Engineering > QUESTIONS & ANSWERS > Stationary Engineer Possible Final Exam Questions and Answers (All)

Stationary Engineer Possible Final Exam Questions and Answers

Document Content and Description Below

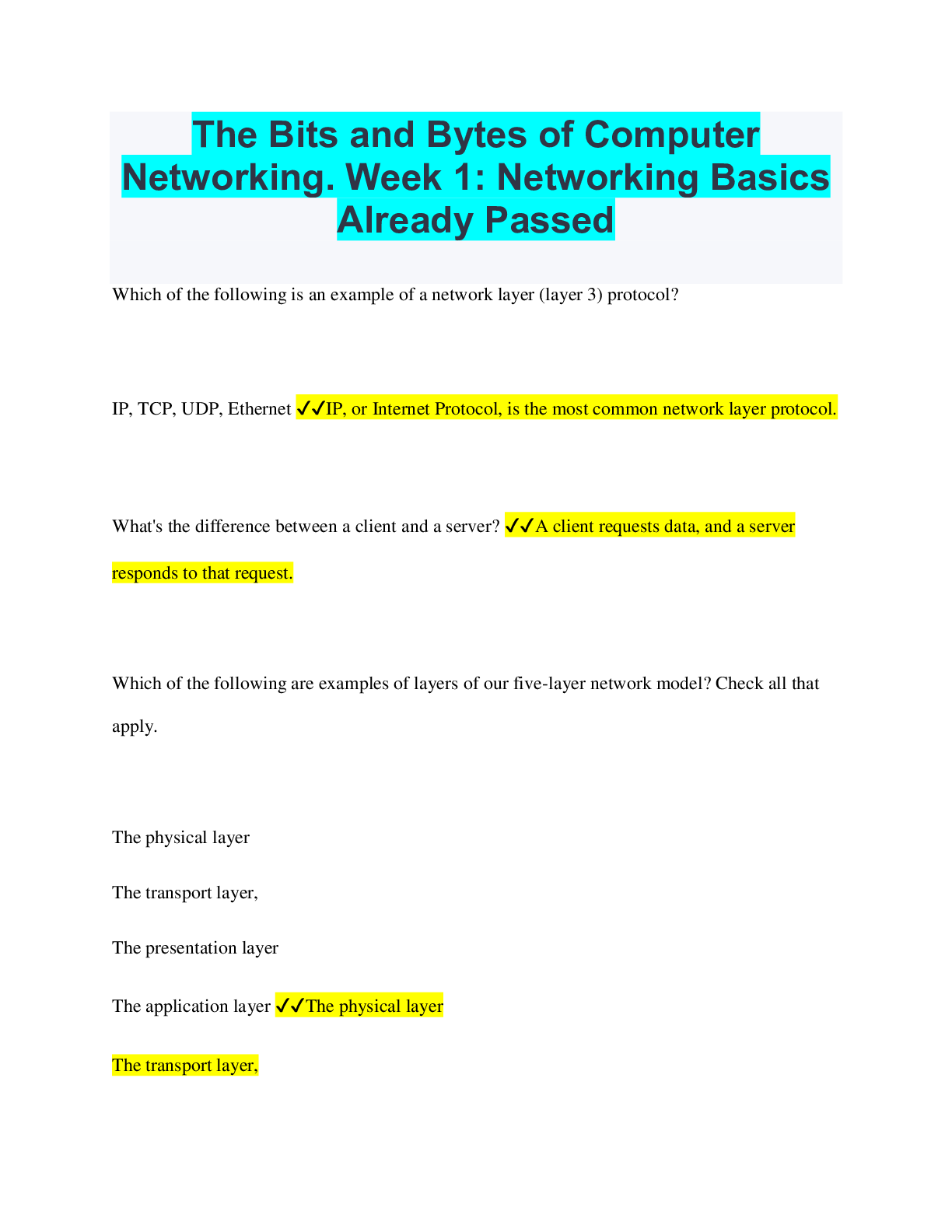

Stationary Engineer Possible Final Exam Questions and Answers Which of the following is an important wunderwriting principle of group life insurance. Answers>> Everyone must be covered in the g... roup An architecture firm would stand to lose a lot of money in the event of the death of its project manager. Which type of policy should the firm purchase on its project manager? Answers>> Key Person Life Policy S is covered by a whole life policy. Which insurance product can cover his children? Answers>> Child Term Rider A 15-year mortgage is best protected by what kind of life policy? Answers>> 15-year decreasing term E and F are business partners. Each takes out a $500,000 life insurance policy on the other, naming himself as primary beneficiary. E and F eventually terminate their business, and four months later E dies. Although E was married with three children at the time of death, the primary beneficiary is still F. However, an insurable interest no longer exists. Where will the proceeds from E's life insurance policy be directed to? Answers>> F When a minor is designated as the sole primary beneficiary, Answers>> a guardian will be court-appointed in the event of a death claim Which if the following best describes a warranty Answers>> Statement gaurenteed to be true A company that has not been authorized to operate in Colorado is known as Answers>> a nonadmitted insurer Insurance policies are offered on a "take it or leave it" basis which make them Answers>> Contracts of adhesion Which settlement option pays a stated amount to an annuitant, but no residual value to a beneficiary? Answers>> Life income ___ of personal life insurance premiums is usually deductible for federal income tax Answers>> 0% Which of these is an element of a Variable Life Policy? Answers>> A fixed, level premium Who benefits in Invested-Originated Life Insurance (IOLI) when the insured dies? Answers>> Policyowner Information obtained from a phone conversation to the proposed insured can be found in which of these reports? Answers>> Inspection Report a life insurance policy would be considered a wagering contract WITHOUT: Answers>> Insurable Interest A policyowner may generate a taxable income from which of the following Dividend options Answers>> Accumulation at Interest All of the following statements regarding a Tax Sheltered Annuity (TSA) are true EXCEPT: Answers>> Income derived from the TSA is received income tax-free ABC Insurance Company has accepted a life insurance application which contains unanswered questions. The company then makes the application part of the life contract. In this situation the insurer has: Answers>> waived one of its legal rights Which of the following is NOT a problem when existing life insurance is replaced with new coverage? Answers>> Comprehensive coverage may increase under the new policy The accidental death and dismemberment (AD&D) provision in a life insurance policy would pay additional benefits if the insured: Answers>> Is blinded in an accident. If its employees share in the cost of insurance, what type of group life insurance plan would a corporation have? Answers>> Contributory The amount of monthly disability benefits payable under Social Security is affected by which of the following factors? Answers>> Amount of the benefits available from other sources S buys a $10,000 Whole Life policy in 2003 and pays an annual premium of $100. S dies 5 years later in 2008 and the insurer pays the beneficiary $10,500. What kind of rider did S include on the policy? Answers>> Return of a premium rider K has inherited a large sum of money. J purchases an annuity with this sum on July 1, and starts receiving payments August 1. These payments will continue for as long as she and her spouse lives. Which type of annuity did K purchase? Answers>> Single Premium immediate Joint With Sirvivor Annuity The part of a Life Insurance policy guaranteed to be true is called a(n): Answers>> Warranty A Cost of Living rider gives the insured Answers>> Additional Death benefits The premiums paid by an employer for his employee's group life insurance are usually considered to be Answers>> Tax-deductible to the employer A policy that becomes a Modified Endowment Contract (MEC) Answers>> will lose many of its tax advantages The option that provides an additional death benefit for a limited amount of time at the lowest possible cost is called a(n) Answers>> Accidental Death and Dismemberment (AD&D) How are Roth IRA distributions normally taxed? Answers>> Distributions are received tax-free Consumer reports requested by an underwriter during the application process of a life insurance policy can be used to determine: Answers>> Probability of making timely premium payments Which of these is an element of a Single Premium annuity? Answers>> Lump-sum payment A Universal Life policy is sometimes referred to as an unbundled Life Policy because the owner can see the interest earned, cost of insurance, and the Answers>> Expense Charges Which of the following are Equity Indexed Annuities typically invested in? Answers>> S&P 500 T is the policy owner for a Life Insurance policy with an Irrevocable beneficiary designation. If T wishes to change the beneficiary Answers>> Beneficiary Whole Life Insurance is sometimes referred to as "Straight Life" What does the word straight indicate when using this phrase? Answers>> The duration of premium payments [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 02, 2023

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Mar 02, 2023

Downloads

0

Views

110

Answered 2023.png)