Business > TEST BANKS > Fundamentals of Futures and Options Markets 8e (Global Edition) John Hull (Test Bank) (All)

Fundamentals of Futures and Options Markets 8e (Global Edition) John Hull (Test Bank)

Document Content and Description Below

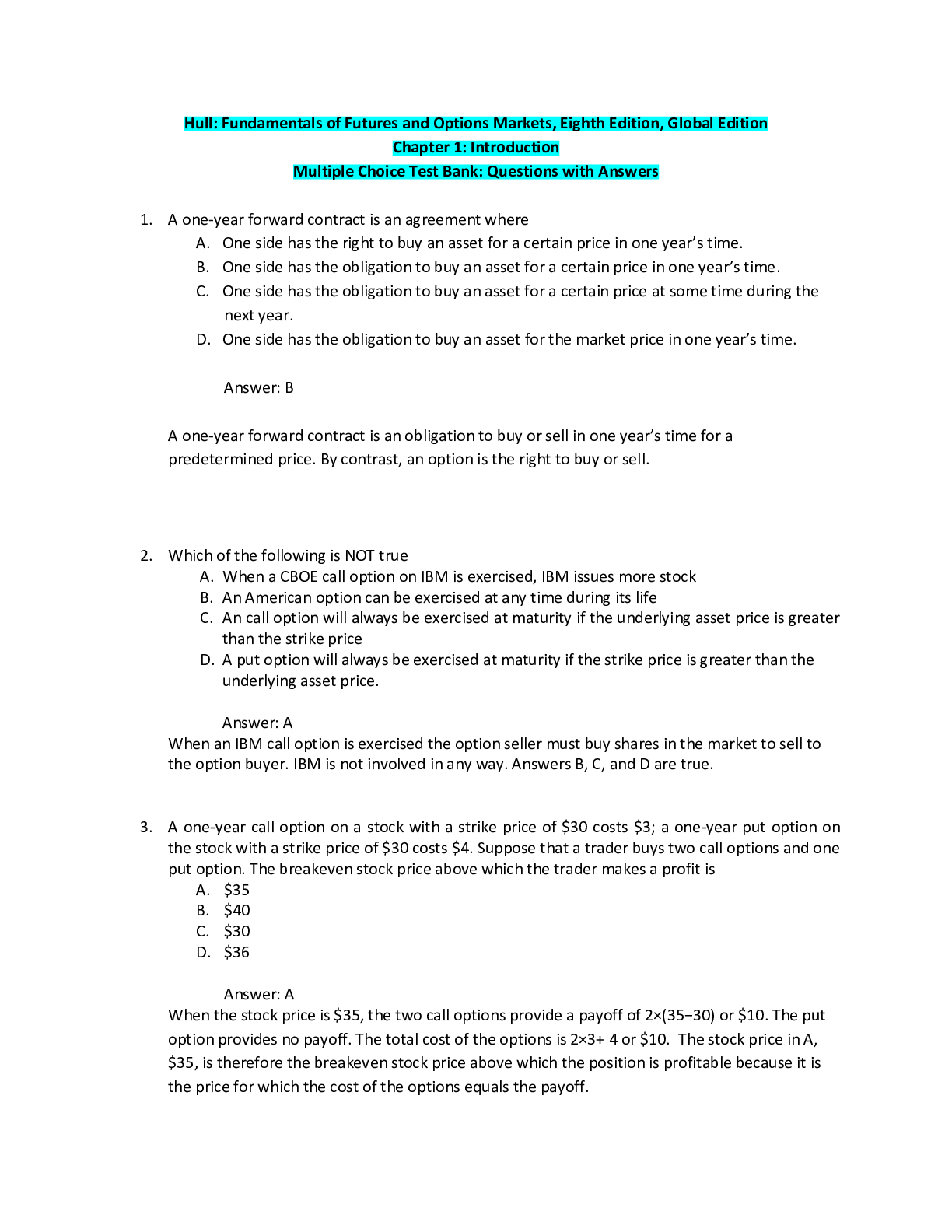

1. Introduction 2. Mechanics of futures markets 3. Hedging strategies using futures 4. Interest rates 5. Determination of forward and futures prices 6. Interest rate futures 7. Swaps 8. Securit ... ization and the credit crisis of 2007 9. Mechanics of options markets 10. Properties of stock options 11. Trading strategies involving options 12. Introduction to binomial trees 13. Valuing stock options: The Black--Scholes--Merton model 14. Employee stock options 15. Options on stock indices and currencies 16. Futures options 17. The Greek letters 18. Binomial trees in practice 19. Volatility smiles 20. Value at risk 21. Interest rate options 22. Exotic options and other nonstandard products 23. Credit derivatives 24. Weather, energy, and insurance derivatives 25. Derivatives mishaps and what we can learn from them [Show More]

Last updated: 2 years ago

Preview 1 out of 595 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Also available in bundle (1)

Click Below to Access Bundle(s)

Fundamentals of Futures and Options Markets 8e (Global Edition) John Hull (Solution Manual with Test Bank)

Fundamentals of Futures and Options Markets 8e (Global Edition) John Hull (Solution Manual with Test Bank) Discount Price Bundle Download

By eBookSmTb 2 years ago

$39

2

Reviews( 0 )

$25.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 13, 2023

Number of pages

595

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 13, 2023

Downloads

0

Views

98