Education > QUESTIONS & ANSWERS > IC VUL MOCK EXAM LATEST VERSION WITH COMPLETE SOLUTIONS 2023 (All)

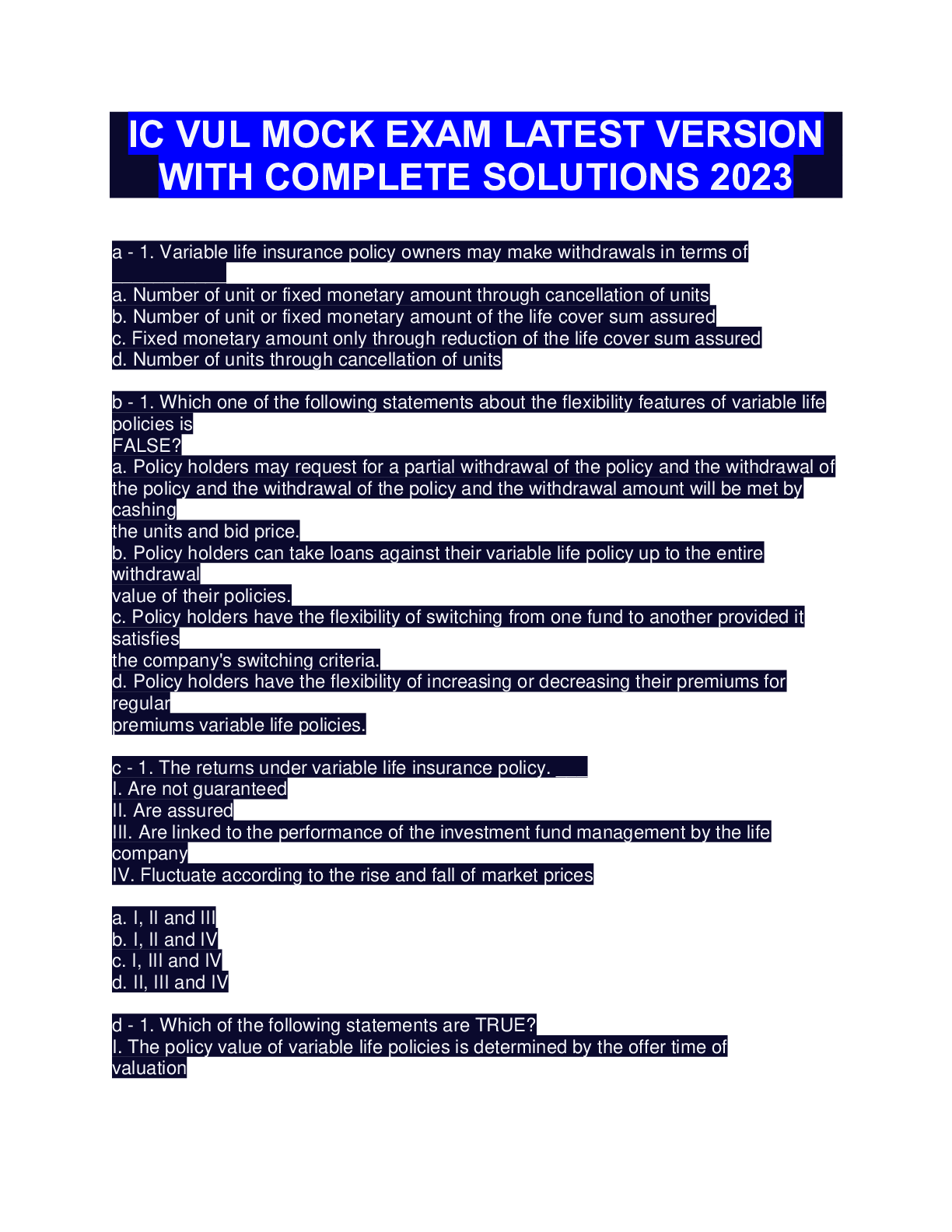

IC VUL MOCK EXAM LATEST VERSION WITH COMPLETE SOLUTIONS 2023

Document Content and Description Below

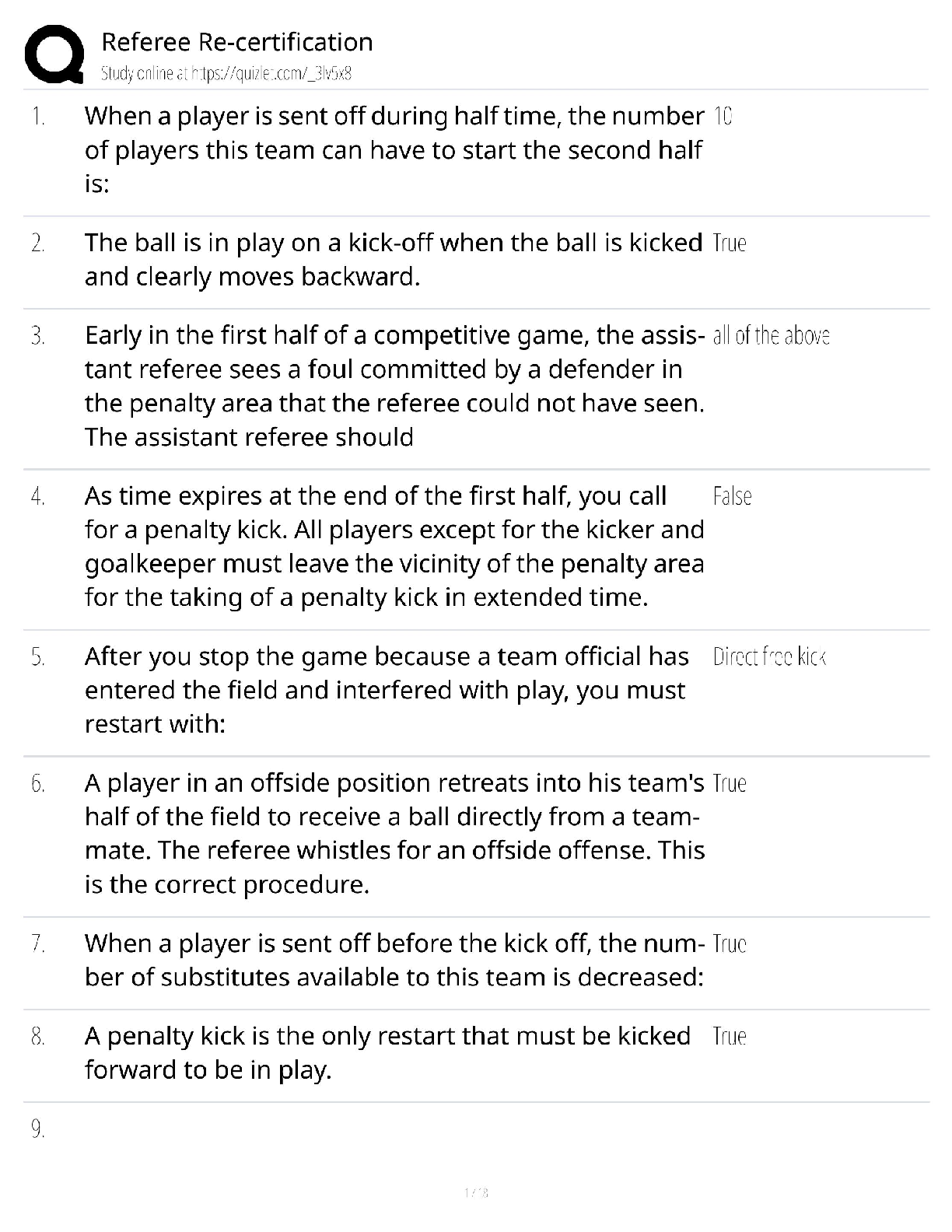

a - 1. Variable life insurance policy owners may make withdrawals in terms of ___________ a. Number of unit or fixed monetary amount through cancellation of units b. Number of unit or fixed monetary ... amount of the life cover sum assured c. Fixed monetary amount only through reduction of the life cover sum assured d. Number of units through cancellation of units b - 1. Which one of the following statements about the flexibility features of variable life policies is FALSE? a. Policy holders may request for a partial withdrawal of the policy and the withdrawal of the policy and the withdrawal of the policy and the withdrawal amount will be met by cashing the units and bid price. b. Policy holders can take loans against their variable life policy up to the entire withdrawal value of their policies. c. Policy holders have the flexibility of switching from one fund to another provided it satisfies the company's switching criteria. d. Policy holders have the flexibility of increasing or decreasing their premiums for regular premiums variable life policies. c - 1. The returns under variable life insurance policy. ___ I. Are not guaranteed II. Are assured III. Are linked to the performance of the investment fund management by the life company IV. Fluctuate according to the rise and fall of market prices a. I, II and III b. I, II and IV c. I, III and IV d. II, III and IV d - 1. Which of the following statements are TRUE? I. The policy value of variable life policies is determined by the offer time of valuation II. The policy value of endowment policies is the cash value plus any accumulated dividends less any outstanding loans due at time of surrender III. The life company needs to maintain a separate account for variable lifer policies distinct from the general account. a. I, and II b. I, II and III c. I, and II d. II and III c - 1. Which of the following statements is FALSE? a. Rebating to offer a prospect a special inducement to purchase a policy b. Twisting is a specific form of misrepresentation c. Misrepresentation is a specific form of twisting d. Switching is a facility allowing policy holders to switch to another variable life funds offered by company. d - 1. Which of the following statements about variable life policies are TRUE? I. Offer price is used to determine the numbers of units to be cancelled to the amount II. The margin between the bid and offer price is used to cover the management cost of the policy III. The policy value is calculated base on the bid price of units allocated into the policy. a. I, II and III b. I and II c. I and III d. II and III d - 1. What is the most suitable investment instrument for an investor who is interested for an investor who is interested in protecting his principal and receiving a steady stream of income? a. Equities b. Warrants c. Variable life policies d. Fixed income securities c - 1. What are the disadvantages of investing in common shares? I. Dividends are paid not more than fixed rate II. Investors are exposed to market and specific rates III. Shares can become worthless if company becomes insolvent a. I, II b. I, III c. II, III d. I, II and III c - 1. Which of the following statements about the differences between variable life insurance policies and endowment policies are FALSE? I. The policy values of variable life and endowment policies directly affect, the performance of the fund of the life insurance company. II. The premiums and benefits of the endowment policies are described at inception of the policy whereas variable life policies are flexible as they are account driven III. The benefits and risks variable life endowment policies directly accrue to the policy holders a. I and II b. I, II and III c. I and III d. II and III d - 1. Which of the following statements about twisting is FALSE? a. Twisting is a special form of misrepresentation b. It refers to an agent inducing a policy holder to discontinue policy with another company without disclosing the disadvantage of doing so c. It includes misleading or incomplete comparison policies d. It refers to an agent offering a prospect a special inducement to purchase a policy b - 1. Mr. Juan dela Cruz is currently earning P30,000/month. He is 35 years old and has a reasonable amount of savings. He has a moderate level for risk tolerance. What kind of policy would you recommend for him to buy a. Participating endowment b. Variable life policies c. Participating whole life d. Annuities c - 1. What are the benefits available when investing in variable life funds? I. The variable life funds offer policy holders an access to a pooled or diversified portfolios II. The variable life policy holder can vary his premium payments, take premium holidays, add single premium top-ups and change the level of the sum assured easily III. The variable life policy holder can have access to a pool of qualified and trained professional fund managers a. I, and II b. I and III c. I, II and III d. II and III [Show More]

Last updated: 2 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

May 18, 2023

Number of pages

12

Written in

All

Additional information

This document has been written for:

Uploaded

May 18, 2023

Downloads

0

Views

123