Business Law > QUESTIONS & ANSWERS > NJ Property/ Casualty Insurance Exam Set Questions and Correct Answers (Verified by Expert) (All)

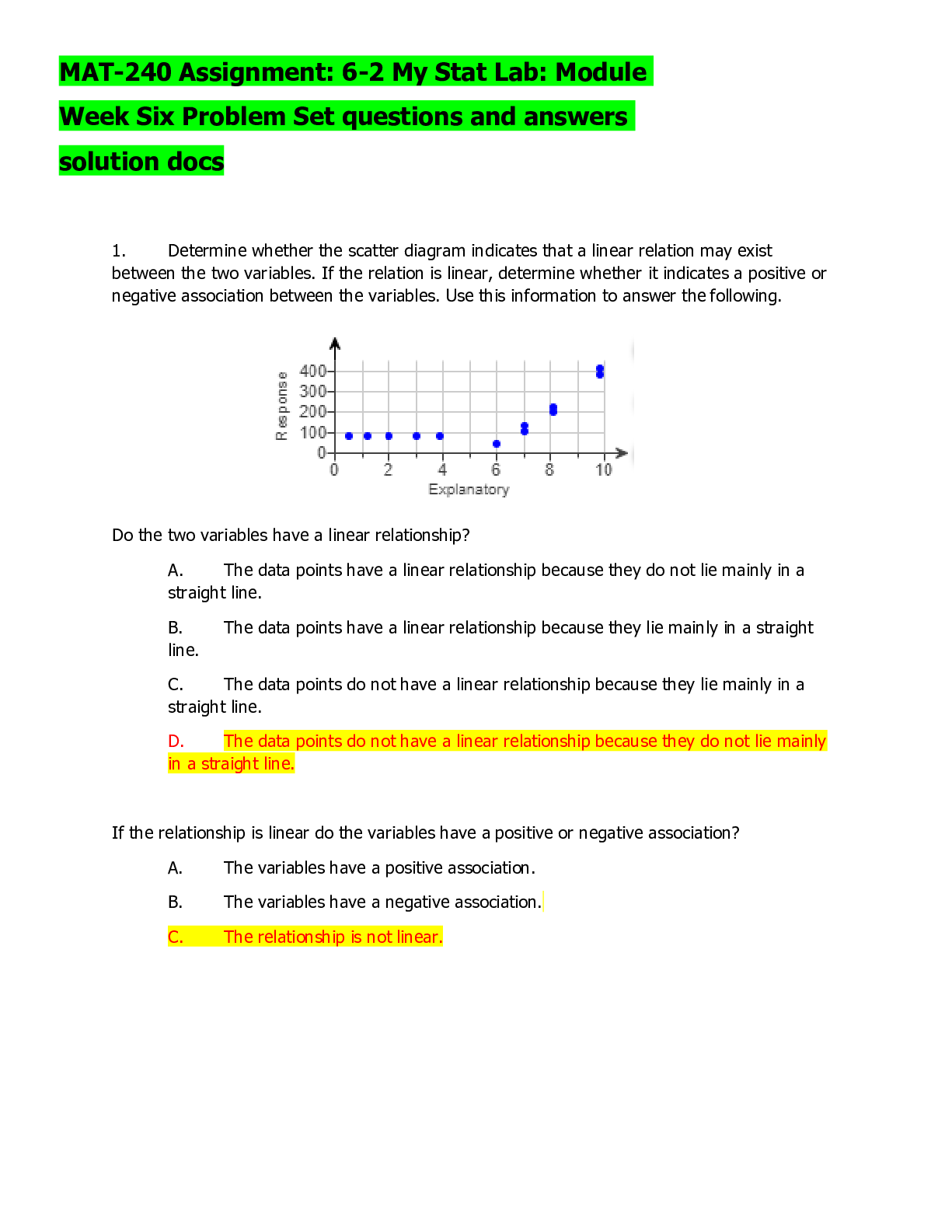

NJ Property/ Casualty Insurance Exam Set Questions and Correct Answers (Verified by Expert)

Document Content and Description Below

NJ Property/ Casualty Insurance Exam Set Questions and Correct Answers (Verified by Expert) Why was the commercial Insurance Deregulation Act Created? ✔✔ To protect the public from the adverse ... effects of excessive, inadequate, & unfair discriminatory rates & marketing practices Which policies issued must follow the provisions of the Commercial Insurance Deregulation Act? ✔✔ Commercial policies When must rate amendments & policy forms be filed with the commissioner? ✔✔ 30 days before What losses are excluded from flood insurance? ✔✔ -Landslides -Sewer backup -Windblown Rain -Snow -Sleet Who administers the NFIP? ✔✔ Federal Insurance Administration (FIA) What does the NFIP stand for? ✔✔ National Flood Insurance Program Why was the National Flood insurance Program constructed? ✔✔ to fill in gaps of flood coverage by the private sector What are the 3 NFIP requirements for coverage? ✔✔ -community land management & flood control programs must reduce flood losses in the future -Flood insurance required in specific flood prone areas as a condition for receiving loans through/ backed by the federal government -Property owners that fail to purchase flood insurance within 1 year after it is available will not be eligible for full disaster relief funding. It will be reduced by an amount of insurance that could have been purchased What is the NFIP max coverage for a single family? ✔✔ Building $250K, Contents $100K What is the NFIP max coverage for other residential? ✔✔ Building $250K, Contents $100K What is the NFIP max coverage for small business? ✔✔ Building $500K, Contents $500K What is the NFIP max coverage for Other Non-Residential? ✔✔ Building $500k, Contents $500K What is the NFIP subsidized rate for a single family? ✔✔ Building $35K, Contents $10K What is the NFIP subsidized rate for Other Residential? ✔✔ Building $100K , Contents $100K What is the NFIP subsidized rate for small businesses? ✔✔ Building $100K, Contents $100K What is the NFIP subsidized rate for other non-residential? ✔✔ Building $100K, Contents $100K What is the wait period before flood insurance can be effective? ✔✔ 30 days, no binders issued What are the exceptions to the 30 day NFIP wait period? ✔✔ -1st 30 days after coverage, community enters standard or emergency program, coverage will begin at 12:01 am the date after application and premium were mailed -When an existing policy was assigned to a property purchaser -At 12:01 am on the 5th day after an endorsement request & premium has been mailed for existing policy What was the Supreme Court's decision regarding the Paul v. Virginia case? ✔✔ insurance was NOT interstate commerce and could not be regulated by the federal govt. Who heard the Paul v. Virginia case? ✔✔ Supreme Court Who heard the US v Southeastern Underwriting Association case? ✔✔ Supreme Court What was the decision in the US v Southeastern Underwriting Association Case? ✔✔ Insurance is interstate commerce and should be subject to federal regulations (currently in effect today) What is the McCarran-Ferguson Act? ✔✔ The federal govt won't regulate insurance business as long as states perform an adequate job of managing their own insurance industries. When was the McCarran-Ferguson Act passed? ✔✔ March 9, 1945 To whom does the insurance commissioner have to provide a report? ✔✔ Governor & Legislature How often must the insurance Commissioner provide a report? ✔✔ Annually How long before a disciplinary hearing must the insurance commissioner notify interested parties? ✔✔ 10 days before What is the fine for failing to comply with a court-ordered subpoena? ✔✔ $5000 If the commissioner decides one has violated the insurance code, what is the fine for unintentional acts performed? ✔✔ $1000 If the commissioner decides one has violated the insurance code, what is the max fine? ✔✔ 1st offense: $5K, 2nd offense $10K, each additional $15K If the insurance commissioner decides one has violated the insurance code, what is the fine for violating a cease & desist? ✔✔ $5k each violation If the insurance commissioner decides one has violated the insurance code, what is the fine for unlawful acts with intentional & material thought? ✔✔ $5k What is the fine for not contacting the dept with an address or name change within 30 days? ✔✔ $250 max if over 60 days [Show More]

Last updated: 2 years ago

Preview 1 out of 36 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 04, 2023

Number of pages

36

Written in

Additional information

This document has been written for:

Uploaded

Jan 04, 2023

Downloads

0

Views

156

.png)

Answered 2023.png)

.png)

.png)

.png)

.png)

.png)