ATI TEAS 7 TEST 2023 BANK WITH ANSWER KEY AND EXPLANATION.

Business > QUESTIONS & ANSWERS > WGU C239 Advanced Tax Practice Exam | 50 Questions with 100% Correct Answers | Verified | Latest Upd (All)

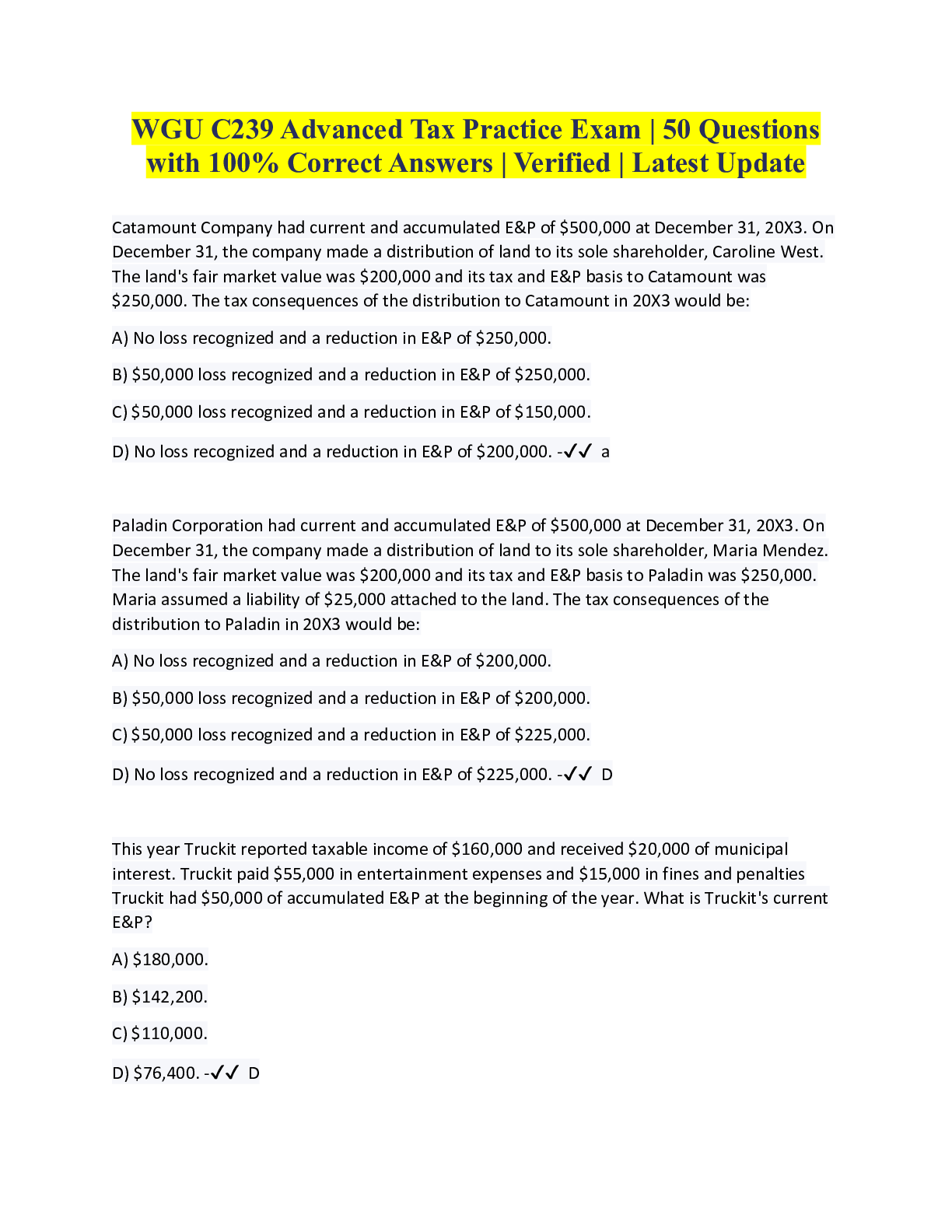

WGU C239 Advanced Tax Practice Exam | 50 Questions with 100% Correct Answers | Verified | Latest Update Catamount Company had current and accumulated E&P of $500,000 at December 31, 20X3. On Decemb ... er 31, the company made a distribution of land to its sole shareholder, Caroline West. The land's fair market value was $200,000 and its tax and E&P basis to Catamount was $250,000. The tax consequences of the distribution to Catamount in 20X3 would be: A) No loss recognized and a reduction in E&P of $250,000. B) $50,000 loss recognized and a reduction in E&P of $250,000. C) $50,000 loss recognized and a reduction in E&P of $150,000. D) No loss recognized and a reduction in E&P of $200,000. -✔✔ a Paladin Corporation had current and accumulated E&P of $500,000 at December 31, 20X3. On December 31, the company made a distribution of land to its sole shareholder, Maria Mendez. The land's fair market value was $200,000 and its tax and E&P basis to Paladin was $250,000. Maria assumed a liability of $25,000 attached to the land. The tax consequences of the distribution to Paladin in 20X3 would be: A) No loss recognized and a reduction in E&P of $200,000. B) $50,000 loss recognized and a reduction in E&P of $200,000. C) $50,000 loss recognized and a reduction in E&P of $225,000. D) No loss recognized and a reduction in E&P of $225,000. -✔✔ D This year Truckit reported taxable income of $160,000 and received $20,000 of municipal interest. Truckit paid $55,000 in entertainment expenses and $15,000 in fines and penalties Truckit had $50,000 of accumulated E&P at the beginning of the year. What is Truckit's current E&P? A) $180,000. B) $142,200. C) $110,000. D) $76,400. -✔✔ D Which of the following are subtractions from taxable income in computing current E&P? A) Federal income taxes paid. B) Current charitable contributions in excess of 10 percent limitation. C) Current year net capital loss. D) All of the choices are subtractions from taxable income in computing current E&P. -✔✔ A Which of the following statements is not considered a timing difference due to separate accounting methods for taxable income and E&P? A) Dividends received deduction. B) Installment gain recognized in current year related to a sale in a prior year. C) Gain on sale of depreciable assets with higher E&P basis. D) Section 179 expense. -✔✔ A Which of the following stock distributions would be tax-free to the shareholder? A) A 2-for-1 stock split to all holders of common stock. B) A stock distribution where the shareholder could choose between cash and stock. C) A stock distribution to all holders of preferred stock. D) A 2-for-1 stock split to all holders of common stock and a stock distribution to all holders of preferred stock are tax-free to the shareholder. -✔✔ A El Toro Corporation declared a common stock distribution to all shareholders of record on June 30, 20X3. Shareholders will receive 1 share of El Toro stock for each 2 shares of stock they already own. Raoul owns 300 shares of El Toro stock with a tax basis of $60 per share. The fair market value of the El Toro stock was $100 per share on June 30, 20X3. What are the tax consequences of the stock distribution to Raoul? A) $0 dividend income and a tax basis in the new stock of $100 per share. B) $0 dividend income and a tax basis in the new stock of $60 per share. C) $0 dividend income and a tax basis in the new stock of $40 per share. D) $15,000 dividend and a tax basis in the new stock of $100 per share. -✔✔ C Wonder Corporation declared a common stock distribution to all shareholders of record on September 30, 20X3. Shareholders will receive three shares of Wonder stock for each five shares of stock they already own. Diana owns 300 shares of Wonder stock with a tax basis of $90 per share (a total basis of $27,000). The fair market value of the Wonder stock was $180 per share on September 30, 20X3. What are the tax consequences of the stock distribution to Diana? A) $0 dividend income and a tax basis in the new stock of $180 per share. B) $0 dividend income and a tax basis in the new stock of $67.50 per share. C) $0 dividend income and a tax basis in the new stock of $56.25 per share. D) $10,800 dividend and a tax basis in the new stock of $180 per share. -✔✔ C Which of the following individuals is not considered "family" for purposes of applying the stock attribution rules to a stock redemption? A) Parents. B) Grandchildren. C) Grandparents. D) Spouse. -✔✔ C Which of the following statements is true? A) All stock redemptions are treated as exchanges for tax purposes. B) A stock redemption not treated as an exchange will automatically be treated as a taxable dividend. C) All stock redemptions are treated as dividends if received by an individual. D) A stock redemption is treated as an exchange only if it meets one of three stock ownership tests described in the Internal Revenue Code. -✔✔ D Sam owns 70 percent of the stock of Club Corporation. Unrelated individuals own the remaining 30 percent. For a stock redemption of Sam's stock to be treated as an exchange under the "substantially disproportionate" test, what percentage of Club stock must Sam own after the redemption? A) Any percentage less than 70 percent. B) Any percentage less than 56 percent. C) Any percentage less than 50 percent. D) All stock redemptions involving individuals are treated as exchanges. -✔✔ C Sara owns 60 percent of the stock of Lea Corporation. Unrelated individuals own the remaining 40 percent. For a stock redemption of Sara's stock to be treated as an exchange under the "substantially disproportionate" test, what percentage of Lea stock must Sara own after the redemption? A) Any percentage less than 60 percent. B) Any percentage less than 50 percent. C) Any percentage less than 48 percent. D) All stock redemptions involving individuals are treated as exchanges. -✔✔ C Comet Company is owned equally by Pat and his sister Pam, each of whom hold 100 shares in the company. Pam wants to reduce her ownership in the company, and it was decided that the company will redeem 50 of her shares for $1,000 per share on December 31, 20X3. Pam's income tax basis in each share is $500. Comet has total E&P of $250,000. What are the tax consequences to Pam because of the stock redemption? A) $25,000 capital gain and a tax basis in each of her remaining shares of $500. B) $25,000 capital gain and a tax basis in each of her remaining shares of $100. C) $50,000 dividend and a tax basis in each of her remaining shares of $100. D) $50,000 dividend and a tax basis in each of her remaining shares of $50. -✔✔ A Comet Company is owned equally by Pat and his sister Pam, each of whom hold 100 shares in the company. Comet redeems 50 of Pam's shares on December 31, 20X3, for $1,000 per share in a transaction that Pam treats as an exchange for tax purposes. Comet has total E&P of $250,000 on December 31, 20X3. What are the tax consequences to Comet because of the stock redemption? A) No reduction in E&P because of the exchange. B) A reduction of $50,000 in E&P because of the exchange. C) A reduction of $62,500 in E&P because of the exchange. D) A reduction of $125,000 in E&P because of the exchange. -✔✔ B Comet Company is owned equally by Pat and his sister Pam, each of whom hold 100 shares in the company. Comet redeems 50 of Pam's shares on December 31, 20X3, for $1,000 per share in a transaction that Pam treats as an exchange for tax purposes. Comet has total E&P of $160,000 on December 31, 20X3. What are the tax consequences to Comet because of the stock redemption? A) No reduction in E&P because of the exchange. B) A reduction of $50,000 in E&P because of the exchange. C) A reduction of $40,000 in E&P because of the exchange. D) A reduction of $80,000 in E&P because of the exchange. -✔✔ C Viking Corporation is owned equally by Sven and his wife Olga, each of whom hold 100 shares in the company. Viking redeemed 75 shares of Sven's stock in the company on December 31, 20X3. Viking paid Sven $2,000 per share. His income tax basis in each share is $1,000. Viking has total E&P of $500,000. What are the tax consequences to Sven because of the stock redemption? A) $75,000 capital gain and a tax basis in each of his remaining shares of $1,000. B) $75,000 capital gain and a tax basis in each of his remaining shares of $2,000. C) $150,000 dividend and a tax basis in each of his remaining shares of $1,000. D) $150,000 dividend and a tax basis in each of his remaining shares of $4,000. -✔✔ D Viking Corporation is owned equally by Sven and his wife Olga, each of whom hold 100 shares in the company. Viking redeemed 75 shares of Sven's stock for $2,000 per share on December 31, 20X3. Viking has total E&P of $500,000. What are the tax consequences to Viking because of the stock redemption? A) No reduction in E&P because of the exchange. B) A reduction of $150,000 in E&P because of the exchange. C) A reduction of $187,500 in E&P because of the exchange. D) A reduction of $375,000 in E&P because of the exchange. -✔✔ B [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

WGU C239 Advanced Tax Concepts Study Set | 60 Questions with 100% Correct Answers | Verified | Latest Update WGU C239 Advanced Tax Practice Exam | 50 Questions with 100% Correct Answers | Verified...

By Prof.Pierro 2 years ago

$16

6

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Apr 20, 2023

Number of pages

16

Written in

All

This document has been written for:

Uploaded

Apr 20, 2023

Downloads

0

Views

919

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·