.png)

LIFESPAN FINAL EXAM

$ 18

.png)

AQA GCSE MATHEMATICS 8300/2F Foundation Tier Paper 2 Calculator Mark scheme June 2021 Version: 1.0 Final

$ 10

Maths 221 Statistics For Decision Making week 3 Quiz LATEST 2021/2022

$ 15

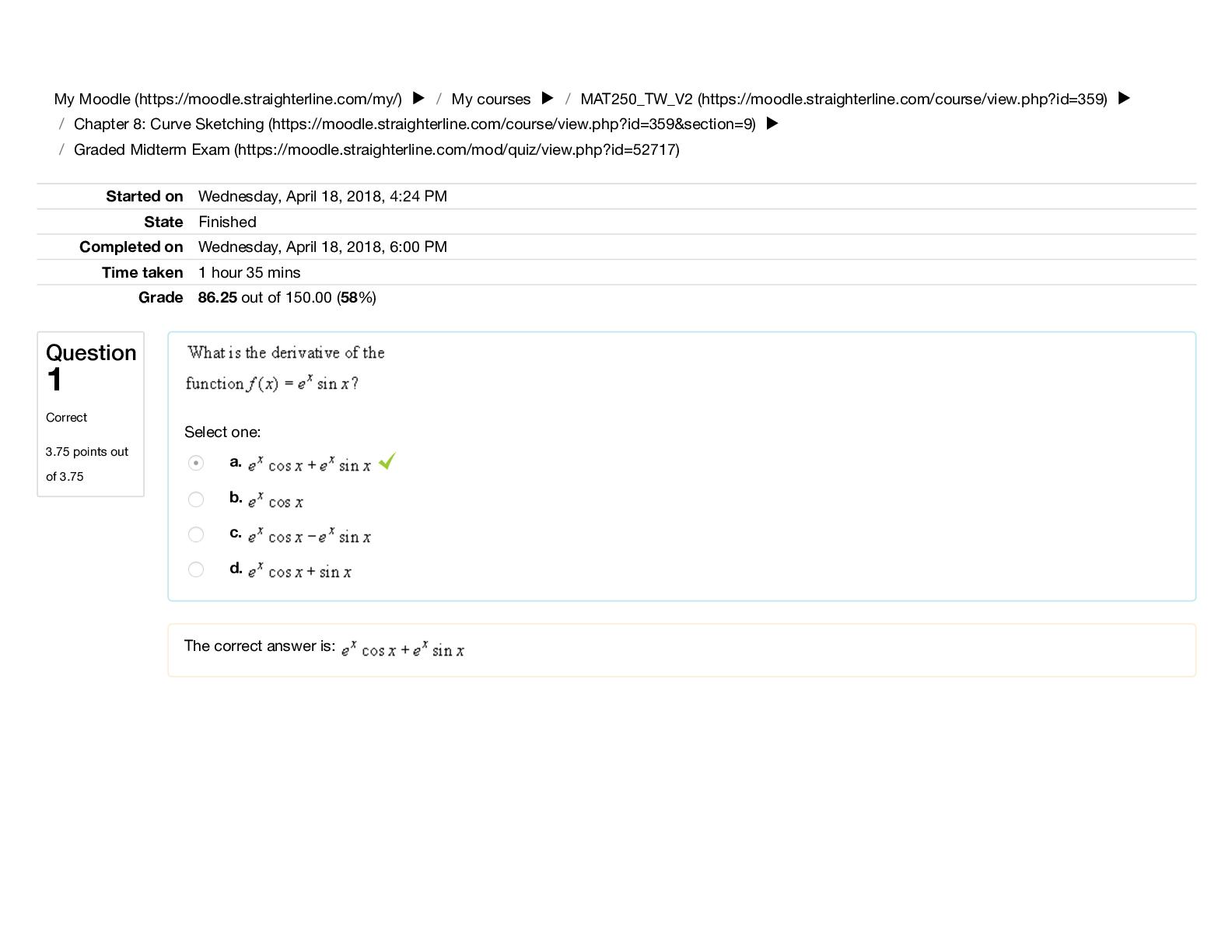

Graded_Midterm_Exam Correct Grade A+

$ 20.5

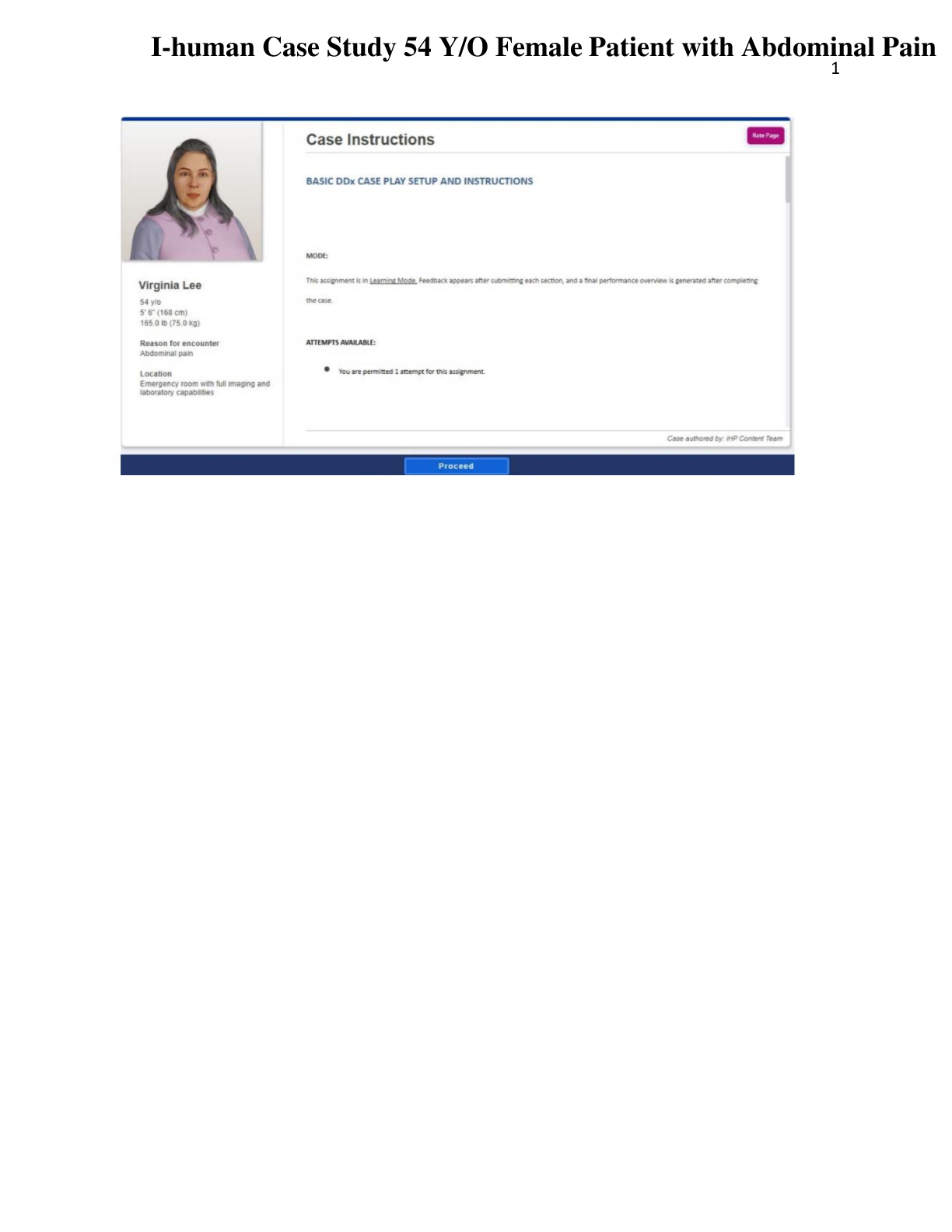

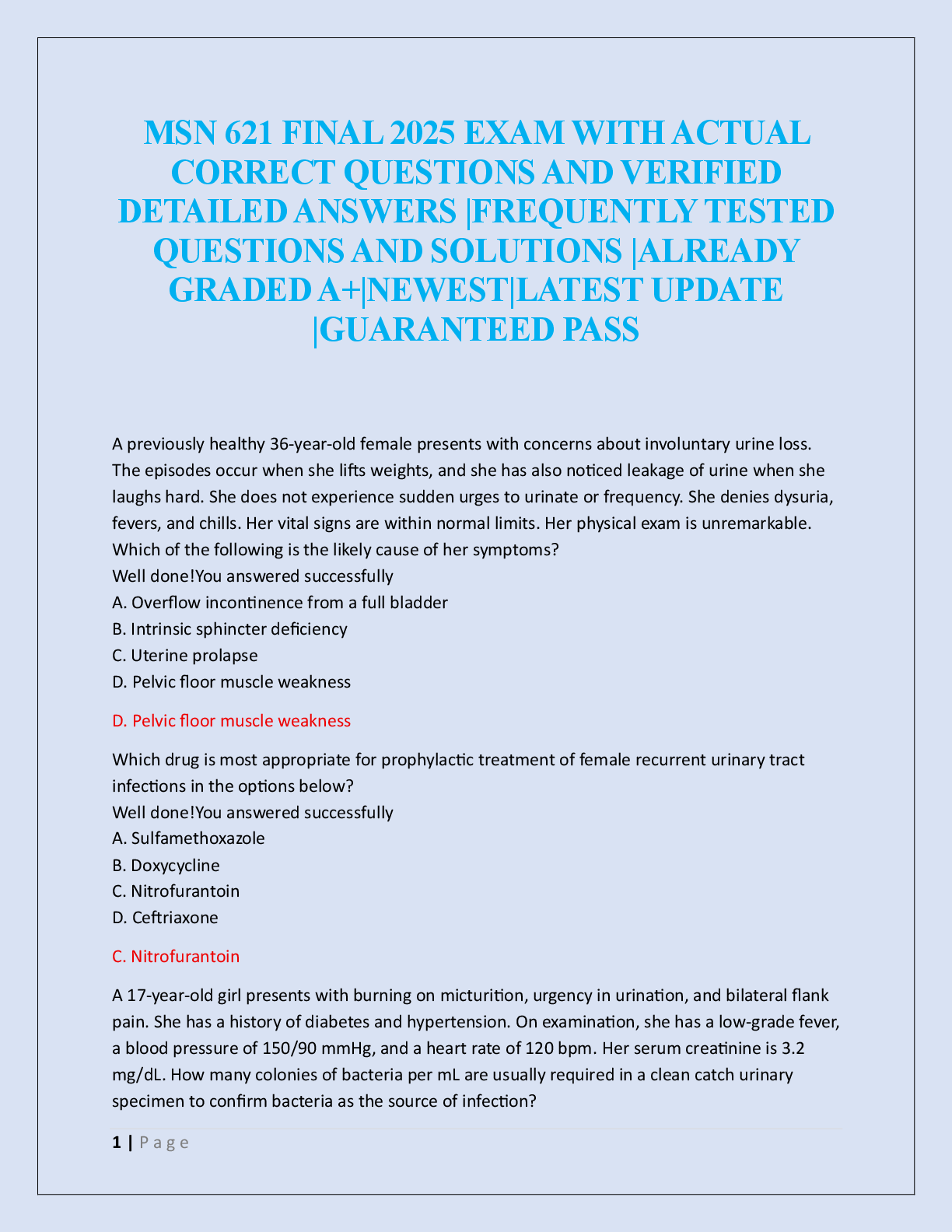

MSN 621 FINAL 2025 EXAM

$ 22

NCC EFM Exam Breakdown & Study Guide

$ 13.5

week9assign.ham c. decision tree final

$ 6

University of Phoenix BUSINESS 475 Exam Questions and Answers Best Rated A+ (Answers 100%Correct/Verified) Latest Update 2022/2023

$ 6.5

HLT 308V Week 3 Benchmark Assignment, Risk Management Program Analysis Part Two

$ 14

Digital systems registers

$ 8

SAP PP Certification Sample Question Set - 2

$ 15

GEN 499 Week 3 Assignment.docx

$ 10

Gen 499 Week 1 Assignment.docx

$ 10

HPB Module 3 - GIT Disease

$ 10

.png)

Pearson Edexcel International GCSE (9–1). Physics PAPER: 2P. Rated A+

$ 9

NURSING PRACTICE FINAL EXAM 2022

$ 15

.png)

CompTIA A+ 220-901

$ 8

Informatica Cloud Data Integration Specialist Certification

$ 12

.png)

AQA GCSE MATHEMATICS 8300/3F Foundation Tier Paper 3 Calculator Mark scheme June 2021 Version: 1.0 Final

$ 10

Nurs_6630_WK10

$ 8

AB140_Assignment_Unit_7

$ 10

NURSING NUR2356 MCD-1 FINAL Study Guide Complete Solution Rated A

.png)

.png)