Accounting > A-Level Mark Scheme > Quiz on VAT MULTIPLE-CHOICE QUESTIONS (All)

Quiz on VAT MULTIPLE-CHOICE QUESTIONS

Document Content and Description Below

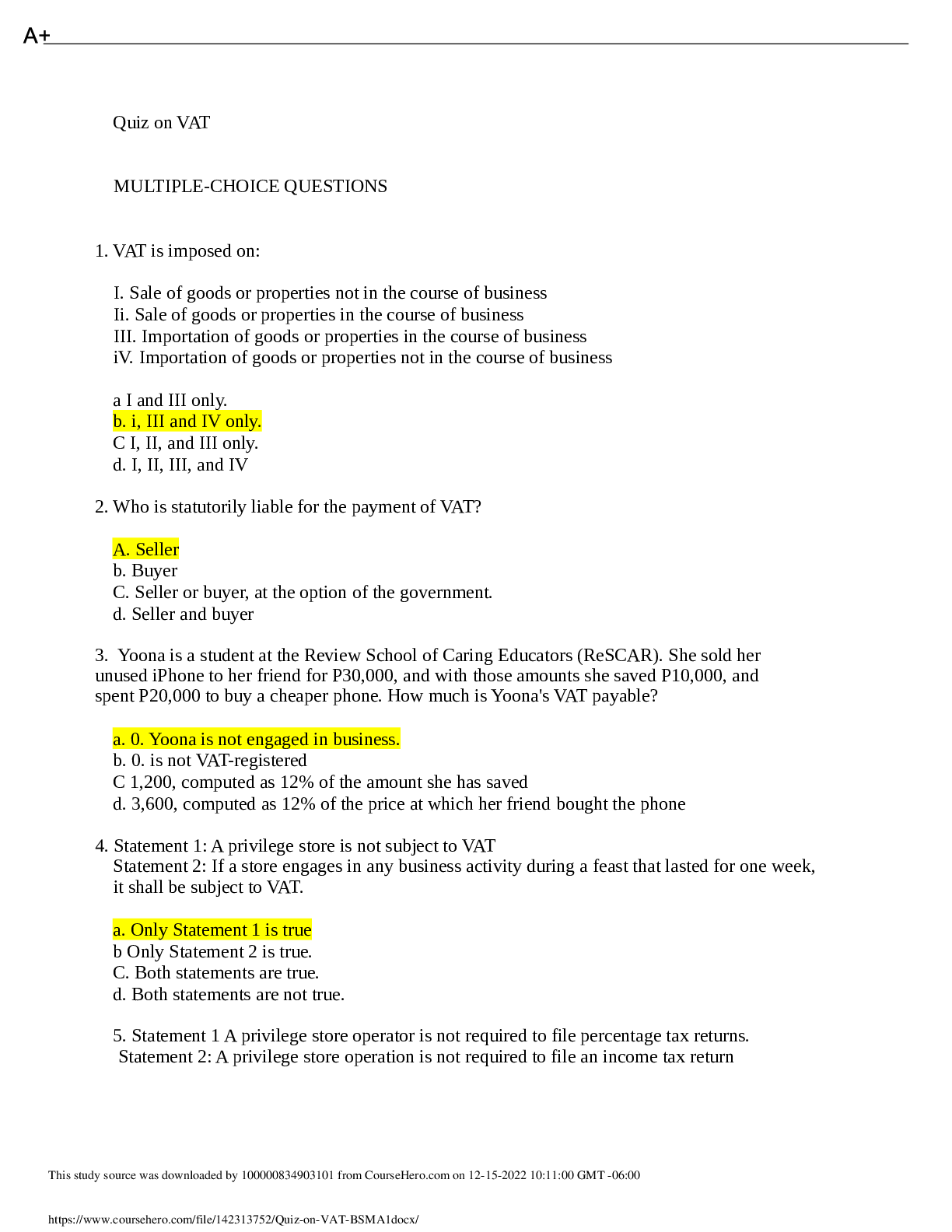

1. VAT is imposed on: I. Sale of goods or properties not in the course of business Ii. Sale of goods or properties in the course of business III. Importation of goods or properties in the course of ... business iV. Importation of goods or properties not in the course of business a I and III only. b. i, III and IV only. C I, II, and III only. d. I, II, III, and IV 2. Who is statutorily liable for the payment of VAT? A. Seller b. Buyer C. Seller or buyer, at the option of the government. d. Seller and buyer 3. Yoona is a student at the Review School of Caring Educators (ReSCAR). She sold her unused iPhone to her friend for P30,000, and with those amounts she saved P10,000, and spent P20,000 to buy a cheaper phone. How much is Yoona's VAT payable? a. 0. Yoona is not engaged in business. b. 0. is not VAT-registered C 1,200, computed as 12% of the amount she has saved d. 3,600, computed as 12% of the price at which her friend bought the phone 4. Statement 1: A privilege store is not subject to VAT Statement 2: If a store engages in any business activity during a feast that lasted for one week, it shall be subject to VAT. a. Only Statement 1 is true b Only Statement 2 is true. C. Both statements are true. d. Both statements are not true. 5. Statement 1 A privilege store operator is not required to file percentage tax returns. Statement 2: A privilege store operation is not required to file an income tax return This study source was downloaded by 100000834903101 from CourseHero.com on 12-15-2022 10:11:00 GMT -06:00 https://www.coursehero.com/file/142313752/Quiz-on-VAT-BSMA1docx/ A+ a Only Statement 1 is true. B. Only Statement 2 is true C. Both statements are true D. Both statements are not true 6. In order to be subject to the requirement of VAT registration, a business must have: a. Gross sales or receipts exceeding P3,000,000 b. Gross sales or receipts of at least P3,000,000 C. Gross sales or receipts, other than those that are exempt under Section 109, exceeding 3,000,000 d. Gross sales or receipts, other than those that are exempt under Section 109, of at least 3.000.000 7. Which among the following taxpayers can avail of the 8% flat rate of income tax? a. A non-VAT registered taxpayer whose annual VAT-subject gross sales or receipts exceed P3,000,000 b. A non-VAT registered taxpayer whose annual VAT-subject gross sales or receipts do not exceed P3.000.000 C. A VAT registered taxpayer whose annual VAT-subject gross sales or receipts exceed P3,000,000 d. A VAT registered taxpayer whose annual VAT-subject gross sales or receipts do not exceed P3,000,000 8. Optional registration for VAT is irrevocable for a period of: a. One (1) year b. Three (3) years c. Five (5) years d. Seven (7) years 9. Which of the following taxpayers is barred from canceling its optional VAT registration? a International common carriers b Operators of amusement places c. Export-oriented enterprises d. Radio and television franchisees 10. The VAT on importation is paid: a The non-resident seller monthly b. The resident buyer monthly C. The non-resident seller before release o [Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 16, 2022

Number of pages

9

Written in

All

Additional information

This document has been written for:

Uploaded

Dec 16, 2022

Downloads

0

Views

124