Risk Management and Insurance > QUESTIONS & ANSWERS > California Life License Exam Latest 2023 Graded A+ (All)

California Life License Exam Latest 2023 Graded A+

Document Content and Description Below

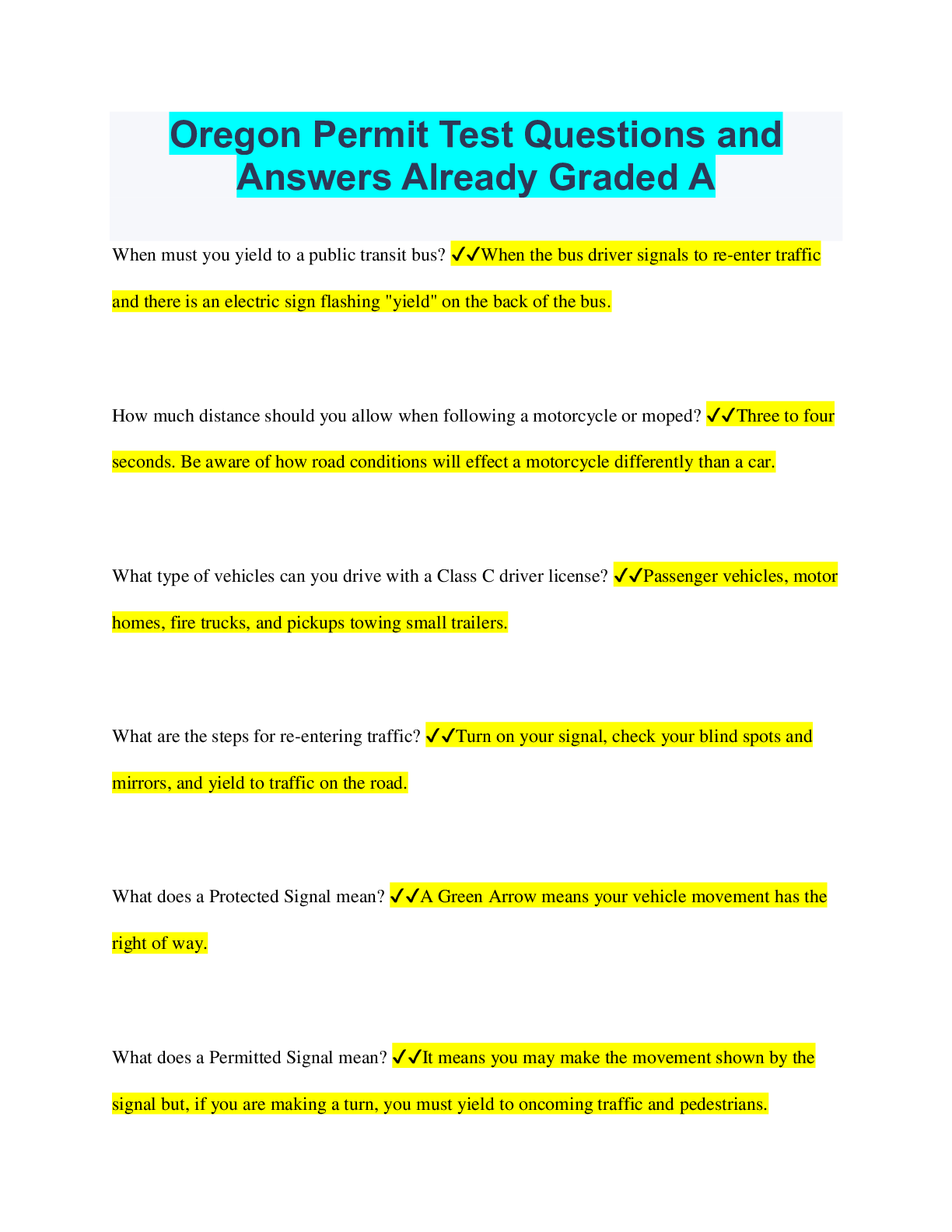

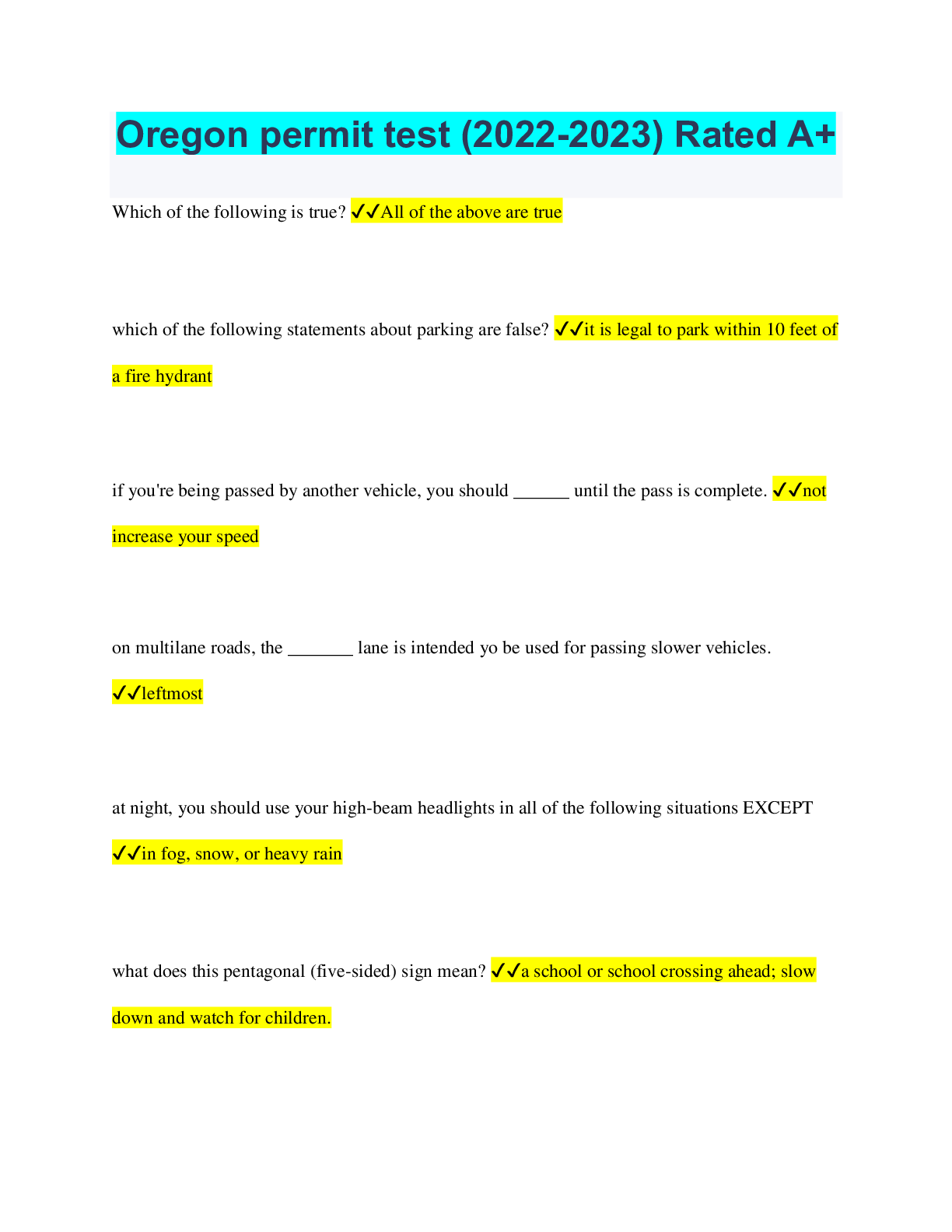

California Life License Exam Latest 2023 Graded A+ An annuity that is purchased with a lump sum premium and whose benefits begin after 12 months is called a ... ✔✔Single premium deferred annuit... y A technique that is used to determine the amount of life insurance needed on the projected earning potential of an insured is called the... ✔✔Human life approach When replacing a policy the producer must present the applicant with a Notice Regarding Replacement of Life Insurance... ✔✔At the time of taking the application The possibility of a financial loss incurred by a life insurance company got the premature death of an insured is known as a... ✔✔Risk A person who signs a fraudulent claim form may be found guilty of... ✔✔Perjury Which policy is a combination of annual renewable term insurance and interest-sensitive cash value? ✔✔Universal life The right to a full refund of premiums for insureds age 60 or older is ✔✔14 days Intentionally omitting a history of heart problem on application ✔✔Concealment A tax-sheltered annuity (TSA) is a qualified plan available for ✔✔Non-profit organizations The intent of replacement regulations is to protect the ✔✔Policyowner Which provision allows a lapsed policy to be put back in force ✔✔Reinstatement According to the California Department of Insurance, an insurer whose articles of Incorporation are registered in Oslo, Norway is considered a/an ✔✔Alien Insurer Mortality is defined as the ✔✔Rate of death Which of the following is NOT a characteristic of group life insurance? - A group may exist for the purpose of purchasing insurance - The Insurance is written as a master policy - Members receive a certificate of insurance - Conversion rights without evidence of insurability must be offered ✔✔A group may exist for the purpose of purchasing insurance When a producer collects the initial premium and issues a conditional receipt, the receipt... ✔✔May allow life insurance companies to start coverage before policy delivery The law of large numbers allows an insurance company to predict the expected losses among ✔✔Members of a group of individuals with similar risks If an insurers legal reserve funds are found to be less than the minimum required by law, the insurer is considered ✔✔Insolvent Which type of policy would be suitable to protect the balance of a home mortgage ✔✔decreasing term When must insurable interest exist ✔✔At the time of application which ✔✔ The rider ✔✔ [Show More]

Last updated: 2 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

California Life Insurance Bundled Exams Questions and Answers (2022/2023) (Verified Solutions)

California Life Insurance Bundled Exams Questions and Answers (2022/2023) (Verified Solutions)

By Nutmegs 2 years ago

$35

20

Reviews( 0 )

$8.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 10, 2023

Number of pages

4

Written in

Additional information

This document has been written for:

Uploaded

May 10, 2023

Downloads

0

Views

105

.png)

.png)

.png)

.png)