Business > QUESTIONS & ANSWERS > WGU C239 Topic 3 Questions | Questions with 100% Correct Answers | Verified | Latest Update (All)

WGU C239 Topic 3 Questions | Questions with 100% Correct Answers | Verified | Latest Update

Document Content and Description Below

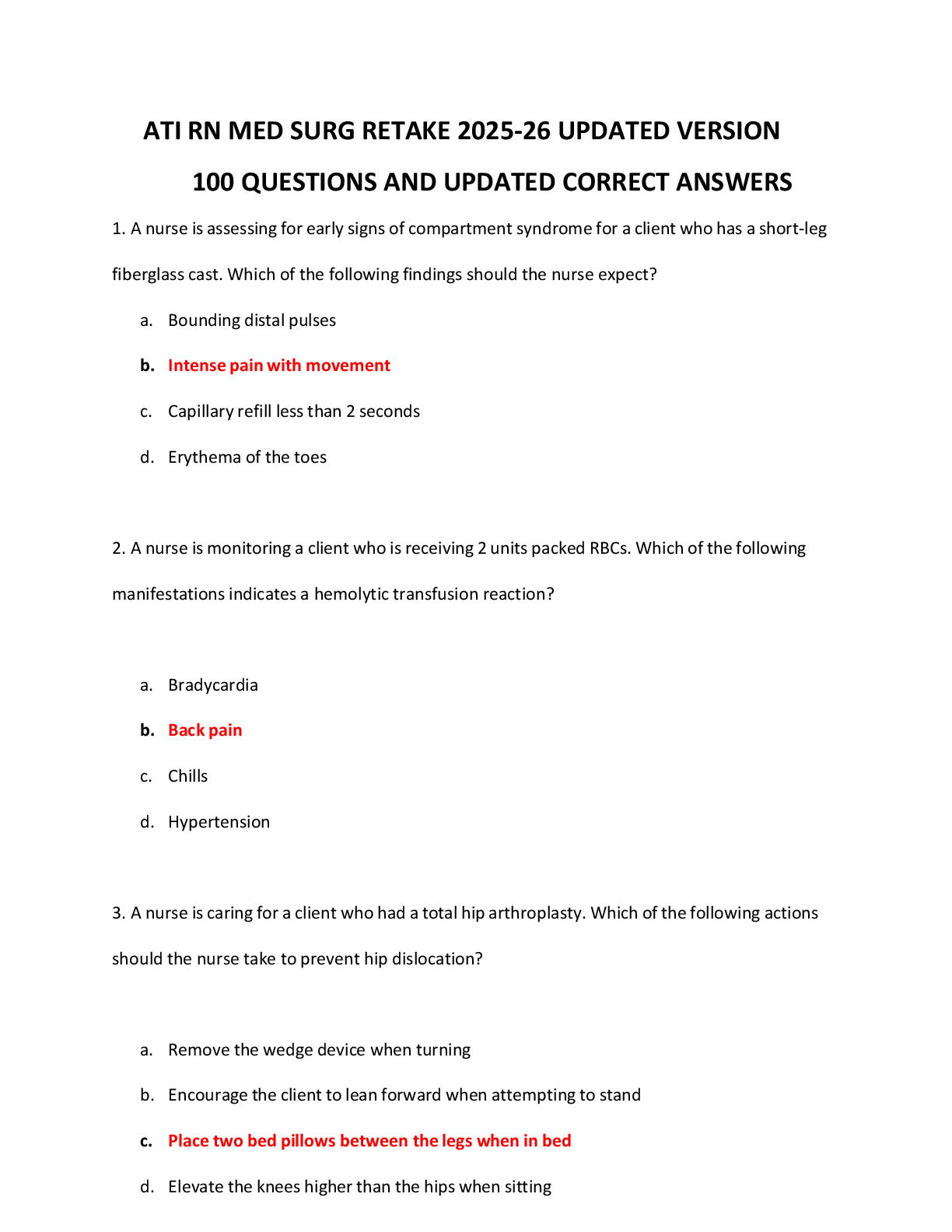

WGU C239 Topic 3 Questions | Questions with 100% Correct Answers | Verified | Latest Update 1. Why would a taxpayer need to include IRS Form 8332, Release/Revocation of Claim to Exemption of Child ... by Custodial Parent, in their personal income tax return? A. To allow a noncustodial ex-spouse permission to take the child's dependency exemption, or to revoke same. B. To disallow an ex-spouse permission from taking child's dependency exemption because they only provided 10% of child's support. C. To disallow an ex-spouse permission from taking child's dependency exemption because they provided less than 50% of child's support. D. To allow a noncustodial ex-spouse permission to take the child's dependency exemption if they provide 90% of child's support. -✔✔ A. To allow a noncustodial ex-spouse permission to take the child's dependency exemption, or to revoke same. 1. What is the purpose of the Forms 1040 Schedule A, and 1040 Schedule C, respectively, for an individual taxpayer? A. To record profit or loss from a sole proprietorship, and itemized deductions B. To record dependency exemptions, and profit or loss from a sole proprietorship C. To record itemized deductions, and profit or loss from a sole proprietorship D. To record the standard deductions in lieu of itemized deductions, and profit or loss from a sole proprietorship -✔✔ C. To record itemized deductions, and profit or loss from a sole proprietorship 1. What is the purpose of the Form 1040 Schedule E (including both page 1 and 2 of Schedule E) for an individual taxpayer? A. To record profit or loss from a sole proprietorship, and K-1s received from S Corporations, Partnerships, and Estates. B. To record rental income & expenses, royalties, and K-1s received from S Corporations, Partnerships, and Estates. C. To record itemized deductions, and profit or loss from a sole proprietorship D. To record the profits but not losses of a sole proprietorship, and royalties. -✔✔ B. To record rental income & expenses, royalties, and K-1s received from S Corporations, Partnerships, and Estates. 1. In 2019, a single person operates a business as a sole proprietorship. The business sells hammers on the internet. The business has revenues of $550,000 and expenses of 350,000, which includes $90,000 of wages. The individual also has a part-time job and earns $20,000. The individuals average tax rate is 24%, and the corporate tax rate is 21%. If the business operates as a C corporation, what is the 2019 tax liability? A. $48,000 B. $42,000 C. $46,200 D. $40,000 -✔✔ B. $42,000 5. Form 2553, Election by a Small Business Corporation, is used for what purpose: A. To elect Sec. 179 depreciation. B. To elect to be treated as an S Corporation for Federal income tax purposes. C. To elect to undo a previous S Corporation election. D. To elect to be treated as a partnership for Federal income tax purposes. -✔✔ B. To elect to be treated as an S Corporation for Federal income tax purposes. 6. Form 2120, Multiple Support Declaration, is used for what purpose? A. To indicate which parent is taking a minor child's dependency exemption. B. To indicate amount of support being provided by a college student for their own support. C. To indicate support provided by a person providing at least 10% for a qualifying relative, other than a child. D. To indicate which parent will be taking the American Opportunity Credit for a college aged child. -✔✔ C. To indicate support provided by a person providing at least 10% for a qualifying relative, other than a child. 7. Matrix Corporation made a charitable donation to the American Red Cross in the amount of $100,000 during 2018. Their taxable income prior to considering this charitable donation is $200,000. What is the amount of corporate tax liability for 2019, prior to any estimated tax payments being applied? A. $37,800 B. $42,000 C. $21,000 D. $31,500 -✔✔ A. $37,800 200,000 Prefinal taxable income (20,000) $200,000 X 10% = $20,000 (Corporate charity is limited to 10% of taxable income b4 the charity or DRD.) 180,000 Taxable income X 21% Corporate flat tax rate 37,800 Tax liability 8. The ultimate economic burden of a tax is best captured by: A) the marginal tax rate. B) the effective tax rate. C) the average tax rate. D) the proportional tax rate. E) None of the choices are correct -✔✔ B) the effective tax rate. 9. Which of the following is not an example of a graduated tax rate structure? A) Progressive tax rate structure B) Proportional tax rate structure C) U.S. Federal Income Tax D) None of the choices are correct -✔✔ B) Proportional tax rate structure 10. The goal of tax planning generally is to: A) minimize taxes. B) minimize IRS scrutiny. C) maximize after-tax wealth. D) support the Federal government. E) None of the choices are correct. -✔✔ C) maximize after-tax wealth. 11. Which of the following increases the benefits of income deferral? A) Increasing tax rates. B) Smaller after-tax rate of return. C) Larger after-tax rate of return. D) Smaller magnitude of transactions. E) None of the choices are correct. -✔✔ C) Larger after-tax rate of return. 12. Which of the following decreases the benefits of accelerating deductions? A) Decreasing tax rates. B) Smaller after-tax rate of return. C) Larger after-tax rate of return. D) Larger magnitude of transactions. E) None of the choices are correct. -✔✔ A) Decreasing tax rates. 13. To calculate a gain or loss on the sale of an asset, the proceeds from the sale are reduced by which of the following? A) Tax basis of the property. B) Selling expenses. C) Amount realized. D) Tax basis of the property and selling expenses. E) All of the choices are correct. -✔✔ D) Tax basis of the property and selling expenses. 14. Long-term capital gains (depending on type) for individual taxpayers can be taxed at a maximum rate of: A) 20 percent. B) 25 percent. C) 28 percent. D) Both 20 percent and 28 percent. E) All of the choices are correct. -✔✔ C) 28 percent. 15. In 2018, Stephanie had the following capital gains (losses) from the sale of her investments: $2,000 LTCG, $25,000 STCG, ($9,000) LTCL, and ($15,000) STCL. What is the amount and nature of Stephanie's capital gains and losses? A) $3,000 net short-term capital gain. B) $3,000 net long-term capital loss. C) $4,000 net short-term capital gain. D) $4,000 net long-term capital loss. E) None of the choices are correct. -✔✔ A) $3,000 net short-term capital gain. 16. The maximum amount of net capital losses individual taxpayers may deduct against their ordinary income per year is: A A) $3,000. B) $5,000. C) Zero, losses are not deductible. D) There is no maximum. All losses are allowed to be deducted. E) None of the choices are correct. -✔✔ A. $3,000.00 [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

Bundle for WGU C239 Exams Compilation | Verified | Guaranteed Success

WGU C239 Advanced Tax Concepts Study Set | 60 Questions with 100% Correct Answers | Verified | Latest Update WGU C239 Advanced Tax Practice Exam | 50 Questions with 100% Correct Answers | Verified...

By Prof.Pierro 2 years ago

$16

6

Reviews( 0 )

$11.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 20, 2023

Number of pages

15

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 20, 2023

Downloads

0

Views

262

.png)