Comprehensive Module 1: Final Exam Questions & Answers-1. Bob uses the cash method of accounting. During the tax year (calendar year), he had the following income and expenses:

• Interest on a savings account (cred

...

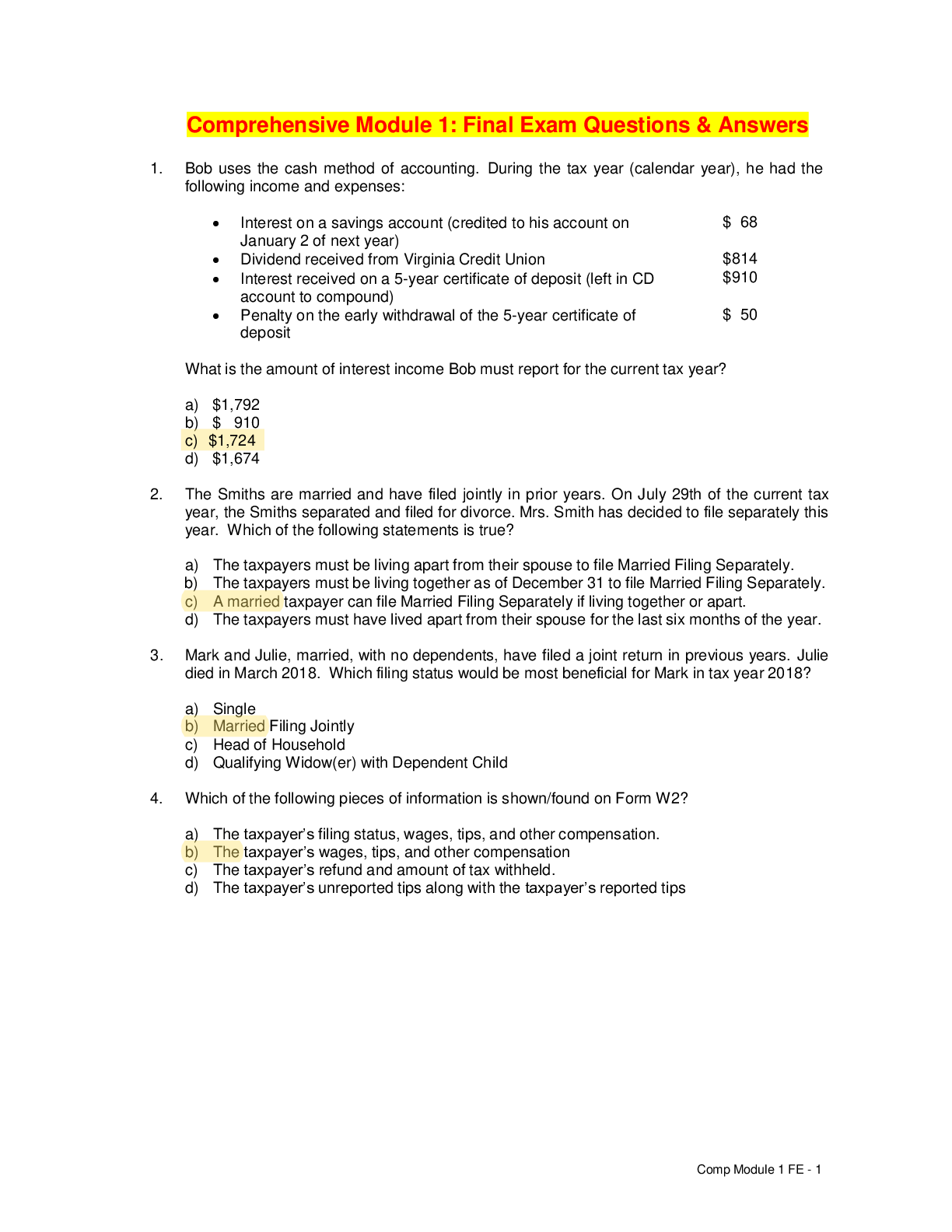

Comprehensive Module 1: Final Exam Questions & Answers-1. Bob uses the cash method of accounting. During the tax year (calendar year), he had the following income and expenses:

• Interest on a savings account (credited to his account on January 2 of next year)

$ 68

• Dividend received from Virginia Credit Union $814

• Interest received on a 5-year certificate of deposit (left in CD account to compound)

• Penalty on the early withdrawal of the 5-year certificate of deposit

$910

$ 50

What is the amount of interest income Bob must report for the current tax year?

a) $1,792

b) $ 910

d) $1,674

2. The Smiths are married and have filed jointly in prior years. On July 29th of the current tax year, the Smiths separated and filed for divorce. Mrs. Smith has decided to file separately this year. Which of the following statements is true?

a) The taxpayers must be living apart from their spouse to file Married Filing Separately.

b) The taxpayers must be living together as of December 31 to file Married Filing Separately.

c) A married taxpayer can file Married Filing Separately if living together or apart.

d) The taxpayers must have lived apart from their spouse for the last six months of the year.

3. Mark and Julie, married, with no dependents, have filed a joint return in previous years. Julie died in March 2018. Which filing status would be most beneficial for Mark in tax year 2018?

a) Single

b) Married Filing Jointly

c) Head of Household

d) Qualifying Widow(er) with Dependent Child

4. Which of the following pieces of information is shown/found on Form W2?

a) The taxpayer’s filing status, wages, tips, and other compensation.

b) The taxpayer’s wages, tips, and other compensation

c) The taxpayer’s refund and amount of tax withheld.

d) The taxpayer’s unreported tips along with the taxpayer’s reported tips

5. Dani is a 25-year old full-time

[Show More]