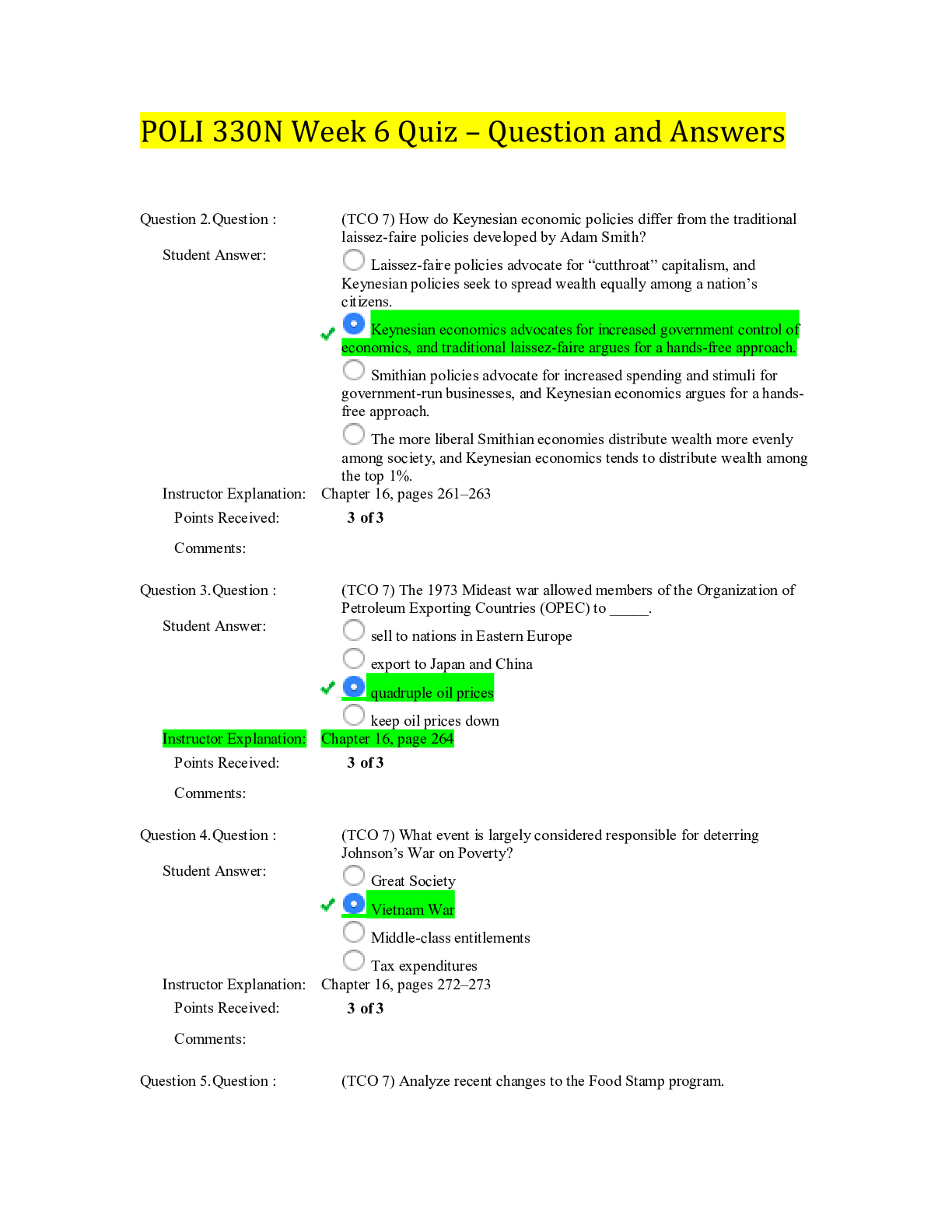

Marketing > EXAM > NetSuite ERP Consultant Exam ALL ANSWERS 100% CORRECT SPRING FALL-2023/24 EDITION GUARANTEED GRADE (All)

NetSuite ERP Consultant Exam ALL ANSWERS 100% CORRECT SPRING FALL-2023/24 EDITION GUARANTEED GRADE A+

Document Content and Description Below

Revenue Recognition - Revenue Commitment Separates the billing and revenue recognition functions, enabling you to recognize revenue and bill customers at different times and to recognize revenue in a... mounts that differ from the amounts billed to customers. A revenue commitment is a non-posting transaction. It serves as the placeholder for the revenue recognition schedule that generates the posting revenue recognition journal entries Revenue Recognition - VSOE Vendor-Specific Objective Evidence (VSOE) feature to ensure that your company properly recognizes revenue for products and services sold as part of a bundle. Revenue Recognition - Revenue Recognition Schedule Determined the journal entries that need to be generated to record the impact of item sales. Revenue Recognition - Revenue Recognition Template Indicate how revenue from associated items should be posted Landed Cost - Landed Cost can be by Weight, Cost, Quantity, or manual Item Pricing - Pricing applied according to the quantity included in the line item By Line Quantity Item Pricing - Pricing is applied for all line items for the same item on a transaction By Overall Item Quantity Item Pricing - Pricing is applied for all items in the same hierarchy by Overall Parent Quantity SQL Functions : NULLIF To avoid divide by zero errors; if the results is zero, replace with null SQL Functions : CASE Returns value based on different conditions SQL Functions : IS NULL Display "unassigned" in results if blank SQL Functions : TO_CHAR Display date by day of the week SQL Functions : DECODE Compares 2 values, then returns specified parameter if they match Custom Records - Enable Optimistic Locking Causes the system to check for conflicting updates when users attempt to save updates to a custom record instance Custom Records - Enable Inline Editing Allow records to be edited directly when they display as a LIST Custom Records - Enable System Notes Tracks all changes made to a record Custom Records - Allow Child Record Editing Allow records to be edited directly when they display as a SUBLIST True or False: A disabled field can display a default value TRUE True or False : A disabled field is not available for transaction line (column) fields FALSE True or False : If a field does not have a default, sourced, or custom information, it will not display on a form FALSE What is the impact of using the "Filter Using" setting when creating a custom Trans Body field, beyond allowing the user to source data onto the transaction? This field allows the dynamic filtering of the list/record field by a particular attribute True or False : There is an "in Transit" option for inventory during which time it is not counted as an asset for either subsidiary FALSE Tax - If subsidiaries share multiple Tax Nexuses, what is the correct order 1. International Tax 2. Subsidiary 3. Tax Agency 4. Nexus 5. Tax Codes, groups, schedules, types, periods Tax - What are the 6 tax editions in NetSuite International, US, Japan, UK, Canada, Australia Subsidiaries : Contacts associated with 1 sub may be linked to a customer/vendor associated with another sub Transactions are never against the contact Sub-customers associated with 1 sub can be linked to parent customers associated with another sub Only if accept payment thru parent is disabled Tax - Tax Period Defines a period over which your company tracks tax. A tax period can be a month, a quarter, or a year, depending on the frequency of your tax submissions or what your business has agreed with the local tax agency. You can run monthly, quarterly, or annual VAT/GST reports in NetSuite. Available in all non-US & non-Canada editions Tax - Tax Nexus A nexus is a tax jurisdiction. Nexuses are part of the NetSuite Advanced Taxes feature, required for NetSuite OneWorld. Each subsidiary must be associated with at least one nexus. The first nexus is automatically assigned to a subsidiary based on the country entered for the subsidiary's address. A subsidiary can have more than one nexus. A nexus and its related tax items can be shared by multiple subsidiaries. Tax - Tax Type A tax type determines where the tax paid or collected is tracked on the balance sheet. The balance sheet account to which NetSuite posts the collection or payment of tax is called the tax control account. Tax - Tax Code Contain information about tax rates and the types of transactions that the tax codes should be applied to. Tax - Tax Schedule Determine how NetSuite calculates taxes for items in each nexus. Tax - Tax Group Combines several tax codes that can then be applied to a transaction, even if the taxes are paid to different jurisdictions. Tax - Tax Agency Vendor These vendors represent taxing authorities to whom you pay collected taxes. Year End Manual Close Manually post the year end journal entry to zero amounts in P&L and post to Retained Earnings Consolidated Exchange Rates vs. Currency Exchange Rates Consolidated applies to: consolidated reports, set per accounting period, base currency for one pair of related subsidiaries, manually edited in the Consolidated Exchange Rates Table Currency exchange rate applies to: transactions, "as of" effective date, base currency and one foreign currency, manually add new rows to Currency Exchange Rates You can change the primary currency on a customer or vendor record, resets the default for transactions, credit limits, and aggregate balance If primary currency is changed you must re-enter the credit limit, cannot remove any currencies which have transactions against them Advanced Inventory Management Calculate reorder based on historical data; Assumes demand is mostly constant; Reordering based on reorder point may create excess inventory Demand planning Ordering based on the expected demand. Demand can be calculated based on: * Outstanding CRM data (i.e. opportunities, estimates & sales orders * Projection of historical demand mathematically Provides ability to use the sales history of another item for calculations Items - Assembly Items Members: non inventory & other charges; item price is INDEPENDENT of members; separate COGS, income from components; decrease asset accounts of member items and increase asset account of the assembly Items - Kit Items item price is INDEPENDENT of members; separate INCOME acct; decrease asset of components Inventory Items, Assembly Items and Service Items Can all be members of Assemblies, Kits, and Item Groups Inventory - Adjustment Inventory Worksheet Uses average cost so it overrides FIFO/LIFO Use this worksheet to enter changes to quantity or value of inventory items other than lot numbered items, serial numbered items, or inactive items. The Adjustment Inventory Worksheet is exclusive of previous stock total - resets the count to the quantity entered. When you use the Adjust Inventory Worksheet with LIFO or FIFO costing, the cost of any item you adjust is averaged. NetSuite ignores LIFO or FIFO, and your costing history is lost. Advanced Receiving Allows you to receive and bill purchase orders as separate transactions. This enables you to receive entire orders or parts of an order, even if you do not bill the order when you receive it. Advanced Shipping Advanced shipping gives your shipping and accounting departments separate processes for fulfilling and billing orders. Your shipping department fulfills part or all of an order when it is ready to ship. Then, your accounting department creates an invoice or cash sale for the shipped items and rendered services. FAM - Transaction types that support asset creation Assembly Build Vendor Bill Inventory Adjustment Inventory Transfer Item Receipt Journal Credit Card Check Expense Report FAM - What are the 2 pages where asset records can be created from transactions Asset Proposal & Asset Creation FAM - Asset Proposal Page Enables you to create asset proposals for the transactions that have been posted against the fixed asset general ledger accounts. You then review the list of proposed assets and select which ones to create asset records for. FAM - Asset Creation Page Enables you to create assets automatically without the need to propose them first. When you use the Asset Creation feature, you can specify the start and end dates of the transactions for which you want to create an asset. However, you will not be able to select individual transactions to generate asset records for. FAM - What are the best practice creating for fixed assets use proposals or asset creation versus manual; proposals keeps the link between GL & fixed asset What happens when Default Payments Account blank Payments received go to Undeposited funds What are the 5 record groups in NetSuite Entities Transactions CRM Items Custom SuiteBuilder (Customisation) With the SuiteBuilder customization tools, you can tailor NetSuite to your individual business needs and processes. SuiteBuilder provides a point-and-click interface for creating fields, forms, record types, transaction types, form layouts, segments, and centers. SuiteBuilder also lets you can define how information is accessed and entered by each user of your NetSuite account. SuiteFlow (Workflow) Use SuiteFlow to create and execute workflows in NetSuite. A workflow is the definition of a custom business process for a standard or custom record in NetSuite. Business processes can include transaction approval, lead nurturing, and record management. A workflow defines and automates the business process. SuiteScript You can use NetSuite's SuiteScript scripting language to extend NetSuite and customize, search for, and process your NetSuite data. SuiteScript enables full-featured application-level scripting capabilities that support sophisticated procedural logic on both the client and server sides. A SuiteScript Debugger is also available for debugging server scripts. SuiteTalk Integrates external systems with NS Compatible with SOAP SuiteAnalytics Dashboards Workbook Search Reports Connect SuiteBundler SuiteBundler allows NetSuite users to package together groups of objects for distribution to other accounts. SuiteBuilder customize form before execution: role-based preferences; default data; change labels; display; set fields mandatory; add buttons SuiteFlow examples Approval processing Reminder emails Lead nurturing Drip marketing Automation based on related records SuiteScript examples Custom server requests from browser Create transactional records Sublist manipulation Redirect user to suitelet Update related records Copy print delete attach records Web services calls Scripted portlets True or False : Suiteflow does not do anything with portlets TRUE Suiteflow limitations that can be implemented by using Suitescript Calling web services Updating other records Initiating a workflow on related records Designing complex business logic Workflow triggers - Client side Before User Edit Before Field Edit After Field Edit After Field Sourcing Before User Submit. Workflow triggers - server side Scheduled, Before Record Load Before Record Submit After Record Submit Why use External Id's when importing 1. Entities with parent/child relationships; 2. Entities using auto-generated numbers; 3. External ids make it easier to import transactions and CRM records by avoiding use of Entity Ids Opening Balances - List 3 options for entering go-live AR & AP transactions 1. Customer/vendor > financial tab > opening balance. 2. Import or manual recreation of fully detailed bill. 3. Use a fake non-inventory item tagged to uncategorized account (preferred) List 3 ways to enter go-live inventory count 1. Enter on hand count upon item create. 2. Adjust inventory. 3. Adjust inventory worksheet. Shipping - If a $15 shipping charge is added to a sales order for 3 items, and 1 of those is fulfilled/billed first and the remaining 2 items are fulfilled/billed later, how much of the shipping charge shows up on each bill? $5/10 $15/0 $0/15 When you charge for shipping and handling, the full amount is charged on the bill for the first item fulfillment. Subsequent order fulfillments charge shipping or handling. Shipping - Shipping item limited to 1 subsidiary You can associate only one subsidiary with a shipping item, but you can create multiple shipping items for the same shipping service. You can then use the shipping services across multiple subsidiaries. The shipping services respect currencies and post to the appropriate subsidiary accounts. What causes a credit card hold? Choose 2 A. Address Verification (AVS) B. Card Verification Value (CVV) C. Soft Descriptor Address Verification (AVS), Card Verification Value (CVV) FAM - If 'Restrict Ability to Reject Proposals' is selected, what is the outcome? Only users with the Administrator role can reject FIxed Asset Proposals. Why would a custom field that has been added to a custom form but doesn't show up on the mapping screen? Make sure the custom form is selected in advanced CSV settings Inventory - Adjust Inventory You can use the Adjust Inventory page to change the quantity and value of an inventory item without entering a purchase order. The form is inclusive of the previous stock total. in other word is adds the qty to stock. If you use the LIFO or FIFO costing methods, enter an inventory adjustment to change the quantity and value of an inventory item. This adjustment preserves the costing history of the item. What is best practice to edit transactions that are in a closed period? Grant the role "Override Period Restrictions" Re-open the closed period Edit the transaction Close the period with quick close Where can the foreign exchange rate be configured to the historical exchange rate? Subsidiary What are the conditions for accepting consolidated payments for child customers? Both Parent and child must using the be in the same currency and in the same subsidiary On which record do you enter tracking number, if you are NOT using a shipping integration? Item fulfillment record What happens when there is a credit card on a sales order? 1. Authorize [Show More]

Last updated: 2 years ago

Preview 1 out of 23 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 12, 2023

Number of pages

23

Written in

Additional information

This document has been written for:

Uploaded

Jan 12, 2023

Downloads

0

Views

66