STATISTICS SUMMARY( STATISTIEK 1 SAMENVATTING)

$ 16

SCI 200 - Final Milestone Unit 4 | with 100% Correct Answers | Updated & Verified

$ 8

SEC-360 Week 7 Quiz - 100% Correct Answers

$ 7

RBT exams 1-5 each 75 Questions & Answers latest Fall ,

$ 10

NURS 6501 Advanced Pathophysiology WEEK 8 Quiz with Answers | All Correct

$ 9

AQA A-level HISTORY 7042/2S Component 2S The Making of Modern Britain, 1951-2007 Mark scheme June 2021 Version: 1.0 Fina

$ 10

Test Bank for Strategic Management Concepts and Cases Competitiveness and Globalization 9th Edition by Hitt

$ 19

BIOD 151 Modul 2 Exam Questions with complete solutions Portage Learning

$ 11

(UMGC) LIBS 150 Introduction to Research Final Exam Review Q & S 2024

$ 11

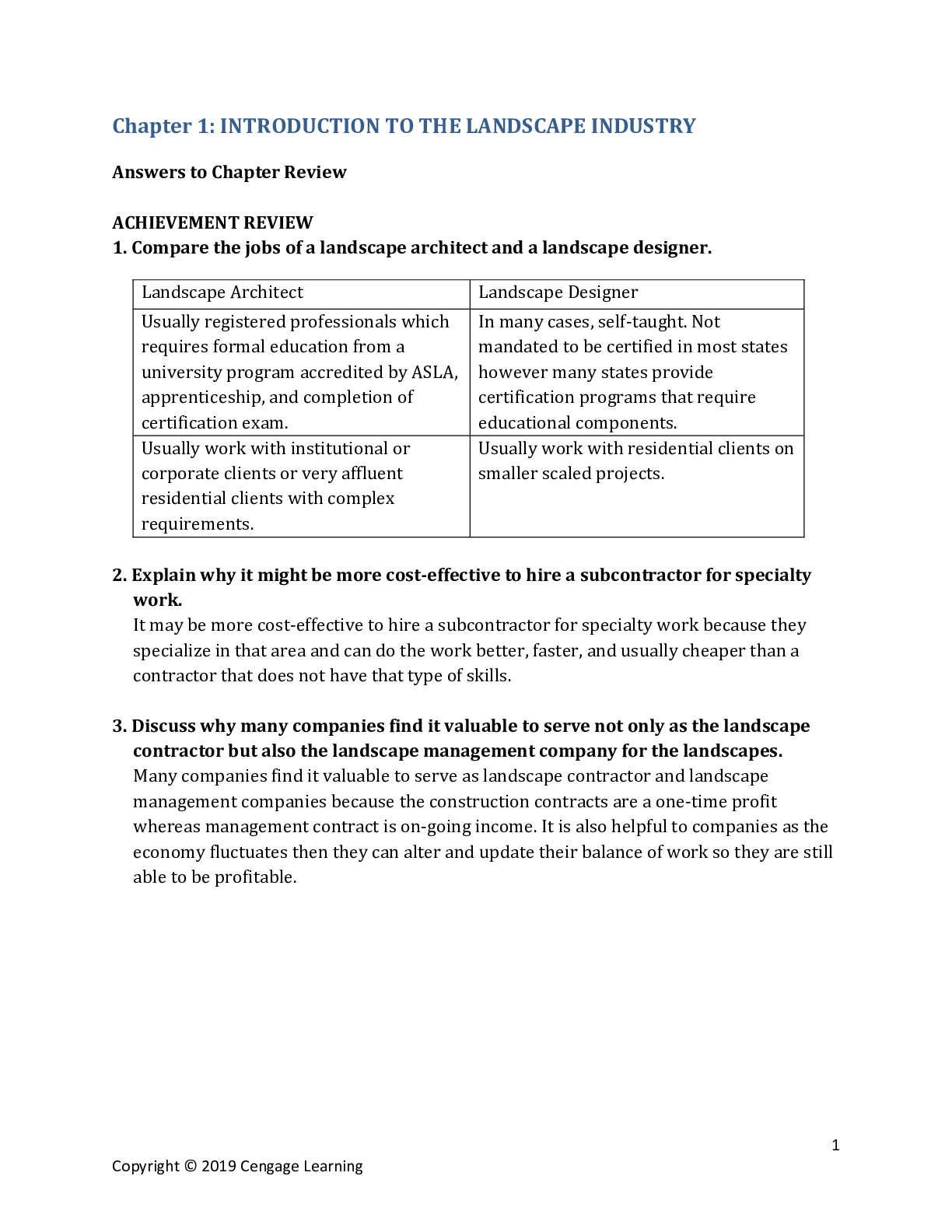

Solution Manual For Landscaping Principles & Practices, 8th Edition by Jack Ingels, Alissa F. Smith

$ 19

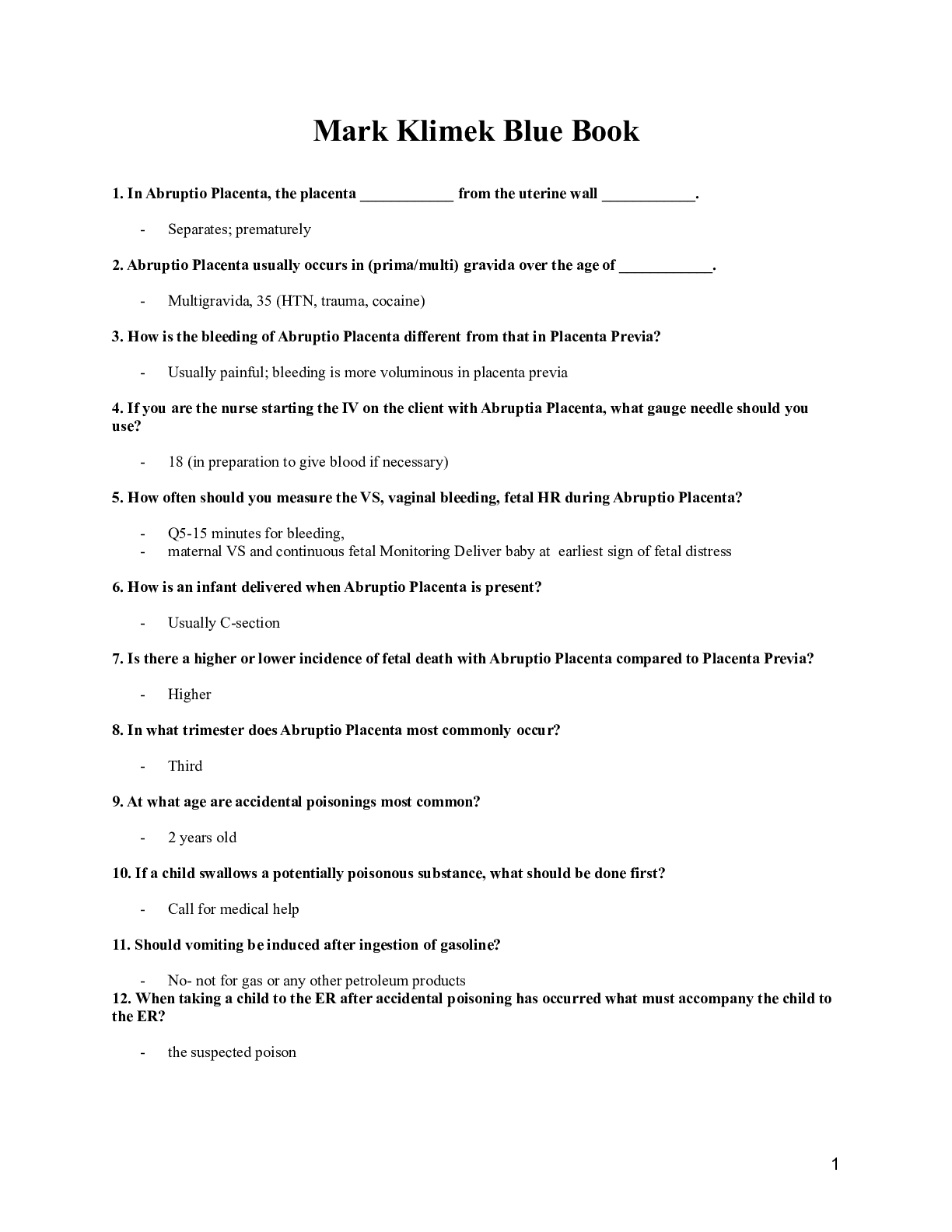

Mark Klimek Lecture Notes new 2021 for High Scoring Grades

$ 12

Pearson Edexcel IAL in A Level Physics WPH14/01 Paper 01 Physics Further Mechanics, Fields and Particles. Mark Scheme (Results) January 2022

.png)

.png)