Finance > Final Exam Review > Review Test Submission_ Chapter 9 Quiz | Download for quality grades | (All)

Review Test Submission_ Chapter 9 Quiz | Download for quality grades |

Document Content and Description Below

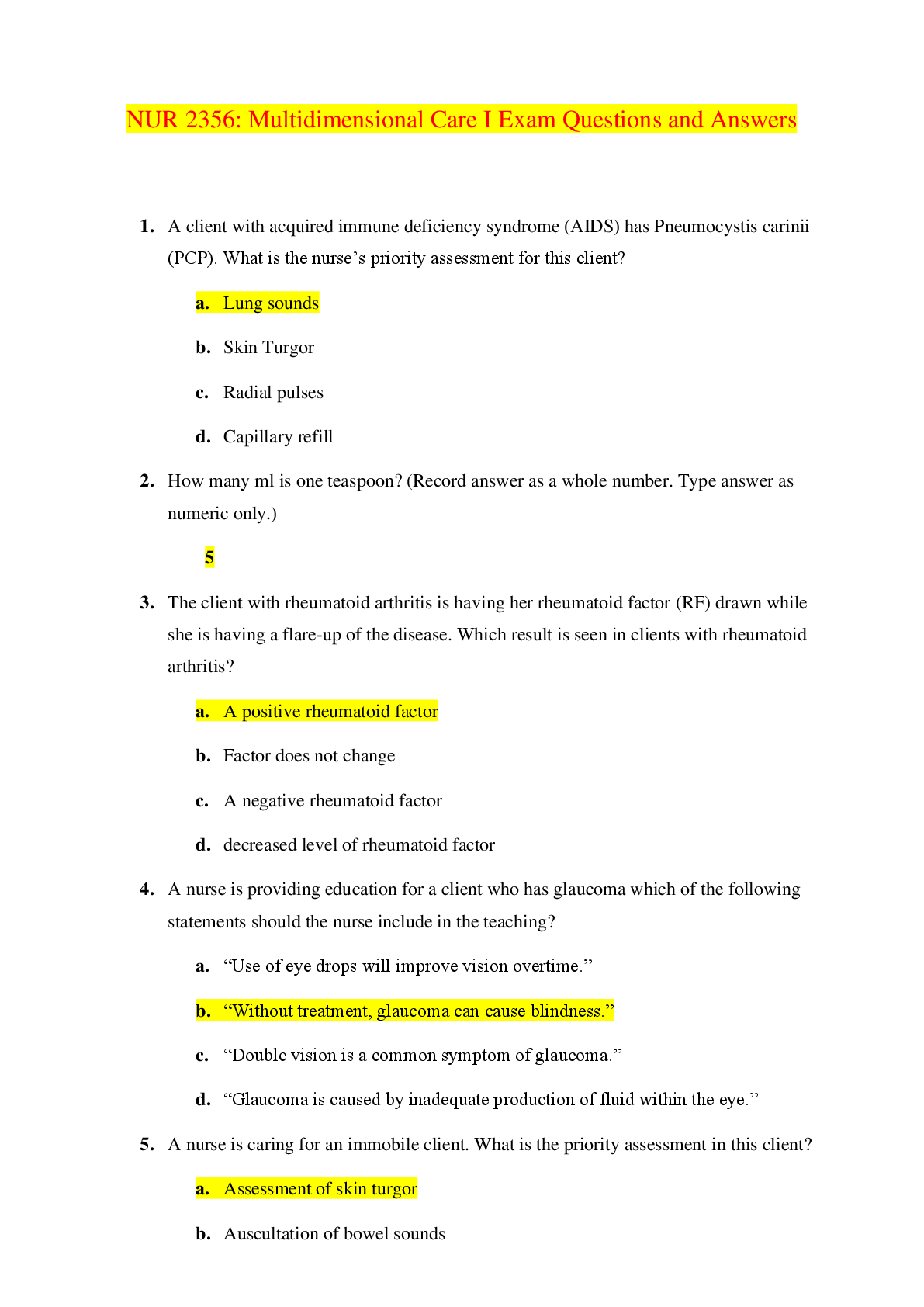

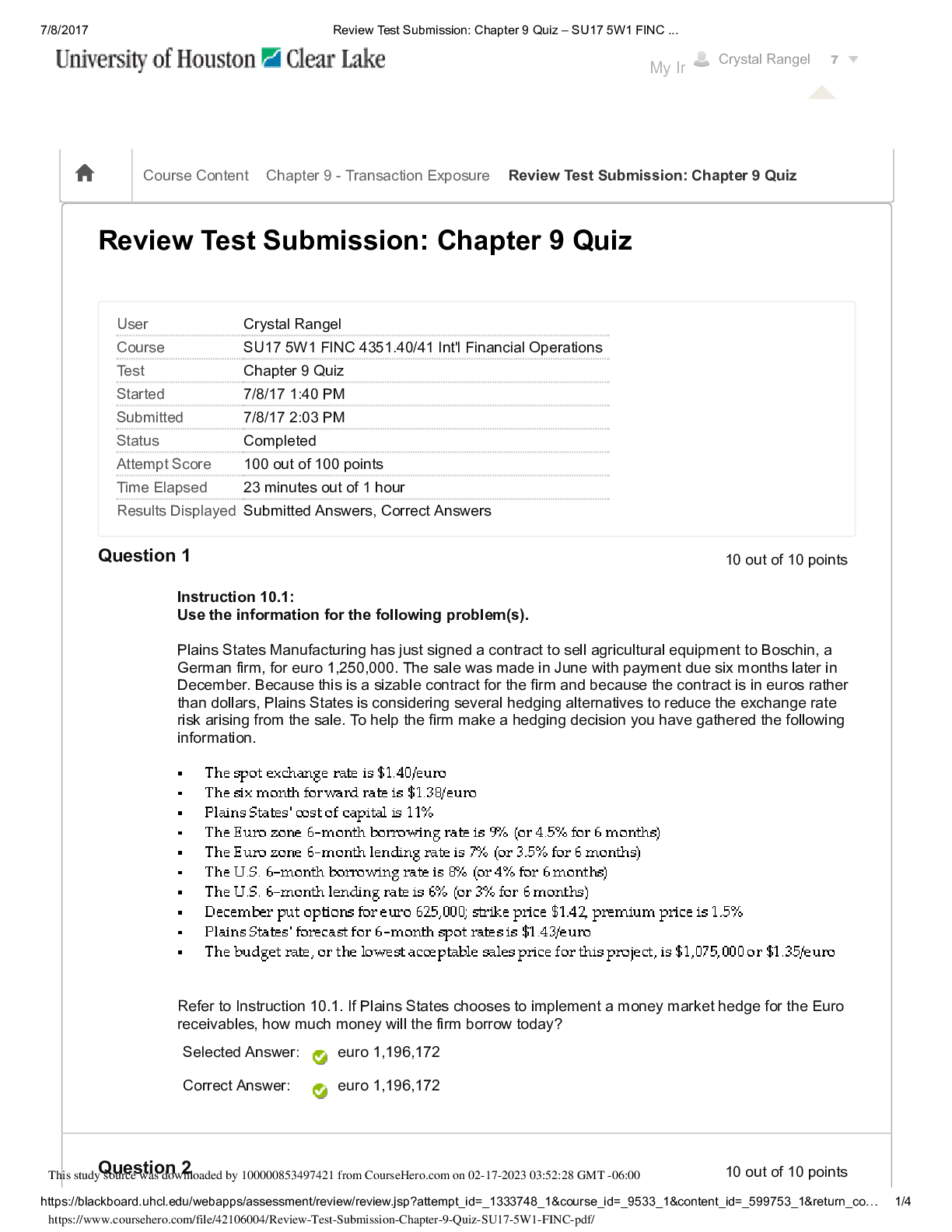

Question 1 Instruction 10.1: Use the information for the following problem(s). Plains States Manufacturing has just signed a contract to sell agricultural equipment to Boschin, a German firm, for ... euro 1,250,000. The sale was made in June with payment due six months later in December. Because this is a sizable contract for the firm and because the contract is in euros rather than dollars, Plains States is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the following information. Refer to Instruction 10.1. If Plains States chooses to implement a money market hedge for the Euro receivables, how much money will the firm borrow today? Selected Answer: euro 1,196,172 Correct Answer: euro 1,196,172 Question 2 My Institution Courses 10 out of 10 points 10 out of 10 points Crystal Rangel 7 The structure of a money market hedge is similar to a forward hedge. The difference is the cost of the money market hedge is determined by the differential interest rates, while the forward hedge is a function of the forward rates quotation. Selected Answer: True Correct Answer: True Question 3 Instruction 10.1: Use the information for the following problem(s). Plains States Manufacturing has just signed a contract to sell agricultural equipment to Boschin, a German firm, for euro 1,250,000. The sale was made in June with payment due six months later in December. Because this is a sizable contract for the firm and because the contract is in euros rather than dollars, Plains States is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision you have gathered the following information. Refer to Instruction 10.1. Plains States chooses to hedge its transaction exposure in the forward market at the available forward rate. The payoff in 6 months will be ________. Selected Answer: $1,725,000 Correct Answer: $1,725,000 Question 4 In efficient markets, interest rate parity should assure that the costs of a forward hedge and money market hedge should be approximately the same. Selected Answer: True Correct Answer: True Question 5 A U.S. firm sells merchandise today to a British company for £100,000. The current exchange rate is $2.03/£ , the account is payable in three months, and the firm chooses to avoid any hedging techniques designed to reduce or eliminate the risk of changes in the exchange rate. If the exchange rate changes to $2.05/£ the U.S. firm will realize a ________ of ________. [Show More]

Last updated: 2 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$3.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 17, 2023

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 17, 2023

Downloads

0

Views

106

JN21.png)