Accounting > QUESTIONS & ANSWERS > Payton Module 3 Questions and Answers - Saint Leo University ACC 498 (All)

Payton Module 3 Questions and Answers - Saint Leo University ACC 498

Document Content and Description Below

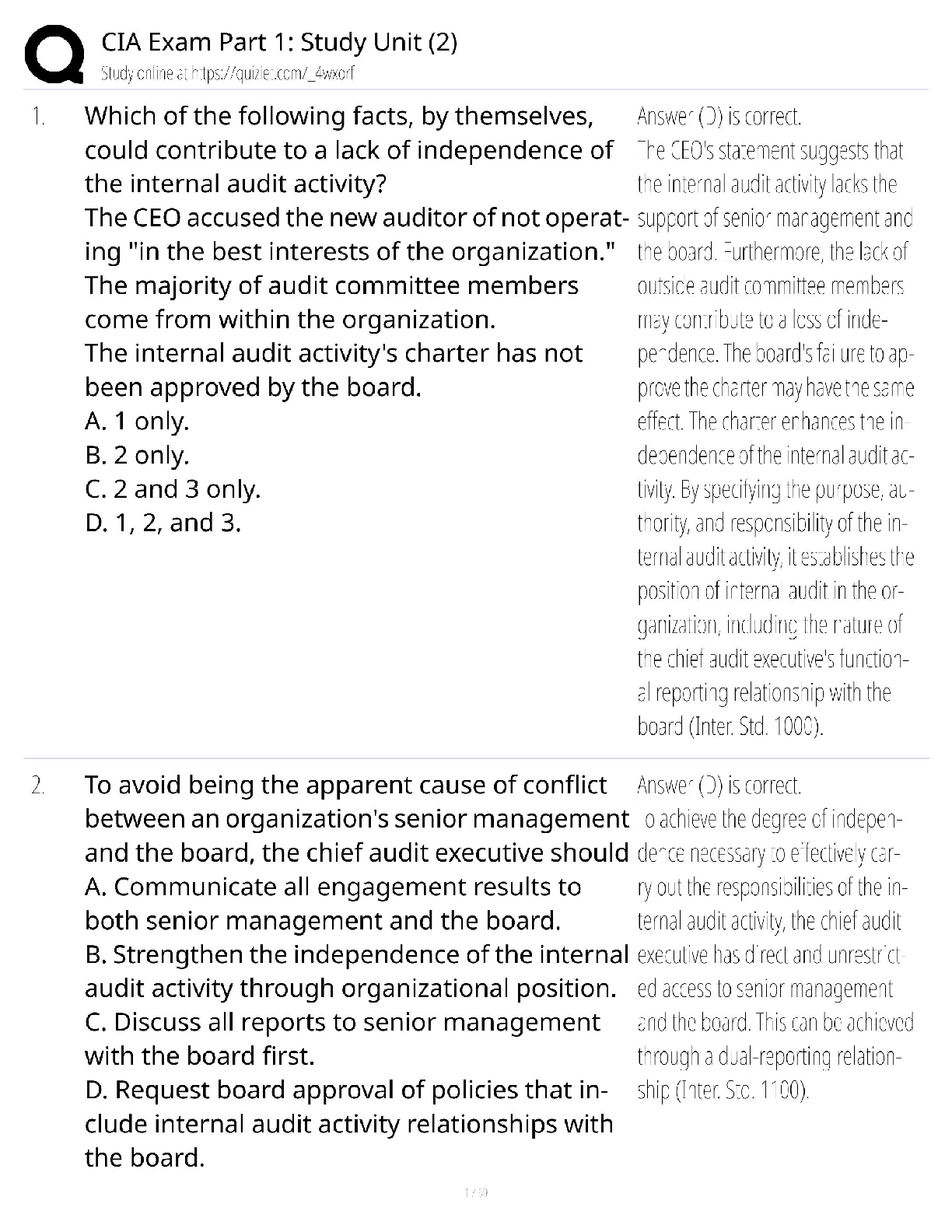

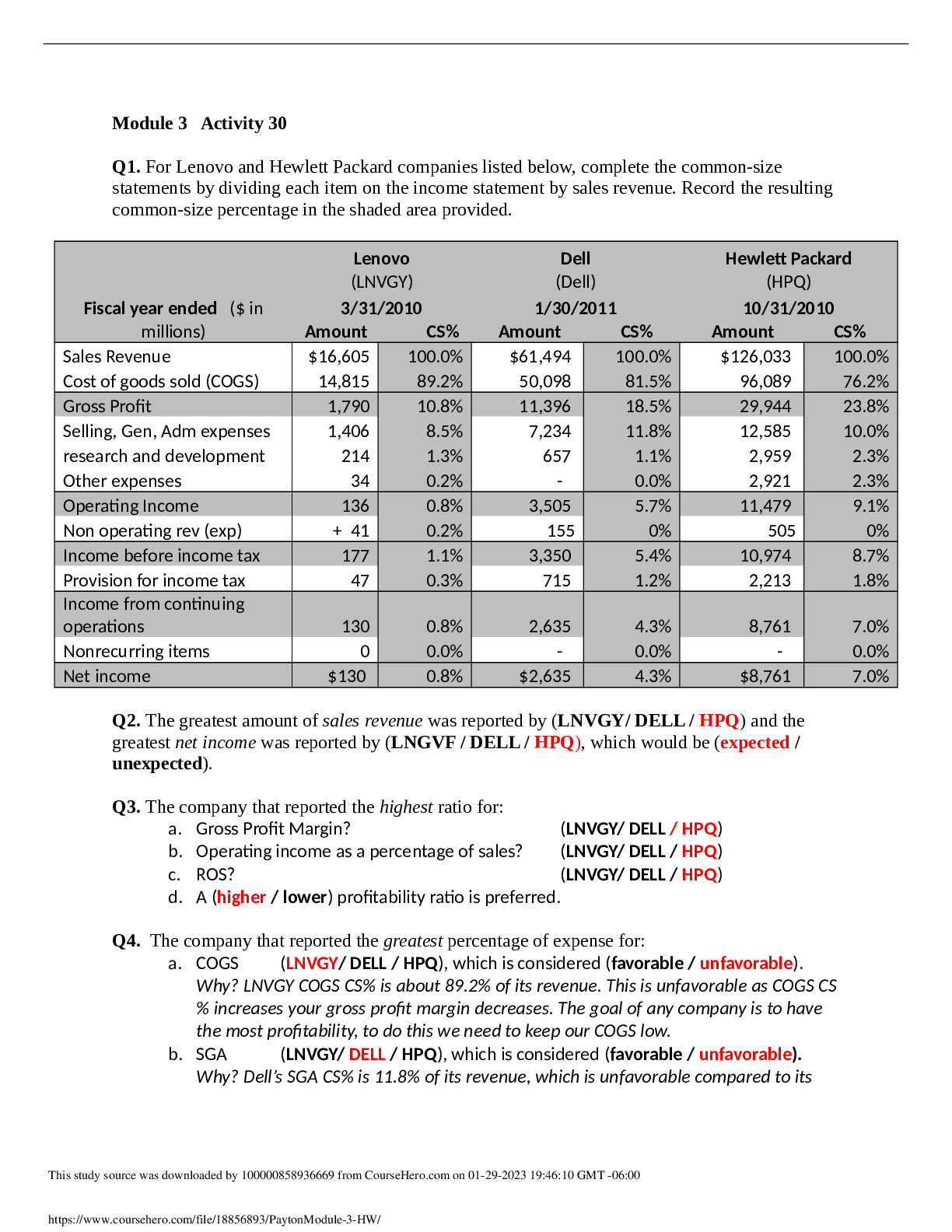

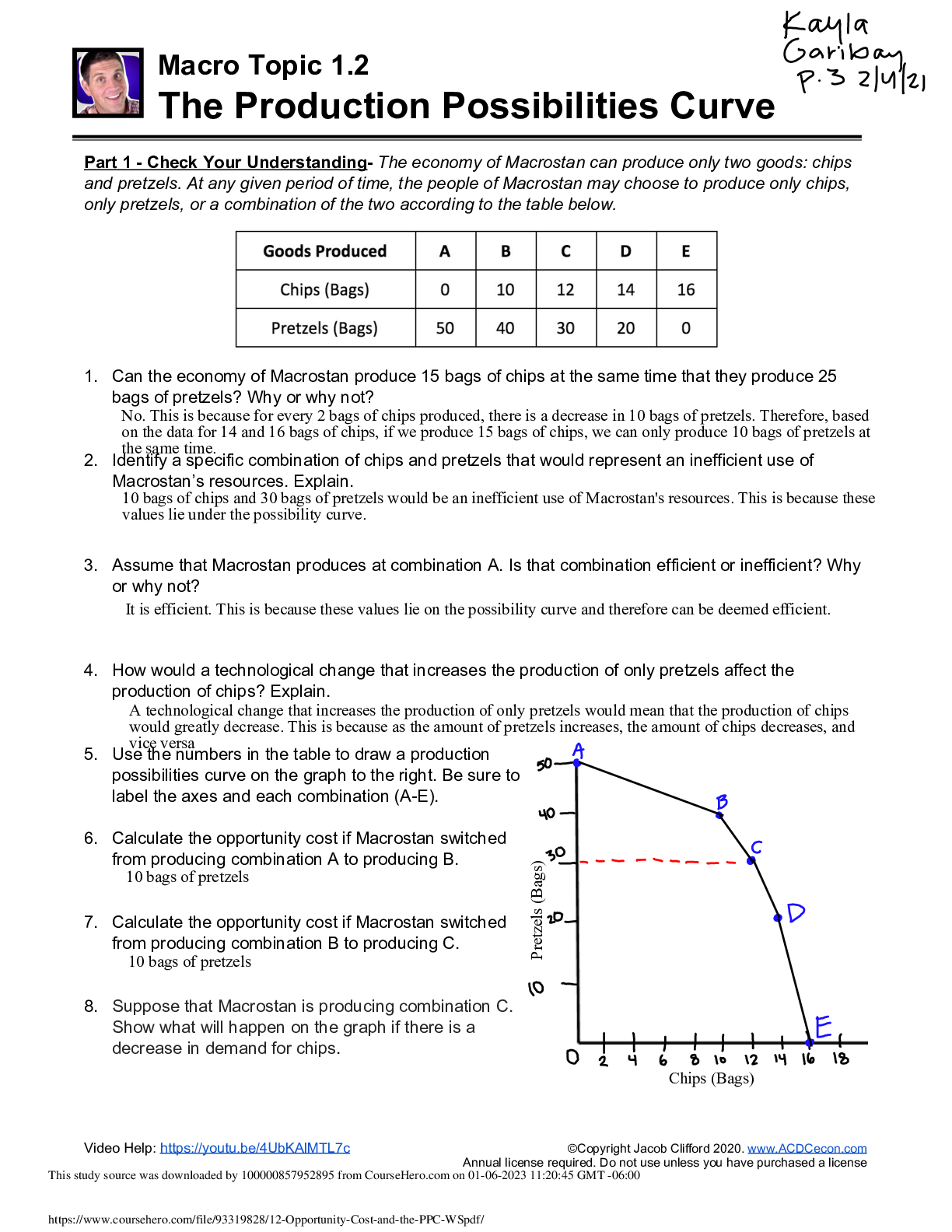

Module 3 Activity 30 Q1. For Lenovo and Hewlett Packard companies listed below, complete the common-size statements by dividing each item on the income statement by sales revenue. Record the resulti ... ng common-size percentage in the shaded area provided. Lenovo (LNVGY) Dell (Dell) Hewlett Packard (HPQ) Fiscal year ended ($ in millions) 3/31/2010 Amount CS% 1/30/2011 Amount CS% 10/31/2010 Amount CS% Sales Revenue $16,605 100.0% $61,494 100.0% $126,033 100.0% Cost of goods sold (COGS) 14,815 89.2% 50,098 81.5% 96,089 76.2% Gross Profit 1,790 10.8% 11,396 18.5% 29,944 23.8% Selling, Gen, Adm expenses 1,406 8.5% 7,234 11.8% 12,585 10.0% research and development 214 1.3% 657 1.1% 2,959 2.3% Other expenses 34 0.2% - 0.0% 2,921 2.3% Operating Income 136 0.8% 3,505 5.7% 11,479 9.1% Non operating rev (exp) + 41 0.2% 155 0% 505 0% Income before income tax 177 1.1% 3,350 5.4% 10,974 8.7% Provision for income tax 47 0.3% 715 1.2% 2,213 1.8% Income from continuing operations 130 0.8% 2,635 4.3% 8,761 7.0% Nonrecurring items 0 0.0% - 0.0% - 0.0% Net income $130 0.8% $2,635 4.3% $8,761 7.0% Q2. The greatest amount of sales revenue was reported by (LNVGY/ DELL / HPQ) and the greatest net income was reported by (LNGVF / DELL / HPQ), which would be (expected / unexpected). Q3. The company that reported the highest ratio for: a. Gross Profit Margin? (LNVGY/ DELL / HPQ) b. Operating income as a percentage of sales? (LNVGY/ DELL / HPQ) c. ROS? (LNVGY/ DELL / HPQ) d. A (higher / lower) profitability ratio is preferred. Q4. The company that reported the greatest percentage of expense for: a. COGS (LNVGY/ DELL / HPQ), which is considered (favorable / unfavorable). Why? LNVGY COGS CS% is about 89.2% of its revenue. This is unfavorable as COGS CS % increases your gross profit margin decreases. The goal of any company is to have the most profitability, to do this we need to keep our COGS low. b. SGA (LNVGY/ DELL / HPQ), which is considered (favorable / unfavorable). Why? Dell’s SGA CS% is 11.8% of its revenue, which is unfavorable compared to it [Show More]

Last updated: 2 years ago

Preview 1 out of 5 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$6.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jan 30, 2023

Number of pages

5

Written in

All

Additional information

This document has been written for:

Uploaded

Jan 30, 2023

Downloads

0

Views

124

.png)

.png)