ch 1 Health and Accident Insurance 2023 with complete solution

Document Content and Description Below

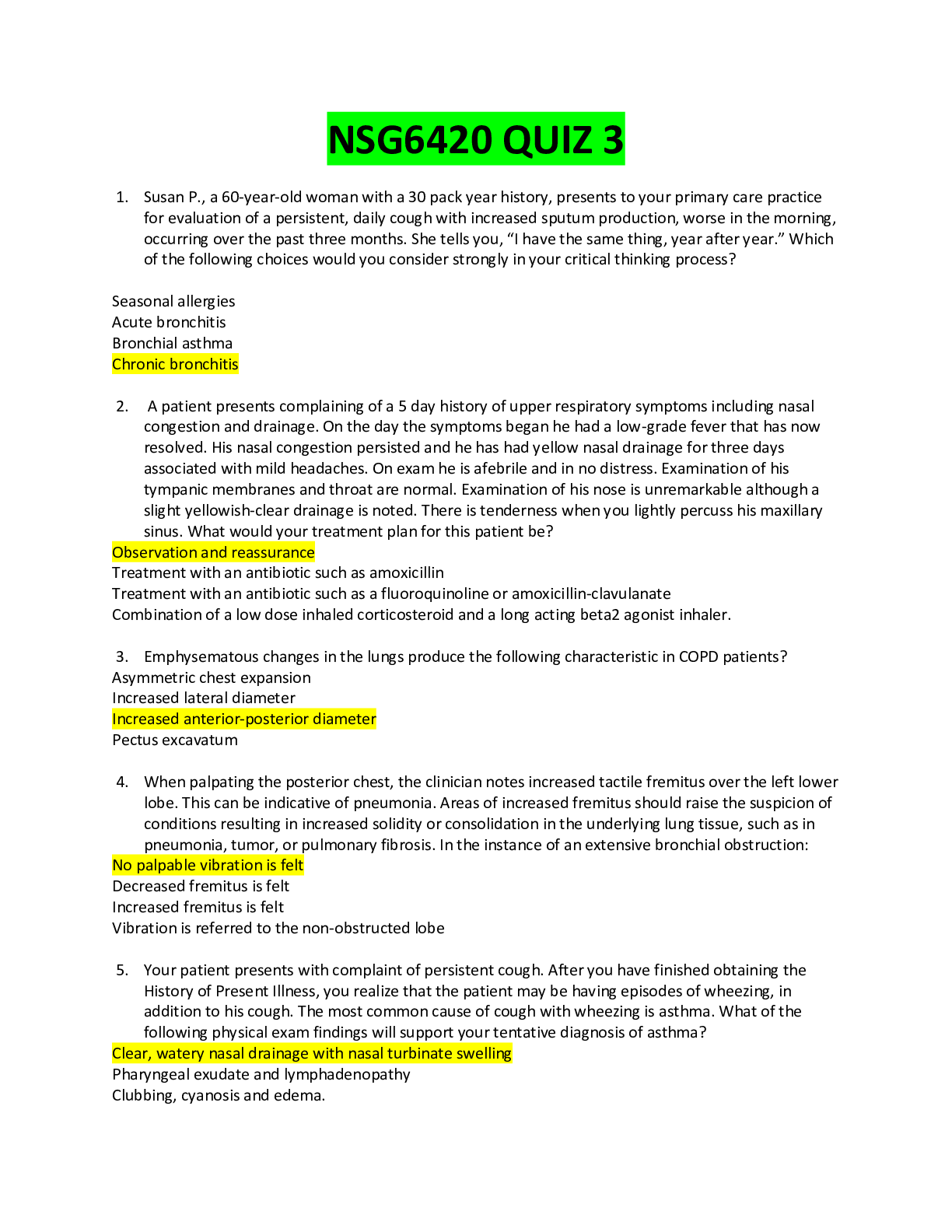

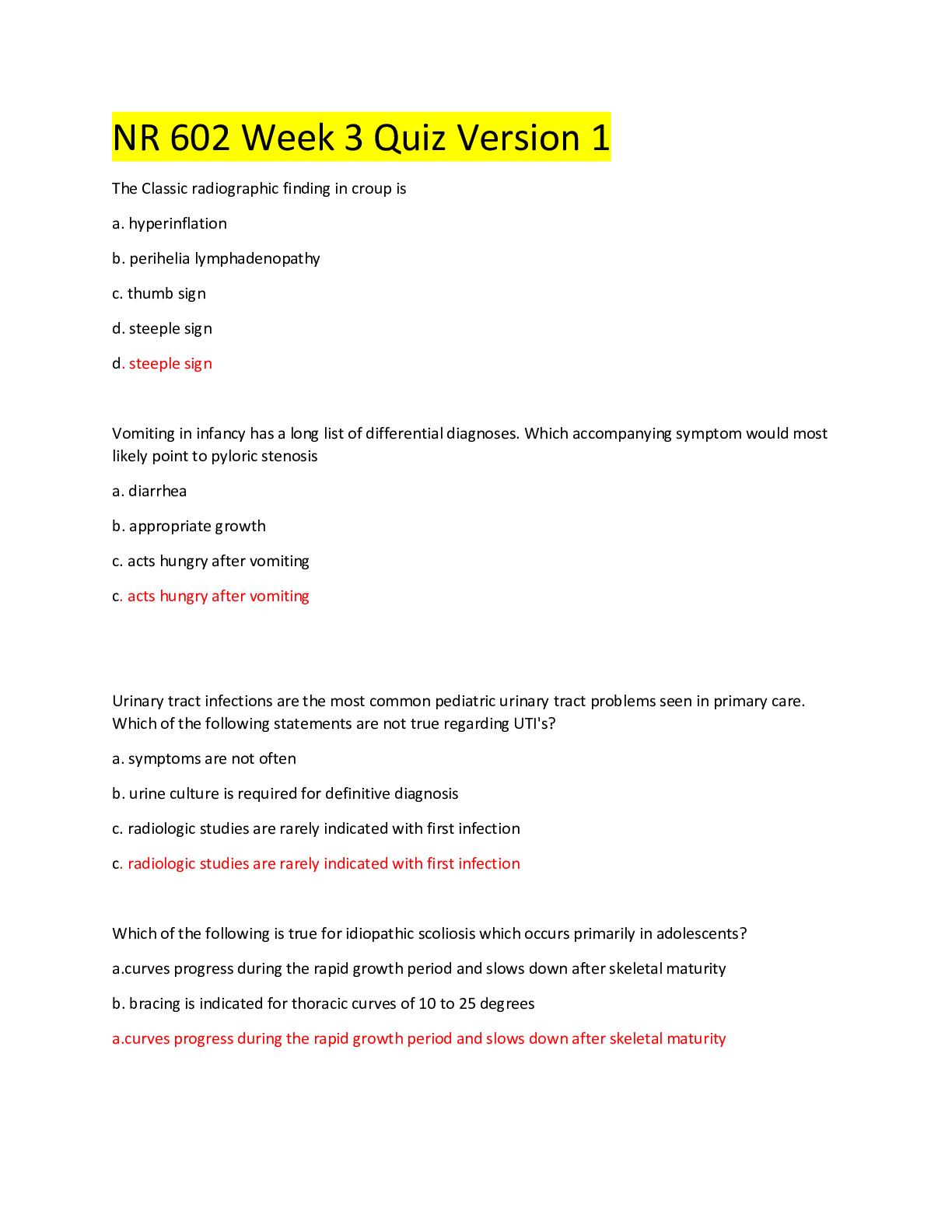

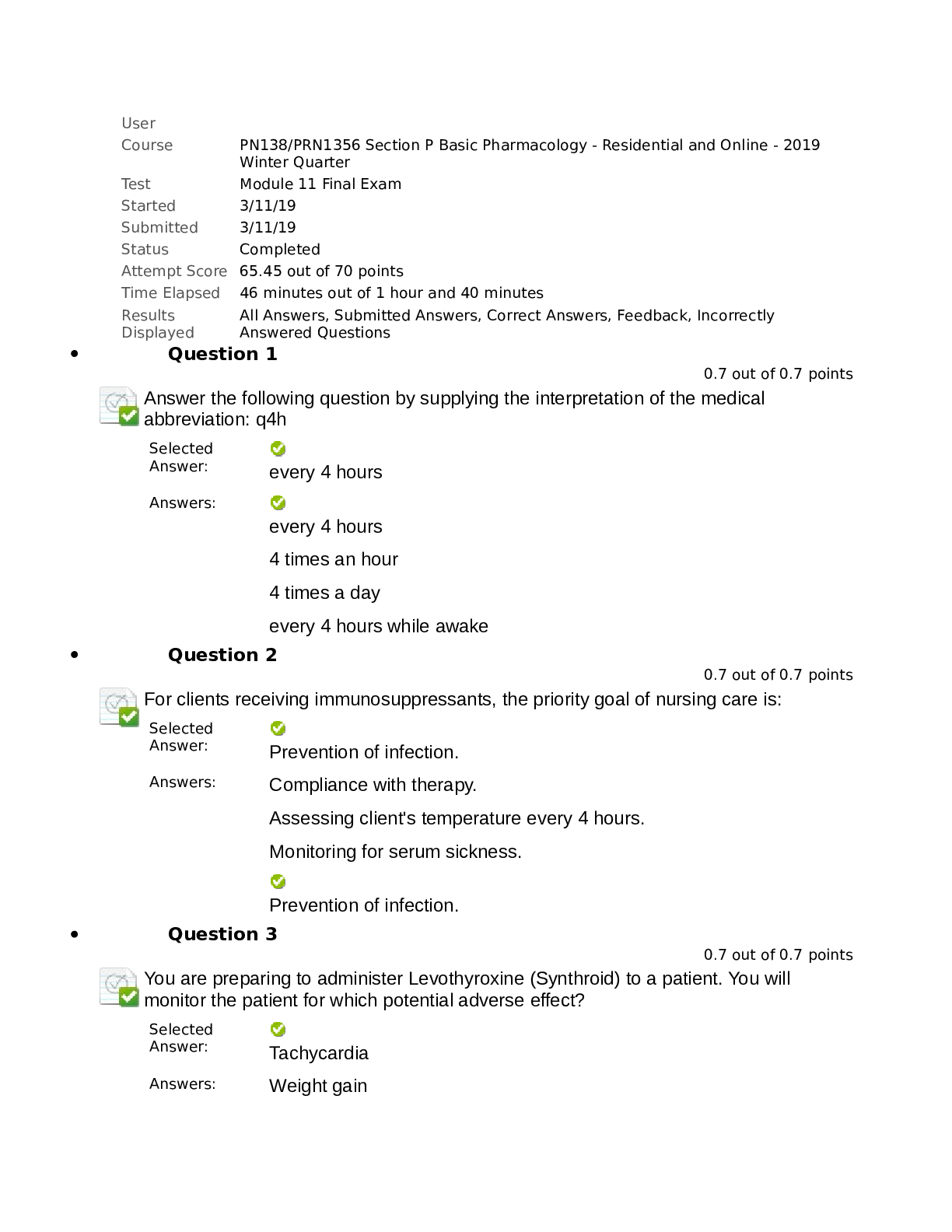

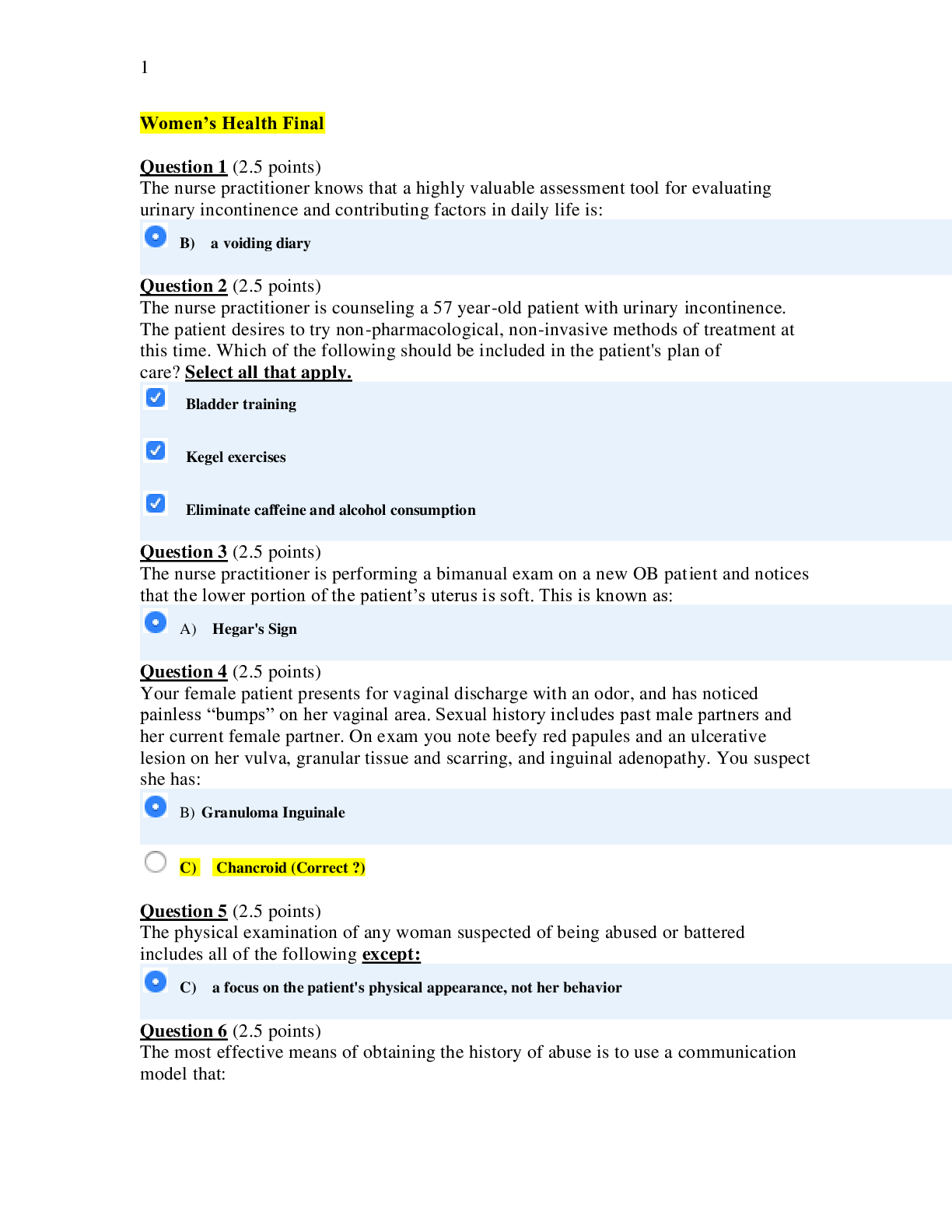

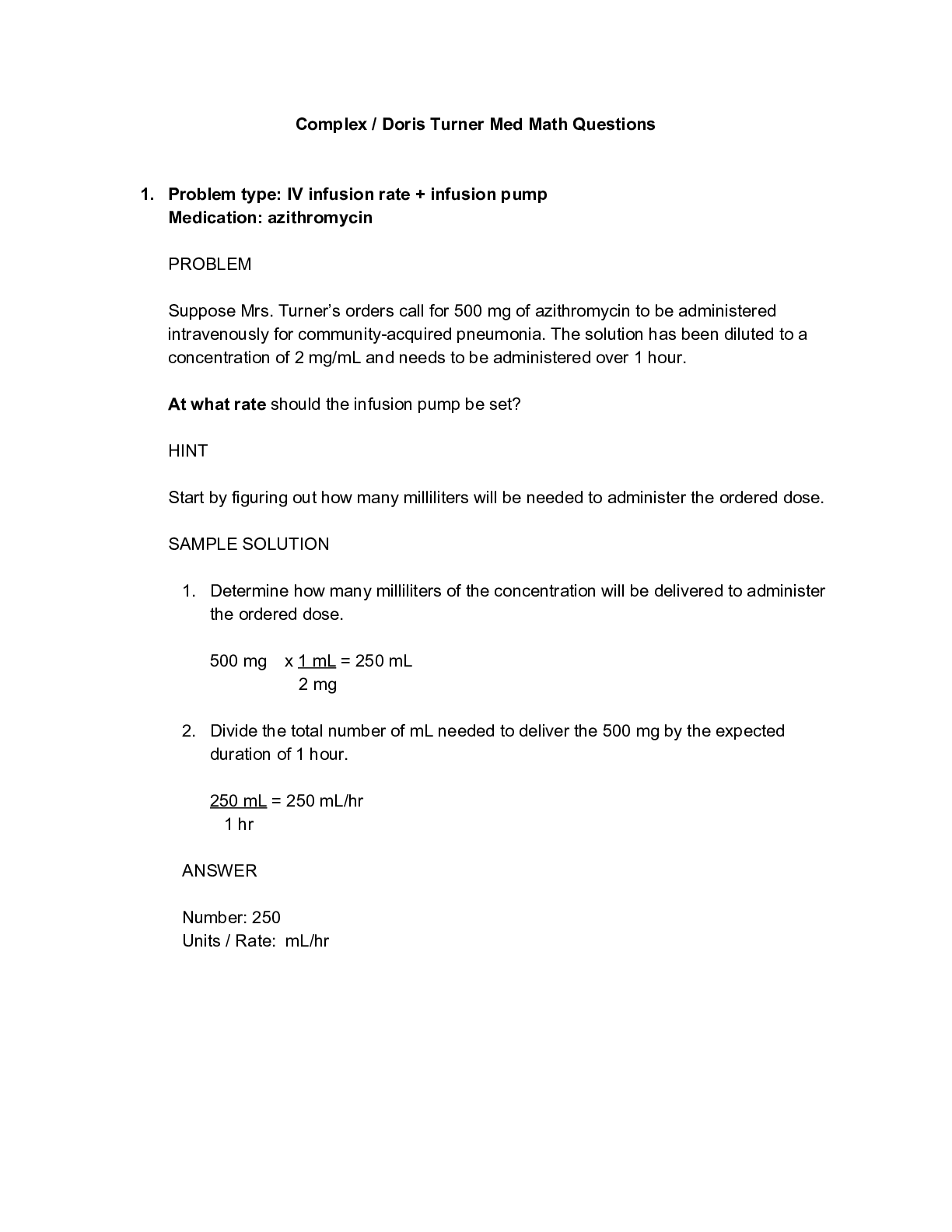

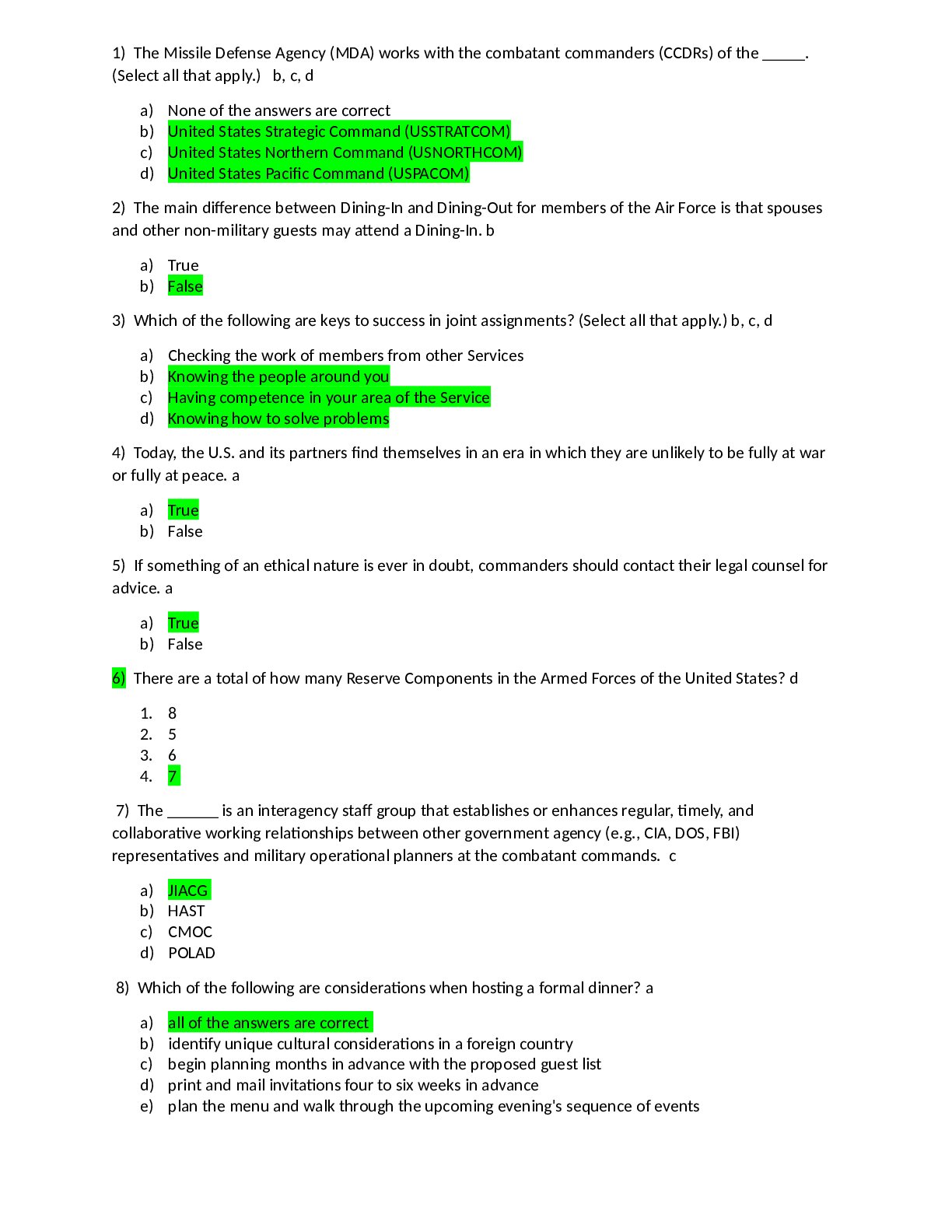

ch 1 Health and Accident Insurance 2023 with complete solution.P is an employee who quits her job and wants to convert her group health coverage to an individual policy. After the expiration of COBR... A laws, which of the following statements is TRUE? - answerShe does NOT need to provide evidence of insurability G is an accountant who has ten employees and is concerned about how the business would survive financially if G became disabled. The type of policy which BEST addresses this concern is: - answerBusiness Overhead Expense S is employed by a large corporation that provides group health coverage for its employees and their dependents. If S dies, the company must allow his surviving spouse and dependents to continue their group health coverage for a maximum of how many months under COBRA regulations? - answer36 A policyowner's rights are limited under which beneficiary designation? - answerIrrevocable The federal income tax treatment of employer-provided group Medical Expense insurance can be accurately described as: - answerEmployee's premiums paid by the employer is tax-deductible to the employer as a business expenditure Which of the following characteristics is associated with a large group disability income policy? - answerNo medical underwriting P and Q are married and have three children. P is the primary beneficiary on Q's Accidental Death and Dismemberment (AD&D) policy and Q's sister R is the contingent beneficiary. P, Q, and R are involved in a car accident and Q and R are killed instantly. The Accidental Death benefits will be paid to: - answerP only The Health Insurance Portability and Accountability Act (HIPAA) gives privacy protection for: - [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 20, 2023

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Jun 20, 2023

Downloads

0

Views

88

.png)

.png)

.png)