Marketing > QUESTIONS & ANSWERS > MKT 571 - BSAD 295 solution 2, Latest 2019/2020 complete solutions, University Of Phoenix. (All)

MKT 571 - BSAD 295 solution 2, Latest 2019/2020 complete solutions, University Of Phoenix.

Document Content and Description Below

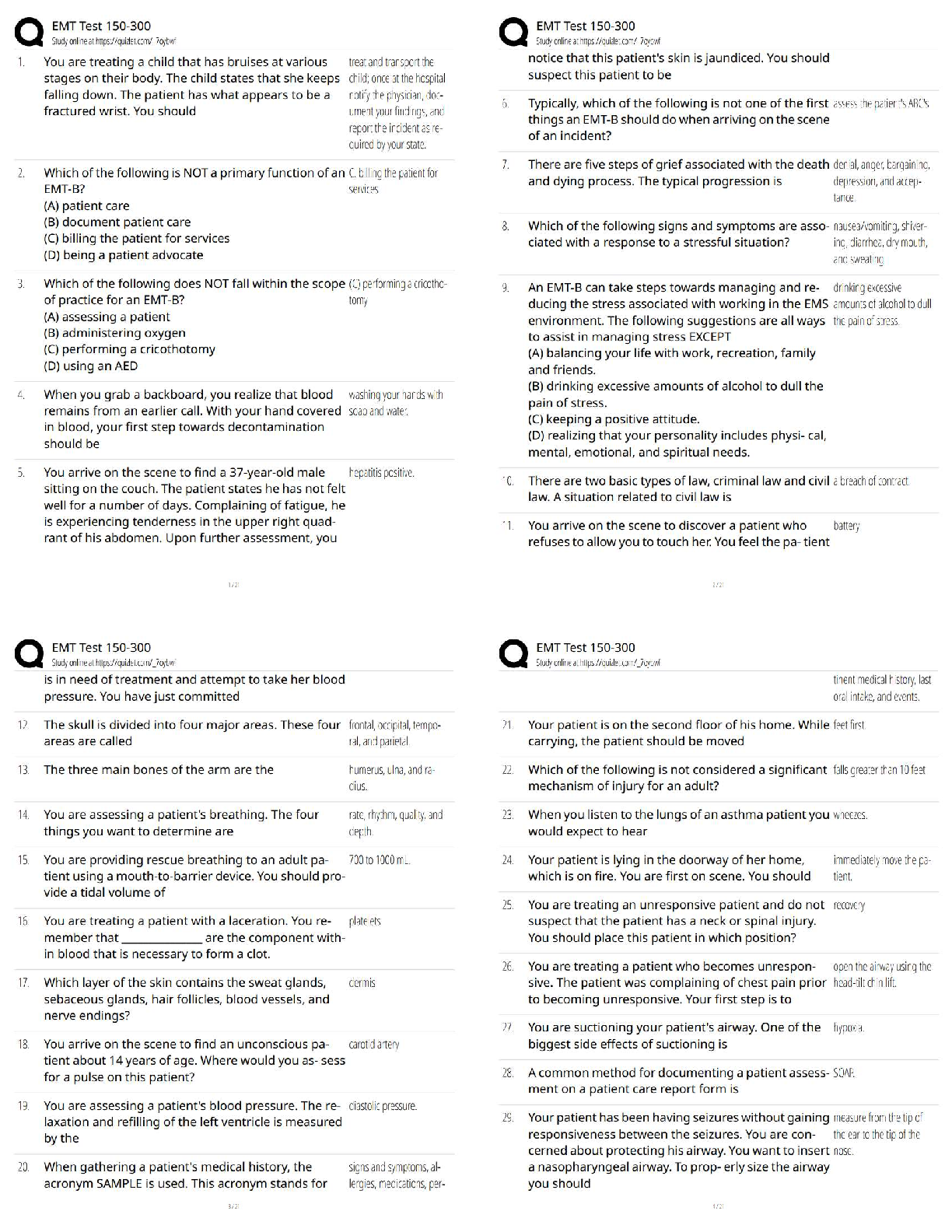

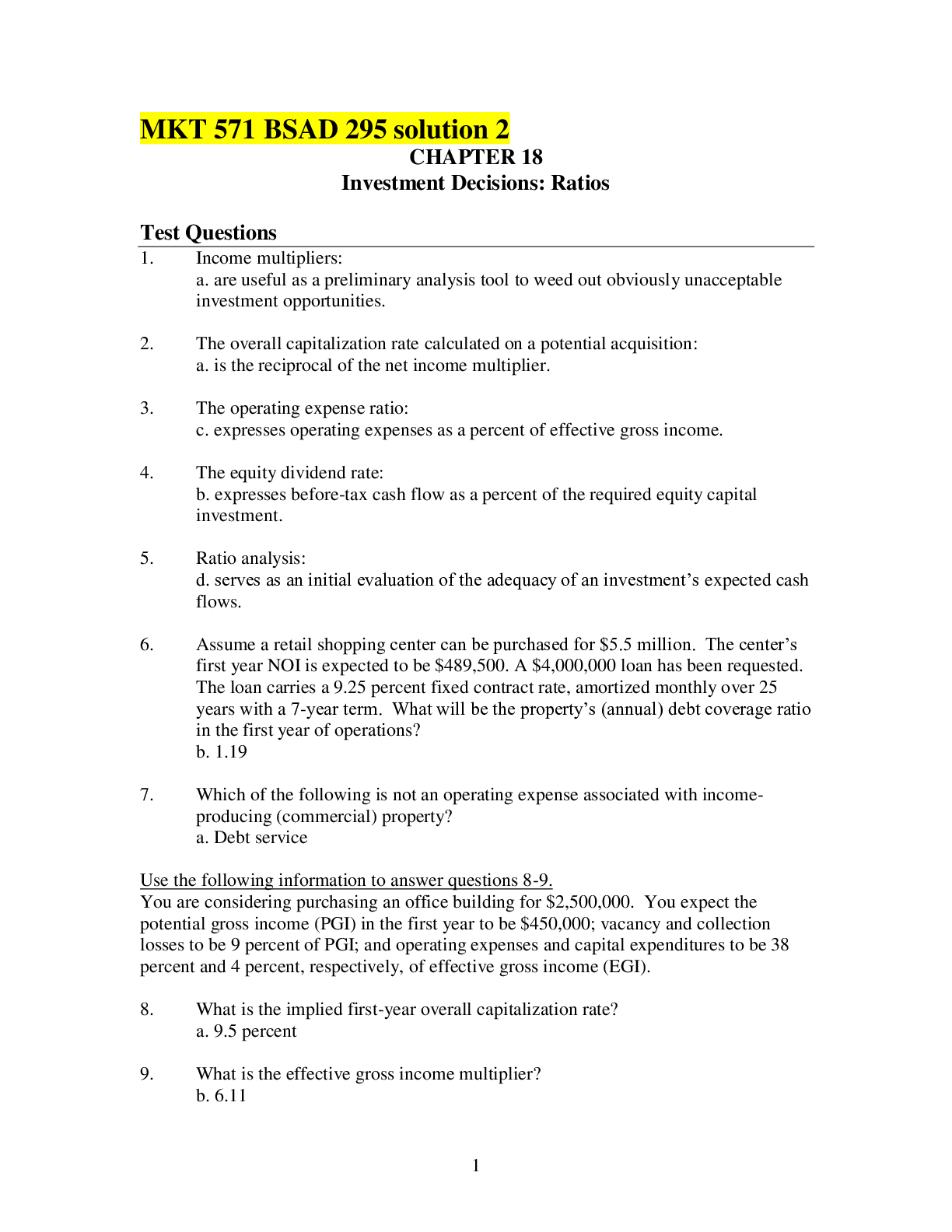

MKT 571 BSAD 295 solution 2 CHAPTER 18 Investment Decisions: Ratios Test Questions 1. Income multipliers: 2. The overall capitalization rate calculated on a potential acquisition: 3. The o ... perating expense ratio: 4. The equity dividend rate: 5. Ratio analysis: 6. Assume a retail shopping center can be purchased for $5.5 million. The center’s first year NOI is expected to be $489,500. A $4,000,000 loan has been requested. The loan carries a 9.25 percent fixed contract rate, amortized monthly over 25 years with a 7-year term. What will be the property’s (annual) debt coverage ratio in the first year of operations? 7. Which of the following is not an operating expense associated with income-producing (commercial) property? Use the following information to answer questions 8-9. You are considering purchasing an office building for $2,500,000. You expect the potential gross income (PGI) in the first year to be $450,000; vacancy and collection losses to be 9 percent of PGI; and operating expenses and capital expenditures to be 38 percent and 4 percent, respectively, of effective gross income (EGI). 8. What is the implied first-year overall capitalization rate? 9. What is the effective gross income multiplier? 10. Given the following information, what is the required equity down payment? • Study Questions Use the following information to answer questions 1 – 3: You are considering the purchase of an office building for $1.5 million today. Your expectations include the following: first-year potential gross income of $340,000; vacancy and collection losses equal to 15 percent of potential gross income; operating expenses equal to 40 percent of effective gross income and capital expenditures equal 5 percent of EGI. You expect to sell the property five years after it is purchased. You estimate that the market value of the property will increase four percent a year after it is purchased and you expect to incur selling expenses equal to 6 percent of the estimated future selling price. 1. What is estimated effective gross income (EGI) for the first year of operations? 2. What is estimated net operating income (NOI) for the first year of operations? 3. What is the estimated going-in cap rate (Ro) using NOI for the first year of operations? 4. An investment opportunity having a market price of $1,000,000 is available. You could obtain a $750,000, 25-year mortgage loan requiring equal monthly payments with interest at 7.0 percent. The following operating results are expected during the first year. For the first year only, determine the: b. Operating expense ratio (including CAPX) c. Monthly and annual payment d. Debt coverage ratio e. Overall capitalization rate f. Equity dividend rate 5. You are considering the purchase of a quadruplex apartment. Effective gross income (EGI) during the first year of operations is expected to be $33,600 ($700 per month per unit). First-year operating expenses are expected to be $13,440 (at 40 percent of EGI). Ignore capital expenditures. The purchase price of the quadruplex is $200,000. The acquisition will be financed with $60,000 in equity and a $140,000 standard fixed-rate mortgage. The interest rate on the debt financing is eight percent and the loan term is 30 years. Assume, for simplicity, that payments will be made annually and that there are no up-front financing costs. a. What is the overall capitalization rate? b. What is the effective gross income multiplier? c. What is the equity dividend rate (the before-tax return on equity)? d. What is the debt coverage ratio? e. Assume the lender requires a minimum debt coverage ratio of 1.2. What is the largest loan that you could obtain if you decide to borrow more than $140,000? But, debt service is equal to the loan amount times the mortgage constant (contract interest rate plus principal amortization). Thus, we can rewrite the above expression as The mortgage constant is the stated interest rate plus the first-year principal payment divided by the loan amount (1,236/140 000 = .0088), or .0888. 6. Why do Class B properties generally sell at higher going-in cap rates than Class A properties? 7. Why might a commercial real estate investor borrow to help finance an investment even if she could afford to pay 100 percent cash? 8. You are considering purchasing an office building for $2,500,000. You expect the potential gross income (PGI) in the first year to be $450,000; vacancy and collection losses to be 9 percent of PGI; and operating expenses and capital expenditures to be 42 percent of effective gross income (EGI). What is the estimated Net Operating Income? What is the implied first year overall capitalization rate? What is the effective gross income multiplier? Item Amount Potential gross income (PGI) $450,000 - Vacancy & collection loss (VC) 40,500 = Effective gross income (EGI) 409,500 - Operating expenses (OE) 171,990 = Net operating income (NOI) 237,510 What is the overall capitalization rate? What is the effective gross income multiplier? 9. What distinguishes an operating expense from a capital expenditure? 10. Explain why income property cash flow is not the same as taxable income. 11. What is the basic shortcoming of most ratios and rules of thumb used in commercial real estate investment decision making? CHAPTER 19 Investment Decisions: NPV and IRR Test Questions 1. A real estate investment is available at an initial cash outlay of $10,000, and is expected to yield cash flows of $3,343.81 per year for five years. The internal rate of return (IRR) is approximately: 2. The net present value of an acquisition is equal to: 3. Present value: b. is the value now of all net benefits that are expected to be received in the future. 4. The internal rate of return equation incorporates: d. initial cash outflow and inflow, and future cash outflow and inflow. 5. The purchase price that will yield an investor the lowest acceptable rate of return is: 6. What term best describes the maximum price a buyer is willing to pay for a property? 7. An income-producing property is priced at $600,000 and is expected to generate the following after-tax cash flows: Year 1: $42,000; Year 2: $44,000; Year 3: $45,000; Year 4: $50,000; and Year 5: $650,000. Would an investor with a required after-tax rate of return of 15 percent be wise to invest at the current price? 8. As a general rule, using financial leverage: 9. What is the IRR, assuming an industrial building can be purchased for $250,000 and is expected to yield cash flows of $18,000 for each of the next five years and be sold at the end of the fifth year for $280,000? 10. Which of the following is the least true? Study Questions 1. List three important ways in which DCF valuation models differ from direct capitalization models. 2. Why might a commercial real estate investor borrow to help finance an investment even if she could afford to pay 100 percent cash? 3. Using the “CFj” key of your financial calculator determine the IRR of the following series of annual cash flows: CF0= -$31,400; CF1 = $3,292; CF2 = $3,567; CF3 = $3,850; CF4 = $4,141; and CF5 = $50,659. 4. A retail shopping center is purchased for $2.1 million. During the next four years, the property appreciates at 4 percent per year. At the time of purchase, the property is financed with a 75 percent loan-to-value ratio for 30 years at 8 percent (annual) with monthly amortization. At the end of year 4, the property is sold with 8 percent selling expenses. What is the before-tax equity reversion? 5. State, in no more than one sentence, the condition for favorable financial leverage in the calculation of NPV. 6. State, in no more than one sentence, the condition for favorable financial leverage in the calculation of the IRR. 7. An office building is purchased with the following projected cash flows: • NOI is expected to be $130,000 in year 1 with 5 percent annual increases. • The purchase price of the property is $720,000. • 100% equity financing is used to purchase the property • The property is sold at the end of year 4 for $860,000 with selling costs of 4 percent. • The required unlevered rate of return is 14 percent. a. Calculate the unlevered internal rate of return (IRR). b. Calculate the unlevered net present value (NPV). a. IRR = 21.88 percent b. NPV = 173,732 8. With a purchase price of $350,000, a small warehouse provides for an initial before-tax cash flow of $30,000, which grows by 6 percent per year. If the before-tax equity reversion after four years equals $90,000, and an initial equity investment of $175,000 is required, what is the IRR on the project? If the required going-in levered rate of return on the project is 10 percent, should the warehouse be purchased? The IRR is 7.84 percent. Based on a going-in levered rate of return on the project of 10 percent, the NPV equals ($10,246) and the project should not be undertaken. 9. You are considering the acquisition of a small office building. The purchase price is $775,000. Seventy-five percent of the purchase price can be borrowed with a 30-year, 7.5 percent mortgage. Payments will be made annually. Up-front financing costs will total three percent of the loan amount. The expected before-tax cash flows from operations--assuming a 5-year holding period—are as follows: Year BTCF 1 $48,492 2 53,768 3 59,282 4 65,043 5 $71,058 The before-tax cash flow from the sale of the property is expected to be $295,050. What is the net present value of this investment, assuming a 12 percent required rate of return on levered cash flows? What is the levered internal rate of return? Year Equity Investment NOI Debt Service BTER Total Cash Flow Present Value at 12% 0 ($211,188) ($211,188) ($211,188) 1 $48,492 $49,215 (723) (646) 2 53,768 49,215 4,553 3,630 3 59,282 49,215 10,067 7,165 4 65,043 49,215 15,828 10,059 5 $71,058 $49,215 $295,050 $316,893 $179,814 10. You are considering the purchase of an apartment complex. The following assumptions are made: • The purchase price is $1,000,000. • Potential gross income (PGI) for the first year of operations is projected to be $171,000. • PGI is expected to increase at 4 percent per year. • No vacancies are expected. • Operating expenses are estimated at 35 percent of effective gross income. Ignore capital expenditures. • The market value of the investment is expected to increase 4 percent per year. • Selling expenses will be 4 percent. • The holding period is 4 years. • The appropriate unlevered rate of return to discount projected NOIs and the projected NSP is 12 percent. • The required levered rate of return is 14 percent. • 70 percent of the acquisition price can be borrowed with a 30-year, monthly payment mortgage. • The annual interest rate on the mortgage will be 8.0 percent. • Financing costs will equal 2 percent of the loan amount. • There are no prepayment penalties. a. Calculate net operating income (NOI) for each of the four years. b. Calculate the net sale proceeds from the sale of the property. c. Calculate the net present value of this investment, assuming no mortgage debt. Should you purchase? Why? Yes, purchase the property because it is a positive NPV project. d. Calculate the internal rate of return of this investment, assuming no debt. Should you purchase? Why? e. Calculate the monthly mortgage payment. What is the total per year? Annual payment = monthly payment x 12 = $61,636 f. Calculate the loan balance at the end of years 1, 2, 3, and 4. (Note: the unpaid mortgage balance at any time is equal to the present value of the remaining payments, discounted at the contract rate of interest.) g. Calculate the amount of principal reduction achieved during each of the four years. h. Calculate the total interest paid during each of the four years. (Note: Remember that debt service equals principal plus interest.) i. Calculate the levered required initial equity investment. j. Calculate the before-tax cash flow (BTCF) for each of the four years. k. Calculate the before-tax equity reversion (BTER) from the sale of the property. l. Calculate the levered net present value of this investment. Should you purchase? Why? m. Calculate the levered internal rate of return of this investment (assuming no debt and no taxes). Should you purchase? Why? n. Calculate, for the first year of operations, the: (1) overall (cap) rate of return, (2) equity dividend rate, (3) gross income multiplier, (4) debt coverage ratio. 11. The expected before-tax IRR on a potential real estate investment is 14 percent. The expected after-tax IRR is 10.5 percent. What is the effective tax rate on this investment? 12. An office building is purchased with the following projected cash flows: • NOI is expected to be $130,000 in year 1 with 5 percent annual increases. • The purchase price of the property is $720,000. • 100% equity financing is used to purchase the property • The property is sold at the end of year 4 for $860,000 with selling costs of 4 percent. • The required unlevered rate of return is 14 percent. a. Calculate the unlevered internal rate of return (IRR). With a cash outflow of $720,000 at time zero (CF0), and using the cash flow (“CF”) key of your calculator, the unlevered internal rate of return (IRR) = 21.50% b. Calculate the unlevered net present value (NPV). Again, with a cash outflow of $720,000 at time zero (CF0), a required unlevered rate of return of 14 percent, and using the cash flow (“CF”) key of your calculator, the unlevered net present value (NPV) = 195,769.78 Chapter 9 Real Estate Finance: The Laws and Contracts Test Problems 1. The element of an adjustable interest rate that is the “moving part” is the: 2. Which of these aspects of a mortgage loan will be addressed in the note rather than in the mortgage? 3. A lender may reserve the right to require prepayment of a loan at any time they see fit through a(n): 4. When a buyer of a property with an existing mortgage loan acquires the property without signing the note for an existing loan the buyer is acquiring the property: 5. Which if these points in a mortgage loan would be addressed in the mortgage (possibly in the note as well)? 6. To finance property where either the borrower, the property, or both fail to qualify for the standard mortgage financing, a common nonmortgage solution is through the: 7. Ways that a lender may respond to a defaulted loan without resorting to foreclosure include all of the following except: 8. If the lender in a standard first mortgage wishes to foreclose cost effectively, it is crucial to have which clause in the mortgage: 9. A common risk that frequently interferes with a lender’s efforts to work out a defaulted loan through either nonforeclosure means or foreclosure is: 10. The characteristics of a borrower than can be considered by a lender in a mortgage loan appreciation are limited by the: 11. The Real Estate Settlement Procedures Act does which of these: 12. Foreclosure tends to be quickest in states that: 13. From a home mortgage lender’s perspective, which statement is true about the effect of bankruptcy upon foreclosure? 14. The most internationally oriented index rate for adjustable rate mortgages is: 15. A type of loan that has grown in volume in recent years which has raised concerns about predatory lending practices is the: 16. A partially amortizing loan always will have 17. Which of these statements is true about mortgage loans for income producing real estate? 18. With what type of loan security arrangement is the deed held by a neutral party and returned upon payment of the mortgage in full? 19. The Truth in Lending Act gives a home mortgage borrower how long to rescind a mortgage loan? 20. Which statement is correct about the right of prepayment of a home mortgage loan? . Study Questions 1. Mortgage law is as clear, consistent, and enforceable in the United States as in any place in the world, and far more so than in many countries. Why is this a vital element of an efficient real estate finance system? 2. The Congress has adopted changes in bankruptcy law that would make Chapter 7 bankruptcy more difficult for households, requiring greater use of Chapter 13, thus providing greater protection to unsecured credit card companies. As a mortgage lender, do you care about this? If so, what would be your position? Solution: The mortgage lender is entitled to the value of the mortgage indebtedness under both Chapter 7 and Chapter 13 because their claim has priority. However, Chapter 13 is essentially a debt workout plan that will most likely delay the efforts by a lender to foreclose on the property. Delays may cost the lender opportunity costs through uncollected interest and legal expenses. Addtionally, the value of the property may deteriorate due to neglect during this process. 3. Residential mortgage terms (mortgage notes) have become increasingly uniform as the mortgage market has become more national and efficient. Is there any downside to this for the homeowner? 4. Most lenders making adjustable rate mortgage loans offer a “teaser rate.” Is this a good policy or is it misrepresentation? 5. Home mortgage lending is heavily regulated by federal laws. Is this a result of Congressional pandering to consumer groups, or are there good reasons why home mortgage lending should be regulated more than, say, automobile financing? 6. For your own state, determine whether: a. It is a judicial or non-judicial foreclosure state. b. The standard home loan is based on a deed of trust or a mortgage. c. There is a statutory right of redemption, and, if so, how long. d. Deficiency judgments are allowed against defaulted homeowners. Based on this information can you judge your state is relatively debtor friendly or borrower friendly? 7. Download one mortgage and one deed of trust from the Freddie Mac website. Compare them to see what differences you can find in their clauses The primary differences between a mortgage and a deed of trust occur if the home is foreclosed. The trustee has power of sale. Therefore, if your loan becomes delinquent, the lender will give the trustee proof of the delinquency and ask the trustee to initiate foreclosure proceedings. CHAPTER 10 Residential Mortgage Types and Borrower Decisions Test Problems 1. Private mortgage insurance (PMI) is usually required on _____ loans with loan-to-value ratios greater than _____ percent. 2. The dominant loan type originated and kept by most depository institutions is the: 3. Which of the following mortgage types has the most default risk, assuming the initial loan-to-value ratio, contract interest rate, and all other loan terms are identical? 4. A mortgage that is intended to enable older households to “liquify” the equity in their home is the: . 5. A jumbo loan is: 6. The maximum loan-to-value ratio for an FHA loan over $50,000 is approximately: 7. The maximum loan-to-value ratio on a VA guaranteed loan is: 8. Conforming conventional loans are loans that: 9. Home equity loans typically: 10. The best method of determining whether to refinance is to use: 11. Probably the greatest contribution of FHA to home mortgage lending was to: Study Questions 1. On an adjustable mortgage, do borrowers always prefer smaller (i.e. tighter) rate caps that limit the amount the contract interest rate can increase in any given year or over the life if the loan? Explain why or why not. 2. Explain the potential tax advantages associated with home equity loans: 3. Distinguish between conforming and nonconforming residential mortgage loans and explain the importance of the difference. 4. Discuss the role and importance of private mortgage insurance in the residential mortgage market. 5. Explain the maturity imbalance problem faced by savings and loan associations that hold fixed-payment mortgages as assets. 6. Suppose a homeowner has an existing mortgage loan with these terms: Remaining balance of $50,000, interest rate of 8%, and remaining term of 10 years (monthly payments). This loan can be replaced by a loan at an interest rate of 6 percent, at a cost of 8% of the outstanding loan amount. Should the homeowner refinance? What difference would it make if the homeowner expects to be in the home for only five more years? . 7. Assume an elderly couple owns a $140,000 home that is free and clear of mortgage debt. A reverse annuity mortgage (RAM) lender has agreed to a $100,000 RAM. The loan term is 12 years, the contract is 9.25%, and payments will be made at the end of each month. a. What is the monthly payment on this RAM? b. Fill in the following partial loan amortization table: Month Beginning Balance Monthly Payment Interest Ending Balance 1 2 3 4 5 c. What will be the loan balance at the end of the 12-year term? d. What portion of the loan balance at the end of year 12 represents principal? What portion represents interest? Month Beginning Balance Monthly Payment Interest Ending Balance 1 0 381.32 0 381.32 2 381.32 381.32 2.94 765.58 3 765.58 381.32 5.90 1,152.80 4 1,152.80 381.32 8.89 1,543.01 5 1,543.01 381.32 11.89 1,936.22 a. The balance at the end of 12 years is $100,000. b. Principal is 144 x 381.32, or $54,910. Interest is $45,090, or $100,000 -$54,910. 8. Five years ago you borrowed $100,000 to finance the purchase of a $120,000 house. The interest rate on the old mortgage is 10%. Payment terms are being made monthly to amortize the loan over 30 years. You have found another lender who will refinance the current outstanding loan balance at 8% with monthly payments for 30 years. The new lender will charge two discount points on the loan. Other refinancing costs will equal $3,000. There are no prepayment penalties associated with either loan. You feel the appropriate opportunity cost to apply to this refinancing decision is 8%. a. What is the payment on the old loan? b. What is the current loan balance on the old loan (five years after origination)? c. What should be the monthly payment on the new loan? d. Should you refinance today if the new loan is expected to be outstanding for five years? a. If the new loan is to be paid off in five years, the balance of the original loan after year ten is $90,938.02, calculated with the following inputs: (N = 240, I = 0.8333, PMT = 877.57, and FV = 0. Answer based on net benefit analysis: A new loan at 8 percent with the same term as remains on the original loan (25 years) would have a payment of $745.38. The savings in monthly payment by going to the new loan is $132.19 (877.57 – 745.38). This results in an accumulated savings of $7,931.40 (60 x 132.19) over the assumed holding period of five years. The cost of refinancing is $3,000 plus two percent of the balance, or $1,931.49 (.02 x 96,574.32), for a sum of $4,931.49. Thus, the net benefit is $2,999.91 (7,931.40 – 4,931.49), and refinancing is financially beneficial. The PV of payment reductions is $7,744.61 (104,318.93 – 96,574.32). The cost of refinancing is $3,000 plus 1,931.49 (0.02 x 96,574.32), or 4,931.49. The NPV of refinancing the loan is $2,813.12 (7,744.61 – 4,931.49). Therefore, you should refinance today if the new loan is expected to be outstanding for five years. CHAPTER 11 Sources of Funds for Residential Mortgages Test Problems 1. Mortgage banking companies: 2. In recent years, the mortgage banking industry has experienced: 3. Currently, which type of financial institution in the primary mortgage market provides the most funds for the residential (owner-occupied) housing market? 4. For all except very high loan-to-value conventional home loans the standard payment ratios for underwriting are: 5. The numerator of the standard housing expense (front-end) ratio in home loan underwriting includes: 6. The most profitable activity of residential mortgage bankers is typically 7. Potential justifiable subprime borrowers include persons who: 8. The normal securitization channel for jumbo conventional loans is: 9. The reduced importance of certain institutions in the primary mortgage market has been largely offset by an expanded role for others. Which has diminished and which has expanded? 10. Warehousing in home mortgage lending refers to Study Questions 1. What is the primary purpose of the risk-based capital requirements that Congress enacted as part of the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA)? 2. Explain what is meant by forward commitments and standby forward commitments. Which part of the mortgage banker’s pipeline is often hedged with forward commitments? With standby forward commitments? Why? 3. Describe the basic activities of Fannie Mae in the secondary mortgage market. How are these activities financed? 4. Explain the importance of Fannie Mae and Freddie Mac to the housing finance system in the United States. 5. What went wrong with mortgage brokerage? Is it being fixed? 6. Describe the mechanics of warehouse financing in mortgage banking.. 7. Explain how affordable housing loans differ from standard home loans. 8. List three “clienteles” for subprime home mortgage loans. 9. You have just signed a contract to purchase your dream house. The price is $120,000 and you have applied for a $100,000, 30-year, 5.5 percent loan. Annual property taxes are expected to be $2,000. Hazard insurance will cost $400 per year. Your car payment is $400, with 36 months left. Your monthly gross income is $5,000. Calculate: a. The monthly payment of principal and interest (PI). b. One-twelfth of annual property tax payments and hazard insurance payments. c. Monthly PITI (principal, interest, taxes, and insurance). d. The housing expense (front-end) ratio. e. The total obligations (back-end) ratio. 10. Contrast automated underwriting with the traditional “Three Cs” approach CHAPTER 16 Commercial Mortgage Types and Decisions Test Problems 1. Due-on-sales clauses are included in commercial mortgages primarily to protect lenders from: 2. Consider a 30-year, 7 percent, fixed rate, fully amortizing mortgage with a yield maintenance provision. Relative to this mortgage, a 10-year balloon mortgage with the same interest rate and yield maintenance provisions will primarily reduce the lender’s: 3. Lockout provisions are primarily intended to reduce the lender’s : 4. The tax-benefits associated with installment sales are: 5. Which of the following statements is most accurate? 6. Which of the following financing structures provides for 100 percent financing? 7. Using financial leverage on a real estate investment can be for the purpose of all of the following except: 8. Which of these ratios is an indicator of the financial risk for an income property? 9. If the property’s NOI is expected to be $22,560 operating expenses $12,250, and the debt service $19,987, the debt coverage ratio (DCR) is approximately equal to: 10. With a mezzanine loan Study Questions 1. Discuss several differences between long-term commercial mortgages and their residential counterparts. 2. Answer the following questions on financial leverage, value, and return: 3. Distinguish between recourse and nonrecourse financing. 4. Explain lockout provisions and yield-maintenance agreements. Does the inclusion of one or both of these provisions affect the borrower’s cost of debt financing? Explain. 5. Assume the annual interest rate on a $500,000 7-year balloon mortgage is 6 percent. Payments will be made monthly based on a 30-year amortization schedule. a. What will be the monthly payment? b. What will be the balance of the loan at the end of year 7? c. What will be the balance of the loan at the end of year 3? d. Assume that interest rates have fallen to 4.5% at the end of year 3. If the remaining mortgage balance at the end of year 3 is refinanced at the 4.5 percent annual rate, what would be the new monthly payment assuming a 27-year amortization schedule? e. What is the difference in the old 6 percent monthly payment and the new 4.5 percent payment? f. What will be the remaining mortgage balance on the new 4.5 percent loan at the end of year 7 (four years after refinancing)? g. What will be the difference in the remaining mortgage balances at the end of year 7 (four years after refinancing)? h. At the end of year 3 (beginning of year 4), what will be the present value of the difference in monthly payments in years 4-7, discounting at an annual rate of 4.5 percent? i. At the end of year 3 (beginning of year 4), what will be the present value of the difference in loan balances at the end of year 7, discounting at an annual rate of 4.5 percent? j. At the end of year 3 (beginning of year 4), what will be the total present value of lost payments in years 4-7 from the lender’s perspective? k. If the mortgage contains a yield maintenance agreement that requires the borrower to pay a lump sum prepayment penalty at the end of year 3 equal to the present value of the borrower’s lost payments in years 4-7, what should that lump sum penalty be? a. ). 6. Consider the stand-alone locations favored by Walgreens for locating their drugstores. In most cases, Walgreens does not own these properties. Instead, they lease the properties on a long-term basis from institutional owners. What does Walgreens gain by leasing instead of owning? What do they lose? 7. Consider the following table of annual mortgage rates and yields on 10-year Treasury securities. a. What is the average annual spread on mortgage rates relative to the 10-year Treasury securities? b. What is the correlation between annual mortgage rates and Treasury yields over the 1990-2005 period? 8. List and briefly describe the typical items included in a commercial mortgage loan application package. 9. List at least six characteristics of a commercial loan application that the lender should carefully evaluate. 10. What is the difference in the present value of these two loan alternatives? Assume the appropriate discount rate is 6 percent. 11. You are considering the purchase of an industrial warehouse. a. Calculate the overall rate of return (or “cap rate”) b. Calculate the debt coverage ratio. c. What is the largest loan that you can obtain (holding the others terms constant) if the lender requires a debt service coverage ratio of at least 1.2? 12. Distinguish among land acquisitions loans, land development loans, and construction loans. How would you rank these three with respect to lender risk? 13. Discuss the potential advantages of a miniperm loan from the prospective of the developer/investor, relative to the separate financing of each stage of the development. 14. You are considering purchasing an office building for $2,500,000. a. What is the implied first-year overall capitalization rate? b. What is the expected debt coverage ratio in year 1 of operations? c. If the lender requires DCR to be 1.25 or greater, what is the maximum loan amount? d. What is the break-even ratio? CHAPTER 17 SOURCES OF COMERCIAL DEBT AND EQUITY CAPITAL Test Problems 1. Double taxation is most likely to occur if the commercial properties are held in the form of a(n): 2. With regard to double taxation, distributions, and the treatment of the losses, general partnerships are most like: 3. Special allocations of income or loss are available if the form of ownership is a(n): 4. Real estate syndicates traditionally have been legally organized most frequently as: 5. A real estate investment trust generally: 6. Which of the following forms of ownership involve both limited and unlimited liability? 7. Which statement is false concerning the limited partnership of ownership? 8. Which of these lenders is most likely to provide a construction loan? 9. Which of these loans is a life insurance company most likely to invest in? 10. Which of these financial firms is the least likely to invest in a large, long-term mortgage loan on a shopping center? Study Questions 1. For what debt in a general partnership is each of the general partners liable? 2. Why are many pension funds reluctant to invest in commercial real estate? 3. Discuss the role life insurance companies play in financing commercial real estate. 4. Approximately 88 percent of investable commercial real estate (on a value- weighted basis) is owned by “noninstitutional” investors. Who are these investors? 5. Briefly explain a commingled fund. Who are the investors in these funds and why do these investors use commingled funds for their purchases? 6. There are two primary considerations that affect the form in which investors choose to hold commercial real estate. List each and explain how they affect the choice of ownership form. 7. Explain what is meant by the double taxation of income. 8. What are the major restrictions that a REIT must meet on an ongoing basis in order to avoid taxation at the entity level? 9. Compare the tax advantages and disadvantages of holding income-producing property in the form of a REIT to the tax advantaged and disadvantages of holding property in the form of a real estate limited partnership. Does either form dominate from a tax perspective? 10. Of the more than $3.6 trillion in outstanding commercial real estate debt, what percent is traded in public markets? What percent is traded in private markets? What institutions or entities are the long-term holders of private commercial real estate debt? What is the fastest growing source of long-term mortgage funds? 11. Distinguish among equity REITs, mortgage REITs, and hybrid REITs. 12. Define funds from operations (FFO) and explain why this measure is often used instead of GAAP net income to quantify the income-producing ability of a real estate investment trust. 13. How have equity REITs, measured in terms of total returns, performed in recent years relative to alternative stock investments? Chapter 15 Mortgage Calculations and Decisions Test Problems 1. The most typical adjustment interval on an adjustable rate mortgage (ARM) once the interest begins to change is: 2. A characteristic of a partially amortized loan is: 3. If a mortgage is to mature (i.e. become due) at a certain future time without any reduction in principal, this is called: 4. The dominant loan type originated by most financial institutions is the: 5. Which of the following statements is true about 15-year and 30-year fixed-payment mortgages? 6. Adjustable rate mortgages (ARMs) commonly have all the following except: 7. The annual percentage rate (APR) was created by: 8. On a level-payment loan with 12 years (144 payments) remaining, at an interest rate of 9 percent, and with a payment of $1,000, the balance is: 9. On the following loan, what is the best estimate of the effective borrowing cost if the loan is prepaid in six years? 10. Lender’s yield differs from effective borrowing costs (EBC) because: Study Questions 1. Calculate the original loan size of a fixed-payment mortgage if the monthly payment is $1,146.78, the annual interest is 8.0%, and the original loan term is 15 years. 2. For a loan of $100,000, at 7 percent interest for 30 years, find the balance at the end of 4 years and 15 years. First, the loan payment must be calculated. The loan payment is $665.30, as solved below: N = 360 I = .5833 PV = -$100,000 PMT =? FV = 0 The balance at the end of four years is $95,474.55, which is calculated by entering the following data into a financial calculator. N = 312 I = .5833 PV = ? PMT =$665.30 FV =0 The balance at the end of 15 years is $74,018.87, which is calculated by entering the following data into a financial calculator. N = 180 I = .5833 PV = ? PMT =$665.30 FV = 0 3. On an adjustable rate mortgage, do borrowers always prefer smaller (tighter) rate caps that limit the amount the contract interest rate can increase in any given year or over the life of the loan? 4. Consider a $75,000 mortgage loan with an annual interest rate of 8%. The loan term is 7 years, but monthly payments will be based on a 30-year amortization schedule. What is the monthly payment? What will be the balloon payment at the end of the loan term? The payment is calculated using the following calculator keystrokes: The balloon payment at the end of year seven is $69,358.07, as calculated with the following calculator keystrokes: 5. A mortgage banker is originating a level-payment mortgage with the following terms: Annual interest rate: 9 percent Loan term: 15 years Payment frequency: monthly Loan amount: $160,000 Total up-front financing costs (including discount points): $4,000 Discount points to lender: $2,000 a. Calculate the annual percentage rate (APR) for Truth-in-Lending purposes. b. Calculate the lender’s yield with no prepayment. c. Calculate the lender’s yield with prepayment is five years. d. Calculate the effective borrowing costs with prepayment in five years. 6. Give some examples of up-front financing costs associated with residential mortgages. What rule can one apply to determine if a settlement (closing) cost should be included in the calculation of the effective borrowing costs? 7. A homeowner is attempting to decide between a 15-year mortgage loan at 5.5 percent and a 30-year loan at 5.90 percent. What would you advise? What would you advise if the borrower also has a large amount of credit card debt outstanding at a rate of 15 percent? 8. Suppose a one-year ARM loan has a margin of 2.75, an initial index of 3.00 percent, a teaser rate for the first year of 4.00 percent, and a cap of 1.00 percent. If the index rate is 3.00 percent at the end of the first year, what will be the interest rate on the loan in year two? If there is more than one possible answer, what does the outcome depend on? 9. Assume the following for a one-year rate adjustable rate mortgage loan that is tied to the one-year Treasury rate: Loan amount: $150,000 Annual rate cap: 2% Life-of-loan cap: 5% Margin : 2.75% First-year contract rate: 5.50% One-year Treasury rate at end of year 1: 5.25% One-year Treasury rate at end of year 2: 5.50% Loan term in years: 30 Given these assumptions, calculate the following: a. Initial monthly payment b. Loan balance end of year 1 c. Year 2 contract rate d. Year 2 monthly payment e. Loan balance end of year 2 f. Year 3 contract rate g. Year 3 payment 10. Assume the following: Loan Amount: $100,000 Interest rate: 10 percent annually Term: 15 years, monthly payments a. What is the monthly payment? b. What will be the loan balance at the end of nine years? c. What is the effective borrowing cost on the loan if the lender charges 3 points at origination and the loan goes to maturity? d. What is the effective borrowing cost on the loan if the lender charges 3 points at origination and the loan is prepaid at the end of year 9? CHAPTER 21 Enhancing Value through Ongoing Management Test Problems 1. The Institute of Real Estate Management (IREM) awards which of the following designations? 2. A contractual relationship in which an individual must act in the best interests of a principal when dealing with a third party is termed: 3. The requirement of a real estate property manager to act in the best interests of the landlord when dealing with a tenant is termed: 4. Which of these is not typically a responsibility of a property manager? 5. Remodeling and rehabilitation: 6. Both the owner and the manager may be better off if property management compensation were based on a percentage of the property’s: 7. The following are necessary for a lease to be valid, except: 8. The asset manager is generally NOT responsible for: 9. Demolition of an existing property on an urban site will likely occur: 10. For non-real estate corporations, which of the following is not a potential advantage of a real estate sale-leaseback? Study Questions 1. An investor purchased a property with an equity investment of $100,000 and an $800,000 mortgage. She has held the property for five years, and the mortgage now has a balance of $750,000. The market value of her property is estimated to be $950,000. What is her present equity investment? 2. What should be included as costs to be matched by value added after rehabilitation? 3. In what ways are the maintenance and repair decision and the rehabilitation decision similar? How do they differ? 4. What factors can change after rehabilitation of a property to produce a higher “after” value than “before” value? 5. What does the property management agreement accomplish? 6. How does routine maintenance and repair affect a property’s performance? 7. Define deferred maintenance and list some examples. 8. How is the financial compensation for property managers usually determined? What “agency” problem does this seem to create? 9. Why is the tenant mix critically important to the performance of shopping center investments? 10. In the real estate asset management/investment advisory business, why has performance-based management replaced, or at least supplemented, the “traditional” scheme for compensating some asset managers? 11. In the context of asset management agreements in the private commercial real estate industry, what is a benchmark index? What is the most typical benchmark index? 12. With respect to complying with applicable landlord-tenant laws, would you rather be managing an apartment complex or an office building? Explain. CHAPTER 23 DEVELOPMENT: THE DYNAMICS OF CREATING VALUE Test Problems 1. The first step in the process of development is to: 2. To gain control of a site, a developer may use: 3. Which of these stages of the development process comes first? 4. All of the following are valuable in facilitating the development permitting process except: 5. A method of construction where the actual construction begins before the design is finished is known as: 6. In a land-development, the primary design professional is a : 7. Soft costs include all except: 8. Which statement is incorrect concerning the typical construction loan? 9. The professional responsible for determining adequate specifications for building footings and foundation is a: 10. When construction costs exceed the amount of the construction loan, a developer frequently will seek to cover the “gap” with: Study Questions 1. Why is the permitting stage of development often the riskiest stage of the process? 2. List at least five ways that a developer may attempt to reduce the risks of the permitting process. 3. Explain what a construction manager is, and why the role could be important in development. 4. In selecting an architect, what must a developer consider about the architect besides design credentials and relevant experience? 5. Why, in some cases, must a developer begin leasing efforts even before the design is complete? 6. Compare the advantages of competitive bidding for a general contractor with negotiated cost plus fee. What is the argument for using a maximum cost with sharing of overruns or savings between developer and general contractor? 7. Explain the possible advantages of miniperm financing as opposed to traditional construction financing followed by “permanent” financing. 8. Why is property development more vulnerable to business cycle risk than investment in existing property of similar type? [Show More]

Last updated: 3 years ago

Preview 1 out of 52 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 20, 2020

Number of pages

52

Written in

All

Additional information

This document has been written for:

Uploaded

Mar 20, 2020

Downloads

0

Views

137