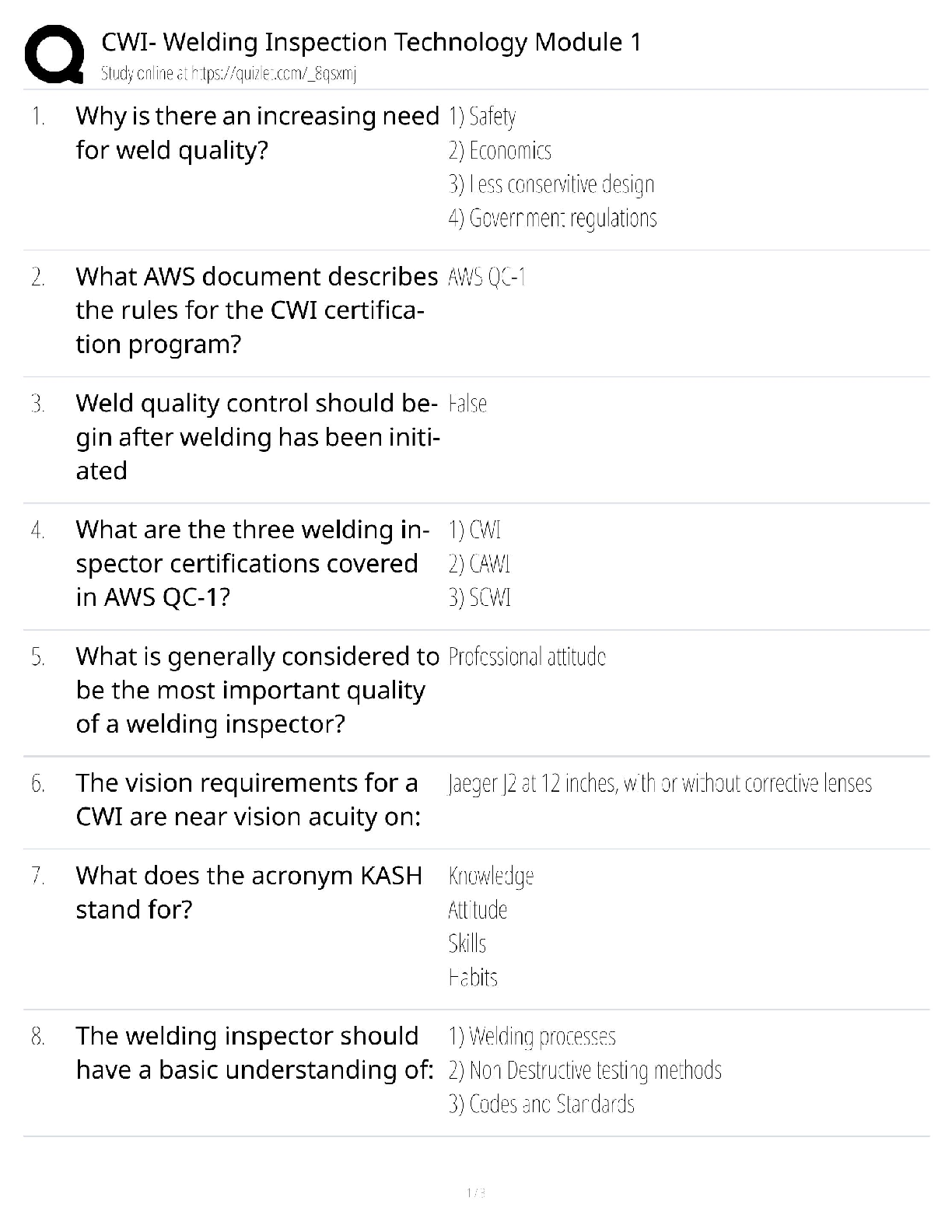

BUSINESS COMBINATION AND CONSOLIDATED FIINANCIAL STATEMENTS 14. Which of the following statements is TRUE? A. The intercompany profit in inventory transfer between affiliates is computed by multipl ... ying the inventory held by the buying affiliate which was acquired from the selling affiliate by the gross profit rate based on sales of the buying affiliate. B. The income and expenses of a subsidiary are included in the consolidated financial statements from the acquisition date. C. Recognition of the realized profit in the beginning requires a working paper debit to cost of goods sold. D. The non-controlling interest in profit is affected by the bargain purchase or gain on acquisition. 15. Which of the following statements is TRUE? A. Downstream and upstream sales affects the computation of the consolidated net income and consolidated sales and cost of goods sold. B. Amortization of excess affects the computation of consolidated operating expenses. C. In case of downstream sales, unrealized profits are charged to consolidated net income and non-controlling interest net income. D. Under the acquisition method of accounting for business combination, the stockholders’ equity of any acquired company is eliminated in the working paper. 16. Which of the following is TRUE? A. When a subsidiary has borrowed cash from the parent company, the related receivable and payable are eliminated in their own set of books in preparing a consolidated statement of financial position B. In a purchase-type business combination, the stockholders’ equity section of a consolidated statement of financial position for a parent and its partially owned subsidiary consists of the parent’s stockholders’ equity accounts only. C. Parent company owns 75% of Subsidiary company. During 2016, Parent sold goods with a 30% gross profit to subsidiary. Subsidiary sold all of these goods in 2016. For 2016 consolidated financial statements, sales and cost of goods sold should be reduced by 75% of the intercompany sales. D. Amortization of excess affects the computation of non-controlling interest in net assets and the non-controlling interest in profit. Problem 17. Marie Co. acquired inventories on May 1,2015, from its 70% owned subsidiary, Paz Company. The inventories were sold for P94,000, including the 25% mark up on cost. Out of these inventories, 65% were sold to outsiders. During the year, Marie reported net income of P215,000 and Paz reported net income of P140,000. How much is the realized profit to be allocated to non-controlling interest in 2016? A. P6,580 [Show More]

Last updated: 3 years ago

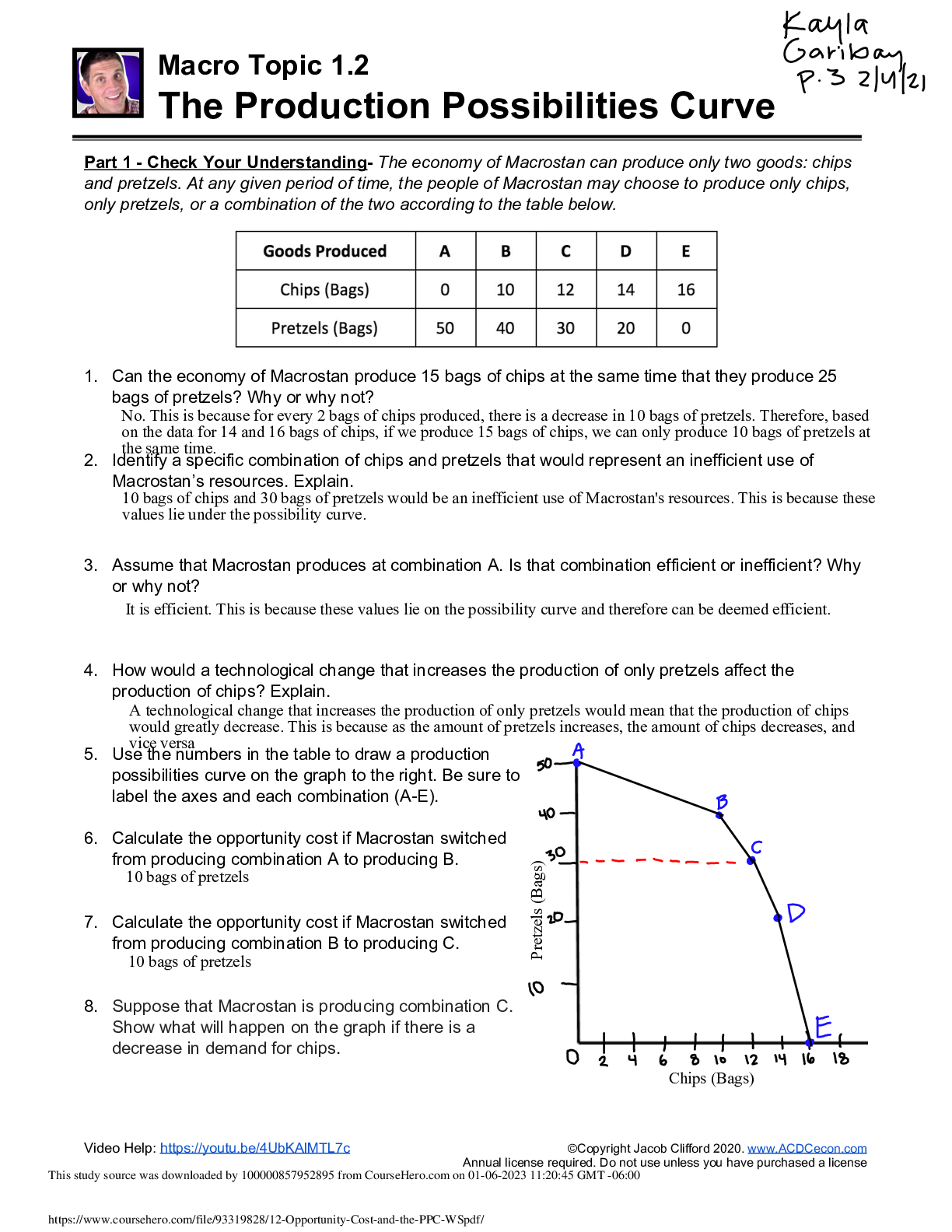

Preview 1 out of 8 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 12, 2022

Number of pages

8

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 12, 2022

Downloads

0

Views

60

.png)

.png)