Finance > EXAM > Study guide Sophia Finance Milestone 2_Complete Questions and Answers (Latest 2020/2021) (All)

Study guide Sophia Finance Milestone 2_Complete Questions and Answers (Latest 2020/2021)

Document Content and Description Below

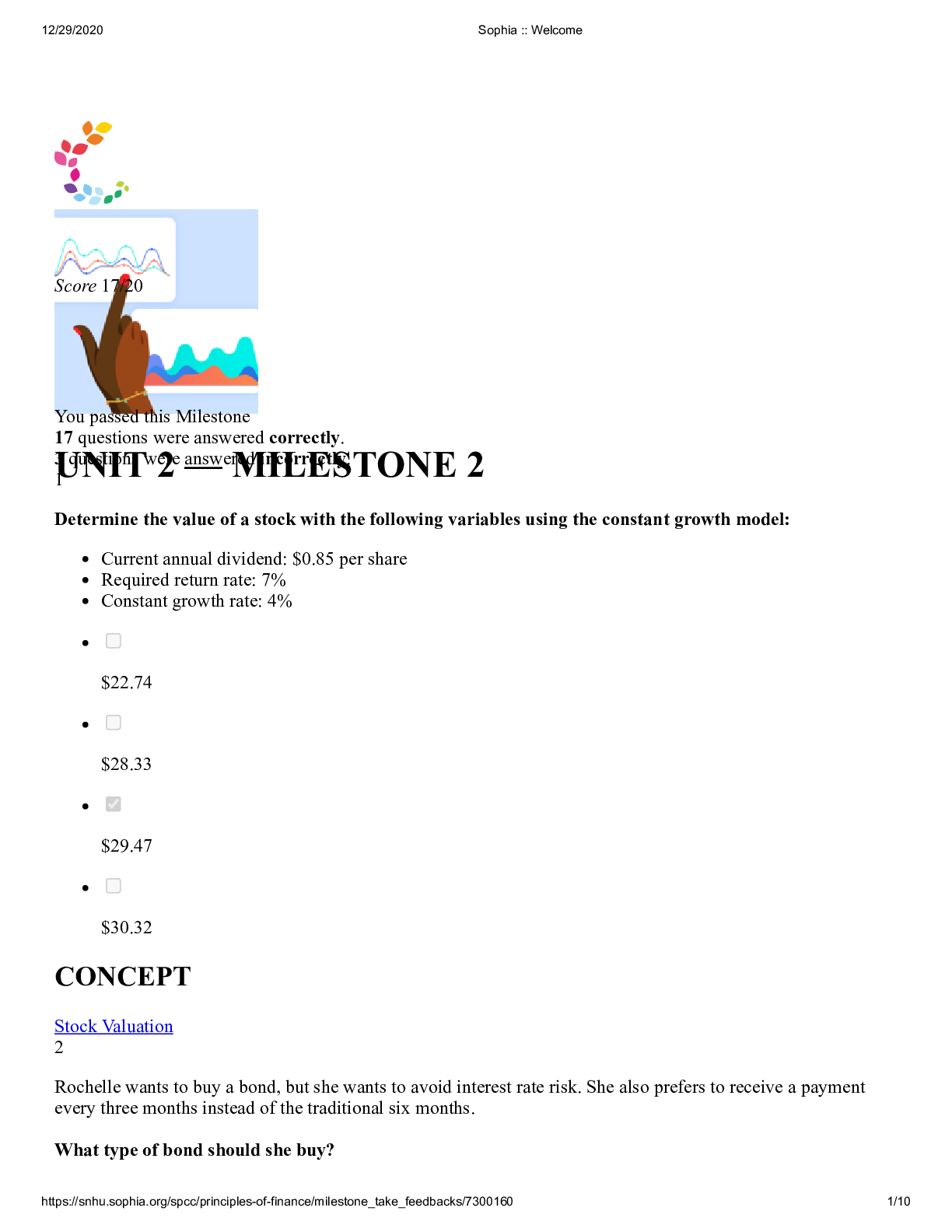

You passed this Milestone 17 questions were answered correctly. 3 questions were answered incorrectly. 1 Determine the value of a stock with the following variables using the constant growth model... : Current annual dividend: $0.85 per share Required return rate: 7% Constant growth rate: 4% $22.74 $28.33 $29.47 $30.32 CONCEPT Stock Valuation 2 Rochelle wants to buy a bond, but she wants to avoid interest rate risk. She also prefers to receive a payment every three months instead of the traditional six months. What type of bond should she buy? 12/29/2020 Sophia :: Welcome https://snhu.sophia.org/spcc/principles-of-finance/milestone_take_feedbacks/7300160 2/10 Zero-coupon Government Floating-rate Fixed-rate CONCEPT Types of Bonds 3 Which of the following best describes a bond? A type of loan with a fixed rate of return that can be outstanding indefinitely. A debt security that typically pays an investor a fixed rate of return for a specified period of time. A debt instrument whose rate of return can fluctuate based on market conditions. A debt security that gives an investor an ownership share in the entity issuing the bond. CONCEPT Understanding Bonds 4 Which descriptor relates to the market-based approach for valuing corporations? Considers the weighted average cost of capital Involves an analysis of risk 12/29/2020 Sophia :: Welcome https://snhu.sophia.org/spcc/principles-of-finance/milestone_take_feedbacks/7300160 3/10 Considered the truest estimate Involves the average cost of a unit of company income CONCEPT Valuing the Corporation 5 Which of the following is a disadvantage of bonds for a potential investor? Bondholders risk a significant price drop if a large number of bonds are sold at once. Some bonds can be redeemed early by the issuer. They have less legal protection than stocks. They are more likely than stocks to end up valueless if a company goes bankrupt. CONCEPT Advantages and Disadvantages of Bonds 6 In calculating the yield of an investment, what is EAR equivalent to? APR APY NPV IRR 12/29/2020 Sophia :: Welcome https://snhu.sophia.org/spcc/principles-of-finance/milestone_take_feedbacks/7300160 4/10 CONCEPT Yield 7 Nadia is going to receive $1,000 from her grandparents next year. According to the time value of money, the gift of $1,000 is worth __________ a gift of $1,000 if she received it today. the same as less than more than twice as much as CONCEPT Introduction to the Time Value of Money 8 Which of the following is true for calculating the future value of multiple cash flows? It is simpler to find the FV of irregular cash flows than of annuities. You can only find the FV of multiple cash flows if the payments occur with the same regularity. To find the FV of multiple cash flows, add the PV of each cash flow together and use the total in the formula for FV. You must choose the same point in the future for each individual cash flow to determine the FV of multiple investments. CONCEPT 12/29/2020 Sophia :: Welcome https://snhu.sophia.org/spcc/principles-of-finance/milestone_take_feedbacks/7300160 5/10 Valuing Multiple Cash Flows 9 Select the pairing that is correctly matched. Common stock: holders can mail in their votes if they can't attend a company's annual general meeting Common stock: may come with an additional dividend provision attached to company financial goals Preferred stock: may be purchased by converting common stock shares into preferred ones Preferred stock: is a less stable investment than common stock with fewer rights of ownership CONCEPT Rules and Rights of Common and Preferred Stock 10 Preemptive rights allow stockholders to acquire __________ before the general public. new stock company assets dividend [Show More]

Last updated: 2 years ago

Preview 1 out of 10 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 28, 2023

Number of pages

10

Written in

Additional information

This document has been written for:

Uploaded

Jan 28, 2023

Downloads

0

Views

91

.png)

.png)

(1).png)