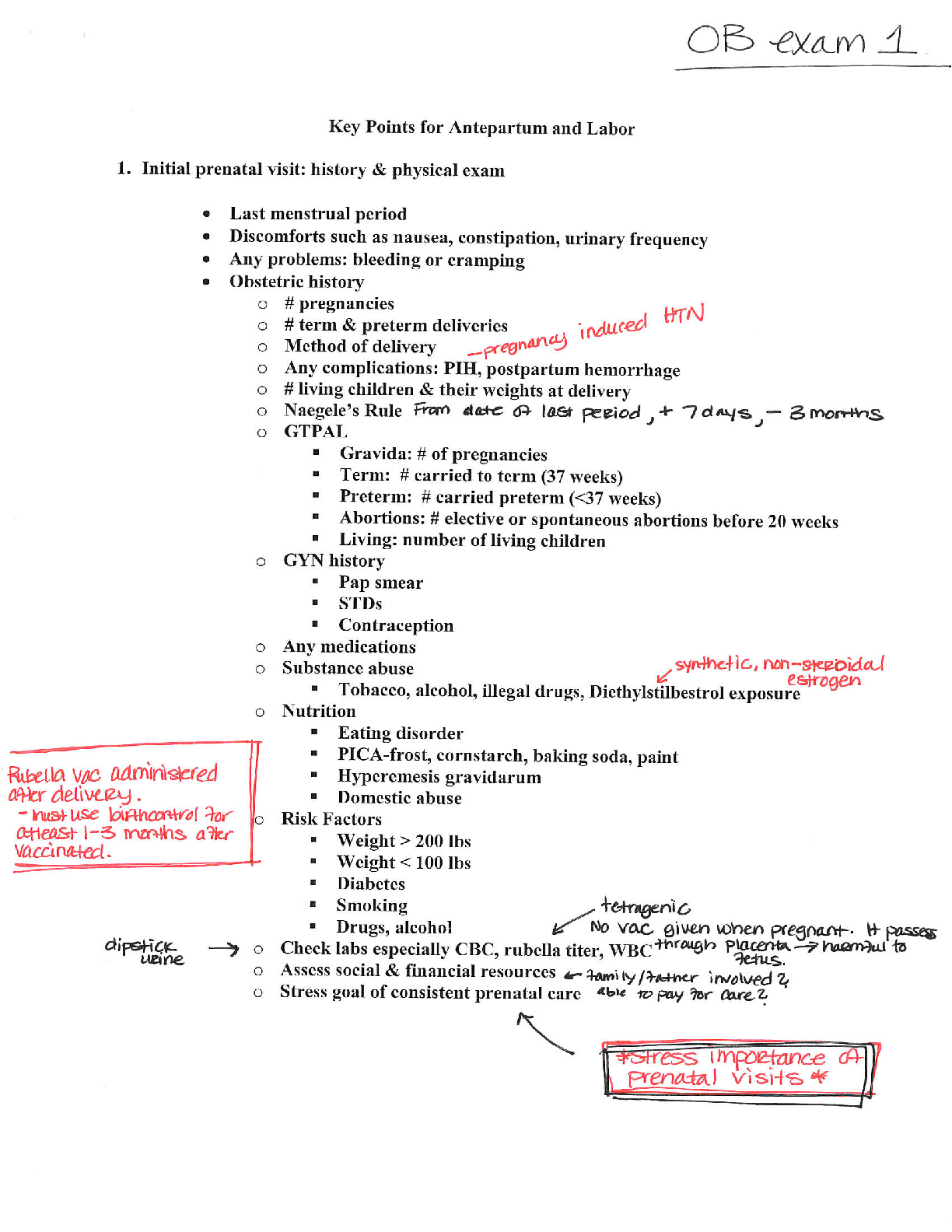

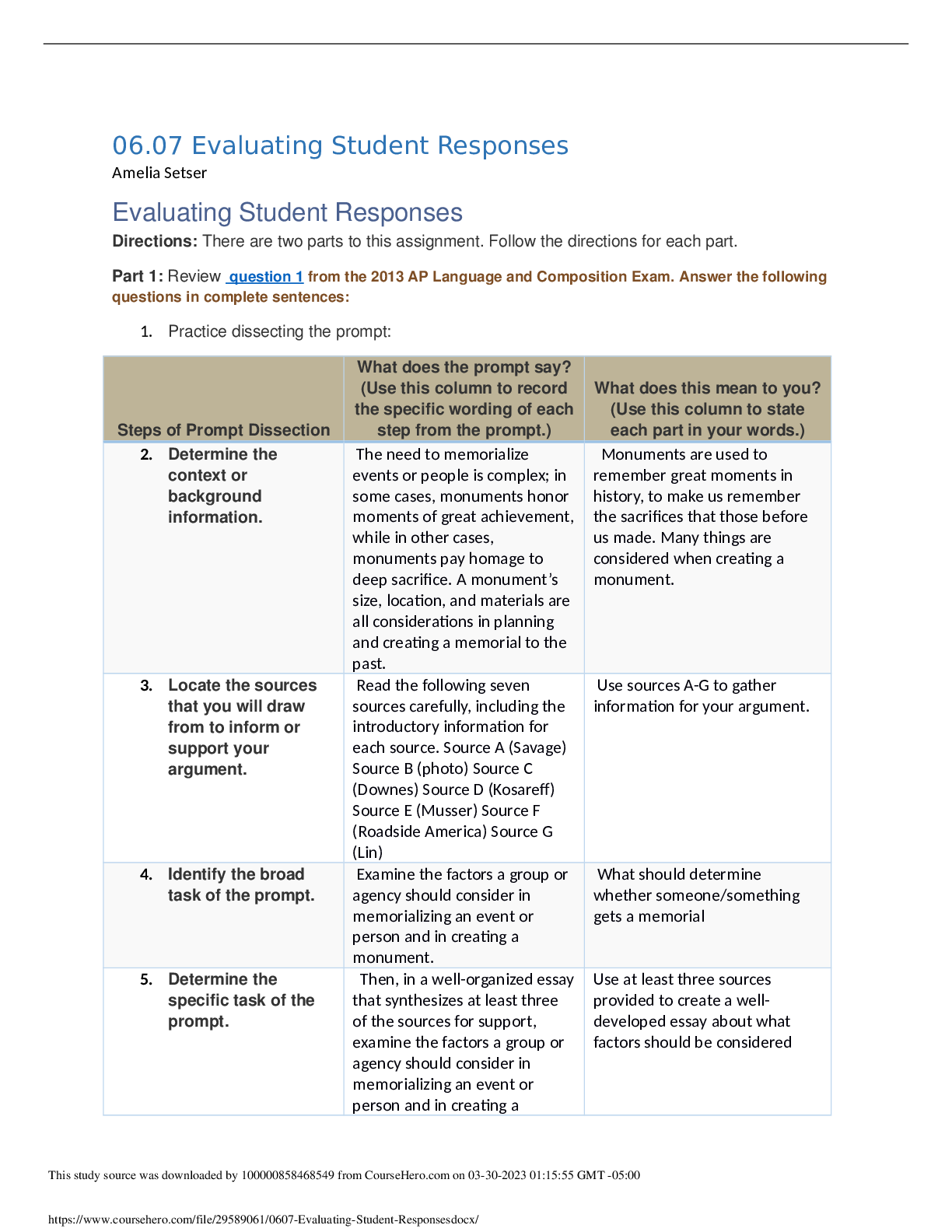

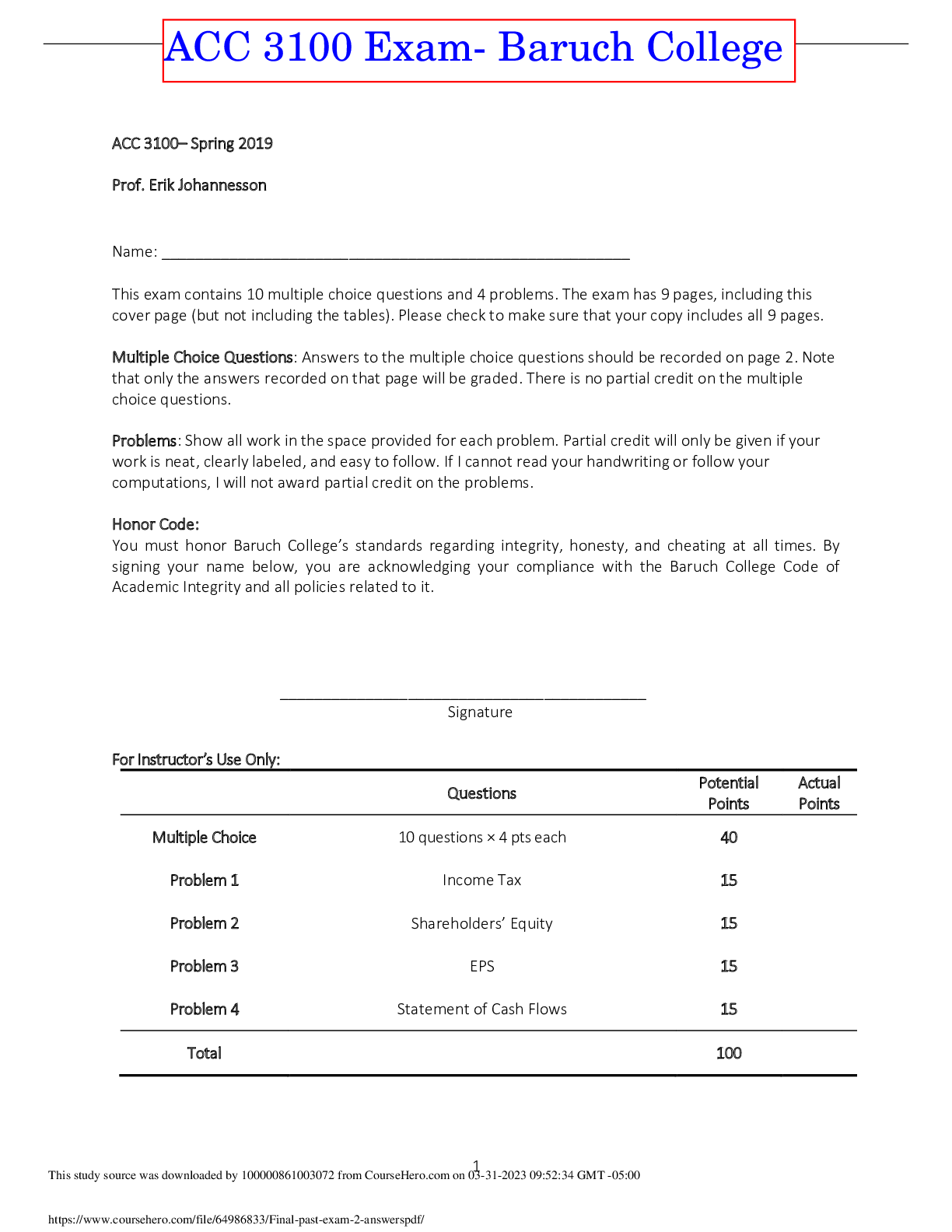

Financial Accounting > EXAM REVIEW > ACC 3100 Exam- Baruch College: Test on Income Tax, Shareholders’ Equity, EPS, Statement of Cash Fl (All)

ACC 3100 Exam- Baruch College: Test on Income Tax, Shareholders’ Equity, EPS, Statement of Cash Flows. MCQ & Solutions. 100% Score

Document Content and Description Below

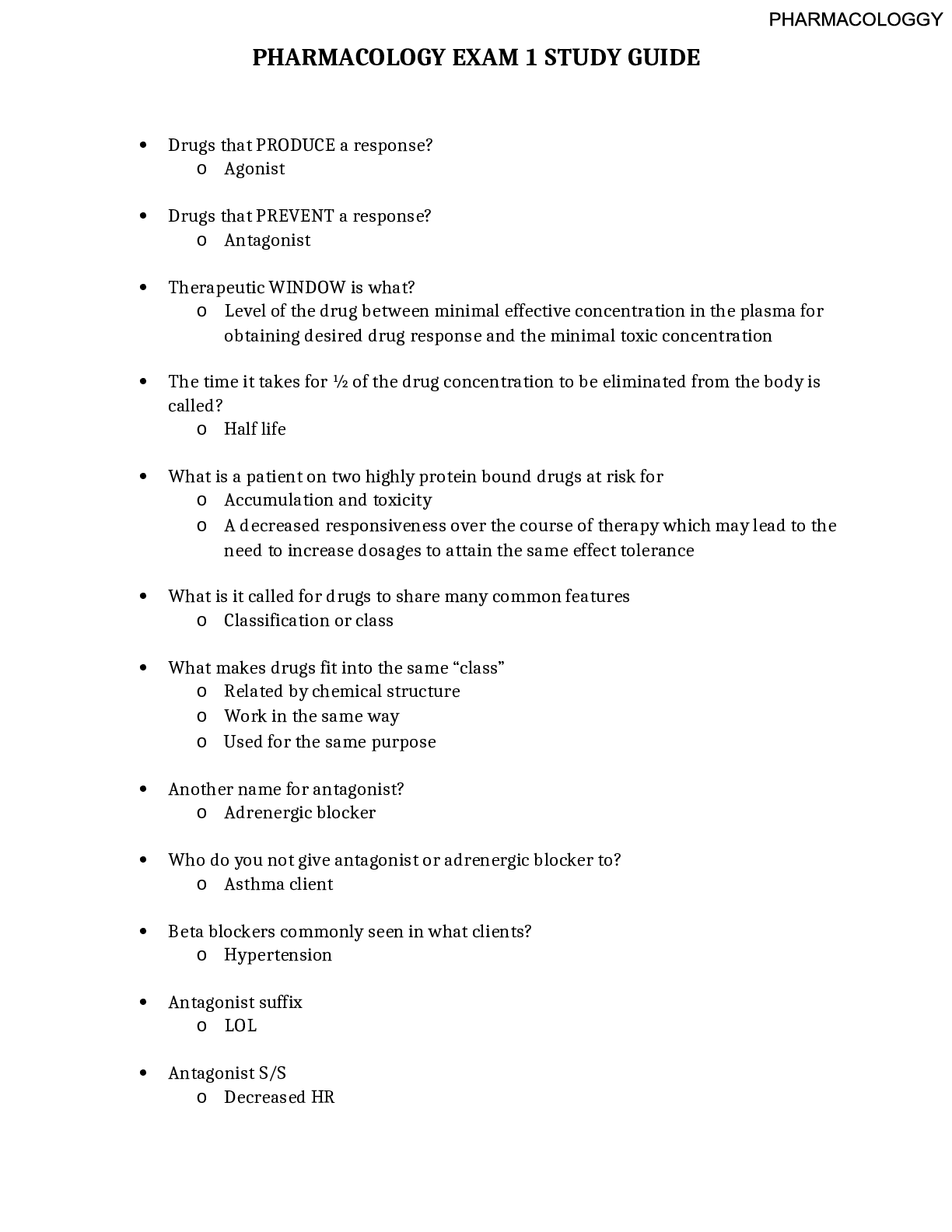

ACC 3100 Exam- Baruch College: Test on Income Tax, Shareholders’ Equity, EPS, Statement of Cash Flows. Questions and Solutions. Which of the following is incorrect about the recent tax reform? A. C... ompanies that had large amounts of deferred tax assets suffered losses. B. Companies can no longer carryback net operating losses. C. Fixed assets can be depreciated immediately for tax purposes. D. Companies that had large amounts of deferred tax liabilities enjoyed gains. E. None of the above. 2. Which of the following creates a deferred tax asset? A. An unrealized gain on an investment held at fair value. B. A realized gain on an investment held at fair value. C. Accelerated depreciation on the tax return. D. Installment sales of long-term assets. E. Subscriptions collected in advance of providing services. 3. During 2018, its first year of operations, American Laminating Corporation reported an operating loss of $100 million for financial reporting and tax purposes. The enacted tax rate is 21%. In 2019, American reported a pretax accounting income of $40 million and applies a net operating loss carryforward up to 80% of taxable income. Which of the following is incorrect? A. Income tax payable in 2018 is zero. B. Net loss in 2018 is $79 million. C. The deferred tax asset balance at the end of 2018 is $21 million. D. The deferred tax asset balance decreases in 2019. E. Income tax expense in 2019 is zero. 4. Which of the following is incorrect? A. Stock dividends decrease the market capitalization of the company. B. Cash dividends decrease the market capitalization of the company. C. Stock dividends decrease the price per share of the company’s stock. D. Cash dividends decrease the price per share of the company’s stock. E. None of the above. [Show More]

Last updated: 2 years ago

Preview 1 out of 9 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 06, 2023

Number of pages

9

Written in

Additional information

This document has been written for:

Uploaded

Apr 06, 2023

Downloads

0

Views

190